Kurt Wuckert Jr. broadcasts a Bitcoin 101 class from the South Florida Bitcoin Citadel. The broadcast is sponsored by the BSV Blockchain Association and covers the basics of Bitcoin, including its structure and function.

The brief history of money

Wuckert begins by showing a Sumerian tablet that describes the details of a loan agreement. He notes that there’s a very little confirmed history of money. There are lots of myths, and this tablet, which is 4,000 years old at least, is the first complex loan agreement, dispelling the idea that there were only primitive forms of money back then.

He then goes through several early forms of money, including yap stones, Roman coins, and others. He explains that Roman coins used to be a weight of measure, but they were problematic, so they issued fiat on the agreement it could be exchanged for precious metals.

Later, wealthy families such as the Medicis and Rothschilds became lenders, formed banks, and eventually created central banks. Lending to governments and kings was much less risky than lending to individuals. There was some backlash to this system, but it stuck, eventually establishing massive financial centers like the City of London.

In the late 19th and early 20th centuries, economists like Ludvig von Mises and John Maynard Keynes debated the benefits of various monetary systems. Mises argued that, instead of money being distributed by fiat, currencies should be issued by private entities and backed by something you can measure (such as gold). Keynes argued that money is backed by power and can be used to increase power. He argued that inflation can continue forever and that what’s good for the empire is good for the people.

The computer revolution and how it links to money

And then came computers. A few dozen years later, Alan Turing designed the Bombe machine to crack the Nazi enigma code. It’s essentially a guess-and-check machine attempting to break the encryption by brute force. “For all intents and purposes, this is a mining machine,” Wuckert tells us. It was a revolution in computing and put Britain on course to lead in that field for a generation.

All of this led to the ‘crypto culture’ and early internet that saturated in the 60s and peaked in the 90s. People like David Chaum, Ralph Merkle, Martin Hellman, and Whitefield Diffie used technology like PGP keys and digital signatures to send encrypted messages. Chaum created the first digital currency, Merkle created the concept of the Merkle tree, and Diffie and Hellman built the Diffie-Hellman key exchange method.

This movement was deeply political and rooted in libertarianism, leading to the cypherpunk movement. Personalities like John Gilmore, Tim May, and Hal Finney characterize this movement. Wuckert points out that there’s a mistaken notion that Bitcoin is a cypherpunk idea, and while some cypherpunks did work on it after it was released, this is not true.

All of this led to modern-day internet culture. In 1999, Milton Friedman said that the missing thing was a “reliable e-cash.” Wuckert points out that he did not mean digital gold but cash, as Bitcoin was intended to be.

Enter Bitcoin

In the pre-internet days, there were around 100 people on earth doing all of this professionally. These people were busy figuring out things like password management, making systems communicate securely with each other, and making commerce easier.

