Money indeed makes the world go round. It has always inexplicably been part of our daily lives, from earning it via jobs and investments to spending it for products, services, and experiences. It is a necessity no matter the currency and has always been a symbol of barter and exchange.

Money has been around long enough for it to advance with everything else in this modern era. Technology has given birth to cashless transactions and even brought forth the concept of digital currency and cryptocurrency, which still encapsulates the essence of money.

The concept of digital currency went viral when the world was introduced to Bitcoin in 2009. It is essentially a digital currency that operates independently from a bank, allowing unchangeable consensus mechanisms to regulate it instead.

To better understand digital currency and its benefits, it is worth looking into a comprehensive history of money.

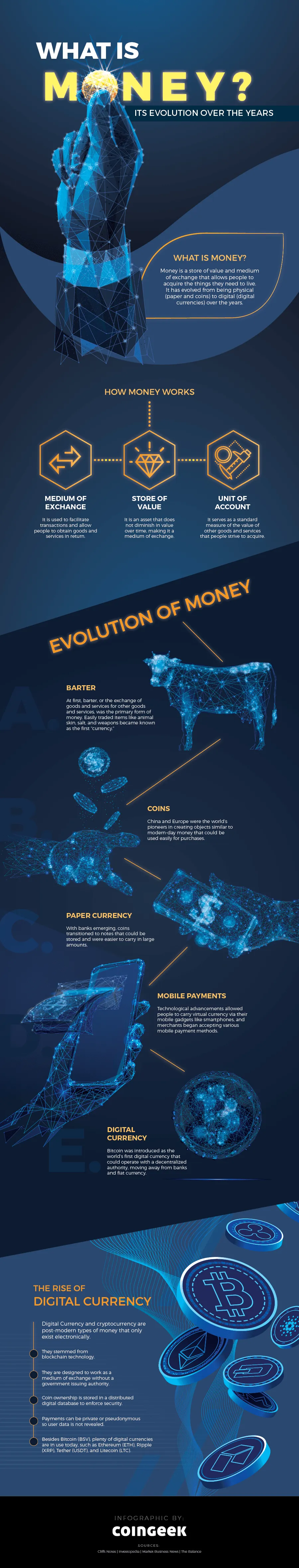

What is Money?

Money is what people use to pay for goods and services. Money has evolved from fiat to digital currencies over the past few years. But before both fiat and digital currency, money was simply barter; two people would agree to exchange their goods and services in amounts that they believe had equal value.

How Money Works

For a method of payment to be considered “money,” it has to have three core functions, it has to be a:

- Medium of Exchange – meaning an item you can use to trade or acquire something else. In this regard, both parties should agree that the money has value.

- Store of Value – Money has to hold its value for a definitive period of time, which is what makes it possible for it to be a medium of exchange. This means that you must be able to store it and use it at a later time, in other words, it holds its value over time. This is much different than bartered or traded goods, which may have an expiration date or might depreciate in value.

- Unit of account – Money must serve as a way to price or measure goods and services that people want to buy. It becomes a baseline for buying different items, with some costing more than others.

Evolution of Money

Source: Bitstocks Media

Money has come a long way from when people used to barter. Below is a more detailed overview of how money evolved over the years.

1. Barter

Bartering was the common practice of acquiring goods and services about 3,000 years before coins appeared. Barter involved a lot of negotiation, haggling, and altering deal terms before two parties could agree that they would receive the same value for exchanged goods and services.

However, a barter could take a significant amount of time. Sometimes, a seller would consider services as a fair trade for their product instead of another product. Let’s say you are selling a rare item. What you consider fair trade for this item might be the buyer performing a task that requires weeks to accomplish.

Eventually, people settled on items that could be easily traded like animal skins, salt, and weapons to make the process faster. These items are often recognized as the first type of currency.

2. Coins

Because trading goods are not always easy to carry around, evolution happened. China and Europe were the world’s pioneers in creating objects similar to modern-day money to make it easier to purchase goods and services.

The first region to use an industrial facility to manufacture coins was in Europe. This facility is known to this day as a mint. The minted coins were made from a naturally occurring mixture of silver and gold called electrum and were stamped with pictures that served as denominations.

3. Paper Currency

In the coming years, banks started to emerge and became the primary institution that stored metal coins. Banks also issued paper money for borrowers to carry around. At any time, a person could go to the bank to have their paper currency exchanged for its face value in metal coins.

This made it easier for people to pay for goods and services in large quantities and added an extra layer of security and convenience for people.

4. Mobile Payments

If there seems to be a common trend in the evolution of money, it’s that it usually becomes more portable, accessible, and convenient to handle. Technological advancements allowed users to carry virtual currency in their mobile devices, like smartphones, and use it at accepted stores and among peers.

Nowadays, banks have official apps that allow you to make local and international interbank transfers, globalizing the reach of money.

5. Digital Currency

With mobile wallets on the scene, it was not going to be long before a completely digital currency would emerge. In 2009, the financial world was taken aback with the introduction of Bitcoin, the first digital currency. It revolved around the fact that it could operate with a decentralized authority, moving away from banks and fiat currency.

In the coming years, many more virtual currencies emerged, such as Ethereum (ETH), Ripple (XRP), Tether (USDT), and Litecoin (LTC), each with their own substantial share in the market.

The Rise of Digital Currency

Digital currency made a significant impact on the world because of its unique features. First off, it only exists electronically and does not need a bank or authority to regulate it. Instead, it turns to technology and encryption.

The emergence of Bitcoin has long sparked a debate among economists about whether or not it’s here to stay. As of today, it plays a role as a new medium of exchange, as it offers things traditional money cannot:

- Peer-to-peer transactions without the need for a middleman or governing authority, such as banks or governments

- Confidential transactions that maintain the privacy of senders

- Easier international trade with lower service fees

- 24/7 access to funds

- Real-time transfers to all accounts

- Increasing adaptability with the emerging new digital currencies and wallets that can handle transactions with them

- More and more establishments are recognizing the value of digital currencies and accept them as a payment method.

- Reliable encryption techniques allow for safe transactions and fewer instances of theft

And this is only scratching the surface. There is no telling what digital currencies will evolve to be, and right now, it is exciting to study and follow the trends in digital money.

The Future of Money

Money will always be here to stay, and it will continue to evolve and adapt to human needs. It’s exciting to see what the future holds next for digital currencies.

Bitcoin may be one of the best ways to learn about cryptocurrency, as it set the trend for altcoins to take flight. If you want to know more about Bitcoin, CoinGeek has tons of articles perfect for Bitcoin for beginners.

Recommended for you

Tiny payments are changing the expenses landscape. Micropayments and nanopayments are not entirely new concepts and practices. But with the

You can earn money when you explore the world of Bitcoin and understand its intricacies. Once you get the hang

07-08-2025

07-08-2025