|

Getting your Trinity Audio player ready...

|

This series started as a way to consider the economic impact of the halvening and the balance between mining for the bitcoin subsidy versus processing transactions and data for profit as part of the act of being an honest node. But it has changed a little bit as we gain more perspective over time. Now, I like to think of this series as a challenge to reflect on where we have been and the progress of the bitcoin economy as a whole. Bitcoins, though issued by Satoshi Nakamoto in 2009, are emitted on a predictable schedule that cuts in half every 210,000 blocks, or roughly four years. While the countdown to zero emission is generations long, the point at which the network needs to become self-sustaining by generating large blocks full of fees will occur during the 2020’s. As network security makes its punctuated transition from the subsidy to standing on its own, we will discuss the history of the major eras of the protocol in a multi-part series with a focus on how block size and progress have always been intrinsically linked. Read Bitcoin History Part 1 and Part 2.

Let’s be clear.

In Part 2 of the Bitcoin History series, we learned that many Bitcoin developers were big blockers before the venture capital money started to spill in. Then, conveniently, Blockstream’s “defensive patent strategy” took hold of BTC Core, and it quickly became a social heresy to suggest that the bitcoin protocol was capable of safely propagating more than 6 megabytes of data per hour. After Mike Hearn walked away and BTC Core changed the locks on Gavin Andresen, Blockstream became the kings of the BTC Core repository. Nearly all discussion of scaling moved to the theoretical, future creation of parasitic networks such as Lightning that would only connect circumstantially to Bitcoin for occasional settlement. And, in stark contrast to the warnings of the white paper, the price of each transaction was reengineered to be high so that the price to participate as a governance “node” (a term that was completely redefined in this era) could remain low.

In 2017, in the last days of a unified bitcoin economy, Craig Wright would make his singular public appearance in blue jeans, BitConnect and the Ethereum ICO boom would usher in a sh*tcoin renaissance and Jeff Garzik would code the Segwit2X implementation. Of course, the VC-funded sock puppets guiding the court of public opinion would beat the drum of the “#No2X” movement, and the entire mining community would get “Back-Stabbed™” by the CEO of Blockstream and the rest of the small blockers.

From there, the split of BTC Core and Cash (BCH) happened rapidly. Due to social pressures, BCH declared that the new consensus would use relay protection so that it would be incapable of orphaning BTC, and the small blockers of this era would win the BTC ticker tussle. The “Bitcoin” name was retained by the more limited chain, even though it was the one making the more stark changes to the protocol and governance of Bitcoin, and the big blockers agreed haphazardly to fight for dominance on the worst metric possible: price. This battle for market cap dominance was (and perhaps still is) futile because Tether also became the dominant trading pair during this era, muddying the waters of organic price discovery to this day.

The debates would continue to rage as many big blockers still waved the Bitcoin flag declaring “Bitcoin Cash is Bitcoin,” and the small blockers would continue with their battle cry:

But how did bitcoiners lose such a crucial battle? How did everything get so bungled in the scaling debate? How did such vile characters win so many PR battles?

First, we need to talk about Barry and DCG

Blockstream, like every other corporation, acts in the interest of its investors in order to make a profit for its board and shareholders. If one follows the money, all invested entities in Blockstream have ties to two major financial industry Titans:

- AXA Strategic Ventures, whose deep connections to the shadowy Bilderberg group could be subject of a much longer article.

- Digital Currency Group (DCG): a conglomeration of venture capitalist groups founded and managed by famous Wall Street investment banker Barry Silbert with the help of its “expert” board members:

- Glenn Hutchins, New York Federal Reserve Board Member.

- Lawrence Summers, Federal Reserve Chairman nominee and World Bank Chief Advisor.

- Matt Harris, Partner at Bain Capital (A firm founded by Mitt Romney.)

The DCG portfolio is managed by Grayscale Investments and Genesis Trading, and they collectively own CoinDesk publishing as a public relations wing to their empire. The group also boasts a large stake in most of the significant names in the bitcoin economy: Coinbase, Abra, BitGo, Kraken, Lightning Labs, Ripple, Xapo, BitPay, BlockchainDotCom, Circle, and many, many more.

