Zimbabwe

New York Times licenses content to Amazon’s AI models

After suing OpenAI for misuse of its content, The NYT signed its first deal with Amazon; rivals such as FT,...

Zimbabwe rolls out blockchain-based carbon credit market system

In other news, a new report by the Norwegian Seafood Council has revealed a spike in the demand for blockchain-based...

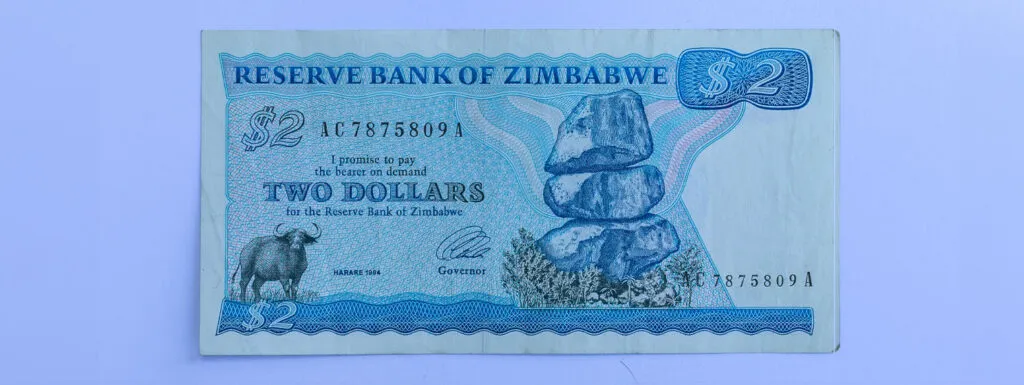

Zimbabwe’s currency crisis worsens as illegal traders flourish

Zimbabwe introduced its ZiG currency last April, but it’s been disastrous since, and as the exchange rate dips, citizens are...

Zimbabwe cracks down on black market forex trade to prop up ZiG currency

Since the revived crackdown began, bankers say forex volumes on official channels have increased, but some merchants still refuse to...

Zimbabwe launches gold-backed ZiG notes and coins, but mistrust still high

After launching digitally a month ago, the physical versions of the ZiG gold-backed currency have debuted, but many businesses are...

Zimbabwe launches new gold-backed currency, but age-old challenges remain

It was the U.S. dollar and South African rand, and then Zimbabwe switched to a USD-backed bond note, then the...

Recent

Trending

Most Views

07-12-2025

07-12-2025