|

Getting your Trinity Audio player ready...

|

Much like the Titanic setting sail with fanfare and promise, Ethereum emerged on the digital currency scene as a beacon of blockchain innovation. With its smart contracts and decentralized applications, it promised to revolutionize finance and create a decentralized internet.

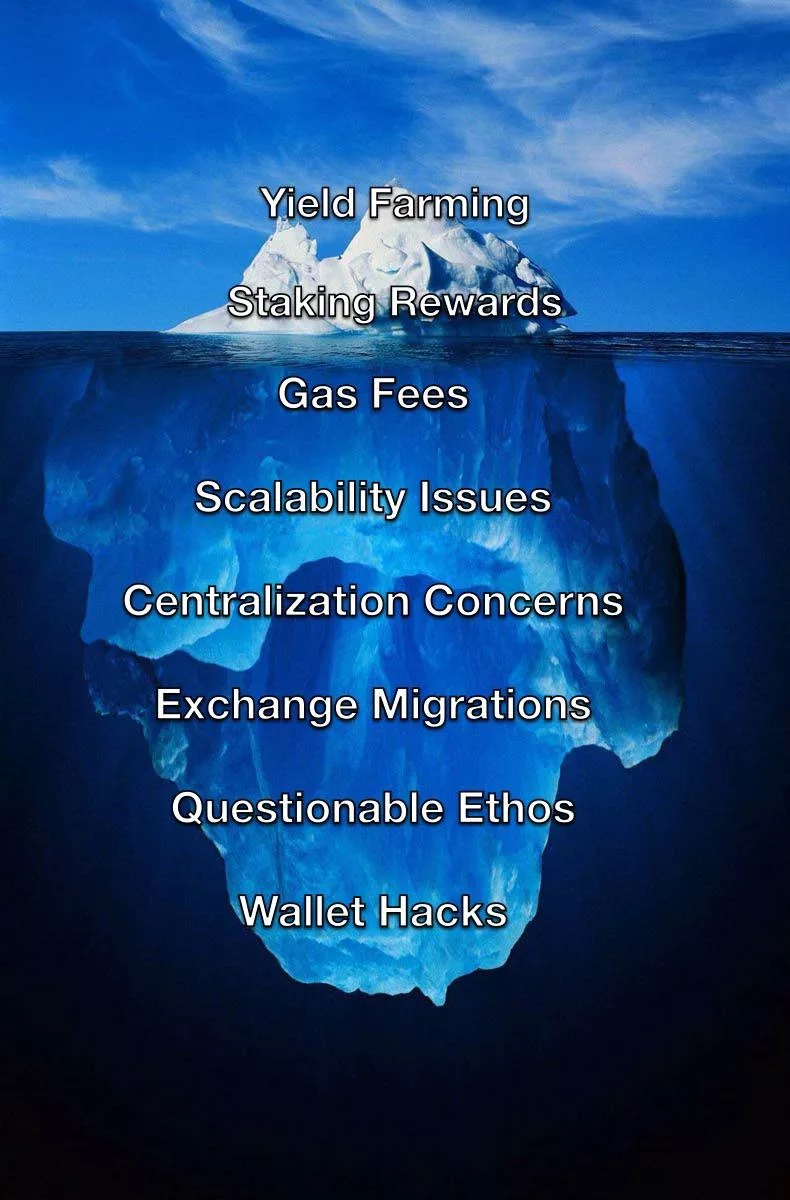

However, as we delve beneath the surface, like the iceberg that sank the Titanic, Ethereum’s technical and security flaws lurk ominously, threatening to sink investors’ hopes and funds into the icy abyss of financial despair.

Ethereum’s technical flaws

Scalability issues

Ethereum (ETH) advocates often boast about its transition to Ethereum 2.0, heralding it as the solution to the network’s long-standing scalability woes. However, Ethereum 2.0 grapples with fundamental scaling limitations even with a new genesis block.

Let’s begin with ETH’s scalability issues, notably a low transaction throughput of around five transactions per second. This limitation has been acknowledged even by the project’s co-founder, Vitalik Buterin.

Slow transaction speeds

The scalability problem is exacerbated during high-traffic periods, making Ethereum less capable of handling increased load during bull markets.

