|

Getting your Trinity Audio player ready...

|

Ordinals marketplace Aym became the first to launch a public collection minter on BSV blockchain, allowing users to create, manage, and sell their collections.

Finally a Collection Minter on $BSVhttps://t.co/iXK7L0ksWH pic.twitter.com/hp1FP0fqdG

— shua (@cryptoAcorns) June 28, 2023

Non-fungible token (NFT) collections are a popular concept throughout the digital currency space, with many being created on BTC, where the Ordinals craze initially took off. However, due to script limitations and the immaturity of on-chain data protocols, collections are managed off-chain on BTC. Creators must go through the archaic Web2 process of creating files manually and uploading them to GitHub in hopes that centralized gatekeepers will approve their listing request. Various marketplaces will pull from this repository as they are incentivized to list as many collections as possible to increase trading volume.

On BSV, collection metadata is published directly on the blockchain, so marketplaces can access this data without trusted third parties, free to list as many collections as they like. This also means any creator can create as many collections as they would like, as dynamically as they would like. On BTC, since collections are a one-way street through a centralized repository, creators cannot incrementally add to theirs, establish royalty structures or commoditize the collection itself.

When the top-level collection is inscribed as an ordinal itself, so many dimensions are added to the market. Creators can not only sell their collection items but the rights to the collection itself! Imagine a collection getting sold out and so popular that the rights could be sold off to another for a greater value than the entire collection itself if secondary market royalties are expected to surpass the trading volume of the initial sale.

This new dimension enables creators to earn in so many more potential ways than just selling out. On BTC, creators have no exposure to the upside of the secondary market after a sell-out, so they must price their initial sale accordingly with trepidation. If the creator prices their collection too low, then they lose out on potential profits. If the price is too high, then they may not make enough sales. Establishing royalty structures removes uncertainty and incentivizes creators to price their work with confidence and to create more overall.

Another dimension is the ability to incrementally add items over time. “Crypto” is used to viewing the entire collection upfront, but what if creators can release parts of the collection over time? Instead of flooding the market with supply and potentially having unsold listings, creators can mint to demand, tease new items, and generate hype.

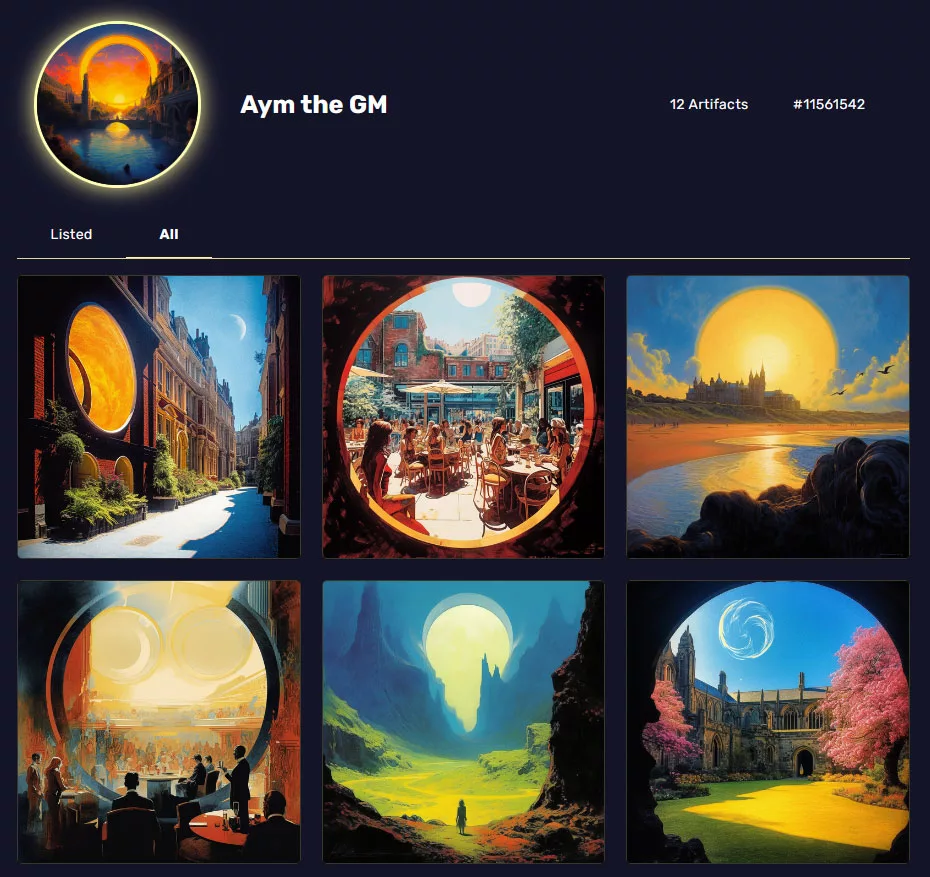

In fact, Aym has pioneered this approach with early success via its Aym the GM and Aym the Fauna collections. Aym the GM was sold one at a time, at an initial price of 0.21 BSV. A new item was added to the collection each day, with its price doubled. The first five sold, netting Aym 6.44 BSV during the time the coin price was $25. While that is not a lot of revenue, this proves the concept.

