This post originally appeared on the Unbounded Capital website, and we republished with permission from Jack Laskey.

TLDR; Long BSV (available on Robinhood)

Overview

A Florida civil suit over the $70+ billion Satoshi fortune that started November 1st could lead to broad market awareness that Dr. Craig Wright is Satoshi Nakamoto. This could have significant short term price impacts on Bitcoin Satoshi Vision (BSV), a version of Bitcoin which Craig Wright is heavily associated with and endorses as “the real Bitcoin.” We believe that the market has an outdated perception of Craig Wright and the potential that he is Satoshi Nakamoto. Additional scrutiny of existing evidence due to the high-profile nature of the trial as well as the potential for new evidence presented in trial could significantly change public sentiment regarding the likelihood that Craig Wright is Satoshi. We believe this could result in a rapid and significant price increase for BSV, due to its association with Craig Wright, its technical merits and market traction which have been overlooked to this point, and in part because of its accessibility to retail investors via Robinhood. BSV is also one of the most shorted cryptos, meaning that there is potential for both a short squeeze and a gamma squeeze, the latter in part due to positions held by Unbounded Capital.

Background

One of the most important trials of the century begins today, Nov 1, 2021 at 10 a.m. Kleiman v Wright is a Florida civil suit over the ownership of around $70 billion dollars’ worth of Bitcoin. Not only is this a stunning sum, but the quality of these Bitcoins is also exceptional. Why? Because they are allegedly the Bitcoins that Satoshi Nakamoto, the creator of Bitcoin, mined in Bitcoin’s earliest days, from 2009-2011. Thus, the trial not only could determine the fate of Satoshi’s Bitcoins, but it could shed an extraordinary amount of light upon one of the biggest mysteries of the 21st century, the identity of the pseudonymous creator of a trillion-dollar invention.

Chances are, you probably haven’t heard about it. Why?

Both mainstream and crypto media have been shockingly quiet about this incredibly significant and intriguing case. The reason for this is that the media, most of the public, and perhaps most importantly, the market, have a major disagreement with both the plaintiff and defendant. The disagreement is whether or not Dr. Craig S Wright, the defendant in the trial and an Australian computer security expert and polymath, is the man, or one of the men behind the Satoshi pseudonym.

Ira Kleiman, the plaintiff, and Dr. Wright, however, are in agreement that Dr. Wright was involved in the creation of Bitcoin and the mining of Satoshi’s billions. The dispute is about Ira’s deceased brother, Dave Kleiman, and the degree to which his involvement in the creation of Bitcoin constitutes a partnership, and a claim on the Satoshi billions by his estate, now managed by Ira Kleiman. However, much of the crypto world thinks Craig is involved in an elaborate hoax—that he is pretending to be Satoshi. This has earned him the moniker “Faketoshi” and inspired t-shirt designs like what are pictured below.

At Unbounded Capital, we believe that the “Faketoshi” narrative is out of date. Most people either formed their opinion about Dr. Wright in 2016 or inherited their opinion from someone who had. A lot has happened with Dr. Wright since then, much of it due to the ongoing discovery process in the trial. The result of this is that people have not been paying close attention to what is happening with Dr. Wright or Bitcoin SV, a fork of Bitcoin Dr. Wright supports as “the real Bitcoin.” We think the trial could change this, and we are placing our bets accordingly.

Our investment thesis behind the Satoshi trial

We think Dr. Wright is likely to both win the trial and also confirm his ownership over these Bitcoins in the process. However, what is most pertinent to our investment thesis is the possibility that the market increasingly perceives Dr. Wright as Satoshi Nakamoto due to new evidence and increased public scrutiny of existing evidence resulting from the trial. In other words, we believe the market is mispricing the probability that Kleiman v Wright will make it clear to the public that Dr. Wright is the inventor of Bitcoin.

BTC’s market cap is already over a trillion dollars. Why would a Satoshi reveal matter at this point? The answer is that Dr. Wright is perhaps the world’s biggest BTC bear. Dr. Wright has been publicly lamenting changes made in BTC which he believes cripple its functionality. Since 2017, he has supported alternate forks as “the real Bitcoin” and focused his efforts in these communities, first Bitcoin Cash (BCH), and for the last three years since its inception, Bitcoin Satoshi Vision (BSV).

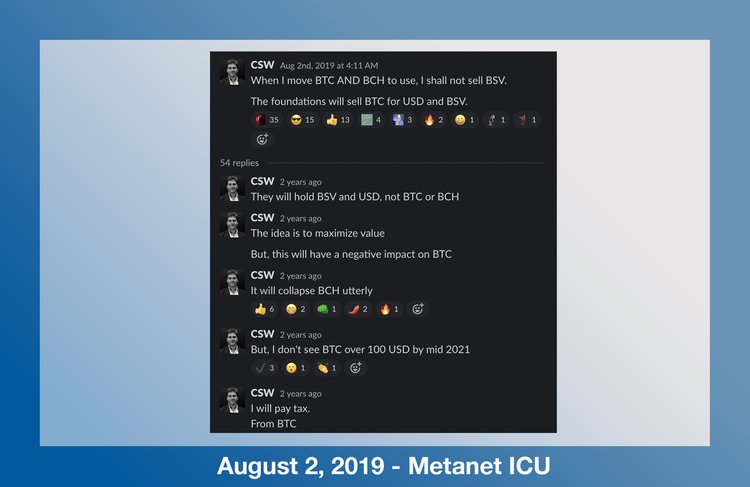

In particular, Dr. Wright has impressed his stamp on BSV, both from an influence standpoint as well as a reputation standpoint. BSV has been inextricably linked to Dr. Wright and has followed the development path prescribed by Dr. Wright—to return to the original Bitcoin protocol outlined by Satoshi Nakamoto in 2008-2009. Not only has Dr. Wright placed his efforts and support behind BSV, but he has also been public about his plan to liquidate Satoshi’s BTC and BCH for BSV and USD and then to use the proceeds from the sale for charitable purposes. Keep in mind that because BTC, BCH, and BSV are all forks of the same chain, Satoshi’s ~1.1M Bitcoin fortune would apply to all of these forks. In other words, Satoshi is suspected to have ~1.1M of each BTC ($66.5B total value), BCH ($0.65B total value), and BSV ($0.17B total value). Craig’s warning is that he will convert the ~$67B of BTC and BCH into BSV and USD. The current market cap of BSV is ~$3.1B.

