Article by Steven Stradbrooke

-

2 July, 2025

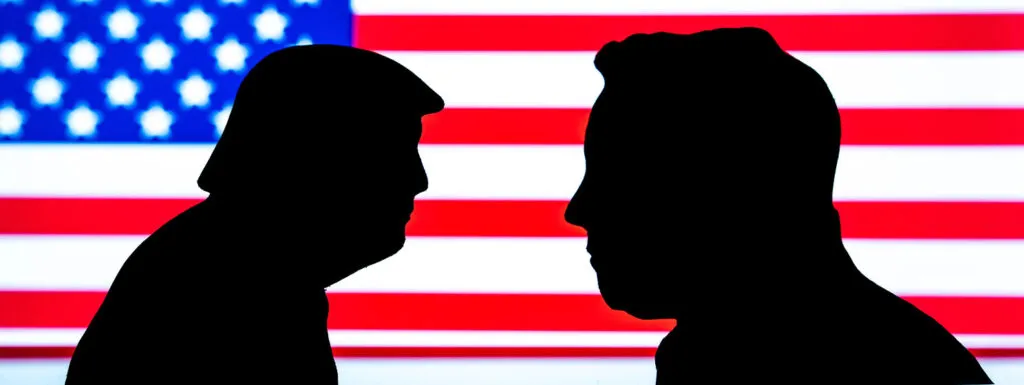

Trump v Musk feud could impact crypto influence in Congress

The Trump v Musk feud could reduce crypto’s influence in Congress, Circle wants to be a bank, and Ripple Labs...

-

1 July, 2025

US legislation plans firm up as Trump’s ‘crypto’ ventures grow

U.S. politicians claim they plan to get digital asset legislation onto the desk of President Trump, whose crypto ventures seem...

-

26 June, 2025

Some block reward miners ditch AI for BTC; others ditch BTC for ETH

Some block reward miners are making strategic moves as they figure out how to turn a profit from this sector;...

-

25 June, 2025

US floats crypto market structure ‘principles,’ no bill yet

The U.S. Senate proceeded with a hearing on digital asset market structure legislation despite only five of the 11 members...

-

24 June, 2025

Fiserv’s stablecoin platform; Congress stable plans unclear

Fiserv confirmed plans to launch FIUSD and a stablecoin-issuing platform on Solana; meanwhile, Congress prepares for a hearing on digital...

-

20 June, 2025

US miners’ share grows as Chinese ASIC makers put down US roots

JPMorgan declared this week that the combined share of the 13 U.S. mining operators accounts for 31.5% of the overall...

Recommended for you

The Trump v Musk feud could reduce crypto’s influence in Congress, Circle wants to be a bank, and Ripple Labs...

July 2, 2025

U.S. politicians claim they plan to get digital asset legislation onto the desk of President Trump, whose crypto ventures seem...

July 1, 2025

07-04-2025

07-04-2025