|

Getting your Trinity Audio player ready...

|

The halvening is a guide stone in the history of Bitcoin: a time to reflect on the advancement in block size, transaction processing profitability, and progress of the bitcoin economy as a whole. Bitcoins, though issued by Satoshi Nakamoto in 2009, are emitted on a predictable schedule that cuts in half every 210,000 blocks, or roughly four years. While the countdown to zero emission is generations long, the point at which the network needs to become self-sustaining by generating large blocks full of fees will occur during the 2020’s. As network security makes its punctuated transition from the subsidy to standing on its own, we will discuss the history of the major eras of the protocol in a multi-part series with a focus on how block size and progress have always been intrinsically linked. Read Bitcoin History Part 1: The early days—Satoshi, no limits, 184B Bitcoins and on-chain poker game.

…and Peter and Luke Jr.

The 2012-2016 era between halvenings was a time of an extreme shift in power and influence. At the beginning of the halvening cycle, the Bitcoin protocol and network were still primarily secured by small hobbyist nodes who were in open communication with developers—who were also a small group of amateur contributors.

By the end of the cycle, extremely specialized ASICs had consolidated most nodes into Chinese managed mega-pools, and most developers were paid through venture capital-controlled development corporations. AXA Investment’s Blockstream became the face of that developer centralization. Governed entirely by censors like the anonymous “Theymos,” Reddit and BitcoinTalk channels became Orwellian doublespeak chambers, where sybils and sock puppets ruled the day.

An extreme juxtaposition grew out of this time period creating a chasm between the Western developer intelligentsia and the Eastern mining industrialists. The debates raged while many of the old guard moved on to do other things with their lives—citing the toxicity of the small blockers. It would be the last period where BTC would benefit from exponential block size growth, and the last halvening with a unified UTXO set of Bitcoin. But many battles were lost in this era as Bitcoiners underestimated the guile of the small blockers.