In classic venture capitalist fashion, DCG’s control of news media, development groups, competing protocols, wallets, payment processors, exchanges and large custodians allows them to control various narratives and assure victory regardless of outcomes. In hindsight, this would suggest the plausibility that everything that occurred in the scaling debate happened according to a centralized plan, rather than as an organic product of competing influences. Furthermore, it could imply that DCG’s management of the “New York Agreement” (the most popular plan to ever gain traction in raising the block size limit of BTC) was simply a ruse designed to remove power from Chinese interests and the bitcoiners who sought to see honest nodes govern consensus. With miners signaling “NYA” as means to declare support for raising the block size limit by cooperation among honest nodes, small blockers were able to change the entire course of Bitcoin’s history swiftly and with very little practical resistance. Within months, the popular NYA was dead, the big blockers had split, and all of the people advocating to change the protocol away from bitcoin’s antifragile incentives were suddenly in charge of the largest proof of work network on earth.

But how is that possible?

In short, the answer is subterfuge, but we have to rewind briefly to understand how it started. The scaling debate truly began in 2013 when a self-declared government intelligence officer named “John Dillon” (an alias?) paid young BTC Core developer Peter Todd to make unconfirmed Bitcoin transactions non-permanent with the “RBF” soft fork. He further established a relationship with Peter over email – conditioning him with bizarre cloak-and-dagger stories and payments for his loyalty. One of his requests to Peter was that he make a small block propaganda video. The Orwellian cartoon that was born from these bribes advocates for off-chain transactions, high bitcoin fees, the elimination of small payments, and it ends by encouraging bitcoiners to demand that miners publicly declare their support for never raising the block size limit as part of a bizarre purity test.

Whole, long conversations, including thinly veiled threats, from Dillon to Todd have leaked and are available here. They are unsettling to read, in hindsight, especially when all of Dillon’s influence is clearly focused on the people who ultimately became Blockstream.

Consider the risks to yourself and your family, and stop what you are doing…– John Dillon to Peter Todd, 2013

The beginning of the small block propaganda.

The video started a scaling war that culminated in Blockstream being created as the paid Bitcoin development group for globalist bankers, and as a central hub for the small block hive mind. With venture capital connections to Blockstream, MIT Media Lab Digital Currency Initiative was also established around this time with over a million dollars from Jeffrey Epstein for research into progressive, Bitcoin-based technologies that ultimately led to off-chain (anonymous) transactions that would be managed in cooperation with Blockstream.

Under the guise of “decentralization” money was funneled between MIT, Epstein and Blockstream to make it appear as though competitive minds were independently discovering the value of small blocks and advocating for them in good faith with the rest of the development community. In reality, Blockstream and their venture partners were patenting proprietary networks that would require bitcoin to never hard fork, never increase block size and never have competitive software implementations to the existing implementations of BTC Core (like what was proposed in “The New York Agreement.”) They were also financially connected to MIT and the anonymity research that would go into Lightning Network through a Japanese venture firm called Digital Garage, which was run by CEO Joicho Ito—who also happened to run MIT’s Digital Currency Initiative. Ito, who was forced to step down from his MIT position due to his corruption, was actively obfuscating Epstein donations to himself and all of the mentioned entities while moving money around quietly and paying the BTC Core lead maintainer: Wladimir Van Der Laan.

So, with nearly everyone “bought off” and all of the Western hemisphere developers redesigning bitcoin to work specifically for corporate patented side chains and immutable human trafficking business, the scaling debate was fizzling out. Bitcoiners who wanted to see bitcoins transacted freely on a global, public ledger had largely been forced into compliance or retirement. With limited exceptions, the only remaining, “old guard” bitcoiners were the honest hashing nodes of China. Largely insulated from the nuances of the in-fighting of the software developers, a tentative “Hong Kong Agreement” saw the coming together of the venture-backed businesses of the West and the hashing node operators of the East. They agreed tentatively to a soft fork addition of the Segwit protocol in 2016; followed by a hard fork to Segwit2X in 2017. Of course, the Chinese node operators had no idea how much underhanded business was occurring in the background, but they trusted the signatures of representatives from Blockstream, MIT and other developers and exchanges.