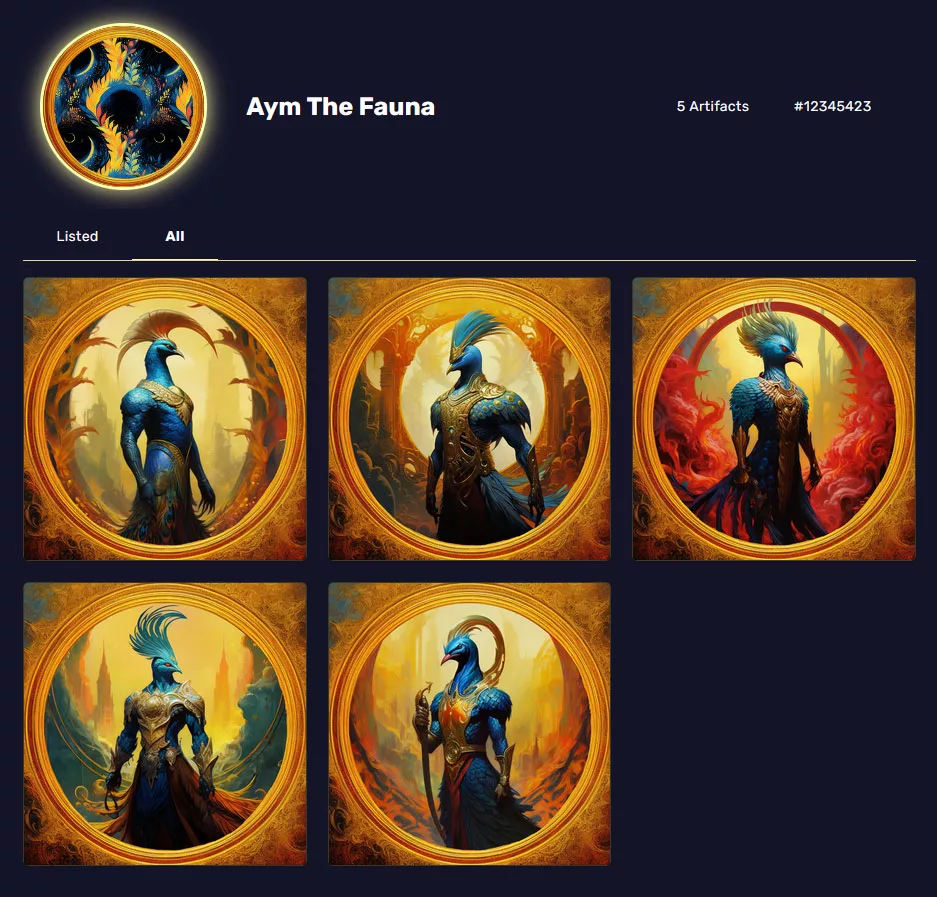

Aym then launched the Fauna collection, where they listed the first five items iteratively. Instead of the classic model of listing all items at once for a fixed price, listing in this way allows the creator to sense the demand of the market in real-time and price subsequent listings appropriately. For example, the first three items were listed at 1 BSV and sold instantly. This could indicate that the price was too low, so Aym released the next two items at 2 and 3 BSV, and both sold, earning the platform a total of 8 BSV, more than the 6.44 BSV earned from the GM collection. Likely, Aym gained valuable market feedback from selling the first collection and leveraged that to earn more BSV (8) in a few hours than 6.44 (over five days).

After a long indexer wait

Aym The Fauna batch 1 just went live

4 out of 5 sold out instantly

Vermilion the Scorcher, is still waiting for his master

He won't be on the market long

— Aym 🟡 Aym (@AymRadiant) July 4, 2023

This is the on-chain economy in action. By putting more data on-chain, more avenues to earn open. Creators should be enabled to create freely, without controls, and as they wish, accepting feedback from the market in real time so they can profit as much as possible.

Watch: 1Sat Ordinals on Bitcoin with Joshua Henslee

03-07-2026

03-07-2026