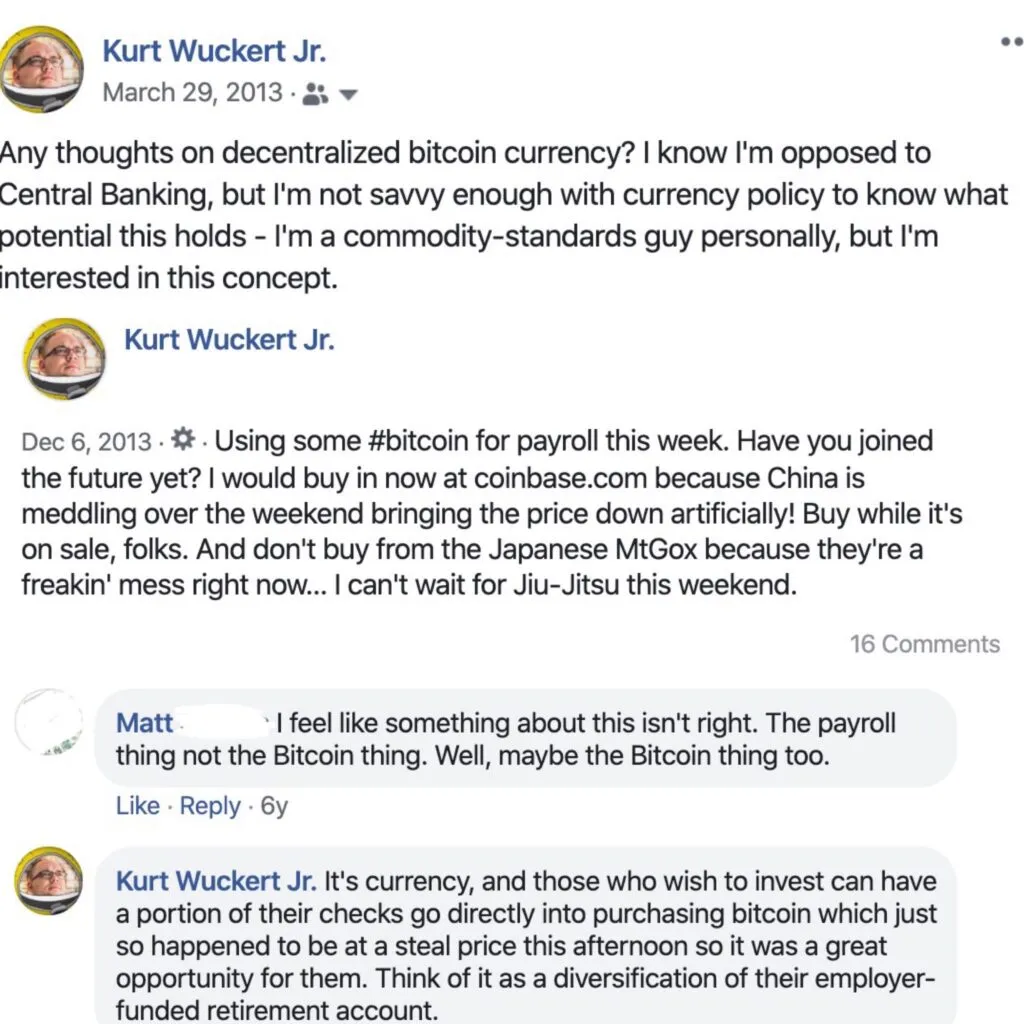

On a personal note, this is the era during which I was introduced to Bitcoin. In 2012, someone asked if they could pay me to print them some posters in exchange for Bitcoin. I accepted, and that started me down the rabbit hole. Here are some of my earliest social media posts about bitcoin. Turns out, I warned everyone about the collapse of Mt. Gox that would happen in 2014, but that is not the focus of this piece!

We are scaling on chain, right?

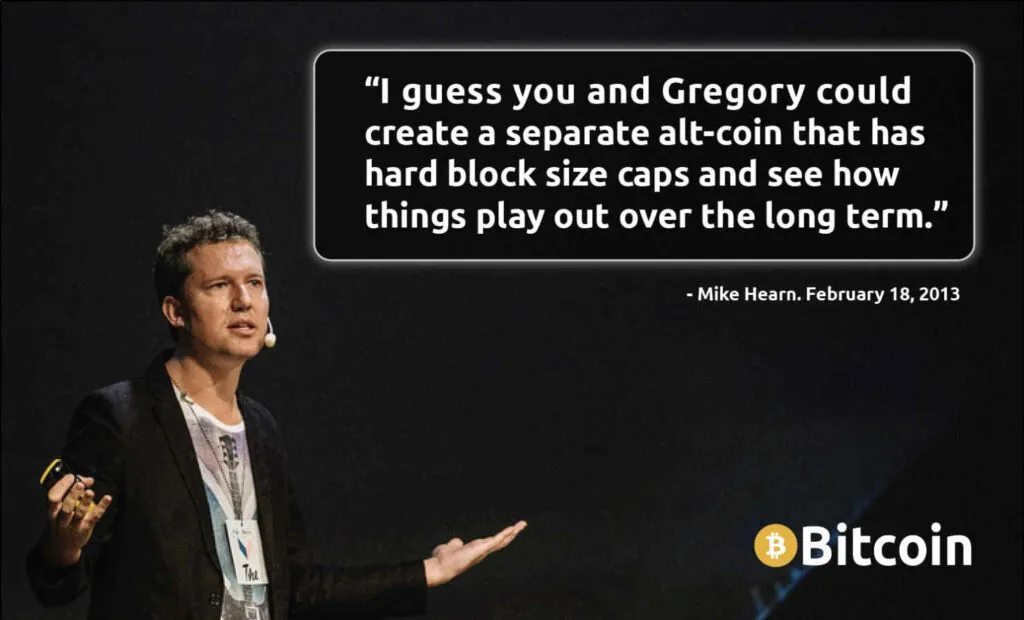

The most fascinating thing about this era of Bitcoin is the wealth of public discussion available from today’s prominent small blockers who were, at the time, advocates of on-chain scaling. In 2012-2014, Mike Hearn and Gavin Andresen were still very much the lead thinkers in the space, and the common view of bitcoin was that the block size limit would continue to be raised as needed.