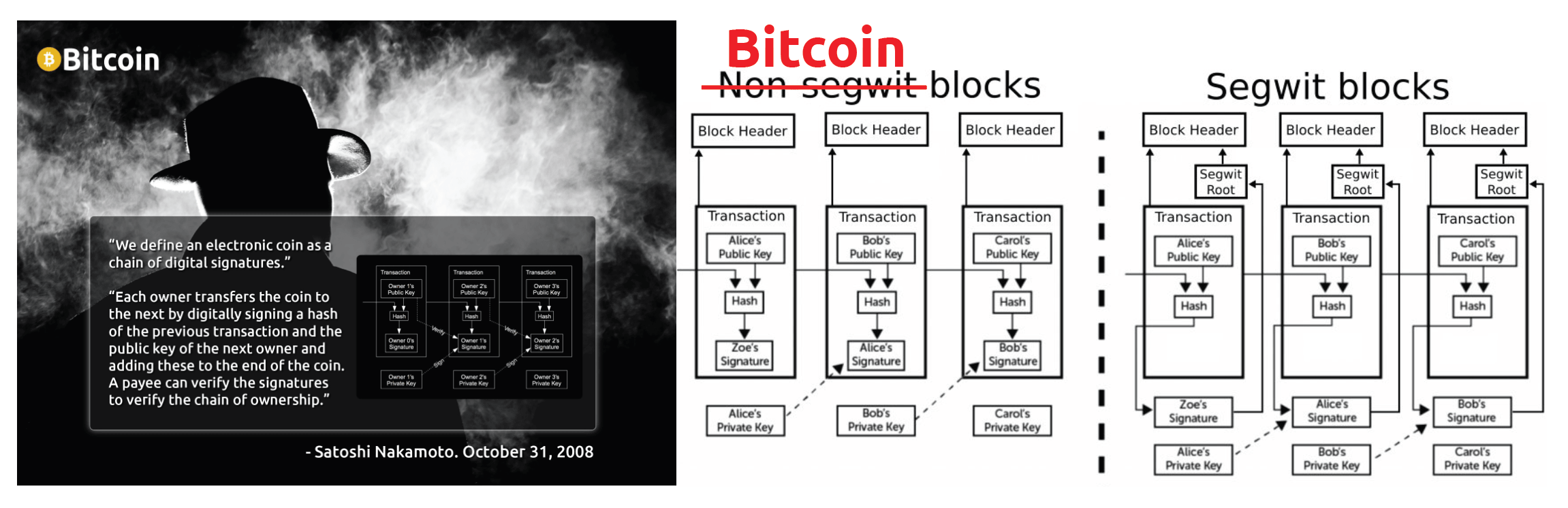

What is the Segwit soft fork?

Segregated Witness (Segwit) is a protocol designed primarily to eliminate the malleability of Bitcoin transactions so that they can be cryptographically trusted to initiate smart contracts with staked BTC in order to fuel Lightning and Liquid network transactions. This is accomplished by replacing Bitcoin signatures with hashed witness data, which is a complex way of describing an attestation of the existence of a Bitcoin signature without having to deal with the size of the signature. Like all forks, Segwit protocol creates transactions with invalid Bitcoin signatures that, under normal circumstances, would cause a split between valid Bitcoin transactions and the new Segwit transaction. This network split does not occur because Segwit transactions are coded to bypass the network security rules like a piece of malware. The invalid transactions, by design, are wrapped into a complex envelope of code in order to trick honest nodes into believing that Segwit hashes are Bitcoin signatures.

The stated benefit of Segwit is that BTC blocks can contain four megabytes of transaction weight rather than just one. This sounds like an obvious blockchain scaling solution, but that 4MB benchmark can only be achieved under ideal conditions which have yet to ever be seen on the BTC network. In hindsight, the more obvious purpose of Segwit was to fundamentally change bitcoin to accept Blockstream-trusted (but technically invalid) transactions which enable their patented off-chain solutions to be deployed. Once deployed, the Segwit malware would absorb a forever-growing number of UTXOs and help lock an increasing amount of BTC coins into Lightning and Liquid channels until all BTC is staked in gateways that exist under Blockstream’s control.

What was Segwit2X and why did it fail?

In contrast to the Segwit “User Activated Soft Fork” (UASF), Segwit2X was an independently developed implementation of Bitcoin that utilized a hard fork in order to upgrade BTC Core to have a 2MBlock size limit at the consensus level, but also optional Segwit support allowing for it to be a sort of “both/and” compromise among all parties who had spent years bickering about the best possible block size limit versus the addition of new technologies and exotic cryptographic tricks to change Bitcoin to be more “efficient.”

Developed by longtime Bitcoin developer and hard money advocate, Jeff Garzik, the Segwit2X implementation, if adopted, would have decentralized the software of BTC away from the monolithic Blockstream, which was rumored to have made private deals under the auspices of “owning” BTC Core. For all intents and purposes, this was true by de facto, since all debates had similar outcomes: Blockstream wins, dissenters get removed.

