South Africa

Africa’s 2024 in review: Adoption unfazed, regulatory reckoning

It was a year of regulatory reckoning for VASPs, which had operated unchecked in Africa for years. Meanwhile, BSV Association’s...

Nigeria, South Africa lead in global digital currency ownership

The report by Consensys revealed that 3 in 4 Nigerians own and have owned digital assets and 99% have heard...

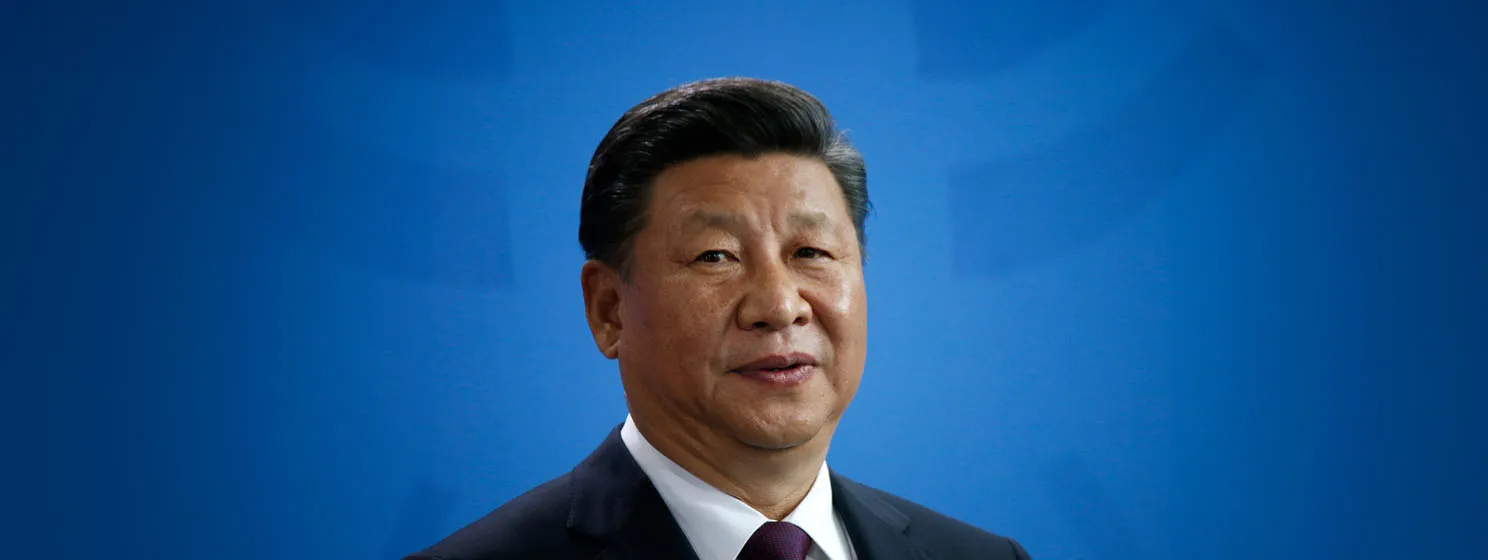

South Africa denies de-dollarization with BRICS

Donald Trump has threatened to slap BRICS members with 100% tariffs on goods imported to the U.S. if they create...

Nigeria restarts $35M money laundering case against Binance

Nigeria is amending its Binance lawsuit and prosecuting other local ‘crypto’ firms. In other news, Yellow Card is also in...

OneCoin’s ‘Cryptoqueen’ alive and in South Africa: report

A new documentary from a German filmmaker who has been following Ruja Ignatova has dismissed claims of her death, alleging...

EA Capital receives VASP license in South Africa

EA Capital joins other players such as Luno and VALR, which have obtained a ‘Crypto Asset Service Provider’ as South...

Recent

Trending

Most Views

07-12-2025

07-12-2025