While the broader investing public is not aware of this, most crypto whales are. We believe that meaningful evidence presented in the trial will likely result in the market front-running the perceived inevitability of an increase in BSV price. We feel that the lack of price movement until now indicates that these whales are not correctly evaluating the likelihood that the trial will lead to this evidence, presenting a window of where there is asymmetric upside in trading on a bullish trial result for BSV.

In the rest of this article, we will present more detailed evidence in support of our thesis including existing evidence that Dr. Wright is Satoshi Nakamoto, positive BSV fundamentals which are being overlooked due to a clear negative media filter, more detail about the conflict of visions which may bias the crypto investing public against the possibility that Dr. Wright is Satoshi Nakamoto, our expectations for the trial, and how current market conditions are ripe for a sharp increase in BSV price due to revelations from the trial.

The market’s view on ‘Faketoshi’ is outdated

Dr. Wright was exposed as Satoshi by Gizmodo and Wired in 2015. He first denied it and later admitted to being Satoshi. When the crypto community were forming their opinions about his claim to be Satoshi in 2016, there was mixed evidence including the absence of evidence thought to be essential—signing publicly with Satoshi’s keys. Dr. Wright orchestrated a private signing with then BTC chief developer, Gavin Andresen, and Bitcoin Foundation head, Jon Matonis. Gavin publicly affirmed that he was satisfied with this private demonstration, as did Jon, and other individuals came forward attesting to knowledge that Dr. Wright is Satoshi.

A public demonstration was offered but never delivered. This left many skeptical. A blog post that came out in 2016 was accused of being a fake proof attempt. While it is cryptic, a close reading of the post makes it clear that it was not a proof attempt. Still, the lack of public proof combined with concerns that Craig was changing and backdating blog posts and other documents led to the consensus view that Craig was a pretender, earning him the “Faketoshi” moniker.

In our view, there was nothing completely unreasonable about this conclusion in 2016. It was a strange story with the attestation of Gavin Andresen and Jon Matonis combined with the lack of a public signing and strange incidents with suspected forgeries. The evidence was unsettling, but certainly inconclusive.

However, even if the view of Dr. Wright as Faketoshi was justifiable in 2016, it has become increasingly outdated in the ensuing years. Craig’s continued actions, the actions of his professional associates, Craig’s extensive commentary on Bitcoin’s creation and design, as well as evidence that has been presented through the Kleiman vs Wright discovery plus evidence put forth by Dr. Wright outside of the trial paints a significant likelihood that Dr. Wright is actually Satoshi or at least a significant part of a potential Satoshi team. We will also explore the significant conflicts of interest which exist in crypto media which may have contributed to the continued prevalence of the “Faketoshi” narrative.

Dr. Wright and associates’ work and actions

One of the most salient, and overlooked reasons to suspect that Dr. Wright is, in fact, Satoshi are his and his business partners’ continued actions. Dr. Wright currently acts as the Chief Scientist at nChain, a Bitcoin R&D firm which has now created and sold enterprise software products utilizing BSV. Dr. Wright and nChain have filed over 1200 patents on Bitcoin related technology. nChain has over 100 employees and recently launched their first enterprise product, Kensei, a data integrity solution, which is being used by Crucial Compliance, a compliance software provider for the online gaming industry, and others. In 2016, almost none of this existed, and what did exist was not well known. Dr. Wright’s professional work since 2016 is much more in line with what one would expect from the inventor of Bitcoin than from a fraud.

The chairman of nChain’s board is Stefan Matthews, who is also the CEO of a publicly traded mining company, TAAL Distributed Information Technologies Inc. (CSE:TAAL | FWB:9SQ1 | OTC: TAALF), which is focused on creating services for the BSV blockchain. Stefan is an associate of Dr. Wright’s from before Bitcoin. Stefan has previously said that Craig offered him 50,000 Bitcoins in 2009, an offer which Stefan rejected. Stefan also claims to have seen a copy of the Bitcoin whitepaper before it’s publication in 2008. Stefan has now dedicated his career to working alongside Dr. Wright on BSV. This story and Stefan’s continued commitment to Dr. Wright and BSV was not known in 2016.

Stefan is also the connection between Dr. Wright and Calvin Ayre. Calvin Ayre is a billionaire who made his fortune through Bodog, a pioneering company in offshore gambling. The Kleiman v Wright trial has revealed that Dr. Wright, at least allegedly, placed Satoshi’s bitcoins into a trust. The inability to access Satoshi’s Bitcoins in 2015 combined with tax issues resulting from the 2015 outing of Satoshi by Gizmodo and Wired placed Dr. Wright in a position where he was looking for an investor.

Calvin Ayre has staked a significant percentage of his fortune and his reputation behind Dr. Wright—an ongoing investment and involvement over the course of almost seven years. Given the fact that Dr. Wright offered private proof to Gavin Andresen, it would defy common sense to think that this same proof and more was not offered to Calvin Ayre. This relationship and the degree to which Calvin would continue to invest in and back Dr. Wright was not well known in 2016.

It is also important to note that many people, including many entrepreneurs, are building in the BSV space. We will address more specifics about BSV fundamentals soon. What is notable is that there is a significant entrepreneurial community that either believes that Dr. Wright is Satoshi, or is not dissuaded by uncertainty or unconcerned about being associated with a “scammer.” In other words, even though the market has largely stuck with the “Faketoshi” thesis, many individuals have rejected it with conviction by dedicating their professional lives to BSV, a phenomenon that was not present or possible in 2016 since BSV did not exist until the end of 2018.

Evidence of Dr. Wright as Satoshi Nakamoto from Kleiman v Wright

Another important post-2016 development has been the discovery process from Kleiman v Wright. Prior suspicions of forged blog posts and other documents have lured the market into a state of comfort in ignoring additional evidence made public via discovery. However, this evidence should not be overlooked, both because of its pertinence and because the massive quantity of evidence makes the possibility of an elaborate hoax more and more unlikely.