The “means of exchange” use case was still paramount as businesses began to adopt bitcoin for payments and The Silk Road reached the peak of its popularity online. The XT, Classic and Unlimited implementations of bitcoin would emerge to facilitate fast, cheap BTC payments, but they were met with fear campaigns and endless rounds of debate from technocrats like Gregory Maxwell and Peter Todd.

However, today’s hardline small-blockers seemed quite reasonable just a few years ago.

For example, bitcoin improvement proposals (commonly called “BIPs”) came from Jeff Garzik and Gavin Andresen to raise the block size limit to 2MB and 8MB respectively, in 2015. Peter Wuille, a co-founder of Blockstream and the future author of Segregated Witness protocol soft fork, proposed raising the block size limit a more conservative (for the time) 4.4% every 97 days until the year 2063, at which point blocks would be limited to 2GB, and reassessed by developers. Intriguingly, this was a step backward from his previous statements in 2013, where he stated a more aggressive pro-hard-forking strategy to increase the BTC block size limit one hundred times larger than it is today—nearly seven years later:

First of all, my opinion: I’m in favor of increasing the block size limit in a hard fork, but very much against removing the limit entirely… My suggestion would be a one-time increase to perhaps 10 MiB or 100 MiB blocks – Peter Wuille. February 18, 2013

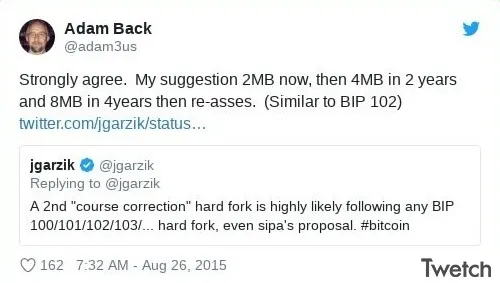

Blockstream CEO, Adam Back was also similarly in favor of raising the block size limit up to 8mb in response to the early popularity of the Bitcoin XT mining software by Mike Hearn. In a post on Twitter that seems impossible today, Back supported what eventually became the BCH roadmap.

In May of 2015, Wladimir Van Der Laan, the biggest contributor of code in Bitcoin Core stated: “I understand the advantages of scaling, I do not doubt a block size increase will *work* Although there may be unforseen issues, I’m confident they’ll be resolved.”

Even famed Bitcoin educator, Andreas Antonopoulos, was in favor of a block size increase in 2015.

Most Bitcoin developers, media and influencers would ultimately renege on the promise to raise the block size limit, but we are getting a little bit ahead of things.

Who or what is Blockstream?

The name “Blockstream” was likely chosen to evoke visions of a dam stopping the flow of potential; bottling it up to sell in metered doses for profit. Founded in 2014 with a seed round from AXA Strategic Ventures, Blockstream launched aggressively. Their funding occurred quietly because the European Insurance company was run by Bilderberg Group Chairman Henri De Castries, and the Bitcoin community would have immediately balked at the notion of a central banking magnate funding the development of bitcoin.

But, with no perceptible business model, Blockstream successfully gathered together the sophomore class of Bitcoin developers and paid them a professional grade salary. Their mission was to guide the open source development of bitcoin until only small blockers controlled the keys to the Github repo.

Quickly, Blockstream received multiple rounds of investment from the “who’s who” of Silicon Valley venture capitalists, and quickly released their “side chains whitepaper.” The paper explained how bitcoin could not remain sufficiently decentralized if the block size limit was lifted, and therefore all development of Bitcoin would ultimately be commercialized into their yet-to-be-announced sidechain solutions.

As venture money increased, the narrative shifted from Bitcoin’s abilities as “programmable money” to having been fundamentally designed as little more than a store of value; a sort of Swiss bank account for the everyman running on software managed by Blockstream.

The small blockers’ public relations campaign warned of the constant fears around the centralization of Chinese hashing nodes, the need for non-hashing nodes in the hands of Western intelligentsia and the need to protect the ledger from what they saw as SPAM—which was any transaction they did not like. Famous for saying “just wait for Lightning Network,” they started promising that trustless payment channels would be ready in “18 months” and that businesses would just need to wait to use Bitcoin!

