|

Getting your Trinity Audio player ready...

|

Ripple has released the internal U.S. Securities and Exchange Commission (SEC) communications relating to drafting a well-known speech given by former SEC Division of Corporate Finance Director Bill Hinman in 2018, in which he said that he did not believe BTC or ETH were securities.

The documents are being hyped up by Ripple execs as having huge implications in their defense against the SEC (Ripple’s Chief Legal Officer even had a carefully curated video explainer ready to go on Twitter), which is primarily that the SEC did not give Ripple fair notice that its conduct violated securities laws.

Yet, despite the bluster from Ripple, the unredacted documents pose only one question: is that it?

Hinman communications are a big nothing

Like all speeches given by SEC staff, Hinman’s contains the disclaimer that “this speech expresses the author’s views and do not necessarily reflect those of the Commission, the Commissioners or other members of the staff.”

Seeing as the speech was delivered in 2018 (practically pre-history to the current state of the digital asset industry), it’s hard to see how the speech could be interpreted otherwise. Internal comments by SEC staff on the draft Hinman speech reflect that.

“We assume the standard disclaimer will be added noting that these are the speaker’s views and not the Commission’s,” said a comment right at the top of the draft, apparently left by Laura Jarsulic, a lawyer in the SEC’s general counsel office.

Those factors notwithstanding, Ripple has been trying its hardest to suggest that Hinman’s speech was SEC guidance from which the market could imply XRP is not a security. At least, says Ripple, the Hinman speech is a sign that the SEC created enough confusion in the market.

On that basis, they hope that the internal communications behind the speech will show that the speech was understood to be official SEC policy and that Hinman had received feedback that his characterization of the Howey test, as it applies to digital assets, was unclear or inaccurate.

Wish I could go in depth now, but we've waited this long (18+ months), I don't want to overstep… suffice it to say @s_alderoty and I believe they were well worth the wait.

— Brad Garlinghouse (@bgarlinghouse) June 12, 2023

And then, this from Ripple Chief Legal Officer Stuart Alderoty:

2/ We now can all see Hinman ignored multiple warnings that his speech contained made-up analysis with no basis in law, was divorced from the Howey factors, exposed regulatory gaps, and would create not just confusion, but “greater confusion” in the market.

— Stuart Alderoty (@s_alderoty) June 13, 2023

The unredacted documents reveal anything but. In reality, they show more or less what you’d expect given the disclaimer that ultimately attached to the speech—that it was not intended as an expression of the SEC’s understanding of securities and the SEC staff who helped draft it was focused on trying to guide the speech away from the language which might suggest otherwise:

“We still have reservations about including a statement directly about Ether in the speech. Even with the caveats in the sentence, it seems that it would be difficult for the agency to take a different position on Ether in the future.”

Another comment sent from Brett Redfearn, then the Director of the SEC’s Division of Trading and Markets, said of Hinman’s proposed comments on ETH’s status as a security:

“If you want to make an affirmative statement that it is not a security, the language could be stronger (i.e., just say it). If you don’t want to take an affirmative stance, we suggest using language similar to what you used for Bitcoin.”

“I like the tone, and I almost think the less detail the better. This is introducing a concept, that will probably generate much discussion, and so leaving room that that discussion is good I think,” wrote SEC director Valerie Szczepanik after reading an early draft.

These are not the communications of a regulatory agency announcing the policy. Instead, they reflect exactly what the disclaimer suggests: Hinman is preparing a speech containing his own personal views. Given his prominent position at the SEC and the discussion, his statements are likely to make, having it reviewed by his colleagues at the Commission is simply good comms practice. No doubt, SEC staff had one eye on the obvious likelihood that future subjects of enforcement action would attempt to use these words against the SEC to escape liability.

Some of those suggestions were ignored, as Alderoty points out. Many of them—such as removing ambiguous language—were incorporated into the final speech, which Alderoty does not point out. Either way, these comments are of little relevance other than to confirm what the SEC says about the speech: that it was not an expression of SEC policy.

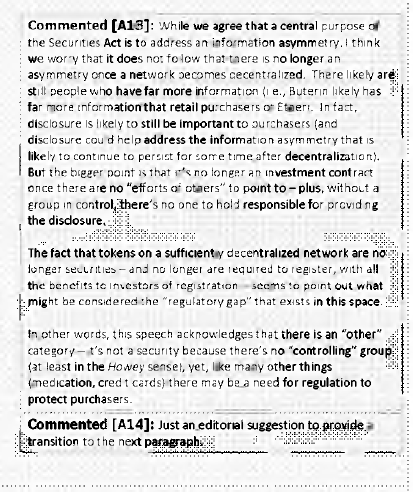

Alderoty also complains that Hinman was warned his speech ‘contained made-up analysis with no basis in law, was divorced from Howey factors, exposed regulatory gaps, and would create not just confusion, but “greater confusion” in the market.’ This is also a misrepresentation of the documents released.

