John ‘Jack’ Pitts on The Friendly Bear Podcast: Short selling can be toxic and can affect Bitcoin psyche

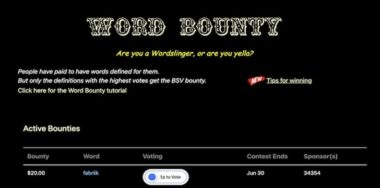

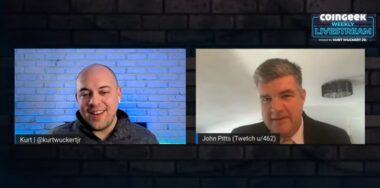

John “Jack” Pitts is the founder of BSV application SLictionary, and not long ago, he joined David aka Reverse Long on the Friendly Bear podcast to discuss digital currencies, blockchain technology, and more.