With the New York Agreement garnering an overwhelming amount of support from honest nodes, something changed all of a sudden on Twitter. Small blockers started social engineering users with the #No2X hashtag, and by declaring a militaristic devotion to “User Activated Soft Forks” or “UASF.” Very rapidly, they defined their endpoints as “nodes,” denigrated miners as second-class nodes, and pushed for the redefining of the governance model of bitcoin with revolutionary overtones. They came into lockstep about their purity laws, small block permanence and the necessity for virtue-signaling with “proof of hat” and even dietary laws in some circumstances.

It has long been hypothesized that the reason for the broad social engineering campaign against Segwit2X, the New York Agreement and Jeff Garzik was because Blockstream’s venture partners invested in them under the pretense that Blockstream was in control of BTC Core. If the reference client for BTC changed to one designed by a non-Blockstream employee, that illusion would quickly evaporate, and the work put into the hegemonic control of the BTC roadmap would have been for naught.

The overtones of fear of Bitcoin’s industrial class (large mining operations) and the need for a populist revolt to govern Bitcoin by means of Raspberry Pi computers led to some comparing their revolution to a Bolshevik takeover or some kind of technocratic union strike.

This anti-business, anti-competitive narrative of small-blocker populism persists to this day. They still often refer to this era as the attempted “corporate take-over of Bitcoin” while conveniently ignoring the fact small blockers and big blockers shared venture partners in many circumstances.

‘Bitcoin’ Cash

Amid the malaise, it became clear that the only part of Segwit2X that would see the light of day was the Blockstream-programmed Segwit. The honest nodes of the network teamed up with research and development teams from Bitcoin Unlimited, Bitcoin Classic, Bitcoin XT and a new outfit called Bitcoin ABC to code up a Bitcoin implementation that would accept 8 megabyte blocks, ignore the Segwit protocol change and have a variation on the difficulty adjustment. A former Facebook developer named Amaury Sechet would code up the reference client with replay protection and Bitcoin Cash was born on August 1, 2017—purposely unable to orphan BTC blocks, and launched with a bug that pushed it ahead in block height by several weeks compared to BTC.

A month or so after the “Future of Bitcoin” conference at Arnhem (critical reference material for Bitcoin fans) BCH was underpriced compared to BTC, and there was a lack of clarity as to what would happen with Segwit2X a month later. Dr. Craig Wright had given a fiery speech about the problems of UASF and the sybil attack against Bitcoin’s governance model, and he and the team at the newly launched nChain needed to make quick decisions about which chain they would support for ongoing research and development.

Ultimately, a coalition of Bitcoin.com, nChain, CoinGeek, Bitmain, ViaBTC and the implementation teams of Bitcoin Unlimited, XT, Classic and ABC would become the basis of the BCH community: fighting to restore Satoshi’s Vision of on-chain scaling, governance by proof of work and growing into an electronic cash system for the world.

Unfortunately, the excitement was short-lived. BCH had some early victories in the narrative war with help from NIST, which stated “Technically, Bitcoin is a fork and Bitcoin Cash is the original blockchain. When the hard fork occurred, people had access to the same amount of coins on Bitcoin and Bitcoin Cash.”

BCH also benefited from support of many veterans of the scaling war, but the split of BTC and BCH also meant that BTC Core became a monolith unto itself. With no big blockers to fight for consensus, Segwit2X died, and Blockstream’s venture partners touted BTC’s failure to upgrade a victory against the attempted “corporate take over of bitcoin.” With fresh liquidity from Tether, Inc, the perception of BCH being a “dividend,” Ethereum ICOs heating up and wall-to-wall news about prices increasing due to rumors about Bitcoin ETF, futures trading began at CME group, and an explosion of excitement occurred around non-KYC trading at a new exchange called “Binance.” All of this was fueling a frenzy of retail traders hungry to make hidden gains by trading coins on shady exchanges around the world!

With the shift from the scaling debate to the bull market, BTC landed in the spotlight, and the BCHers began to bicker about the path forward. Some believed in fighting to orphan BTC by any means necessary. Others squabbled about changes to the protocol, and still others sought to create de facto governance organizations in the form of “The Bitcoin Cash Fund.” From selfish mining to poison blocks and the fight over “0 conf” safety, personalities got hot in early 2018 with sparring matches among Emin Gun Sirer, Peter Rizun, Amaury Sechet and Dr. Craig Wright becoming toxic.

In parallel, BTC’s fees had risen to an average of about $50 per transaction, summarizing all of the warnings from the big blockers for the last several years. But the “cash” narrative had largely been lost, and BCH was not nearly as unified in vision as BTC—which was benefitting from the positive PR of massive price gains in a short amount of time.