Take one of Alderoty’s examples:

7/T&M directly asked Hinman to tie his newly invented factors “more closely and explicitly to the Howey analysis.” Again, Hinman ignored the suggestion. pic.twitter.com/uVZQYcmGV8

— Stuart Alderoty (@s_alderoty) June 13, 2023

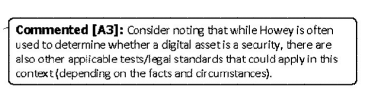

The person leaving this comment is not, as Alderoty says, telling Hinman to focus on Howey because the draft speech ‘goes beyond’ the letter of the law. Further up in the same document Alderoty quotes, the commentator actually suggests making clear that Howey is not the only test that would apply:

The court in Howey itself recognized that the question of what is an investment contract depended on a flexible rather than a static principle, and the test they set out is intended to fit within novel asset offerings which still amount to securities.

The suggestion quoted by Alderoty again reflects this: it is couched as a ‘general comment’ asking Hinman to ‘consider’ tying his factors closer to Howey. This makes no sense if the commentator thinks Hinman is simply going beyond the law: it is a suggestion to keep the factors Hinman considers relevant to the discussion of whether a digital asset is a security as close to the explicit Howey analysis as possible, no doubt in order to keep the contents of the speech as unambiguous as possible.

Not adopting this suggestion, of course, leaves Hinman open to bad-faith charges of creating ‘confusion in the market,’ but in light of the disclaimer that Ripple repeatedly ignores, Hinman is, at worst guilty of being unclear in expressing his own thoughts on how Howey’s ‘flexible’ and adaptable analysis when applied to digital assets.

In fact, far from Ripple’s characterization that SEC staff reviewing Hinman’s speech felt it went ‘beyond the law,’ the documents reveal that SEC staffers were concerned that over-focusing on the centralization factor might give the impression that offerings from more decentralized projects are not subject to investor protection rules.

In other words, Hinman might be understating the law rather than going beyond it.

Market unimpressed by Hinman docs

To focus too hard on the documents gives Ripple’s gasping defense more airtime than it deserves in the first place. Alderoty and Garlinghouse’s exhortations regarding the internal documents only make sense if your starting point is that Hinman’s speech was SEC policy. Without that, Hinman’s speech and the comments surrounding it are irrelevant. The speech was never intended to account for official SEC policy, as is made clear in every speech by SEC personnel posted on the SEC.gov website. Hinman leaned on staff at the SEC to review the draft speech, no doubt out of prudence, given that the SEC’s thinking in this area was still developing.

Such prudence was entirely justified given that Ripple is now trying to use the speech to evade liability now that the SEC has applied the long-standing test for securities to determine that XRP was indeed a securities offering.

The fact that Hinman did not take all of the SEC staff’s suggestions is not, as Alderoty pretends, a sign that Hinman was creating confusion in the market as the SEC’s position. It’s a sign that, as the disclaimer says, Hinman isn’t speaking on behalf of the SEC at all.

12/So what should happen now? First, remove the speech immediately from the SEC’s website…

— Stuart Alderoty (@s_alderoty) June 13, 2023

13/An investigation must be conducted to understand what or who influenced Hinman, why conflicts (or, at the very least, appearances of conflicts) were ignored, and why the SEC touted the speech knowing that it would create “greater confusion.”

— Stuart Alderoty (@s_alderoty) June 13, 2023

14/ And finally, Hinman’s speech should never again be invoked in any serious discussion about whether a token is or is not a security. Unelected bureaucrats must faithfully apply the law within the constraints of their jurisdiction. They can’t – as Hinman tried – create new law.

— Stuart Alderoty (@s_alderoty) June 13, 2023

Of course, the two of them know exactly what they’re doing. The work they put into setting expectations of the release of these documents paid off for them, at least for a while: XRP steadily rose 6% over Monday and Tuesday until the release of the documents.

The market, however, appears unimpressed with what was delivered. It has since lost all the ground it gained this week and then some, sitting at an even 50 cents at the time of writing. It was worth a good try.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

12-26-2025

12-26-2025