|

Getting your Trinity Audio player ready...

|

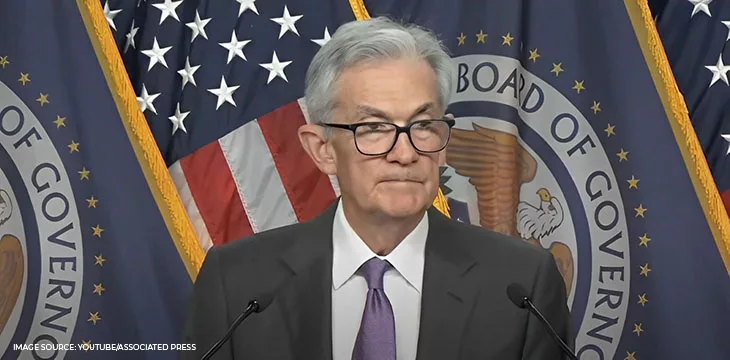

U.S. Federal Reserve Chairman Jerome Powell insists he’s not a Bond villain plotting to unleash a central bank digital currency (CBDC), while a new study says concerns about BTC and other digital currency tokens ever serving as global currency are overblown.

On March 20, Powell announced that the Fed had decided to hold interest rates at their current range of 5.25-5.5% but reiterated previous statements that three small cuts—to a target of around 4.6%—are likely before the year is through. But for our purposes, we’ll focus on his comments regarding Republicans’ night terrors that the Fed is plotting to spring a draconian CBDC on an unsuspecting America.

Asked to clarify the Fed’s CBDC plans, Powell said: “We haven’t come to a conclusion that we should propose … that Congress consider legislation to authorize a digital dollar. And it would take legislation by Congress signed by the president to give us the ability to do what we think of as a CBDC, which is really a retail CBDC, with the public. So we’re just a long, long way from that.

“What we are doing—and I think what every major central bank is doing—is we’re trying to stay in the frontiers of what’s going on in digital finance. And it has many, many different areas. It has applications in wholesale finance, [and] in the payments system … these issues have become very front burner in the last five or six years. We need to be knowledgeable about all that. So, we actually do have people trying to understand things.

“But it’s wrong to say that we’re working on a CBDC and we’ve secretly got a lab here … and we’re just gonna spring it on Congress at the right moment. We don’t. I haven’t at all, in my own mind, made a decision that I think this is something the U.S. should be doing. I just think it’s something we need to understand and we do have people who are keeping up with that as part of the broader payments landscape.”

This likely won’t satisfy the likes of Rep. Tom Emmer (R-MN), who tweeted his suspicions

last week that the Fed was planning to let fly its CBDC while America sleeps. God help Powell should a video leak of a secret Fed meeting in which he muses about how a CBDC could be worth one hundred billion dollars.

Republicans’ CBDC fears largely center on the enthusiasm China’s government has for the citizen surveillance capabilities of its digital yuan, which is by far the most advanced CBDC going. But other nations—including those that Donald Trump doesn’t think are shitholes—are indeed weighing the pros and cons of digitizing their currency.

For example, Sweden’s Riksbank issued a report this week on Phase 4 of its e-krona pilot, which focused on synchronizing offline payments with online balances in so-called ‘shadow wallets.’ The takeaway was that “a secure and functional offline solution requires a lot of development cooperation work in terms of technology, regulations and processes.” In other words, it is theoretically possible but not quite there yet.

US stablecoin bill so stable it’s not moving

Republicans—some of them, at least—are in favor of approving U.S.-friendly stablecoin legislation before the current Congressional term is over. However, the likelihood of this occurring appears to shrink by the day.

Rep. Patrick McHenry (R-NC) attended this week’s Update the System Summit in Washington, DC, where he weighed in on the chances to pass his Clarity for Payment Stablecoins Act of 2023. The event, sponsored by the Coinbase (NASDAQ: COIN) digital asset exchange, brought together a range of digital currency stakeholders as well as some federal politicians eager to collect their share of the lobbying millions that Coinbase is throwing around these days.

McHenry, who chairs the House Financial Services Committee, told attendees that he and the Committee’s top Democrat, Rep. Maxine Waters (D-CA), have “a workable frame” for advancing the stablecoin bill. “We’re at the phase where we can see the airport … we just don’t know when we’re going to land the plane.”

However, other speakers suggested the two sides were still miles apart on who will oversee issuers of so-called ‘payment stablecoins’ (an artificial distinction cooked up to favor USDC—the stablecoin issued by Coinbase’s partner Circle—over the international rapscallions known as Tether and their crime-friendly USDT). McHenry favors leaving oversight to the states, while Waters is pushing for a federal role.

McHenry spoke of the need to attach the stablecoin bill to a “legislative vehicle” with greater support/urgency and was therefore far more likely to pass in a deeply divided House. Assuming it clears that hurdle, it would then have to make it through the Senate, where Sens. Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) are working on their own stablecoin bill (a follow-up to the pair’s previous legislative efforts).

In other words, with the legislative clock rapidly ticking down to November—and both Congressional chambers taking a two-week break as of Friday—nobody should be counting their stablechickens before they hatch.

Not so disruptive disruptor

While U.S. companies like Coinbase and Circle push their ‘payment stablecoin’ fantasies, the number of people worldwide using tokens as cash remains minuscule. A new academic study suggests digital currency as a whole will continue to struggle to become an accepted form of payment in many countries, but maybe not for the reasons you think.

The study, Explaining variation in national cryptocurrency regulation: implications for the global political economy, pokes holes in the widely held belief (amongst ‘crypto bros,’ at least) that certain tokens are poised to usurp the U.S. dollar’s role as the world’s reserve currency. The dollar is increasingly seen as vulnerable due to the rapidly expanding federal debt and ongoing efforts by rival nations to undermine U.S. financial hegemony.

However, the study’s authors concluded that “cryptocurrency threatens the international political and economic status quo less than many speculate because regimes most likely to be at odds with U.S. monetary and financial dominance face a strong incentive to ban the technologies in their own countries.”

The authors note that countries most vehemently opposed to welcoming digital currency into the financial mainstream include many authoritarian regimes with no great love for the U.S. of A. These regimes traditionally micromanage every aspect of their local economies, like China’s strict capital controls that limit how much money its citizens can send abroad yearly.

Other countries’ peg’ their currencies to the dollar or a basket of prominent currencies in order to restrict volatility. Given digital currency’s notorious volatility—think Tesla’s short-lived experiment with allowing customers to purchase cars with BTC, provided they fork over the tokens within minutes of fixing a price—basing an economy on such unstable tokens would be a recipe for fiscal chaos that could threaten an autocrat’s hold on power.

The authors of the study noted that dollar-based stablecoins have proven popular in countries undergoing rapid inflation and devaluations of their local currencies, including Argentina, Lebanon, and Turkey. The authors suggest this could ultimately strengthen the dollar’s international role, although some more security-conscious U.S. legislators might see things differently.

There’s also the chance that Circle has to be bailed out by the U.S. federal government again like it was in early 2023 after Silicon Valley Bank’s failure ate $3.3 billion in USDC’s fiat reserves. Or the government might take Circle’s advice and seize the billions in T-bills that Cantor Fitzgerald is (allegedly) holding on Tether’s behalf. Such episodes could seriously damper international enthusiasm for digital greenbacks that the U.S. isn’t obligated to recognize as actual dollars.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: CBDCs are more than just digital money

03-10-2026

03-10-2026