In previous installments of this series, we spoke on the era where the block size limit was first being touched. In 2017, the 1 megabyte block size limit had finally become a serious issue, but the small blockers claimed that great on-chain “efficiency” like Segwit, Schnorr Signatures and off-chain solutions like Lightning Network would make the low limit tenable into the future. In some ways, they were right. People genuinely do not want or need to use BTC for anything that required big blocks as most people were happy to hold their coins on custodial exchanges and never make a BTC transaction anyways. Investors were there to get rich by buying and holding the asset and nothing more.

However, miners like Mempool started to mine blocks over the BTC limit on BCH in 2018, and after the split of BSV and BCH, increasing records for total block size have continued to be set—indicating that there was always demand for a scalable Bitcoin network. We just wouldn’t know unless we looked!

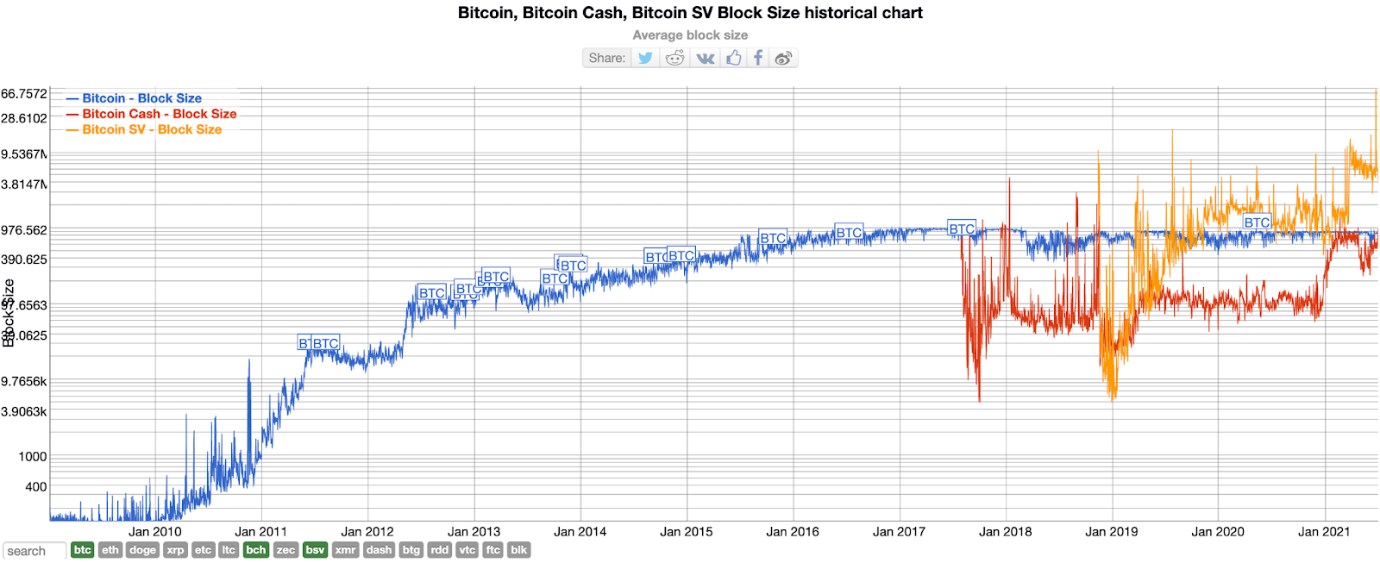

Today, BTC average block size remains right around 1 megabyte, BCH average block size is roughly the same even though their protocol limit is 32 megabytes, but BSV average block size (liberated to have no protocol limit) continues an upward trend where every quarter has a higher average block size than the last. In January 2021, average block size was more than double that of BTC and BCH, by March 2021, the average was over 5 megabytes. By the end of the second quarter in 2021, the average block size hit a peak of 65 megabytes on the main net before settling back down to the mean rate of growth with an average around 10 megabytes per block.

The reasons for incredible growth in the Bitcoin SV ecosystem will be covered in the 4th and final installment of the Bitcoin History Series: Genesis – A New Beginning in the Aftermath of The Great Hash War. There, we will cover the role of Bitcoin.com, Bitcoin ABC and Bitmain, and the betrayal that split the chain and everything that happened leading up to BSV’s complete (and unintended) liberation from the small blockers.

03-02-2026

03-02-2026