|

Getting your Trinity Audio player ready...

|

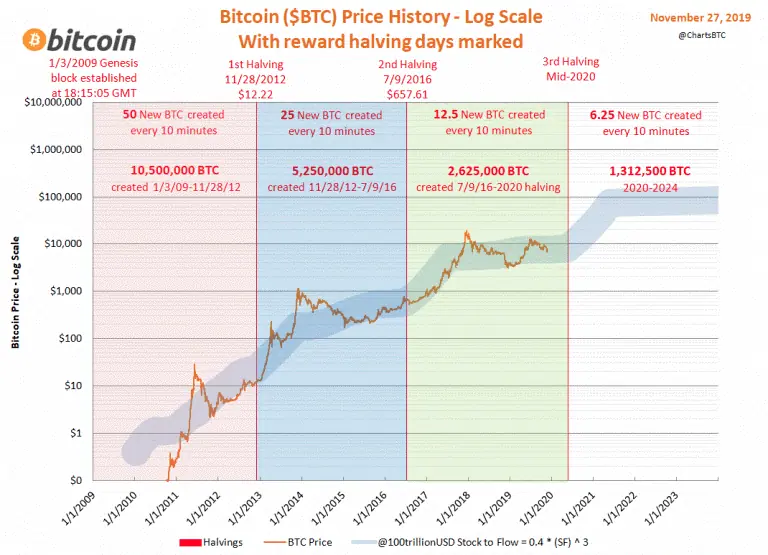

In 2009, miners earned 50 bitcoins per block but $0 since Bitcoin was not priced at launch. In 2023, miners earn 6.25 BTC per block, which is around $162,500 (as of writing). Miners earn far less satoshis today, but much more fiat currency. Even when demand and fees reached all-time highs on the BTC network in May 2023, where fees earned in a block exceeded the subsidy for the first time since 2017, miners still earned less or the same BTC per block that they did in 2017 (12.5).

Notably, if miners kept their BTC tokens from then, they saw the greatest price appreciation in an asset in human history. Of course, looking back, everyone wished they would have mined in 2009, or 2013 at 25 bitcoin per block, or 2017 at 12.5 bitcoin per block. At each halving event (roughly every 4 years), the BTC USD price has been much higher than the previous.

In between these points, when prices are falling and volatile, this mentality is not so clear. Miners come and go, as do the participants in the system. What is clear is that the incentives are to earn as much BTC as possible today, as generally speaking, there will be less available coins to earn tomorrow, as with each halving, the coins distributed are less and less.

Given the price increases, the incentives are to HODL, not spend coins in hopes of more price appreciation. The incentives from this interesting economic reality are staggering.

For example, this implies that entrepreneurs should create as often as possible, as early as possible, to earn as many coins as possible instead of working heads down for weeks or months for a product. This is completely contrary to traditional business practice, as it takes time to develop a well-functioning product. However, in a system where coins flow freely, without capital control, and information travels so quickly, the traditional approach is now obsolete. Two of the largest selling points of Bitcoin have been “not your keys, not your coins” and “be your own bank.”

While these naive concepts have some negative, unintended consequences, the most important and positive implications are ownership and creation.

Anyone can create anything and own that thing on-chain. The word “own” implies they can do whatever they want with that thing. The “Bit” in BitCoin represents data, and “Coin” means the token, but also the ability to invent or create.

While a developer is working on a product in month 3 of 6, another can create something else out of nowhere that renders the previous’ work obsolete in a span of 24 hours—this is the nature of the system, as over 14 years, Bitcoin has absorbed more and more of the traditional financial system over time and while absorbing more fiat money akin to a black hole.

We have witnessed the most rapid example of this with Ordinals on BTC. In less than 150 days, we have seen token protocols, non-fungible tokens (NFTs), businesses, and exchanges built on BTC where none existed before January 2023. If someone was working on a fungible token protocol on BTC before March 7, that work was deprecated via a tweet on March 8. If someone was working on a centralized exchange for NFTs on BTC in February, that work was deprecated when Ordswap launched trustless trading via PSBTs days later.

The nature of the system is to create something that people want today, not tomorrow, and to create for those that own Bitcoin today, not tomorrow, for the coin will have more value on-chain and more creations tomorrow than today.

Watch: Untangling Bitcoin mining at the CoinGeek Weekly Livestream

07-14-2025

07-14-2025