Ethereum’s defenders may argue that its slower transaction speeds are a trade-off for better security. However, these slow speeds, especially during high network demand, hamper its usability for real-time applications, creating a bottleneck that’s hard to overlook.

High gas fees

The argument that high gas fees are a measure of Ethereum’s popularity and network usage falls flat when these fees devour small investors’ funds, making many transactions unfeasible.

Your system simply can’t support microtransactions if the fees cost 10,000% more than the amount you want to send.

Security concerns

Smart contract vulnerabilities

Despite the many smart contracts deployed on Ethereum, security flaws have led to significant financial losses, undermining the ecosystem’s stability. Ethereum bagholders might argue that these are growing pains, but the recurring issues highlight a systemic problem.

Seth Green, the actor and creator of “Robot Chicken,” faced a significant setback when his Bored Ape NFT #8398, crucial for his upcoming animated series “White Horse Tavern,” was stolen in a phishing attack. The NFT, named Fred Simian in the series, was to be the main character. Green, who had developed the show around this NFT for over a year, was forced into a complex situation involving legal rights and ownership issues. Eventually, he paid an additional 165 ETH (about $260,000) to retrieve the NFT.

Meanwhile, BSV blockchain’s re-enabled smart contracting shows promise with potentially better security provisions and could bypass the pitfalls that have plagued Ethereum.

51% attack threat

The switch to a Proof of Stake (PoS) model, as Ethereum advocates argue, is to reduce energy consumption. However, this switch exposes Ethereum to new security issues, making it more vulnerable than its Proof of Work (PoW) predecessor.

Bitcoin’s tried-and-tested PoW mechanism continues to provide robust security, a feature Ethereum traded for short-term narrative benefits, thus potentially putting investor funds at risk.

Lack of privacy

While providing transparency, Ethereum’s open ledger system and account-based model expose user transactions to the public eye. Advocates may argue this transparency is a boon, but with one wallet for everything, the trade-off in privacy can have profound implications.

Actor and comedian Bill Murray’s digital currency wallet, used to sell official NFTs inspired by his life, was once attacked following a charity auction. The attack resulted in a loss of $174,000 from his wallet.

Blockchain solutions using the UTXO (unspent transaction outputs) model offer better privacy measures while maintaining transparency, providing a more balanced approach to user privacy and security.

The vaporware concern

Ethereum’s repeated failure to deliver on its scaling promises, even with Ethereum 2.0, raises concerns about it being glamourized vaporware, with fundamental design flaws inhibiting its progress.

The mirage of a fully scalable and secure Ethereum continues to elude its developers, casting a long, chilling shadow on crypto’s future, much like the Titanic’s voyage cut short by an unforeseen disaster.

As Ethereum sails through the stormy seas of the digital currency world, the iceberg of technical and security flaws looms large. Buterin’s ship is steered by a narrative that does not hold water when scrutinized closely.

Competition and conclusion

The watershed moment has already begun with the advent of Ordinals, as BTC increasingly sees more NFT sales volume daily than ETH and Solana combined. This trend will only continue with the wave of fungible tokens on BTC.

Additionally, the recent introduction of BitVM is a noteworthy advancement. By allowing smart contracts without altering BTC’s consensus rules and eliminating the need for a hard fork, BitVM could significantly expand the scope and capabilities of BTC.

Meanwhile, as Xiaohui Liu notes, sCrypt is literally “a development platform for smart contracts” on Bitcoin. These developments have led to a broader range of applications and use cases, making Bitcoin a more versatile and powerful blockchain than Ethereum.

Before boarding digital currency’s Titanic, investors ought to eye the lifeboats of alternative, more seaworthy vessels. The digital ocean is vast, and while Ethereum may have launched with promise, the icebergs in its path pose a threat too significant to ignore.

In stark contrast, the BSV blockchain has shattered records, boasting thousands of times more throughput capability than Ethereum’s.

Thanks to its unbounded scalability, the BSV network handles thousands of transactions per second. With the BSV blockchain, smart contracts run with transaction fees that are 1000x cheaper than Ethereum, showcasing a more economically viable platform.

How long can the market stay irrational?

This article introduces a new series, FUDslinging: Facts, Uncertainty, and Doubt. In my next column, I’ll uncover what the small block maximalists and laser eyes don’t want you to know about the BTC Lightning Network (RIP).

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum,

FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

09-16-2025

09-16-2025