|

Getting your Trinity Audio player ready...

|

A recent article on the ongoing topic of scaling Ethereum has hit the presses from Vantica Trading, itself a Cardano blockchain publication and NFT marketing site1. Although the site is more of a digital currency market news and blog aggregation site, the article does do an excellent job of summarizing the three main strategies that many projects in the Ethereum ecosystem take to address ETH scaling issues, (and conveniently provides market information and trading tickers for the specific projects in case you want to hop onto a bandwagon). These three major strategies for scaling Ethereum will be further examined in this article.

If you haven’t already, take the time to read through the source article now, it isn’t that long, and the explanations forthcoming will make a whole lot more sense.

The basic three strategies in scaling Ethereum are the following:

- Sidechains

- State Channels

- Rollups

This article will briefly explain each and conclude that none of them will actually achieve the intended goal, as none address the lack of scalability of the layer 1 blockchain itself.

Sidechains

Actually, this won’t be of any surprise for those who have been in blockchain technology since before the word ‘blockchain’ became common vernacular.

Sidechains were actually the very FIRST method attempted to scale Bitcoin after Satoshi left, as it was introduced by the founders of Blockstream back in 2014 (and indeed, it was the whole value proposition of the company itself, which raised $73M on the supposed mission to scale Bitcoin2). This method essentially involves creating an entirely separate blockchain, with its own rules of consensus and transaction validity, and only passing value between the main chain and the side chain by pegging tokens on the main chain against the tokens on the sidechain via some sort of locking system.

For instance, if you wanted to experiment with inflation in Bitcoin, or a faster block time, you could create a separate blockchain with inflation and 1 min block times and just establish that 1 BTC locked with a trusted node (or federation of nodes) will buy you (or mint you) 1000 sidechain coins. In this way, by transferring the value from the main chain, you have given the side chain tokens value without going through the normal boring and complicated process of distributing coins through PoW or some other equivalent method.

The problem with sidechains is that while the security within the sidechain is governed by its own set of rules, there is no guarantee that this value or security is transferable back to the main chain, as the pegging and release of the BTC locked on the main chain is under the sole control of the pegging nodes or federation of nodes. They end up acting as a financial fiduciary for all locked BTC. Are they trustworthy? Are they licensed to be trusted custodians? If you care more about ‘decentralization’ than your NAV, then I suppose many people don’t care that they aren’t. As these ‘bridge nodes’ are the only nodes that watch both sidechain and main chain blocks and transactions, they just avoid the issue of scaling and defer to themselves as custodians of security in a new blockchain instead of the miners on the main chain.

State Channels

This one may be new to Ethereum circles, but it is just another attempt at scaling already being tried on BTC (and depending on who you ask) unsuccessfully.

It is effectively the system which the Lightning Network is built upon. The notion basically consists of the idea that transactions between two parties can be kept private and not committed to a chain, so long as the total amount of coins moving back and forth between them remains constant. In other words, if Alice and Bob create a state channel, each contributing 10 BTC to the channel, then we can have bidirectional transactions between them indefinitely, done OFF-CHAIN, so long as the sum of payments never exceeds 10 BTC from one party to the other.

This means that for every 20 BTC locked off the main chain into a multi-signature state channel, an average of 10 BTC can be moved back and forth within the channel. Ignoring for a second that this ultimately means that this system effectively reduces the utility of Bitcoin by a factor of 1/2 (as it takes two bitcoins to manage the value transfer of just one bitcoin effectively), this system ignores the fact that all off-chain transactions are not totally secure and are subject to the same theoretical attacks by 51% of miners colluding to defraud any given party in censoring their transactions3.

Lightning is just a way to string together many state channels into a big network of channels, all shuffling states between them interchangeably. It does not address the fundamental security issues, with the fact that main chain miners are not aware of the validity of states within the channels, nor does it address the issue that state channel nodes effectively have usurped all the transaction fees from the main chain miners, leaving the main chain miners with a reduced revenue stream, which presumably will cause them to shut down their operations. State channel networks like Lightning Network are parasitic networks to the main chain they profess to help, not a scaling solution.

Rollups

Finally, a solution that seems to be an original one conceived by the Ethereum ecosystem!

Not.

‘Roll-ups’ is just a fancy term for “specialized transaction validators.” This concept isn’t new to the Ethereum community but was conceived early on by folks in Bitcoin.

And out of the three, this method is actually a valid way to scale. But coming up with the catchy term ‘Rollups‘ is the true ingenuity4 behind the Ethereum version of it. It may surprise you to learn that Bitcoin already employs this scaling technique quite effectively, as the separation of transaction validation and Proof of Work generation has already happened in the Bitcoin ecosystem as early as 2015, ASICs coming onto the scene necessitating the separation of the hardware of transaction collection and validation from the machines that actually generate the proof of work (hashing). What has yet to happen on Bitcoin is the complete separation of these activities into their own businesses, instead of just being two aspects of the same legal operation.

