|

Getting your Trinity Audio player ready...

|

Bitcoin mining is one of the most misunderstood aspects of the Bitcoin economy. Many people still feel that it is a waste of energy as an easy way to demonize Bitcoin itself as being anti-ecological. That argument itself can be an entirely separate debate on its own (and should be), so instead, for this week’s editorial, I’d like to focus more on the economics of the mining industry itself.

Bitcoin Magazine recently published a good article summarizing the fact that big players like Intel are getting into the industry by bringing their custom ASIC expertise to develop chips for SHA-256 hashing. This has been a reoccurring theme for the last five years, and indeed Intel has been rumored to be developing and patenting technology for ASIC mining chips since 2018. This is significant, as the recent supply chain bottlenecks due to the global pandemic response have brought to light the vulnerability and dependency of the world on the few companies able to manufacture computer chips.

Outside of TSMC in Taiwan and Samsung in South Korea, only Intel stands as a company capable of manufacturing custom silicon at global scales. Presently, China-based Bitmain is still the de facto dominant ASIC manufacturer for mining rigs due to their access to advantageous economies of scale and their energy-efficient chip designs. However, they still rely on TSMC as their primary chip foundry. To have Intel enter the market with their own custom ASIC designs while at the same time having their own silicon fabs is a competitive advantage that the current Bitmain monopoly cannot ignore.

Increased competition is always good. It keeps the incumbents innovating and prevents the dominance of inefficient monopolies. Intel’s final entry will certainly be welcomed by the industry as a whole and stands to shake up the market for the better. Though the article does incorrectly portray a common misunderstanding, that is, the introduction of increased efficient mining devices will create increased hurdles to newcomers and small mining operations.

To quote:

If some constraints are removed from the industry, Bitcoin’s hash rate could grow immensely. As a result, profitability would diminish for new entrants seeking to mine BTC as the bitcoin-producing market gets more competitive, requiring players to have a greater share of the global hash rate to remain in business. — Bitcoin Magazine

While I don’t want to sound like a hit piece against the otherwise stellar reporting and accuracy of Bitcoin Magazine1, this is categorically incorrect and demonstrates a lack of understanding by the author (anonymous, of course) of the actual mining economics of Bitcoin. As anyone who truly understands the design of Bitcoin knows, the mining algorithm was designed as a ‘Red Queen Game2‘, or for the economist readers out there, it is a multi-leader Stackelberg game. The Nash equilibrium is not affected by the introduction of innovations that reduce the cost of mining operations—not if it is equally available to all participants.

In this case, from the perspective of mining operators (those that own and operate mining data centers), it does not affect the competitive barriers to entry at all. The misconception proliferated by the Bitcoin Magazine article is that having available more efficient hardware would mean an increase in hash rate, which would, in turn, make it more cost-prohibitive for a newcomer to the hashing market to turn a profit due to the higher hash power required in order to produce the same amount of bitcoins in any given day.