What does this evidence include? Let’s start with the premise of the case. A standard document called the “Joint Neutral Statement of Case” is submitted to lay out, in plain English, what is being disputed in the legal action. Each party, Plaintiff and Defendant, describe what they are alleging. The Joint Neutral Statement of Case for Kleiman v Wright confirms that the case is predicated on the suggestion that Dr. Wright played a central role in the creation of Bitcoin. In other words, the Kleiman family, which is 4 years and, presumably, millions of dollars into this case, is convinced that Dr. Wright is at least part of ‘Satoshi Nakamoto.’

What about documentary evidence? The extensive discovery process in Kleiman v Wright made public a trove of documentation including tax documents, loans, contracts for equity, invoices, and trust documents which paint a picture of Dr. Wright routinely dealing in large quantities of Bitcoin in its early days. These include (with links to docket submissions as well as third party summaries):

- Testimony from various witnesses (testifying on behalf of plaintiff and defendant) who place Dr. Wright talking about and sending documents pertaining to Bitcoin before and shortly after its release

- ATO (Australian Tax Office) documents and testimony about Dr. Wright’s 2009 Bitcoin R&D spend

- Deposition and documentary evidence which paint a picture of a complex structure of legal entities formed between 2009 and 2015 by Dr. Wright and related parties

- 2011 IP Licensing Agreement paid for with ~3% of total BTC supply (over 200,000 BTC) (page 20)

- 2012 Deed of Loan documents collateralized by 650,000 BTC from Dr. Wright owned entities (page 11)

- 2013 contracts for equity in Bitcoin related companies in exchange for 323,000 BTC (page 1)

- 2015 email (page 12) detailing invoices between Dr. Wright related entities (DeMorgan) and Panamanian firm HighSecured for IaaS services rendered paid for with 60,000 BTC with on-chain corroboration.

- The 2017 Tulip Trust Document which owns the rights to all of Dr. Wright’s assets which he will become eligible to control after June 2020 (page 27)

The last document in this list is possibly the most consequential and will likely be central to the court case. The Tulip Trust is a 2011 Seychelles trust that purports to own the rights to over one million bitcoin and valuable Bitcoin related intellectual property. The document has allegedly been updated three times, with its most recent version dated July 6, 2017 (page 27). Portions of this trust document remain redacted but the readable portions give us the following key information:

- The trust is set up to promote the work of Dr. Craig Wright (named alongside his alias Satoshi Nakamoto), to progress the legal nature of Bitcoin, and to build a scaled financial system on top of bitcoin that can achieve over 1 trillion transactions per second

- The trust grants its trustees access to Wright International Investments and Tulip Trading Ltd assets

- Wright International Investments: the “Satoshi Million” Bitcoin mined before 2010 can only be spent after a full meeting of members between the dates of December 2019 and the end of 2020

- Tulip Trading Ltd: Any recoverable assets owned by the Dr. Wright related entities including the Bitcoin purchased in 2011 which originally capitalized the companies

- The trust has an activation date in January 2020

- The trust was set up by Dr. Wright but access to the document was explicitly withheld from him during the period of July 10 2017 until December 15 2019. Dr. Wright will be able to become a trustee by a vote of members ONLY AFTER June 2020.

A significant amount of evidence submitted in discovery has been sealed or redacted. We expect some of this additional evidence to be presented at trial, details of which will be presented later in this analysis.

There have also been multiple “motions to seal” in the discovery process. This indicates there exists evidence that has been shared with the plaintiff which may be used at trial that is not yet publicly accessible on the docket. However, descriptions of what these documents include is available in the “Trial Exhibit List”. Noteworthy exhibits we could expect to see in the coming days and weeds include Exhibit Numbers D142 and D143 titled “Multiple 2008 Receipts.” Dr. Wright has hinted in a 2019 blog post that the domain to “Bitcoin.org,” the website which hosted the Bitcoin whitepaper, was done with a credit card. If this information is produced in trial and corroborated by records from the credit card issuer, this would likely be compelling to crypto whales who have not been following post 2016 developments which ought to change their assessment of Dr. Wright as Satoshi Nakamoto.

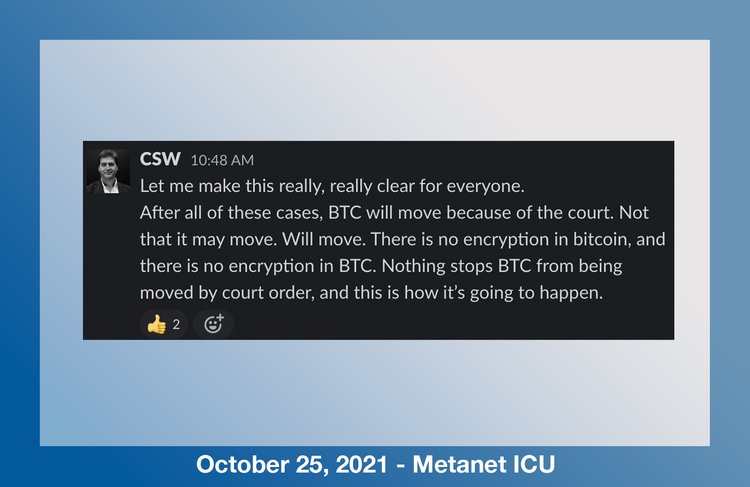

Extended commentary by Dr. Wright on Bitcoin and Satoshi

For many who are working in the BSV space, the most notable evidence of the past five years since 2016 is the extended commentary by Dr. Wright on Bitcoin and its origin. Between talks at conferences, podcast appearances, blog posts, academic papers, patents, and extended commentary in the semi-private slack group, Metanet ICU—Dr. Wright has generated thousands, and perhaps tens of thousands of hours of content about Bitcoin, the underlying technology, the creation of Bitcoin, and the follies of BTC and other blockchains like Ethereum. To many, this wealth of commentary has provided numerous unique insights—many of which have facilitated the creation of BSV, both from a technical standpoint and by helping to define numerous value props for Bitcoin and blockchain technology which were previously unknown or under-explored.

