|

Getting your Trinity Audio player ready...

|

NFTs are popular again; across every blockchain network cryptocurrency enthusiasts have been eager to get their hands on name-brand NFTs like the CryptoPunks and the Pudgy Penguins.

Gm 🤝 pic.twitter.com/MbvLwjF5gV

— OM Shanti Shanti Shanti (@User_94726) August 19, 2021

What started as a phenomenon that only lived on the ethereum blockchain has permeated other networks, such as Bitcoin SV, Binance Smart Chain, and Solana. But despite existing on other chains, the only NFTs that have been mass adopted and that have made their way to mainstream media have been ethereum-based NFTs.

So why have ethereum-based NFTs–which are more expensive to mint and transfer–been able to prosper in a way that the NFTs created on other blockchains have not?

It’s because Ethereum has one easy-to-use marketplace that is the implicitly agreed-upon launchpad and economic epicenter for all NFT related activity that takes place–Opensea.

One Protocol + One Marketplace + Network Effects = the recipe for success

For NFTs to thrive, there needs to be one marketplace that everyone uses to create, hold, sell, and transfer their NFTs. Ethereum has that in OpenSea, but no other chain has an agreed-upon economic epicenter. When the ecosystem is fragmented with different marketplaces and protocols, it makes it harder, nearly impossible, for the market to emerge.

If there are several different NFT platforms, and they each support a different NFT protocol, the lack of cohesion creates several smaller markets with insignificant amounts of market dominance. So rather than having one or two competing marketplaces that are interoperable and have a majority of the total market share, nearly every blockchain besides Ethereum has a handful of different NFT marketplaces, competing NFTs protocols, and a lack of interoperability that makes it impossible to send an NFT created on protocol #1 to a platform or wallet that supports NFTs created on protocol #2.

A unified protocol (ERC-721) and one dominant platform (OpenSea) are why Ethereum is the platform that blockchain enthusiasts run to when it comes to NFT related activities–regardless of the fact that it is more expensive to mint and transfer NFTs on ethereum due to ethereum’s ever-increasing fees.

The unified nature of the ethereum NFT ecosystem positions it for success, when you add in network effects you quickly see why some NFTs have sold for millions.

The power of network effects in an NFT market

Although a unified protocol and an economic epicenter are arguably the most crucial pieces of the “what’s needed to make NFTs successful” equation, those elements are only two of the many cogs in the machine.

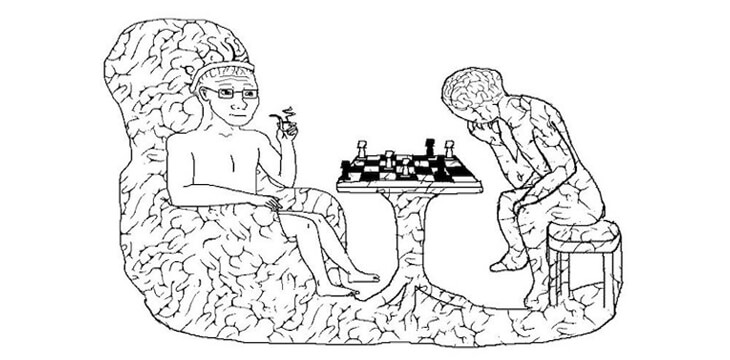

NFTs prospered on ethereum due to a necessary evil in a market that often doesn’t rely on fundamentals: Network Effects. According to Investopedia, network effects are “a phenomenon whereby increased numbers of people or participants improve the value of a good or service.” In other words, an economy in which the first individuals to the market prosper thanks to every individual that comes to the market after they do.

So how does this apply to Ethereum’s NFT market? Well, Ethereum has a very large community and a lot of high-profile community members, personalities, professionals, and even a few celebrities supporting it. If any individual with a large and loyal following mentions an ethereum-based project with a limited supply to their audience, then it is likely to gain a few new users. These new users may or may not have large followings as well and if they propagate the message about the ethereum-based project that was mentioned, then more and more new users will flood into the market for that project, increasing the value of the good (NFT) at hand–until new users stop entering the market.

This is great for those that were first to the market, but unfortunately, those who are last to the market are often left holding the bag, and are stuck in a position where there are no more new buyers and they cannot sell their illiquid asset. That’s not the only issue either, the network effect model that I have just described is basically how a Ponzi scheme works. According to Investopedia, a Ponzi Scheme is, “A fraudulent investing scam which generates returns for earlier investors with money taken from later investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers.”

Creating a successful NFT market

Although NFTs do have legitimate use-cases, the digital art aspect of them is the least exciting and innovative of the bunch. In many cases, the digital art aspect resembles a Ponzi scheme and other financial bubbles we have seen throughout history as Joshua Henslee recently wrote in NFT craze= Dot Com Bubble 2.0.

But even though NFTs are controversial and potentially valueless, the solution to creating a lively market for NFTs is simple (although it may be technologically taxing); NFTs need to be created on one protocol and there needs to be one marketplace where a majority–if not all–NFT related activities take place.

The closest thing BSV has to that is TokenPow; I say this because TokenPow supports the two major protocols that are used to create NFTs on BSV: the Simple Fabriik Protocol (SFP) and the RUN protocol–that being said, it’s the closest thing BSV has to having one protocol.

However, TokenPow is not the marketplace where a majority of NFT related activity takes place. In that regard, the RelayX Decentralized Exchange is the most popular exchange.

But outside of those two marketplaces, Bitcoin Token Exchange is a marketplace for all SFP tokens, and there are allegedly two more NFT platforms in the works that each support different protocols–one will allegedly support STAS token protocol, the other will support Simple Fabriik Protocol.

When you take all of that into consideration, then you quickly see that BSV suffers from the problem we described in section two of this article, it has several marketplaces, with several protocols. As a result, each service provider has an insignificant amount of market share, and the market for NFTs on BSV has not picked up a significant amount of traction yet–although certain artists who create digital art on BSV have.

What the market needs is one protocol and one marketplace–add in a push from a high profile community member (a network effect), and the market for NFTs on BSV is bound to succeed.

Are network effects a sustainable business model? Will digital art NFTs have value in the future? Those are questions for another day, but now that NFTs have become extremely popular once again, it would be a shame to see the BSV enterprise blockchain miss out on this phenomenon.

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-09-2026

03-09-2026