Nearly all of the small blockers would consolidate into Blockstream by 2015. They brought in public rabble rousers like Samson Mow from outside of the Bitcoin community to assert their “toxic” narrative consisting of multiple rounds of social purity tests. After laying a wide base of groundwork, they would largely control the entire roadmap for BTC going forward while the old guard became overwhelmed by censorship and attacks. In 2015-16 nodes not conforming to Blockstream’s edicts in Bitcoin Core were repeatedly DDoS attacked; eliminating big block competitors like Bitcoin XT and Bitcoin Classic from the network entirely.

Mike Hearn said of the attacks,

The attacks were so large that they disconnected entire regions from the internet:

I was DDoS’d. It was a massive DDoS that took down my entire (rural) ISP. Everyone in five towns lost their internet service for several hours last summer because of these criminals. It definitely discouraged me from hosting nodes.

In other cases, entire data centers were disconnected from the internet until the single XT node inside them was stopped. About a third of the nodes were attacked and removed from the internet in this way.

Worse, the mining pool that had been offering BIP101 was also attacked and forced to stop. The message was clear: anyone who supported bigger blocks, or even allowed other people to vote for them, would be assaulted.

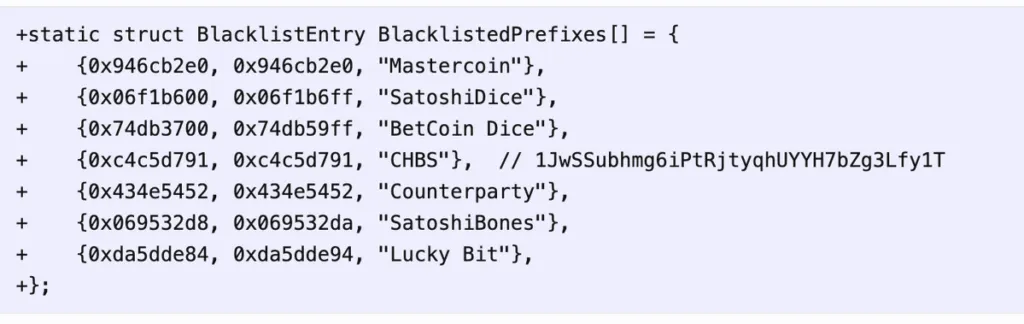

Meanwhile, Blockstream employees were issuing code that contained blacklisted addresses of legitimate Bitcoin businesses—functionally censoring them from using the Bitcoin network.

Because they saw business activity on the blockchain as SPAM, they had the gall to re-categorize these transactions all together, stating:

All entries on the blacklist are known DDoS attacks against the Bitcoin network, not political. – Luke Dash Jr October 6, 2014

Ultimately, Blockstream and their artfully executed coup d’etat over Bitcoin would prove quite successful, but a counter-revolution was brewing. As Chinese hashing nodes were consolidating into large ASIC farms operated by the enigmatic Jihan Wu, a new figure would enter the discussion to reinvigorate the big block narrative; but not before several, gut-wrenching losses. A little-known computer scientist named Dr. Craig Wright would make his way to a Melbourne Bitcoin conference… His refreshing take on Bitcoin would raise curiosity about the bounds of on-chain scaling, and it would also be the catalyst for what ultimately became the darkest phase of the Bitcoin civil war.

Who is Craig Wright?

As a prelude to a wild 2015, this brief documentary appeared: the first public appearance of Dr. Craig Wright as a bitcoiner. He was a highly credentialed polymath with grandiose claims about Bitcoin in line with the big blockers’ vision of scaling, but nobody was ready for all of the revelations that would change the face of Bitcoin forever.

Caption: The first time the bitcoin world would meet Dr. Craig Wright.

In 2015, Dr. Wright would become one of the most talked about figures in the Bitcoin discussion. One of his first public appearances was at the Bitcoin Investor Conference in Las Vegas in November, where he spoke circles around Nick Szabo about the “Turing complete” nature of Bitcoin script. Szabo criticized, but Wright persisted, and the entire panel seemed dumbfounded by the level of understanding that the largely unknown figure had on the topic. He explained the use of scripts that the supposed experts did not even know existed—catapulting him into the spotlight.

Due to the exposure, however, the next season in Wright’s life would be a whirlwind.

