In January, Dr. Craig Wright sent out a series of copyright infringement notices to companies hosting the Bitcoin White Paper, demanding that the hosting cease. Close to the same time, he published a blog post on open source licensing which made the case that open source software is not free from copyright and developers of open source software are not free from liability. Additionally, his legal battle against Peter McCormack is nearly at an end, with McCormack abandoning his defense that his tweets were true and therefore not legally defamatory.

However, one event in the Dr. Wright story which hasn’t received as much attention as it perhaps deserves took place back in February of 2020: Surrey Police were informed that hackers broke into Dr. Wright’s network and stole the keys to 111,000 BTC. This week, he sent letters to developers for BTC, BCH, BCH ABC and BSV setting out duties he argues they owe to him and demanding they take action to ensure these coins are not dealt with any further.

This latest move is not likely to be the last of Dr. Wright’s legal battles, but it might provide an important piece in discerning what is motivating Dr. Wright at this point in time, and what the future might hold for him and the rest of the digital asset community.

A Brief History of the Bitcoin

A brief history of Bitcoin is vital to this story. According to filings in the McCormack case (and echoed in Kleiman), Dr. Wright began working on the project that would eventually become Bitcoin in 2004 in a desire to create a secure payment system and importantly, one which would allow micropayments. Dr. Wright’s vision for the project before taking it public can also be seen in his masters in law (LLM) thesis, which was submitted to Northumbria University in 2007 under the title “Payments Providers and Intermediaries as Defined in the Law of the Internet.”

Ultimately, the Bitcoin project was announced in 2008 under the name Satoshi Nakamoto and was circulated among various cryptographic and peer-to-peer forums, drawing interest and offers to help from the likes of Hal Finney. The now-famous Bitcoin white paper was published the same year.

Development moved fast from there: the first version of the software itself was released in November 2008, receiving another re-release in December and then January of the following year. Finally, the Genesis Block was created January 3, 2009, with the first Bitcoin being mined almost a week later on January 9.

It is widely known that Satoshi Nakamoto should be the rightful owner of a huge amount of Bitcoin. Ira Kleiman certainly believes so—it is these assets which he is currently suing Dr. Wright over, claiming that Wright developed and mined Bitcoin with his brother, Dave Kleiman. Kleiman has yet to produce much in the way of evidence in support of this proposition, so the exact nature of the relationship between Dr. Wright and Dave Kleiman isn’t publicly clear, though correspondence produced by the former would suggest that Dave Kleiman was not involved in the creation of Bitcoin and only came on board to assist in publication of the White Paper.

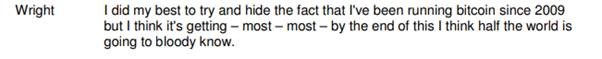

Inevitably, such a massive collection of assets—not just the Bitcoin itself but all of the operations adjacent to the development of the protocol and the mining that did take place—will have significant tax implications. In fact, it is the tax issue which first brought Dr. Wright to the world’s attention as a Satoshi Nakamoto candidate. When Wired/Gizmodo unmasked Dr. Wright—against his will—in 2014, it published documents and correspondence (questionably obtained) attributable to Dr. Wright from both before Bitcoin was publicly revealed to the world and after which among other things show Dr. Wright attempting to fit Bitcoin—and his enormous Bitcoin holdings—into his tax affairs. These documents are extensive and have been incorporated into the Kleiman litigation. They include representations made to the Australian Tax Office about Bitcoin mined since 2009, including Dr. Wright worrying aloud that the tax investigation is going to expose him to the world:

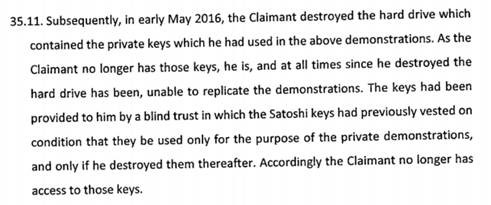

Dr. Wright does not have access to the coins. According to filings and testimony in the Kleiman litigation, the keys associated with the Satoshi Nakamoto fortune were originally transferred to a blind trust inaccessible to Dr. Wright until January 2020. The only other time the keys have been accessed were for the Gavin Andresen demonstration in 2016, where the keys were provided from the Trust on the condition that they only be used for the demonstration and that they be destroyed after—which Dr. Wright did, according to filings in the McCormack case:

Following this, in accordance with the rules specified at the time the trust was set up, Dr. Wright was only granted access in January 2020.

Dr. Wright hack of 2020

However, shortly after submitting documentation to the courts in Kleiman case in January 2020, it was reported to the Surrey Police that Dr. Wright was the victim of a hack which saw the theft of private keys to two BTC addresses and which led to the theft of nearly 111,0000 BTC—today worth over US$6.2 billion.

Dr. Wright’s law firm, Ontier, sent legal letters to BTC developers informing them of his ownership of the relevant Bitcoin and that the hack had taken place. The letter argues that the BTC developers have a duty to prevent transactions which they know to be illegal from being entered onto the blockchain.

It’s an open question which obligations protocol developers owe toward users. Legal challenge on this point is absent, but given the circumstances in which the courts have imposed fiduciary duties on those trusted by others to make good decisions on their behalf, it seems sensible that a similar approach would be taken to those who ultimately control the progress and development of their protocols. This is to say nothing of the criminal implications of, for example, dealing in stolen property.

Despite being an open question, it is undoubtedly vital to the future of Bitcoin. Dr. Wright is obviously not the first person to have their Bitcoin stolen and isn’t the last. Can it truly be the case, as the likes of the BTC Core and BCH communities would argue, that a person who owns those coins has no recourse if those coins are stolen or otherwise misappropriated, despite the developers having oversight and responsibility over the system governing how those coins can be used? It seems that if digital assets are ever to be relied on at scale, then the answer to this question has to be no, and judging by the letters Dr. Wright sent out this week, he is intending to demonstrate this in Court. The question now, finally, will be one for the Courts to decide rather than centralized developers whose ideal world is one in which they owe no duties to anyone. Despite protestations that they exist outside the scope of the law, they will see first hand that this cannot be the case, and to resist the authority of the courts will be to guarantee the death of their product.

What is on the horizon in 2021

Based on the above, we can take a good guess at Dr. Wright’s motivations heading into 2021. To summarize:

- Dr. Wright has been vocal about the pervasive myth that blockchain developers are somehow free from the kind of liability that the law regularly imposes in almost any other context;

- He has recently begun enforcing his claim over the Bitcoin White Paper, which has hitherto been used to sell products unaffiliated with Bitcoin, and

- Perhaps most importantly, Dr. Wright was the victim of a hack in 2020 which ultimately saw the theft of over a billion dollars’ worth of Bitcoin.

Intentionally or not, it seems that Dr. Wright now finds himself as the perfect plaintiff to demonstrate the points he has been making for years: that there is nothing about blockchain, Bitcoin or any other digital asset which takes them outside the scope of the law, and that it is only a matter of time before governments and regulators begin showing this.

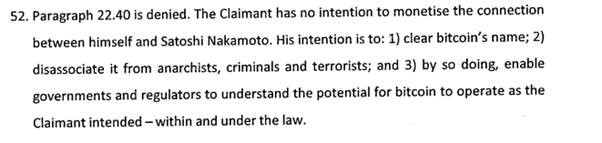

As if it needs any more reiteration, Dr. Wright’s reply to McCormack’s defense in that case contains a neat paragraph articulating Satoshi Nakamoto’s motivation:

CoinGeek will be providing further insight and analysis into what this legal liability might entail for the future of Bitcoin throughout this week.

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.