IRS

New IRS reporting requirements for digital assets put on ice—for now

New rules mandating firms to report digital asset transactions of over $100K won't take effect for now, with the IRS...

Kraken ask court to intervene against IRS demands

In a petition filed in San Francisco, Kraken argued that it should not be required to comply with “the enormous...

IRS braces for spike in digital asset tax fraud in coming weeks

Jim Lee, head of the IRS criminal investigation department, noted that the cases are in their “hundreds,” with the bulk...

IRS updates digital currency question in 1040 tax form

The tax agency posted its 1040 form last year to ask about virtual assets; however, a query led to confusion...

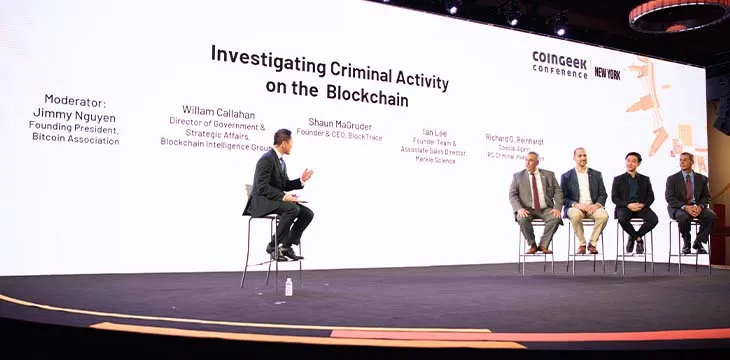

Everyone has a role to play in combating crypto crooks

The final day of the CoinGeek Conference in New York saw Bitcoin Association Founding President Jimmy Nguyen moderating a panel...

Closing the tax gap through digital asset issuers

In his latest piece, Johnny Jaswal offers strategies on closing the tax gap via digital assets—with a focus on digital...

Recent

Trending

Most Views

07-13-2025

07-13-2025