While there are many ongoing, valid arguments against specific points being argued by Dr. Wright, the quantity and quality of his commentaries are exceptional, even for what one might expect from Satoshi. For a fraud, they are almost unimaginable. Virtually all of these commentaries on Bitcoin by Dr. Wright were created after 2016, although many of Dr. Wright’s arguments can trace their roots back to the original Satoshi writings.

Negative media filter against Dr. Wright

It’s understandable that the average Bitcoin investor might not be up-to-date on the information about Dr. Wright since his 2016 outing, but what explains the media, particularly the cryptocurrency media’s, lack of interest? Why, for example, are you just now hearing about the information likely to become public through this historically large trial. Put simply, the cryptocurrency media is biased against Dr. Wright and filters their reporting accordingly.

Take CoinDesk as an example. They are one of the most prominent cryptocurrency media organizations. CoinDesk is owned by Digital Currency Group which has an extensive portfolio of investments in the cryptocurrency space, the vast majority of which would suffer should the narrative around Dr. Wright shift from “kooky fraud pretending to be Satoshi” to “the inventor of Bitcoin.” Does Digital Currency Group want the inventor of Bitcoin publicly criticizing their investments? Clearly not. How has CoinDesk reported on the Kleiman v Wright story thus far? Their first reporting on the case was titled ‘Satoshi’ Craig Wright Is Being Sued for $10 Billion which outlined the case from the position of highlighting Dr. Wright’s alleged “scheme against Dave’s estate” to “seize Dave’s Bitcoin and his rights to certain intellectual property” and somewhat downplaying the implication that the Plaintiff assumes Dr. Wright played a central role in Bitcoin’s creation. In fairness, CoinDesk was doing this reporting early after the lawsuit was filed and before more newsworthy information had come out during the discovery process.

So, how did CoinDesk’s reporting evolve once this information was made public? Very little. CoinDesk’s coverage has largely stuck to the frame of “Dr. Wright is being sued for massive fraud” ignoring most of the extremely newsworthy information available for reporters to uncover in the docket. Some additional headlines from CoinDesk on this case from over the years include:

- Craig Wright Ordered to Disclose Bitcoin Addresses in Kleiman Court Case (May 6, 2019)

- Craig Wright Spars With Kleiman Lawyers in Combative Courtroom Appearance (June 28, 2019)

- Judge Blasts Craig Wright’s Evidence, ‘Inconsistent’ Testimony in Kleiman Trial (August 15, 2019)

- Craig Wright ‘Abusing’ Privilege to Block 11,000 Documents, Kleiman Lawyers Say (February 4, 2020)

- Craig Wright Challenges Court Order Criticizing His Evidence in $4B Kleiman Case (March 26, 2020)

- Craig Wright Called ‘Fraud’ in Message Signed With Bitcoin Addresses He Claims to Own (May 25, 2021)

- Ex-Wife’s Testimony Suggests Craig Wright ‘Defrauded’ Court, Kleiman Lawyers Claim (August 5, 2020)

- Craig Wright Must Face Trial Over Alleged $11B Bitcoin Fortune as Request for Summary Judgment Denied (September 21, 2020)

The bias of CoinDesk is easy to discern from the way they emotionally conjugate their headlines. What about more recent updates? After all, the trial starts this week. A Google advanced search for the most recent CoinDesk publications featuring the terms “Kleiman,” “Wright,” or “Trial” shows that the most recent update (at the time of writing*) is their May 10, 2021 post (over 5 months old) which notes the trial’s delay until November 1 2021.

Earlier this week, CoinDesk.tv did include a section of their “All About Bitcoin” weekly round-up video on the trial. CoinDesk’s Managing Editor of Technology, Christine Harkin, briefly summarized the trial as she understood it. This summary mentions a dispute between Dr. Wright and the Kleiman estate over IP and Bitcoins but is vague as to which Bitcoins are in question, despite the idea of “the Satoshi Million,” or a trove of dormant Bitcoin’s mined by Satoshi in its early years, being a well understood subset of Bitcoins within the cryptocurrency space. Harkin also mentions that “…of course there have been any number of other internet and Bitcoin sleuths out there who’ve been hard at work debunking so much of what Craig Wright has claimed in terms of his involvement with the development of Bitcoin.”

The apparent bias of the cryptocurrency media has a downstream effect on the reporting from the broader financial and tech media, many of whom seem to outsource a lot of their sensemaking in the blockchain space to cryptocurrency publications or thought leaders who are of the mindset outlined above. The cryptocurrency media presenting the Kleiman v Wright case as either a forgone conclusion OR something not worth much attention almost certainly has played a role in the near media blackout on what stands to be one of the largest individual civil IP disputes in US history.

*Since writing this section, CoinDesk has published an article on the case, their first significant coverage since May

Significant conflicts of interest may lead to media bias

There are significant conflicts of interest present in crypto media which may have created an incentive to paint Dr. Wright as an unreliable source, and more recently, to downplay achievements of BSV. The most prominent of these conflicts of interest is the significant investment stake that Mastercard ventures has in Digital Currency Group (DCG). DCG owns CoinDesk and has many significant investments which depend on the success of BTC. DCG is also an investor in Blockstream, an organization which has helped to set a technical direction for BTC which we think is very favorable to Mastercard whereas the vision of Bitcoin first articulated by Satoshi and now articulated by Dr. Wright and embodied by BSV represents a significant threat to Mastercard’s core business.

Mastercard and other credit cards typically charge a fee of around $0.25 and 2% per transaction. Transaction fees on BTC are typically in excess of $10 whereas transaction fees on BSV are typically under $0.001. This significant disparity is primarily due to a self-imposed limitation by BTC, restricting the maximum block size—the amount of data that can be added to the blockchain in any given period of time. By placing a cap on data, there is a cap on transactions which leads to a shortage of available transactions relative to total demand for transactions.

There is no such limitation on BSV. Miners are free to mine as large or small blocks as they choose. This has led to a consistent increase in block sizes over time as miners capabilities improve and demand for BSV blockspace has increased. Allowing blocks to grow has allowed fees to stay small. We think that a blockchain with scalable, cheap transactions is a threat to Mastercard’s business. On the other hand, an unscalable, expensive blockchain is not. We are not sure that Mastercard’s investments are designed to cripple the technical capabilities of Bitcoin, but in important ways, they have had that effect.