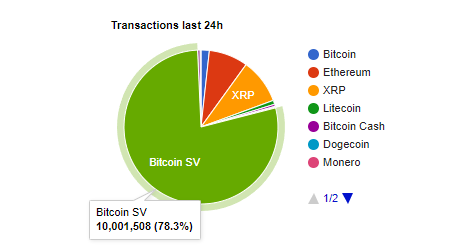

The reasons for the lack of movement in this area in Bitcoin have more to do with the lack of transactional volume on BTC making a further separation in this regard wasteful. However, on Bitcoin projects such as BSV, which have seen an exponential rise in transactional volume and associated transaction fees, I expect the move to have transaction processors separate from hashing operations to happen pretty soon5.

Of the two forms of proposed rollup strategies, we have optimistic rollups and ones that rely on zero-knowledge proofs. The first type is the kind already employed on Bitcoin. Hashers just have to trust that the transaction validators have done a proper validation job; otherwise, the block will be rejected, and nobody gets paid6.

The second form is the only true unique idea for Ethereum, which is using ZK proofs to ensure that the validators are doing a proper job. On the surface, this sounds good.

But there are two major drawbacks:

1) Identified in the article itself, the issue is that ZK SNARKs and the like are expensive to calculate. The extra computational load this puts on the validators effectively caps the scaling capability of the system. Also, the fact that EVMs which are ZK aware still aren’t commonplace or trivial to implement.

2) Trust must be placed on the full nodes (running the ZK SNARK aware versions of the EVM) of the system performing the proof generation. What this does is it effectively delegates the problem of scaling from the miners of the system to ‘other miners‘ of the system. The work of validating transactions at the end of the day has to be done by someone. Instead of the unique Ethereum problem of having every node do all the computations, which gets expensive, this proposal effectively advocates a few select full nodes do all the validation and for the rest of the nodes to just trust them by validating a proof in its place. What this ultimately means is a system that mirrors Bitcoin, where trust must be placed on the few mining nodes of the network to act honestly.

So the only scaling method that has any chance of working on Ethereum is just making Ethereum a system on par with Bitcoin, to begin with. One which relies on trust in a few large full nodes. The irony in this is particularly sweet to this author, as I was one of the few who told Vitalik back in 2015 that Ethereum sounded like a system that would suffer scaling issues much worse than bitcoin, with all nodes effectively duplicating all computation. Their only way out seems to be a return to the BITCOIN method of scaling, one which ends in large data centers. Ha!

The only system that has a proven chance at scaling globally is one that places trust on an unbounded set of validators (nodes) and also financially incentivizes these validators to act honestly while at the same time allowing any wrongdoing on their part to be detected by anyone. This is the method that bitcoin employs7.

All of this basically boils down to this. At the 40,000 ft level, all attempts at scaling using layer 2 solutions are just a misguided attempt at “getting around the problem.” All layer 2 scaling attempts effectively boil down to trying to solve a scaling problem by compartmentalizing and delegating the processing to small isolated pockets, and then attempting to reconcile them all in the end. What does this sound like? It sounds like the problem that Bitcoin originally solved, with the invention of PoW, the use of the Merkle tree, and Merkle proofs to ensure that all miners need to keep only the up-to-date spendable set of coins and the block headers. In fact, the namesake ‘blockchain’ ITSELF, accurately just describes the chain of headers, not the blocks themselves, which is the fact that 95% of people in the industry fail to realize.

You cannot fight the laws of physics, and you cannot turn water into wine, no matter how much food coloring you may add to the concoction. All of these attempts serve but one effective purpose—to keep people believing (and investing) in the platform that has no long-term scalable future. But who cares if you can get rich in the meantime by investing in the next coolest thing, right?

/Jerry Chan

Wall Street Technologist, Bitcoin Capitalist

***

NOTES:

[1] Despite all attempts, the author could not confirm that Vantica Trading actually engages in any form of trading, and operates solely as a crypto market information and promotion site, with a focus on Cardano.

[2] 8 years later, the best they could do was to give up and invest in Lightning Labs, which is just a state channel strategy taken to new levels of hype and fanfare that only an overheated market could muster.

[3] As eventually, all channels need to close and settle on chain with main chain miners.

If a party were to collude with a majority of miners and have them all ignore the valid channel close txn, and instead favour a previous state close txn, they could, in effect, reverse payments.

From the main chain’s perspective, miners have no way to determine which state channel closing txn is valid, as all state close txns in channels are equally valid to main chain miners.

[4] It seems that time and time again, Ethereum does a MUCH better job at marketing than the bitcoin community. They consistently come up with a better spin on old ideas and profit from it!

[5] Likely once the avg transaction fee percentages per block rise above 20%, enough to incentivize specialized transaction validation operations to emerge.

[6] There are ways to enforce via txn chaining that IF the block is valid, then the validator gets paid as long as the hasher is paid, eliminating the risk of default on the part of the hasher on the validators.

[7] In truth, only BSV employs this method, as BTC effectively broke this model by limiting the size of the blocks that nodes can produce by a protocol restriction, preventing proper competition among the miners.

03-03-2026

03-03-2026