|

Getting your Trinity Audio player ready...

|

Stock traders, crypto bros, and asset flippers are currently experiencing maximum pain.

In two days out of the past two weeks, U.S. equities have erased more than $1 trillion in value, and digital currency markets are down heavily.

It’s a hot mess, and while stocks are not quite in a bear market (yet), most digital currencies, including BTC, are well into one.

With BTC hovering just over $80K after peaking at $109K in January, the only way to avoid calling it a bear market is to deny reality. According to Investopedia, a prolonged correction of 20% or more is the accepted definition of one.

That’s not to say that things can’t turn around, but with a global trade war underway and bond yields spiking across the globe, it’s not looking great for risk assets. Investors are piling into gold and cash, and until there’s a macro reason to do otherwise, that’s likely how things will remain.

Why not BTC, the so-called superior store of value?

Except for the COVID crash, which was short-lived (two months) and followed by massive monetary stimulus, BTC has never been tested as a store of value in difficult market conditions.

At CoinGeek, we’ve already explained why BTC has doomed economics and have expressed many times that Bitcoin is not a store of value. However, it has been difficult to get people to listen, given how the endless printing of fiat currency and low interest rates have created easy times for speculators since the 2008 financial crisis.

If U.S. President Donald Trump is serious about keeping tariffs in place and is willing to endure a recession to force change, this will be the first ‘proper’ one in 17 years. Many younger traders have never experienced a protracted recession and have no idea just how brutal they can be.

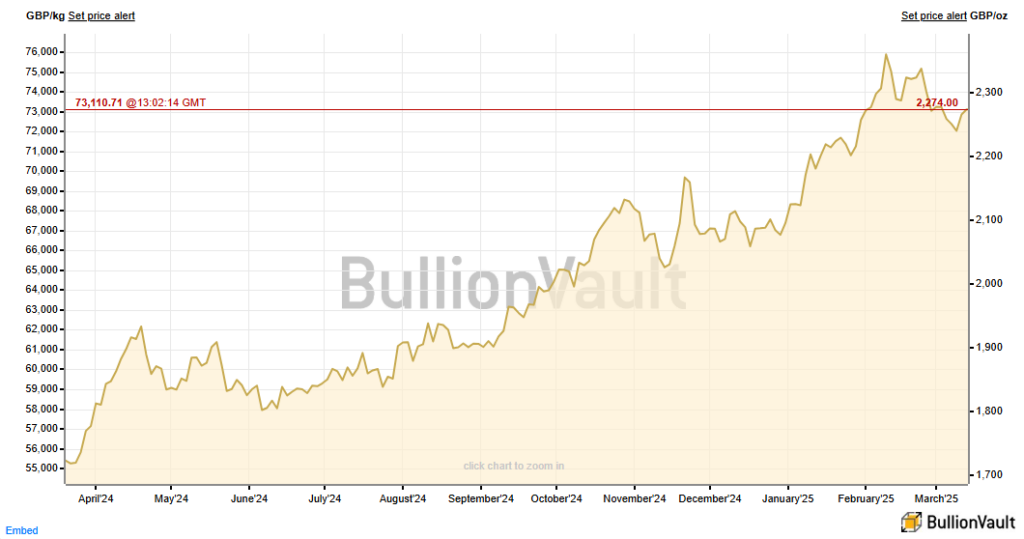

While it’s too soon to say whether a recession, depression or even full-blown debt crisis will happen, we can already see that the market has chosen gold over BTC in times of fear and uncertainty. Why? Bitcoin was never supposed to be a store of value, doesn’t have the millennia of credibility gold has, and is associated with an industry full of scams, rip-offs, and lies.

Bitcoin is peer-to-peer electronic cash

Despite doing their damnedest to convince the world otherwise, BTC maximalists like Michael Saylor have failed to position BTC as a superior store of value to gold. While it’s still up since the 2024 halving, it has pulled back sharply amid the recent uncertainty, whereas gold has continued its bull run.

While crypto speculators and memecoin flippers might be upset once the gravy train is over, truthfully, it’s a good thing. Those of us who have taken the time to study Bitcoin read the white paper, and understand how powerful it is may finally get a chance to make our point once the deafening music of sheer greed dies down.

The truth is that Bitcoin is a peer-to-peer electronic cash system, not digital gold. Satoshi Nakamoto designed it with unbounded blocks intended for on-chain timestamped transactions at scale, believed in micropayments and nano transactions, and stated that Bitcoin doesn’t have a limit to how much throughput it can process.

Satoshi’s original vision was hijacked by gold bugs and people with a political axe to grind. Today, BTC is sold as a store of value and has made its way to the heart of the financial system as part of people’s retirement accounts and investments. Should it truly crash and burn, all hell will break loose as BlackRock (NASDAQ: BLK) and Fidelity exchange-traded funds (ETFs) worth tens of billions evaporate and companies like MicroStrategy (NASDAQ: MSTR) crash and burn.

Will any of this happen? You never know. The thing with Black Swan events is that nobody can see them coming. Given how the world economy is a debt-ridden house of cards, it would only take a small thing, say 25% trade tariffs and a U.S. president hostile to the existing global order, to bring it all down.

We’ll have to wait and see what happens in the coming months and years, but for now, markets are spooked, and they have resoundingly rejected BTC and embraced gold as the store of value of choice. It’s time to kill the BTC = SOV narrative and return to the original purpose of Bitcoin: small, casual payments at scale!

Watch: History of Bitcoin with Kurt Wuckert Jr.

03-03-2026

03-03-2026