It is important to note that these limitations have been accepted because authoritative sources like CoinDesk and Blockstream endorse them as being necessary. Because Dr. Wright is such a vocal advocate of BSV’s unlimited block size approach, if he is recognized as Satoshi, this may supersede the authority of sources like CoinDesk and Blockstream and lead to a broad recognition of the superiority of the BSV path. The BSV path is also gaining empirical verification as the blockchain’s usage continues to increase. The market lacked this empirical evidence when decisions to pursue the Blockstream path on BTC were made. Continued adoption of BSV as a cheap payments solution could ultimately present a significant threat to Mastercard. We do not know whether or not Mastercard has interfered in the market in this way, but the presence of the conflict of interest is an important part of the story nonetheless.

Why won’t he sign? A conflict of visions

With the wealth of evidence that has emerged since 2016 pointing to Dr. Wright as Satoshi, it may surprise some that he is not more widely recognized as Satoshi. What must be understood, is that for many, only one piece of evidence will suffice—a signature made with keys assumed to be controlled by Satoshi. This is in line with the crypto ethos—“Not your keys, not your crypto.” Implied by this ethos is that if you don’t prove possession of Satoshi’s keys, you are not Satoshi.

While for many, a digital signature with Satoshi’s keys will be required to prove that Dr. Wright is Satoshi, we think it is easy to understand how Dr. Wright could be Satoshi and have refrained from signing publicly with Satoshi’s keys. The first reason is somewhat straightforward—we know Satoshi wanted to stay anonymous. If Dr. Wright had signed, he would be in a much more public position facing greater scrutiny. While he acknowledges that he is Satoshi, he has not been publicly acknowledged. This is in line with what one would expect to be Satoshi’s preference.

Another important motivating factor for Dr. Wright not to sign may have been his desire to improve his positioning and his ability to profit from and control the Bitcoin space. Through nChain, Dr. Wright and his partners have filed over 1200 patents and built a leading enterprise-facing blockchain organization, all while other companies like IBM were not paying attention to him or his research, instead emulating chains like Ethereum which Dr. Wright considers inferior. In this time, his and others work have led the creation of a significant industry around BSV. Importantly, BSV has also successfully restored the original Bitcoin protocol—a feat that may not have been possible with greater scrutiny. If he can later engineer a reorientation of the crypto markets around BSV, he stands to gain immensely by having laid this groundwork.

A more technical reason may exist for why Craig has not signed. The trial has revealed that the Satoshi coins were controlled by a trust. Further, we suspect that this trust may be digitally enforced by having spent the Satoshi coins into transactions which could not be re-spent until a certain point in time. While we know that Jon Matonis and Gavin Andresen report to have witnessed a demonstration of a signature, it is also possible that the trustees did not allow him to publicly sign or move coins. This suggestion has been put forward by financial cryptographer Ian Grigg who was an early recipient of the Bitcoin whitepaper as a member of the cryptography mailing list in 2008, and someone who claims to have been involved with the post-outing process after Dr. Wright’s doxxing and eventual public acceptance of the Satoshi pseudonym. The trust may also have a technical enforcement mechanism which hinders Dr. Wright’s ability to move coins or sign at will.

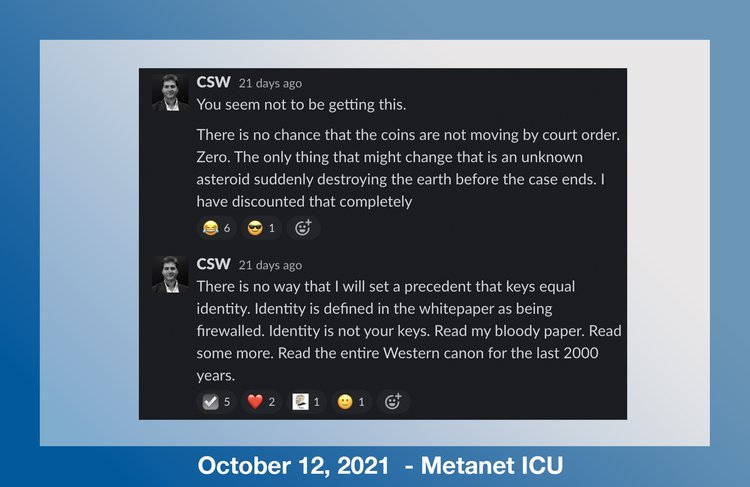

Finally, and perhaps most importantly, Dr. Wright has made clear that a conflict of visions exists between him and the mainstream crypto ethos. Dr. Wright is seeking to establish judicial supremacy over Bitcoin. He wants to prove that possession of keys in Bitcoin does not equal identity or ownership, the same way possessing a key to a car does not mean one owns that car. Craig has not only maintained that signing would not prove identity, but that he seeks to leverage courts, not just to prove his identity as Satoshi, but to engineer a movement of coins triggered by an order by courts. The purpose of this court-ordered coin movement would be to set a precedent that Bitcoin does not exist outside of the scope of existing laws and law enforcement mechanisms regarding the ownership of property. The mechanics and results of this type of movement are beyond the scope of this analysis. It’s importance is to help explain why someone who is Satoshi would not seek to prove their identity by creating a digital signature, the reason here being that proving identity with a signature endorses a worldview that Dr. Wright claims to oppose.

Dr. Wright’s background: Consistent with Satoshi

Craig has an impressive track record as both an academic and as an industry leader in computer security. He has dozens of degrees and certifications including a Doctorate of Philosophy, a Master of Statistics, an LLM in international commercial law, Masters of Information Security Engineering, Information Security Management, Information System Security, Management (IT), Networking and System Administration, and at least 19 certifications from GIAC, a leading computer security certifier. He has been an adjunct lecturer at Charles Sturt University where he received many of his degrees.

He has been widely published on information security, both formally and informally on his own extensive blogs. Before becoming fully involved with Bitcoin and after a stint as a Wesleyan minister, Craig had a prolific career as a computer security expert working for OzEmail, K-Mart, ASE, Mahindra & Mahindra, Lasseter’s Online, and BDO Kendalls, all done in conjunction with his academic career. He has also consulted for various government organizations and police departments, both before and after Bitcoin’s creation. His background in computer security as well as audit map well to Bitcoin – a secure, distributed, and time-stamped audit trail used to create a digital cash system.

