Brazil

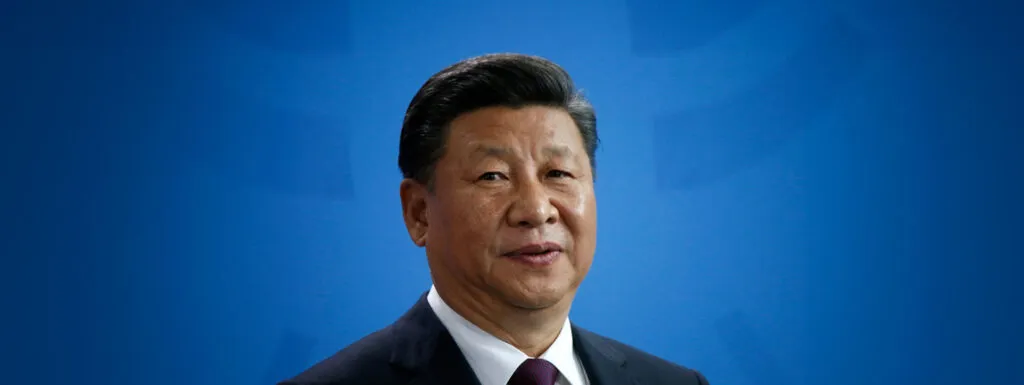

Xi Jinping no-show at BRICS Summit: A silent power play?

Xi's absence at Rio sparked talks of an internal coup, interpreted as China's subtle frustration at the pace of BRICS's...

China expands AI partnerships with Brazil, Australia

China is strategically addressing U.S. restrictions by strengthening its AI collaborations with Brazil and exploring potential partnerships with Australia.

Brazil’s prepaid card, digital wallet market to reach $53B by 2030

In other news, Chinese firm Alipay has announced the completion of a payment transaction using smart glasses.

Brazil eyes monitoring ‘crypto’ transactions amid tax uproar

Brazil is looking into solutions to help authorities track digital asset transactions amid struggles to find common ground on regulating...

Brazil to relax proposed stablecoin laws as adoption spikes

Brazil’s central bank says its proposed laws might have been too tough and restricted innovation, especially on stablecoin usage in...

Law enforcement moves to stamp out widespread crypto Ponzis

Various financial crimes, from Ponzi schemes to romance scams, are proliferating in the 'crypto' space, prompting law enforcement to take...

Recent

Trending

Most Views

07-12-2025

07-12-2025