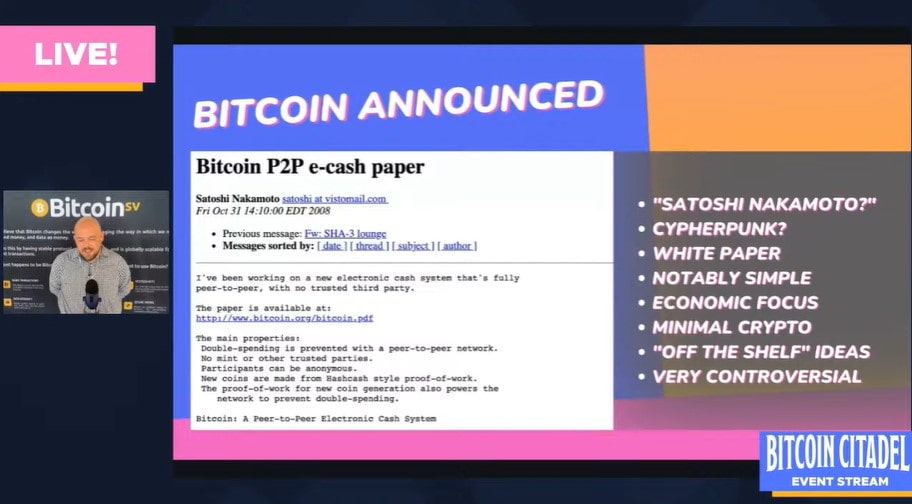

On October 31, 2008, Satoshi Nakamoto dropped the Bitcoin white paper on the Metzdowd Cryptography mailing list. Nobody in this insular community had ever heard of him. His initial communication told them he’d been working on a “new electronic cash system that’s fully peer-to-peer with no trusted third parties.”

Nakamoto’s paper was not received well by this community. They had questions about who he was, whether he was an individual or a group, and were eager to tell him why it wouldn’t work. Characters like James Donald told him everybody would need to run a full node. Nakamoto told them they were wrong, explaining that Bitcoin was primarily an economic system that used cryptography for some things, such as key generation, and that’s why they didn’t grasp it. “There was a fundamental disagreement on day one,” Wuckert tells us.

The first thing Nakamoto mentioned was that he solved the double spending problem, Wuckert tells us. This is a computer science application of a real-world problem—double payments. Due to corruption in databases like those run by Visa, as well as human error, these things happen.

Due to the costs associated with mediating disputes and fixing issues like double spending, micropayments were economically unviable in trust-based systems. With a decentralized system like Bitcoin, these costs were eliminated, so the minimum voidable payment was much smaller.

However, in Bitcoin, there is no central party like a mint at the center of the network. How do you get different parties who don’t necessarily trust each other to agree on the state of the ledger? The Bitcoin white paper outlined the solution.

How Bitcoin works—key concepts

Essential to Bitcoin is the concept of hashing. What is a hash function? A hash function compresses data into a predictable format—a long string of numbers and letters. If you have the key to unlock it, you can access that data forever, read it, send it to someone else, etc. Hash functions are an essential compression and security tool in Bitcoin.

Explaining the Bitcoin network more broadly, Wuckert shows a graph illustrating how it looks. He explains that nodes are computers on the peer-to-peer network; they run 24/7, validate transactions and enforce the rules of the system, and send and receive data. As there are lots of different nodes operating globally, there’s no way to coordinate corruption and theft. This allows us to do business with people we don’t necessarily trust without all the intermediaries we have come to rely on.

What is blockchain? It’s a distributed database. It’s forward-only and very difficult to reverse, showing us a permanent ledger of payments. Every time somebody builds a new data block on top of a previous one, it becomes a lot more difficult to reverse the data in them, Wuckert explains.

Delving into wallets, Wuckert says they are the most misunderstood thing in Bitcoin. Bitcoin wallets don’t work like real wallets, he explains, mentioning that your coins are not in your wallet; they’re on the ledger.

Wallets generate private and public keys, unlock coins to be spent, create addresses for receipt, and can manage other assets (like NFTs) too.

“It works a little bit like a window that allows you to see the parts of the network to which you have keys,” he says.

Proof of work is another key concept in Bitcoin. “This really, really matters,” Wuckert tells us. It’s not just a technical mechanism—it has been likened to a peacock’s tail—a costly display of fitness. Mining farms are hot and extremely costly, consuming vast quantities of electricity. They’re barely profitable, ensuring people are mining for the right reasons.

Mining pools are pieces of software on top of nodes that allow other people to add their hash power. These collective pools are the only way most people stand a chance of mining blocks against big players with hundreds of millions to spend.

Wuckert then breaks down a Bitcoin transaction step-by-step:

- You broadcast a transaction to the Bitcoin network.

- Nodes gather and validate unconfirmed transactions.

- ASICs search for a valid hash for proof-of-work.

- A reconciled block is proposed with POW to be entered to the chain.

- If accepted, nodes are paid a subsidy and transaction fees.

What about disagreements in Bitcoin?