While Dr. Wright is clearly brilliant to anyone who takes a close look, he is not a high EQ individual. This has impaired his ability to be understood by others. Much of his poor PR can be traced to being impatient, impolite, and overly specific to the point of failing to convey meaning. Craig admits to having Autism and Aspergers. It is not surprising that someone who saw what others missed with Bitcoin would be unlike others in significant ways.

‘Faketoshi’ narrative hides strong BSV fundamentals

Part of the bull case for BSV as a result of the trial is that BSV benefits from greater market scrutiny. Because BSV is seen by many as unreputable due to its association with Dr. Wright, many have overlooked the significant technical achievements and adoption of BSV. If the trial causes investors to see Dr. Wright as Satoshi and take a closer look at BSV, we think they will conclude that BSV is a significant competitor in the blockchain space and should be valued accordingly.

The value proposition of BSV is a scalable Bitcoin with its full features restored—the same scarce 21 million Bitcoins but without high fees and limited throughput and with the original scripting language and smart contracting capabilities restored. Businesses utilizing BSV are typically taking advantage of some combination of its micropayment capabilities—instant payments as low as 1/100th of a cent, utilizing the blockchain ledger for its immutability and transparency, and the smart contracting abilities of BSV which are similar to but more scalable than blockchains like Ethereum.

BSV began operating independently in late 2018. The major restoration of the original protocol was completed in February 2020 with the Genesis upgrade. Since 2018, BSV’s achievements include

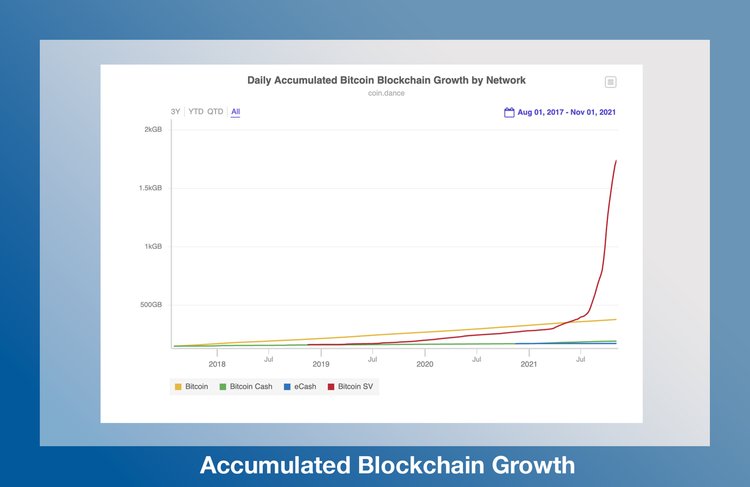

- Setting world record block sizes which recently reached 2 GB (BTC has 1 MB cap)

- Surpassing BTC in total blockchain size

- Over 16M transactions in a block on STN

- Creation of horizontally scalable node software, Teranode, and demonstrating 50,000 TPS

- Maintaining low fees, even with surging volume

- Restoration of bitcoin script which is deprecated on BTC

- Creation of scrypt and use of advance scripting functionality to create the game of life on Bitcoin, proving it’s turing completeness

- Creation of dozens of additional on-chain protocols for tokens, smart contracts, data storage, data serialization, and more

- Proliferation of wallets, many of which invented or first implemented advanced functionality such as paymail, threshold signatures, and true peer-to-peer infrastructure

- Creation of many useful SDKs such as Handcash Connect which have enabled the creation hundreds of applications such as Haste Arcade

- Adoption by nation of Tuvalu to create a national digital ledger

- Major esports organization Built By Gamers partners with BSV companies to utilize and promote BSV-based technologies

- Utilization of the chain as a data storage layer by metastreme, predict ecology for ESG data

- Games like cryptofights achieving daily transaction volumes in excess of total Ethereum mainnet

- Twetch, a BSV based social network, having over 60,000 users

- Tokenized protocol being selected by Aquantium LLC to tokenize equity and debt instruments on the BSV blockchain

- Maxthon, the default browser for over 600 million users, using BSV to create new types of browser functionality only possible with BSV

- Vxpass, a BSV based vaccine passport solution, used by Kingdom of Lesotho

- Domineum partnership with nChain

- Bitboss launching the first FDIC backed stablecoin

- Kensei adopted by Crucial Compliance

- Kensei adopted by Kompany

- Surviving 51% attacks unscathed

- VOIB (voice over Bitcoin) – using Bitcoin to make a phone call

- Mintblue used by Visma Group to record invoice data on BSV blockchain

- Unisot utilizing BSV to track scandinavian supply chain for fish

- EHR Data using BSV as a data ownership solution for the healthcare industry

- And quite a bit more!

What is notable about these achievements is not just the achievements themselves. Also important is that many of the technical achievements directly contradict claims made by technical authorities in BTC and other crypto thought leaders. The current BTC roadmap was initiated based on a belief that Bitcoin could not scale in the manner that BSV is now demonstrating. This belief that Bitcoin cannot scale was in contrast to what Satoshi wrote pseudonymously in 2010. While it is not surprising that someone who claims to be Satoshi would recommend returning to the design created by Satoshi, what is notable about BSV’s success is that it has vindicated this original design to date. In fact, BSV’s success throws the entire roadmap of BTC and crypto into question and can change the perception of what is possible and desirable in the crypto and blockchain space.

While BSV’s achievements are significant and numerous, the coverage of BSV, especially by prominent crypto news outlets like CoinDesk, has been extremely unfavorable, highlighting only negative events, downplaying some achievements, and generally misrepresenting the space by overblowing issues and ignoring successes. It is unclear if this is explicitly coordinated. It is possible that this misrepresentation is simply due to bias resulting from the “Faketoshi” narrative. However, it is also possible that because BSV represents a competitive threat to existing chains, the owners of major crypto media publications such as Digital Currency Group, the owner of CoinDesk, who have significant investments into BTC and ETH are attempting to suppress knowledge of BSV’s successes to protect their existing investments as well as their reputations. Regardless, the negative media filters around BSV and Dr. Wright are evident. I encourage you to attempt to find positive media coverage of any of the above achievements from a media organization that is not explicitly focused on covering the BSV ecosystem such as CoinGeek or a simple press release.