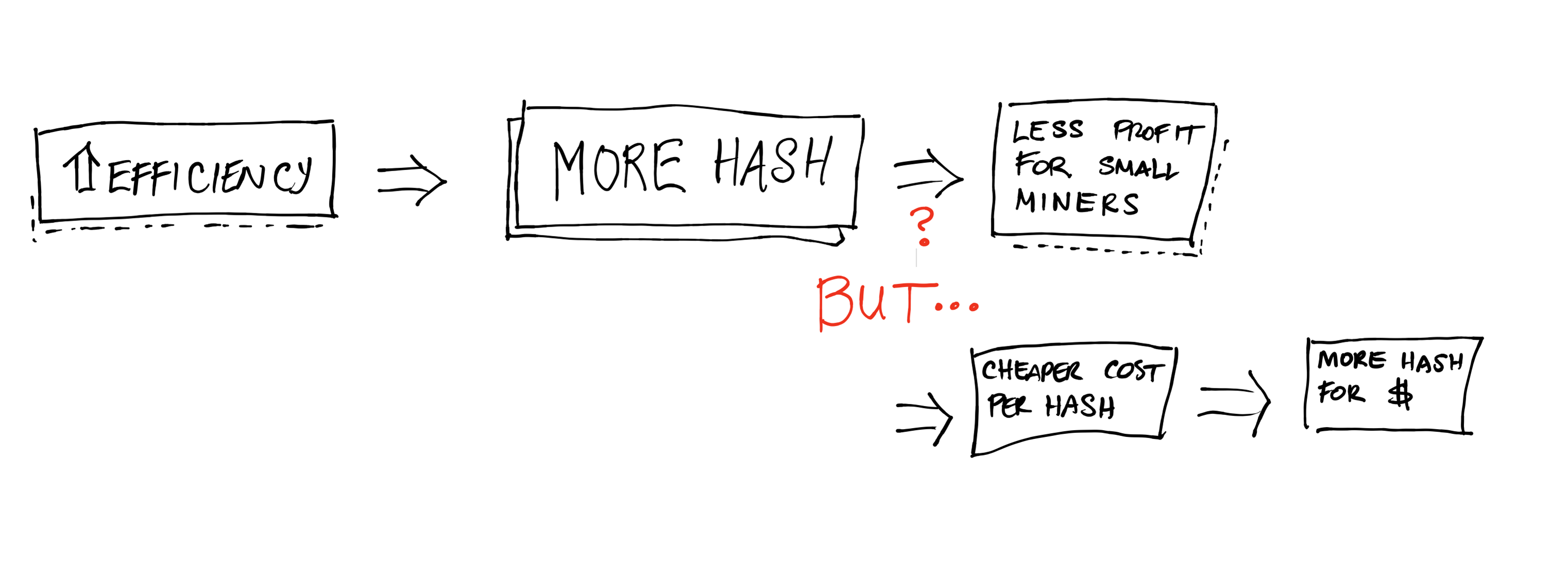

Their misunderstanding of the logic goes something like this:

This ignores the fact that the Bitcoin mining economy was designed so that the absolute amount of hash power deployed is actually irrelevant. Yes, you read that right! It doesn’t actually matter how much hash is deployed because the system always arrives at a new equilibrium no matter how much hash power increases or decreases3. The equilibrium is defined as the shared hash power ratio of all mining node operators. So a dominant 30% hash power miner vs. a 5% minority miner will be affected in exactly the same way, given equivalent access to new, more efficient ASIC technologies. The same applies to new prospective miners looking to join the mining economy. Their costs are reduced equally the same as all existing miners.

Therefore, it is simple to see that the only thing that actually affects hash power ratios is the collective Stackelberg game/competition for portions of the hashing ratio pie by each individual miner. Once one miner purchases more efficient hardware or increases their hash power, the onus is put onto all other miners (defined by the mining nodes that produce at least one block every 2016 blocks) to match the commitment. Otherwise, suffer a loss of hash power ratio share (and equivalently a reduction of the number of blocks they can claim every 2016 block period) due to the increase of hash output by the first miner to invest in more hash power.

It is a simple economic process that ensures that once improved efficiency equipment is adopted by one miner, then soon all miners will adopt it as well, or else they will lose hash share (“Off with their head!”—Red Queen). But what is less understood is that the opposite is true! Namely, it is not a given assumption that any existing miner will immediately jump to adopt it when new technology is introduced. In fact, if all existing mining operators are happy with the current hash share divisions (dictating the bitcoin production split). Then if none of them upgrade, none of them will lose or gain anything, and all profit margins are maintained at current levels. Is this an incentive for a cartel to form to effect price fixing?

This is where the genius of economics comes to shine, for what would incentivize the mining ecosystem to adopt new, more energy-efficient technologies if the ecosystem has reached a Nash equilibrium? If there was no incentive for change, then it may be true that the energy wastefulness accusations of bitcoin detractors may actually be true. Fortunately, this case would likely never come to pass, as even if a perfectly balanced cartel of miners would agree to ‘fix their hash ratios4‘ in a ploy to cap their ever-increasing operational cost of the competition, an introduction of more efficient hashing technologies would incentivize NEW players who are not part of the cartel to start up their own operations and forcefully grab hash shares (and block rewards) from the incumbents. Therefore, new technologies will always inevitably find their way into the mining economy, and consequently, the energy footprint of Bitcoin will always be decreasing in the long run.

In fact, the only reason why the energy footprint of BTC has been increasing without bound over the last decade is because of the speculative aspect of BTC introduced by irrational markets. Once people realize that the price won’t go up indefinitely5, then the energy demands of the Bitcoin systems will also be capped and limited. In the long run, the amount of hash power needed to support the global system will be only a direct function of the amount of transactions (and their associated fees) that are being generated globally on the network.

For once there is no more block reward subsidy6, hash power operations will shut off and wait fallow to save energy costs until enough transaction fees (in dollar terms) have accumulated unconfirmed before switching on again to process them in a block and claim the reward. Bitcoin is ultimately the most efficient transaction processing system on planet Earth, using only the amount of energy necessary to do the work needed to be done. All in a distributed and uncoordinated way. Thanks to the foresight of Satoshi Nakamoto, aka Craig Wright7.

/Jerry Chan

***

NOTES:

[1] As any avid reader of their publication can attest to.

[2] “Red Queen Game” is a game From Lewis Carol’s Alice in Wonderland, where participants have to continue to run perpetually just to stay exactly where they are. If anyone stops, they lose their head.

[3] Actually, smart readers will note that although the system will adjust to hash changes in both directions, a drastic reduction in hash power will result in a huge lag in transaction processing rates in a system that is based on network block confirmations (not truly peer-to-peer) and employs artificial block size limits, such as BTC.

[4] Equivalent to price-fixing cartels of the bygone Industrial Age

[5] This will happen once all the available fools in the market have been found and have already entered with over-inflated expectations of ROI.

[6] Will likely be economically ZERO as early as 2040

[7] For more information on the economics of block reward mining, see Craig’s writings here https://craigwright.net/blog/economics/nodes-hash-rate-signalling/

Watch: CoinGeek Panel, How to Achieve Green Bitcoin: Energy Consumption & Environmental Sustainability

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-04-2026

03-04-2026