BRC-20

Bitcoin 2023 Year in review

This year showed the calm before the storm: the market seems to be heating up for a 2024 bull market,...

Panda Wallet launches world’s first on-chain lock-to-mint smart contract

Open-sourced Web3 browser extension Panda Wallet announced the launch of locktomint.com, where users can mint tokens against an on-chain smart...

HODL: First LRC-20 token mints out in 9 hours

hodl was deployed with a 21 million supply, but for mints of hodl to be valid, they must be accompanied...

Bitcoin is the exchange

sCrypt released a blog and implementation of token limit orders using Bitcoin script—an evolution of the on-chain Order Lock technology,...

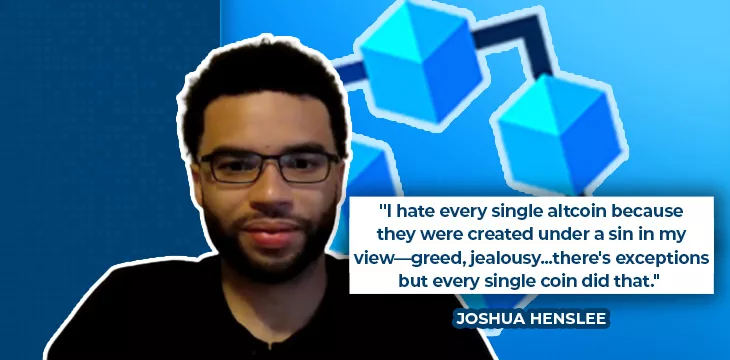

How will Ordinals affect Bitcoin?

In this podcast, Joshua Henslee goes in-depth on the impact of Ordinals on Bitcoin, the value of costs, and why...

On-chain trading is the future of online commerce

Many economists and pundits are questioning the necessity of blockchain technology, as they ask what is the purpose of the...

07-09-2025

07-09-2025