About two weeks after Wright’s trouncing of Szabo, Gizmodo and Wired Magazine, outed Wright as Satoshi Nakamoto. Before the news had even made it around the globe, the Australian Tax Office would raid Wright’s home, pushing him into about six months of living on the run. During this period, Wright sought help from those who he hoped would be allies as he tried to assess his next steps.

Just two weeks later, Mike Hearn suddenly quit Bitcoin forever. He declared the Bitcoin experiment dead as a complete failure citing the toxicity of the community and that the network was “on the brink of technical collapse” in his letter of good riddance from all the grief that Bitcoin had caused him. He stated about the new de facto king of the repo, “Gregory Maxwell had an unusual set of views: he once claimed he had mathematically proven Bitcoin to be impossible. More problematically, he did not believe in Satoshi’s original vision” before having these closing words to the bitcoin community:

…good luck, stay strong, and I wish you the best.

Who is Satoshi Nakamoto?

While publicly denying the Nakamoto identity after being driven from his home, Wright reached out to a few influential people in the Bitcoin economy, and he gave them the necessary cryptographic proofs of his identity for a reveal in the first week of May of 2016. The following were chosen presumably for their roles in the Bitcoin economy, and had the following to say about their experiences:

Gavin Andresen: Lead Developer and Maintainer of the Bitcoin Core Github repository.

I believe Craig Steven Wright is the person who invented Bitcoin.

I was flown to London to meet Dr. Wright a couple of weeks ago, after an initial email conversation convinced me that there was a very good chance he was the same person I’d communicated with in 2010 and early 2011. After spending time with him I am convinced beyond a reasonable doubt: Craig Wright is Satoshi.

Part of that time was spent on a careful cryptographic verification of messages signed with keys that only Satoshi should possess. But even before I witnessed the keys signed and then verified on a clean computer that could not have been tampered with, I was reasonably certain I was sitting next to the Father of Bitcoin.

Jon Matonis: Renowned monetary economist and Founding Chairman of the Bitcoin Foundation.

I had the opportunity to review the relevant data along three distinct lines: cryptographic, social, and technical. Based on what I witnessed, it is my firm belief that Craig Steven Wright satisfies all three categories. For cryptographic proof in my presence, Craig signed and verified a message using the private key from block #1 newly-generated coins and from block #9 newly-generated coins (the first transaction to Hal Finney). The social evidence, including his unique personality, early emails that I received, and early drafts of the Bitcoin white paper, points to Craig as the creator. I also received satisfactory explanations to my questions about registering the bitcoin.org domain and the various time-of-day postings to the BitcoinTalk forum. Additionally, Craig’s technical working knowledge of public key cryptography, Bitcoin’s addressing system, and proof-of-work consensus in a distributed peer-to-peer environment is very strong.

According to me, the proof is conclusive and I have no doubt that Craig Steven Wright is the person behind the Bitcoin technology, Nakamoto consensus, and the Satoshi Nakamoto name.

Ian Grigg: Legendary Financial Cryptographer and inventor of the Ricardian Contract.

Yet, a warning to all. Satoshi was a vision, but Craig is a man. The two are not equal, not equivalent, not even close. Which is why the team aspect is so important to understand, something the world will not appreciate for some time. It is true that Craig is the larger part of the genius behind the team… As you come to know Craig you will discover he is no legend, no God, no saviour. He’s just a guy, a prickly one at that, he’s a lot like those very difficult geek/nerd/blatherers that turn minor IT support into a social drama. In short, Craig is human, in that very way that Satoshi could never be.

The first week of May 2016 also saw Wright appear for a public signing on the BBC, where he explained the nature of a Bitcoin public key signing and confirmed the Satoshi keys (a crucial aspect of proving the Satoshi identity) on the program. But rather than a celebration for the return of Nakamoto, and a renewed interest in the development of on-chain business, there was a massive culling of non-Blockstream bitcoiners instead. Gavin Andresen immediately had his commit keys revoked, and a public shaming campaign of anyone associated with Wright started within the week.

On May 6, 2016, Wladimir Van Der Laan said of Andresen, “His privileges were seen as a liability by members of the project for a while… if he is absolutely convinced that this is Satoshi, there is a risk that he’d give away the repository to a scammer.”

