Article by Johnny Jaswal

-

14 June, 2021

Closing the tax gap through digital asset issuers

In his latest piece, Johnny Jaswal offers strategies on closing the tax gap via digital assets—with a focus on digital...

-

19 March, 2021

The endangered state of digital asset exchanges

The U.S.’s expanding offensive on digital asset players should be a clear signal that existing regulatory structures apply to the...

-

3 January, 2021

Ethereum 2.0 – Ether’s journey from a security to a security

The myth of decentralization and a lack of understanding regarding the state of digital assets and platforms have allowed assets...

-

18 November, 2020

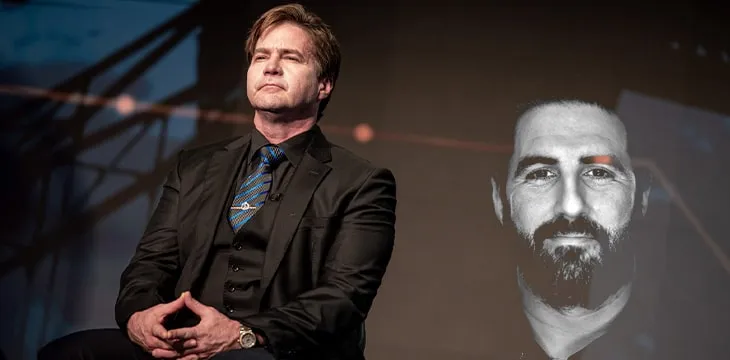

The rule of law, anarchy and self-righteousness: Craig Wright and Peter McCormack

Bitcoin can only work and be accepted within the rule of law, under which we are all equal, Johnny Jaswal...

Viewing 1-4 out of 4 articles

Recommended for you

In his latest piece, Johnny Jaswal offers strategies on closing the tax gap via digital assets—with a focus on digital...

June 14, 2021

The U.S.’s expanding offensive on digital asset players should be a clear signal that existing regulatory structures apply to the...

March 19, 2021

07-02-2025

07-02-2025