Our expectations of the trial and its importance

Because our perspective is that Dr. Wright is likely Satoshi Nakamoto based on existing evidence, we also think it is likely that Dr. Wright has additional evidence to support his identity as Satoshi Nakamoto. While significant evidence has already come out in the trial, a significant amount of evidence has been sealed. As mentioned the Exhibit List includes reference to receipts from 2008, “writings and notes” from 2007, “BOD (Board of Directors) meeting minutes” from 2007, email chains from 2008, and even potential Bitcoin predecessors like an entry titled “TimeChain v0.0.2 Alpha” from 2008. In addition to these new exhibits, we are expecting information to surface from witness testimony, perhaps most notably from Dr. Wright directly.

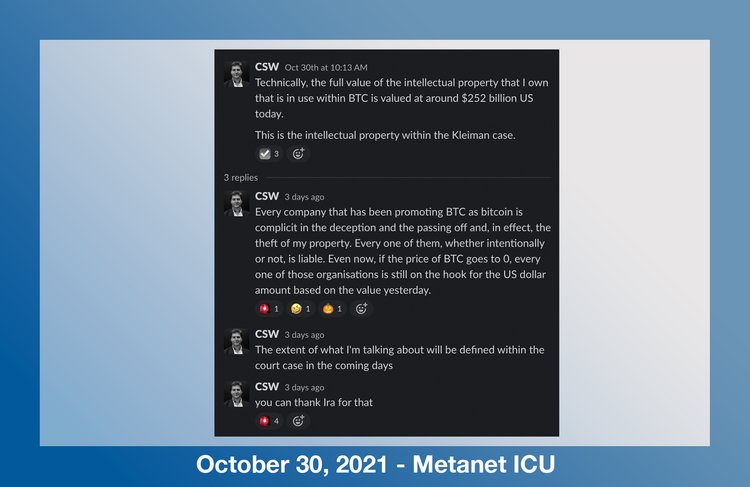

Allusions to the type of evidence which may come forward have been made by CSW himself. When one soberly divorces themselves from the “code is law” ethos of the broader crypto currency space which single-mindedly demands cryptographic evidence of someone being Satoshi Nakamoto, the myriad of other types of evidence that ought to exist becomes more clear. Things like the testimony of those with close relationships to Satoshi, documentation indicating interest and study in relevant domains, computer records pertinent to Bitcoin’s development, and more. In recent messages in the Metanet ICU slack, CSW has both indicated that he will bring such types of information forward AND begun to preempt likely responses from his PoSM-heavy (“proof of social media”, as opposed to Bitcoin’s “proof of work”) crowd of detractors.

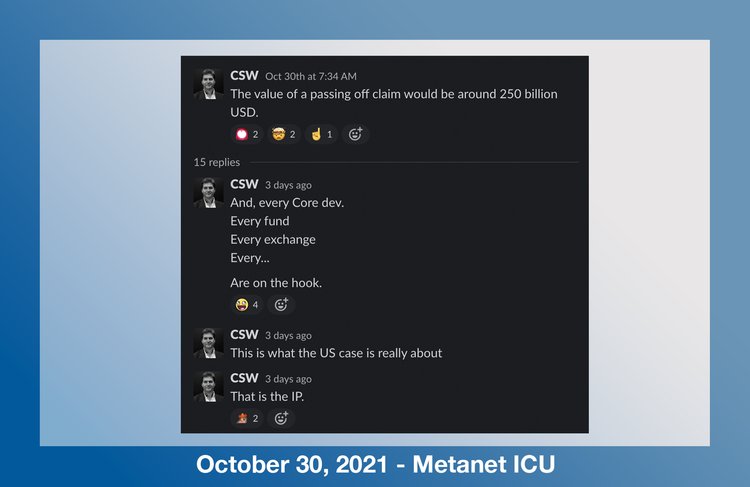

Dr. Wright has also made several important predictions about the outcome of the trial. To summarize quite a few recent statements on the likely outcome of the trial, Craig is predicting his victory, that the outcome will determine that he is the creator of Bitcoin, and that the case will trigger events which will result in BTC being moved due to court orders.

In general, we think that the trial represents a turning point for Dr. Wright and his team. They have been operating in relative secrecy from the mainstream over the past few years. To meet their stated goals of making BSV a globally adopted technology and the new foundation of the internet stack, there will need to be a shift in public perception and significant investment in the BSV space. While this lawsuit was not initiated by Dr. Wright and his team, their actions and warnings paint a picture that they are using the trial as a turning point and are expecting to shift from operating in relative secrecy to step into the public mantle of being “Satoshi Nakamoto” and supporting BSV as Satoshi’s Bitcoin. They have indicated that they will go so far as to paint BTC as a “passed off” version of Bitcoin and attempt to make it illegal for institutions such as Coinbase and Robinhood to refer to BTC as Bitcoin.

While we don’t have a strong position on their likelihood for success pursuing the legal claim that exchanges like Coinbase are passing off BTC as Bitcoin, we think their attempts will increase the probability of greater public scrutiny of Dr. Wright, his claim to be Satoshi, and BSV. Also, we expect that due to Dr. Wright and his team’s broader ambitions for BSV and their legal crusade against BTC, they will be seeking media attention on the trial in general, and particularly the elements of the trial that further paint Dr. Wright as Satoshi. We think that greater scrutiny of these things will reveal a strong bull case for BSV. Accordingly, we expect whales who have already linked Dr. Wright with BSV to front-run this greater market recognition of Dr. Wright and BSV which could lead to a rapid price increase during the trial.

Market landscape

The current market landscape and market history of BSV further paint a bullish scenario for BSV during the trial. There is significant precedent for Dr. Wright news affecting the price of BSV. When Dr. Wright was granted the US copyright for the Bitcoin whitepaper, the price jumped 120%. Another large price surge occurred shortly after based on fake news circulating in the Chinese trading community which pointed towards Dr. Wright being Satoshi. Finally, when Dr. Wright confirmed receipt files from a bounded courier, an event detailed by the Tulip Trust, the price briefly rose around 300% before falling after it was made clear that this delivery would not immediately facilitate the movement of Satoshi’s coins. These events as well as other smaller examples paint a picture that the market may very rapidly start buying BSV upon the receipt of additional information pointing towards Dr. Wright being Satoshi.

