|

Getting your Trinity Audio player ready...

|

Ordinals is the polarizing non-fungible token (NFT) protocol launch that has injected much hype into the digital currency space in 2023, incentivizing a rush to mint JPEGs atop the BTC blockchain. Such activity has polarized the BTC community, demonstrating a contradiction between what is left of the free market, libertarian, censorship-resistant camp, and the small blockers who believe BTC should only be used for sound money transactions.

Embedding file data into the blockchain is a long-debated topic, with the market clearly placing value on doing so, for example, on other blockchains and now on BTC. Clearly, demand exists for doing so on the highest market cap coin, as block sizes have risen significantly.

Correlated or not, the price of BTC has risen, perhaps from increased demand to try a new use case, which further results in conflicted views as both aforementioned camps want to see the price increase.

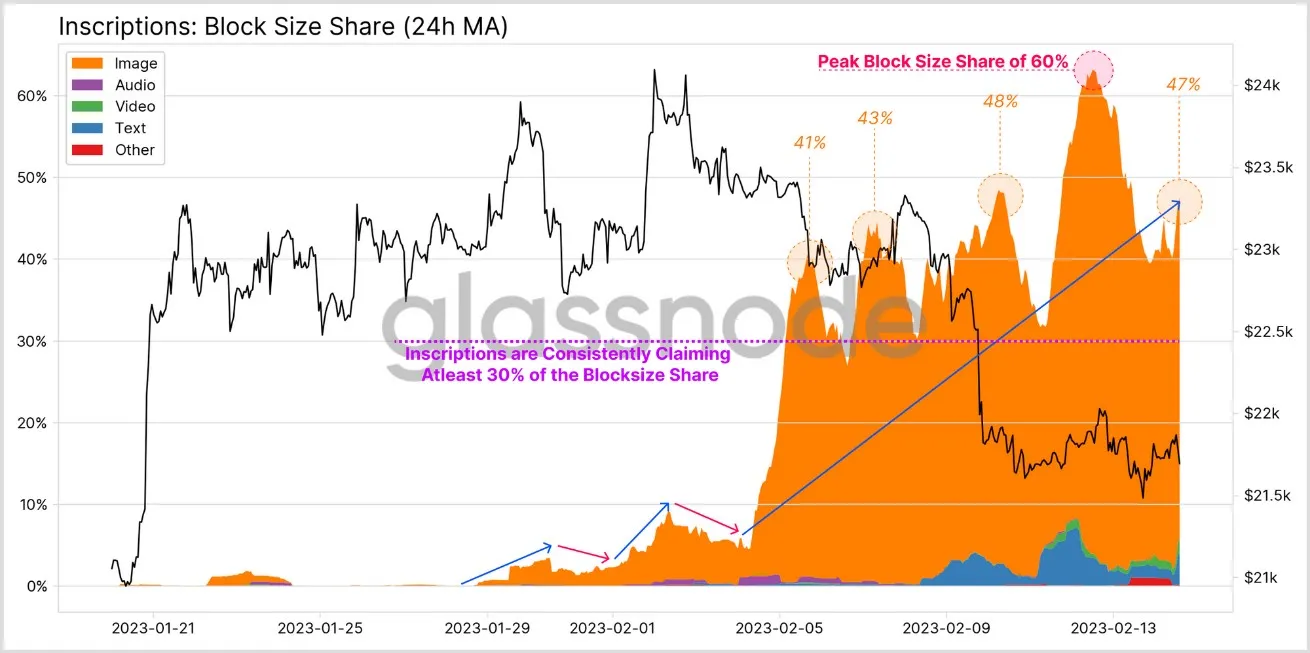

However, the most important metric to watch is the percentage of block space ordinals take instead of those ever-so-important “standard” money transactions. In February 2023, Ordinal Inscriptions are, on average, taking around 40% of space of a BTC block.

If demand does not spike for your typical payment transaction, debating whether Ordinals should be allowed will remain as just that, debates.

However, if BTC sees sudden price volatility, demand for on-chain transactions could rise, and then the engineered ‘fee market’ would take effect where users must bid higher and higher Satoshi per byte fee rates to get their transaction into the next block.

Typical payment transactions are much smaller in size than Inscriptions, so a miner would naturally, and ironically by the Core developers’ own engineering and guidance, prioritize mining the highest fee transactions, which are Inscriptions!

This new dimension to the fee market implies that fees attached to payment transactions must rise above those with JPEG data, costing more and more precious satoshis to transact, increasing frustration in the community. Inevitably, those sending censorship-resistant money will ask:

“Why should I have to pay more fees than someone else’s stupid monkey JPEG?”

The irony is that BTC’ers are considering censoring another user’s transaction so that their ‘censorship-resistant’ transaction can be prioritized!

This desired fee market is what will cause another soft, hard fork, chain split, modification, or whatever Newspeak term will be applied to this new devastating protocol change that yet again stifles innovation atop the so-called permissionless blockchain.

The BTC Core team has already expressed interest in making such a change to essentially fix their own created loophole in the Taproot upgrade that allowed Ordinals in the first place.

Also, I seem to remember a BIP draft for real "NFTs" on Bitcoin – anyone know what happened to that?

Maybe someone should fork their attack code to use that spec instead of attacking Bitcoin…

— Luke Dashjr (@LukeDashjr) February 1, 2023

Of course, once upon a time, the same type of language was used against those who wanted larger blocks. In August 2017, Segregated Witness was implemented. Nearly six years have passed since then, and it marks the last time a BTC fork occurred such that the other chain (Bitcoin Cash) persisted. The ecosystem is much larger now than then, miners are larger, many more exchanges exist, and much more infrastructure has been developed.

The reason another chain survived is because enough miners saw value in committing hash power toward big block Bitcoin. This time is no different—miners clearly are earning more fees with Ordinals than before, so why would they allow central planners to threaten their income yet again?

$BTCNFT – It Is Known

Few –

— shua (@cryptoAcorns) February 10, 2023

Watch: Build on Blockchain Common Challenges & Tools to Make it Easier

07-09-2025

07-09-2025