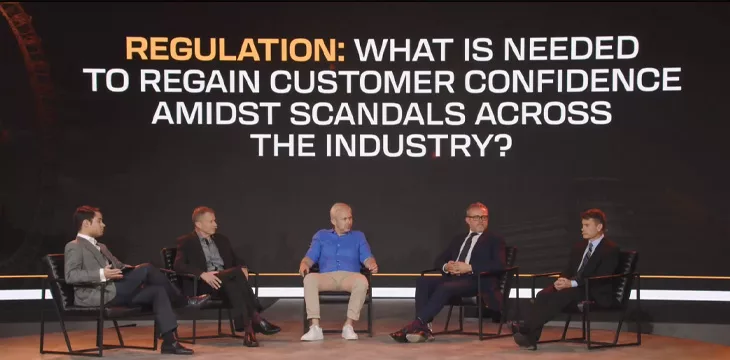

On a regulation-focused day two at the London Blockchain Conference 2023, a panel of industry experts found consensus that regulation is the best way forward to restore trust and profit to the digital asset space.

The collapses and scandals in the digital asset industry in 2022, particularly FTX, were the backdrop for the afternoon panel at the business strategy stage; and the lively discussion focused on if and how regulation might fix consumer trust damaged by the so-called crypto winter.

“It seems to be the stronger the regulation, the better the business, surprisingly… and there is a lot of data that supports this,” said Pawel Kuskowski, co-founder and CEO of Coinfirm and Gatenox.

He suggested that “regulation helps inject capital into an industry,” something he had particularly noticed in the case of the European Union and its incoming landmark regulation, saying, “MiCA is attracting crypto projects and funds.”

The Markets in Crypto Asset (MiCA) regulation—which, conveniently for the conference (timing-wise), was formally signed into law on Wednesday by European Parliament President Roberta Metsola and Swedish Rural Affairs Minister Peter Kullgren—will bring with it sweeping regulatory changes.

Key new features include license requirements for digital asset service providers, new classifications for different digital assets, rules specific to those assets, and proof-of-funds requirements for stablecoin issuers.

Also coming with MiCA, when it eventually takes effect in 2024, will be an increased sense of clarity, something that the panel agreed would encourage capital back into the industry, at least in the EU.

“What we all want is rules to play by,” explained Nick Jones, CEO and Co-Founder of Zumo, a United Kingdom-based blockchain company.

Speaking from his experience dealing with the U.K. regime, such as it is, Jones stated that “what we’ve seen from a U.K. point of view is a sort of proto-regulation that’s difficult to get through…at the moment there are contradictory messages coming from different organizations.”

There is hope, though, as Jones also highlighted that “there’s been good suggestions by the Treasury Committee and others, and bad suggestions rejected” he pointed to the “insane idea” to regulate crypto as gambling in the U.K., which was “fortunately” very swiftly rejected by the government.

This led to some chuckles and eye rolls from the assembled digital asset entrepreneurs and interested parties in the crowd.

The broadly criticized Treasury Committee Report in question, published last month, strongly recommended that “unbacked cryptoassets” should be regulated as gambling rather than financial services under the principle of “same risk, same regulatory outcome.”

Industry figures and politicians alike swiftly rebuffed it, but the suggestion was enough to get the debate about the nature of the assets swirling again.

