|

Getting your Trinity Audio player ready...

|

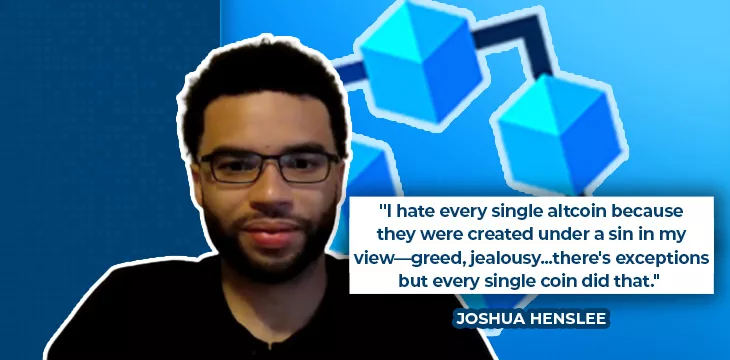

Joshua Henslee has repeatedly said that Ordinals have changed everything but that most people don’t get it yet. He recently appeared on the Learner Tank Podcast to explain how Ordinals will affect Bitcoin and why he thinks they’re so revolutionary.

Ordinals are causing sky-high fees on BTC, but that’s where the action is (for now)

Henslee begins by telling the host he’s playing around with Ordinals on BTC right now. Regarding volume, BTC is way ahead of BSV blockchain because people ignore the tech in favor of making short-term money. Ironically, Ordinals on BTC validate the BSV blockchain vision, but since we haven’t hit the technical limitations on BTC yet, that’s where the action is happening.

Giving a brief history of this relatively new phenomenon, Henslee explains that Ordinals kicked off in January, and BRC-20 tokens started in early March. He has been tracking demand and monitoring things like transaction fees which at one point shot into the hundreds and thousands of dollars. This is good for miners but bad for users. Demand is slowly subsiding, and things are calming down, but Henslee still sees a crossroads ahead for BTC: they either increase the block size or Core devs nuke Ordinals and ruin the party.

Henslee reassures the host he is “absolutely not” joining the dark side and going over to BTC. He’s just on that chain because that’s where the action is right now, but he’s still working on BSV blockchain projects. He assumed this couldn’t be done on BTC, but he recognizes that he was wrong about that, and that has caused him to question some of his conclusions.

Is BTC more likely to raise the block size rather than migrate to a more technically capable chain like the BSV blockchain? Henslee believes so. Whether it’s true or not, the market perceives BTC as Bitcoin, and that’s the chain users want to build on. However, the same old arguments about the burden of running a full node are still being made, so there will be resistance to any block size increase.

On the state of BSV today

Henslee notes that, while it is technically inferior, the BTC transactions are mostly composed of real people trying to do things. This is stacking the blocks full of fees for miners. Even though the BSV blockchain has many more transactions, there’s not even close to the same money in the blocks. With tiny transaction fees, there has to be massive demand before miners consider switching to BSV blockchain, and we’re just not there yet. He points out that big blocks make more economic sense in the long run, but the small fees in the blocks create a short-term problem.

What could fix it? Massive demand for BSV transactions and/or speculation on the coin price. Even driving it up through speculation only would boost miner revenues and attract interest in the chain. Currently, BSV has only two permanent miners—TAAL and GorillaPool—and TAAL has the vast majority of the hash power. There needs to be more miners, and when they come, it will make the network stronger and less vulnerable to attacks we have seen in the past.

How did we get here? There is a confluence of factors working together, he says. Lack of demand, exchange delisting, and a price drop all lead to a downward spiral. Could it lead to the death of the BSV blockchain? Henslee says no—as long as the coin has a price, people will mine it, and that can even be done with GPUs at lower difficulty levels. The blockchain will stay alive as long as the coin has a price.

When will the true path be revealed?

The host asks Henslee where all of this is going. People disagree about the fundamental nature of Bitcoin and where all of this is headed. When will the truth be revealed? Will there be an uproar on BTC within months, or is it a longer-term likelihood?

“It’s hard to say,” he replies. He’s keeping an eye on the fees in each block and the price of tokens. While the moment of truth will eventually come for BTC, he does say this is a truly revolutionary development—a peer-to-peer, trustless network with no counterparty risk. Most people haven’t yet woken up to the reality of what has happened and its implications, including that altcoins are dead in the water.

How can we access this on-chain economy? Via wallets, giving users total control. We can mint tokens and non-fungible tokens (NFTs) and pay/swap them for bitcoins directly. It’s a lot like vending machines; we put cash in and get something back directly. Indeed, this is an analogy Satoshi Nakamoto used himself.

Where will the money go when it flows into the on-chain economy? Nobody knows, but at the peak of the recent hype, the token ORDI had 50% of the liquidity because it was the first.

Are Ordinals only JPEGs, or are they potentially much more?

Henslee says they can be anything; JPEGs, video, audio, or combinations of these. In the long term, he thinks AI generators like Midjourney will be connected to a blockchain, noting that apps like Hapi allow BSV blockchain users to mint NFTs directly to the blockchain for just $0.04 per mint.

The conversation then delves into an interesting fact about Ordinals; while all NFTs have a unique serial number in the form of a transaction ID, Ordinals are also numbered individually, allowing people to perceive value in numbers they like, which are earlier than others, etc. For example, people who like the number seven might place more value on NFTs with that number than others. When we add identity into the mix, NFTs can also derive extra value based on who minted them.

Henslee encourages viewers to do whatever they can think of on the BSV blockchain. It costs nearly nothing, so there’s nothing to lose. He says that he minted something for four cents and sold it for $3—astronomical returns on a percentage basis.

How can a beginner learn to build on BSV?

The host finishes by asking Henslee how he can start building on BSV, saying how excited he is after this podcast.

Henslee says he has some basic tutorials on his YouTube channel but recommends learning Javascript to build applications.

What will happen to Web2 companies if BSV blockchain takes off the way we hope? Will they migrate across? Henslee thinks they’re more likely to die off as the business models they rely on are fundamentally based on the old system. This may be difficult for us to imagine now, but before the internet, there were many giant companies that dominated their industries, and many of them no longer exist.

Watch: How to build a BSV business

07-11-2025

07-11-2025