Ultimately, the exit of Mike Hearn and the removal of Gavin Andresen during the same season as the entrance of Dr. Craig Wright would become a catalyst for the next phase of the Blockstream Civil war. Ian Grigg summarized this era as such:

Should you work with Satoshi? Hang out with Craig? Ask silly questions on chat? Spend your journalistic career filling out the other members? Ask the Satoshii for advice on altCoins?

No.

I can tell you, if you’re a friend of Satoshi, you’re marked. Everyone who’s got close to Satoshi has suffered…

People died for Bitcoin, folks, people died.

The 2016 halvening

Amid all the fury surrounding Andresen, Wright and the takeover of bitcoin, the second halvening was set to occur in the second week of July 2016. In stark contrast to the hope and excitement that defined the 2012 halvening, this one would occur during some of bitcoin’s darkest days. Mike Hearn would lament:

“…there’s no longer much reason to think Bitcoin can actually be better than the existing financial system. Think about it. If you had never heard about Bitcoin before, would you care about a payments network that:

- Couldn’t move your existing money

- Had wildly unpredictable fees that were high and rising fast

- Allowed buyers to take back payments they’d made after walking out of shops, by simply pressing a button (if you aren’t aware of this “feature” that’s because Bitcoin was only just changed to allow it)

- Is suffering large backlogs and flaky payments

- … which is controlled by China

- … and in which the companies and people building it were in open civil war?”

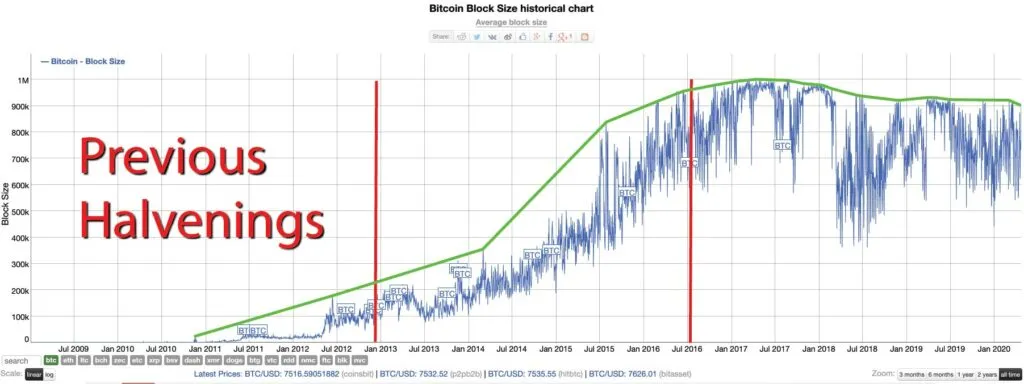

Despite the malaise, Bitcoin had again experienced parabolic growth in average block size from under 200kb to near 1000kb, which continued to be a bullish sign for Bitcoin in this halvening era.

Traffic was still spilling onto the network; absorbing value from other parts of the economy. The fiat price was continuing to appreciate, but average fees per transaction were beginning to skyrocket because of the block size limit—a major deterrent for continued growth. Tether was becoming a major player on the exchanges, and hash power was about to take a post-halvening dive just before the 2017 bull-run would create all-time-highs in price, hash power and difficulty.

The halvening was about a year before the need for more transaction processing capacity would foment the Raspberry Rebellion. This would ultimately split Bitcoin into the Blockstream controlled Bitcoin Core and the more independent (at the time) Bitcoin Cash and initiate an on-going bitcoin bear market that persists to this day.

The era between the 2016 and 2020 halvenings is coming to an end, and with it, we will see the death of the subsidy-based mining era. In its place, the rise of the transaction processing economy is occurring on the professional grade Bitcoin network (Bitcoin SV), but that will be covered in the next parts of this series!

Editor’s Note: Many thanks to Bitcoin researcher Derek Magill for maintaining a complete database of Satoshi Nakamoto’s publicly known writings at https://nakamotostudies.org/, and for his direct help in sourcing some of the quotes used in this article.

07-05-2025

07-05-2025