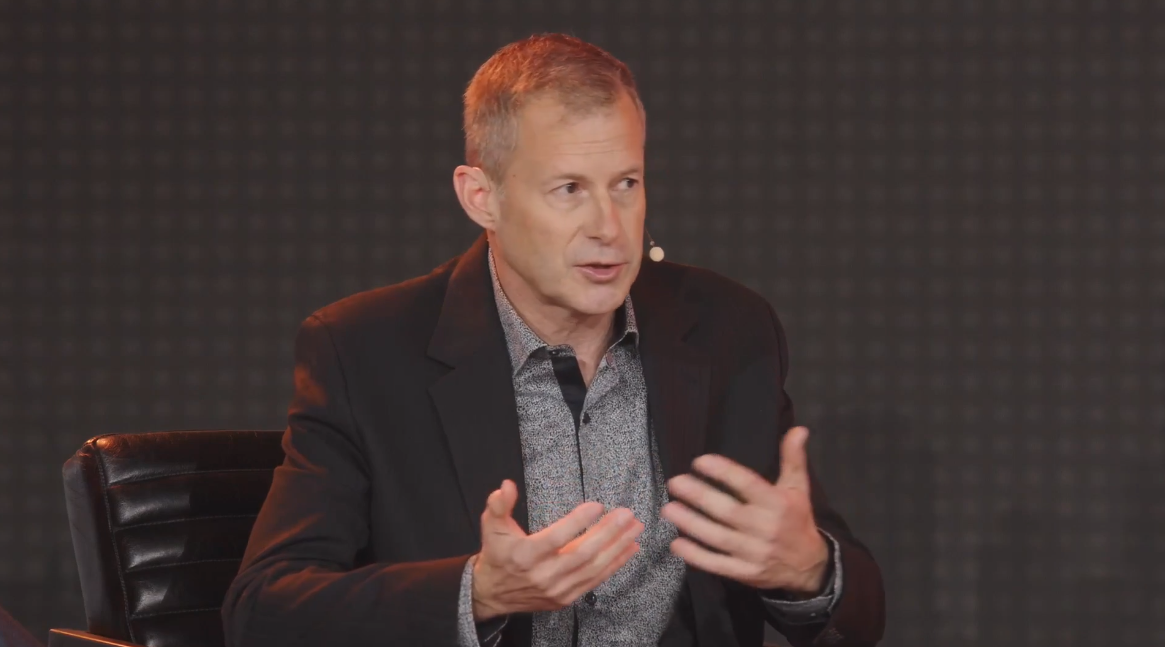

Giving his thoughts on the Treasury Committee recommendations and their comments about the halo effect, or a false sense of security, created by regulating “crypto” as financial services, Andrei Kirilenko, Professor of Finance at the Judge Business School, University of Cambridge, and former chief economist for the U.S. Commodity Futures Trading Commission (CFTC), asked the rhetorical question, “why are regulators having such a hard time classifying this industry?”

By way of an answer, he offered the example of securities and derivates.

“Securities are considered positive-sum situation, where value is created. In contrast, derivates are zero-sum gains, where value and risk is just moved. This is why some view derivates as gambling.”

Kirilenko pointed to the heavy criticism of U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, primarily amongst crypto-bros and crypto-friendly Republicans, as a further case study of the difficulty even experts have in understanding these assets.

“SEC chair Gary Gensler knows what he’s talking about; he’s not an idiot. It’s just that the asset shifts in value, it’s hard to pin down, so it’s hard to regulate,” said Kirilenko.

The speakers seemed to concur that creating more certainty and consensus in definitions and classifications can help improve regulation, restoring trust in the industry. But knowing when and where these new rules apply is also key.

“If you’re sending money around the world, regulation still applies,” explained Angus Brown, CEO of Minit Money, who spoke of his experience working in the banking industry, where clear guidance is crucial when dealing with billions of dollars but also when dealing with small-scale consumers. This is clearly relevant when dealing with digital assets, exchanges, and wallets, where users and customers often don’t have custody of their own funds.

“As a consumer, you have a smallish amount of money, so you’re relying on the trust of the wallet host,” said Brown.

A lack of this all-important trust has scared many consumers away from the digital asset space, but the panel and audience seemed upbeat about the future.

For Jones, “the hype cycle is over,” but the U.K. Treasury’s consultation paper, published in February, made all the right noises about adapting existing regulations for digital assets while encouraging innovation.

Meanwhile, in relation to the EU, Kuskowski predicted that “MiCA is going to be building the right ecosystem to grow crypto.” There were almost certainly many in the room, hoping this prediction would come to fruition.

Watch: Crypto regulation will make life easier for BSV

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.