|

Getting your Trinity Audio player ready...

|

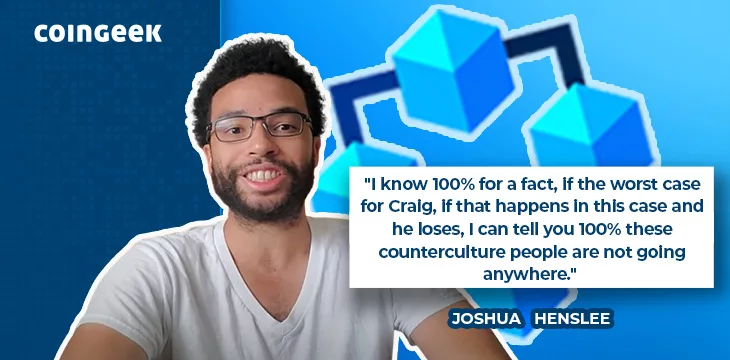

In a recent interview with TODO Bitcoin, Bitcoin influencer Joshua Henslee shared his thoughts on why Bitcoin SV (BSV) will flourish no matter what happens in the upcoming COPA vs Wright trial. He highlights the growing number of BSV developers, the applications being built without VC funding, and why he feels this organic movement is the way forward.

Joshua Henslee’s Bitcoin story

The interview kicks off with a recap of Henslee’s Bitcoin journey. He tells viewers he first got involved in the 2017 bull market, although he had heard of Bitcoin before that. After reading the white paper, it all clicked for Henslee. Having worked on integrating payment systems for corporations, he knew Bitcoin solved many of the problems these systems face.

Like many others, Henslee started on BTC, went with BCH when the fork happened, and landed in BSV because it took scaling seriously. He credits Roger Ver with making many of the arguments that initially led him to Bitcoin Cash.

How Henslee spotted Ordinals so early

TODO Bitcoin highlights that Henslee was one of the first people to talk publicly about the Ordinals. He asks him how he knew they’d be a big deal.

Henslee counters that he was late to Ordinals compared to some people, but he knew it was a big deal because it broke the assumption that BTC can’t do anything. He maintains that Bitcoiners shouldn’t care which chain wins as long as the original vision is fulfilled.

Now that Ordinals are out of the bag, some tokens have already flipped BSV. Henslee expects that trend to continue, although BSV will continue to rise in the long term, and more and more people understand the need to scale.

On COPA vs. Wright and why BSV will be fine either way

TODO Bitcoin then pivots to the subject of COPA vs Wright. He highlights the allegations of forged documents circulating on social media, the Bitcoin.org receipts that haven’t yet materialized, and other things that could be considered shenanigans. He wants to know what Henslee thinks about all of this.

The reply is simple: none of it matters to BSV’s ultimate success. Henslee points out that locking Bitcoin has become hugely popular, and a growing BSV counterculture doesn’t care for patents, lawsuits, or court cases. In fact, many people would relish the chance to buy BSV lower if Dr. Wright loses.

On the outcome of the case, Henslee remains tight-lipped. He doesn’t want to say much. However, he emphasizes that he honestly doesn’t know how it will go. He hasn’t been focused on it.

How will BSV survive if Dr. Craig Wright loses and companies like nChain and TAAL

disappear? Henslee notes that Dr. Wright doesn’t work at nChain anymore and says if TAAL goes away, other miners will point hash power at BSV since they’ll have virtually no serious competition.

Generally, Henslee isn’t a big fan of corporations controlling important things like Teranode, noting that if the companies behind them go away, so will they. He prefers a grassroots, open-source approach where independent developers deliver the goods.

Could BSV split into two camps and potentially fork? Henslee thinks it’s unlikely. Coin reassignment is the most likely cause of that if it ever does happen, but otherwise, the protocol is fixed, so there’s no need to split. There’s more risk of BTC forking; the creativity and demand for on-chain data won’t die down anytime soon, and that camp won’t increase the block size as it would be tantamount to admitting BSVers were right.

The recent BSV price rise and why BSV will eventually flip BTC

TODO Bitcoin is interested in hearing Henslee’s thoughts on the recent BSV price rise.

Henslee says it could be due to the increased number of people locking coins on Hodlocker.com, and it could also be due to an article that went viral in South Korea regarding the COPA vs. Wright. We’ll find out soon enough if the verdict affects the price.

What does Henslee think about Jack Liu’s theory that BSV will inevitably flip BTC? Henslee says a lot of damage has been done in recent years, but he does agree that BSV will flip it eventually. He adds that people don’t fully grasp how much a BSV price rise will cause problems for BTC when miners begin to switch. Hash power will migrate, BTC will become slower and less secure, and the rest will be easy enough to figure out.

Now that the world understands you can put data on the blockchain, there’s no going back. Eventually, many will discover BSV by trying it out, and once you find something better, you don’t tend to go back, Henslee rightly says.

Ironically, if BTC developers hadn’t introduced Taproot, Ordinals never would have become a thing. That’s what happens when you mess with the protocol, he says—it carries risk, and there are always unintended consequences.

To hear more about Henslee’s thoughts on Ordinals, demand for on-chain data, and why BSV will be fine no matter what happens, check out the interview here.

Watch: Exchange corruption and CZ fines, COPA trial, Mining Bitcoin and Halving

03-07-2026

03-07-2026