“Bitcoin’s security is competitive, not technological,” Wuckert reminds us. This is what he was alluding to earlier when he said it was an economic system rather than a purely cryptographic one. In a competition, there are winners and losers, and this can lead to disagreements. For example, two people might find a block within seconds, with different nodes disagreeing on who found it first and which block to build on.

One way to solve this is to go with the block mined by the party that has contributed the most proof-of-work to the network (the biggest peacocks’ tail). However, if a block has already been propagated to most of the network, that might be the one considered valid. One of these blocks will always die, causing one party to lose—this is called an orphan race.

There are also other disagreements, such as what type of transactions can be processed, who and who not to do business with, etc. These disagreements can lead to splits, leading to the question of which chain is Bitcoin. This has happened several times in the past—there are multiple competing chains today but only one true version which is Bitcoin SV.

The biggest disagreement in Bitcoin history

The biggest disagreement in Bitcoins’ history was about the block size limit. In the early days, Nakamoto agreed to implement a 1MB block size limit to prevent DoS attacks. At the time, Bitcoin was running on people’s laptops and work computers, so this was needed. The block size limit was supposed to be temporary, but a reluctance to raise it again led to the biggest political fight in the history of Bitcoin.

Nakamoto advocated for big blocks, telling the early Bitcoiners that nodes would end up in large data centers. He also disagreed with using Bitcoin for nefarious purposes, including helping Wikileaks after its incoming payment methods were used. He disappeared shortly after this, leaving the keys in Gavin Andresens’ hands. Andresen then distributed the keys to the SourceForge repository to others, such as Gregory Maxwell and Luke Dashjr. The infighting about the way to make it go started right away.

Soon after, big money arrived on the scene. Players like Digital Currency Group, with executives from Bain Capital, candidates for Chairman of the Federal Reserve, came with bundles of cash and offered these ragtag developers generous salaries to steer Bitcoin development. They stripped out features of Bitcoin, pushing the narrative that it should be a settlement layer for large transactions and small transactions should be done through payment layers developed by companies they own.

Nakamoto was then doxed. He was warned that his details, like his IP address, were known, and Bitcoin developers started getting blackmail emails from his original email address.

Is Dr. Craig Wright Satoshi Nakamoto?

Not long after this warning to Nakamoto, Wired and Gizmodo magazines simultaneously published articles claiming that an Australian polymath, Dr. Craig Wright, was Bitcoin’s inventor.

Dr. Wright was unknown to the cryptographers who had interacted with Nakamoto early on, and they did not like what he stood for. To this day, it’s remarkably unpopular that Dr. Wright is Nakamoto due partly to his very different vision of what Bitcoin is and how to prove he invented it. Dr. Wright prefers to use the law and disagrees with the logic that moving a coin from Nakamoto’s wallet proves his identity.

Today, Dr. Wright works at his company nChain, and is focused on scaling Bitcoin and patenting intellectual property related to blockchain technology. “He’s doing the dance and working his ass off,” Wuckert says, circling back to his analogy on the peacocks’ tail and proof-of-work.

Big block backlash 2015-2018

Wuckert shows a list of people who have tried various innovative things on Bitcoin. Gavin Andresen, Mike Hearn, Dr. Craig Wright, and others have been consistently picked off and edged out by small-block extremists.

As a result of all the disagreements, three chains are now competing for hash power. BTC, BCH, and BSV have competing visions of what Bitcoin should be. BSV has unbounded blocks and unlimited scaling potential for ultra-low fees, and the others have very definite upper limits on how many transactions they can process and what they can do. Central to BSV is the notion that the protocol can not fundamentally change to allow for stable building on top of it.

Wuckert closes by saying that how Bitcoin should be will always be a contentious issue, and everyone can compete as they wish. He then advocates for Bitcoin SV and demonstrates how it works, offering free pennies of Bitcoin to HandCash wallet users to try applications like Haste Arcade.

Watch: The Future World with Blockchain

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.