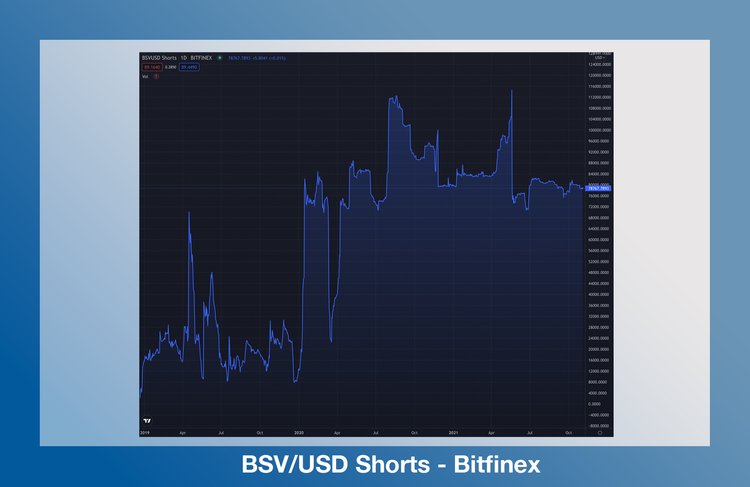

BSV has also lagged significantly behind the rest of the crypto market over last year’s bull run, even though many significant achievements have occurred. This can be partly explained by the negative media filter around BSV. However, even negative events have not influenced BSV price, such as the block-reorg attacks over the summer. These attacks received extensive coverage even though the attacks did not disrupt network functioning, nor did they affect the price of BSV. BSV price movements have typically been in the form of sharp increases followed by long periods of decline. This increasingly uncorrelated BSV chart may be due to the very significant short volumes relative to other crypto currencies.

BSV has been one of the most heavily shorted assets, often the most shorted cryptoasset on a per capita basis. For most fund managers employing a long short strategy, BSV is a natural short pair. Until recently it had been highly correlated with BTC, and it is largely viewed as a scam or a version of Bitcoin with no chance of success. This coupled with underperformance relative to most of the cryptomarket makes it seem like one of the least risky assets to short in a market where shorting any cryptoasset comes with a large degree of risk. We think that this dynamic that has in part kept the price of BSV down relative to the rest of the cryptomarket could flip quickly if the perceived risk of a significant, uncorrelated BSV price increase occurs in the coming weeks.

We think that a meaningful BSV price increase could generate both a short squeeze and a gamma squeeze. The gamma squeeze would be in part due to Unbounded Capital’s large OTM call options position with major OTC market makers in the crypto space. It is also important to note that BSV is not as liquid as other cryptoassets, in part due to delistings of BSV by major exchanges like Binance which were triggered by defamation lawsuits initiated by Dr. Wright. Controversy around Dr. Wright has kept BSV off of popular exchanges like Coinbase, although importantly, the asset is available on Robinhood. This restricted liquidity could exacerbate a significant price increase due to difficulties obtaining BSV compared to other similar assets.

Pricing in crypto is very subjective. The benchmark for BSV is clearly BTC. Currently the price ratio is around 400:1, an all-time relative high. If public perception of BSV is that it is Satoshi’s preferred version of Bitcoin, we expect that ratio to sharply decline, mainly due to an increase in BSV price.

Importantly, BSV has strong scalability fundamentals. We have recently seen a significant rise in the price of Solana, the blockchain seen as the greatest competitor to Ethereum due to it’s significantly higher scalability. We think BSV and BTC could mirror the relationship between Ethereum and Solana. One year ago, the ETH:SOL market cap ration was ~113:1. Today, it is only ~9:1. 9:1 BTC:BSV would result in a ~4000% increase in the price of BSV if BTC stayed at $61,000.

We think the major risk of negative alpha for BSV relative to the broader crypto market during the trial is that long-term holders may sell their positions if the trial does not have a significant result. However, we think for traders who are mainly speculating on the trial and do not have an independent bull case for BSV, having exposure across many years would not be a sensible approach. Rather, buying directly in advance of the trial would make the most sense. We have not seen a price run-up in advance of the trial. This is in line with our thesis that the crypto market underestimates the likelihood that Dr. Wright is Satoshi. We believe that most BSV holders are bullish on the tech fundamentals in addition to price action related to Dr. Wright as Satoshi, and are therefore less likely to sell if the trial does not produce a result.

Potential trade mechanics

Unbounded Capital is primarily speculating on the trial outcome through deep OTM call options purchased OTC, an option not available to retail traders. Other trade mechanics one could consider include leveraged exposure on Bitfinex or perpetual swaps on FTX. For traders who are less advanced in general or who are not set up to trade on crypto exchanges, Robinhood is a highly accessible platform which makes taking a long position on BSV simple.

We believe that this trial does not simply represent a trading opportunity for BSV. We believe that this trial could have historical significance as a major landmark event which reveals Satoshi to the world. If so, it will have been very cool to be a part of this event, even if we are simply spectators and speculators.

Conclusion

The crypto market is operating on an outdated view of the likelihood that Dr. Wright is Satoshi. Kleiman vs Wright represents an opportunity for additional evidence and greater media scrutiny to change the public and crypto market’s views on Dr. Wright. If public sentiment shifts towards recognizing Dr. Wright as Satoshi, it could cause BSV, the network Dr. Wright supports as “the real Bitcoin” which also has strong, overlooked fundamentals, to appreciate rapidly relative to its benchmark BTC. Market conditions are ripe for this type of rapid movement due to the high ratio of short exposure and potential for a gamma squeeze.

To stay up to date on the proceedings visit UnboundedCapital.com/trial for real time information from the courtroom.

CoinGeek will feature Kurt Wuckert Jr. in daily recap coverage which will be livestreamed on a daily basis at 6:30 p.m. EST on our YouTube Channel.

Watch our Day 1 Special Report from the Kleiman v Wright trial here:

Watch our Day 2 Special Report from the Kleiman v Wright trial here:

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.