|

Getting your Trinity Audio player ready...

|

In 2005, I wrote a paper for a college macroeconomics class about how to use any commodity that had a public spot price as a form of money. The example I gave was paying for chickens with sugar, bridging the gap between barter and money using API calls at the point of sale. The limitation, at the time, was the lack of a public spot price that could be globally agreed to, how to scale with trustworthy attestations of the purity of the commodity, and of course, the adoption of an additional piece of software and/or hardware at checkout. But the paper did well anyways!

Fast forward to late 2012: I missed the first three years of Bitcoin, but understood that it could be used to solve the token attestation problem from my paper. Of course, the token protocols didn’t exist yet, but I was very excited that my idea could be engineered because of a global proof-of-work consensus network.

What I didn’t understand was how to issue a token on Bitcoin.

And then this video came out!

Colored coins was a proposal to add extra data to individual satoshis in a way that was analogous to “coloring” them. It was this proposal that led to me getting into the mining space—not strictly for hashing, but understanding that as the ledger grew more quickly with use that there would be a profitable business model in serving trustworthy data to the network, and if we could do that well, the company could be foundational to implementing my “tokens as money” idea from years earlier.

Little did I know at the time, but the “Bitcoin Core” devs were waging a quiet coup d’etat over control of the network to stop the use of Bitcoin for tokens.

By 2014-16, the Counterparty team(s) were working hard on useful Bitcoin tokens that unlocked economic opportunities and had caught the interest of card games and merchants for the issuance of collectibles, proof of purchase, loyalty programs, and more.

Here's a BTC wallet from 2014 with fungible #bitcoin tokens displayed. This is from back before the geniuses that control the BIP process nuked it and paved the way for the creation of 20,000 altcoins.

There never needed to be an Ethereum or altcoin economy, folks… #coinprism pic.twitter.com/ClL2uFp6Sh

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) October 6, 2022

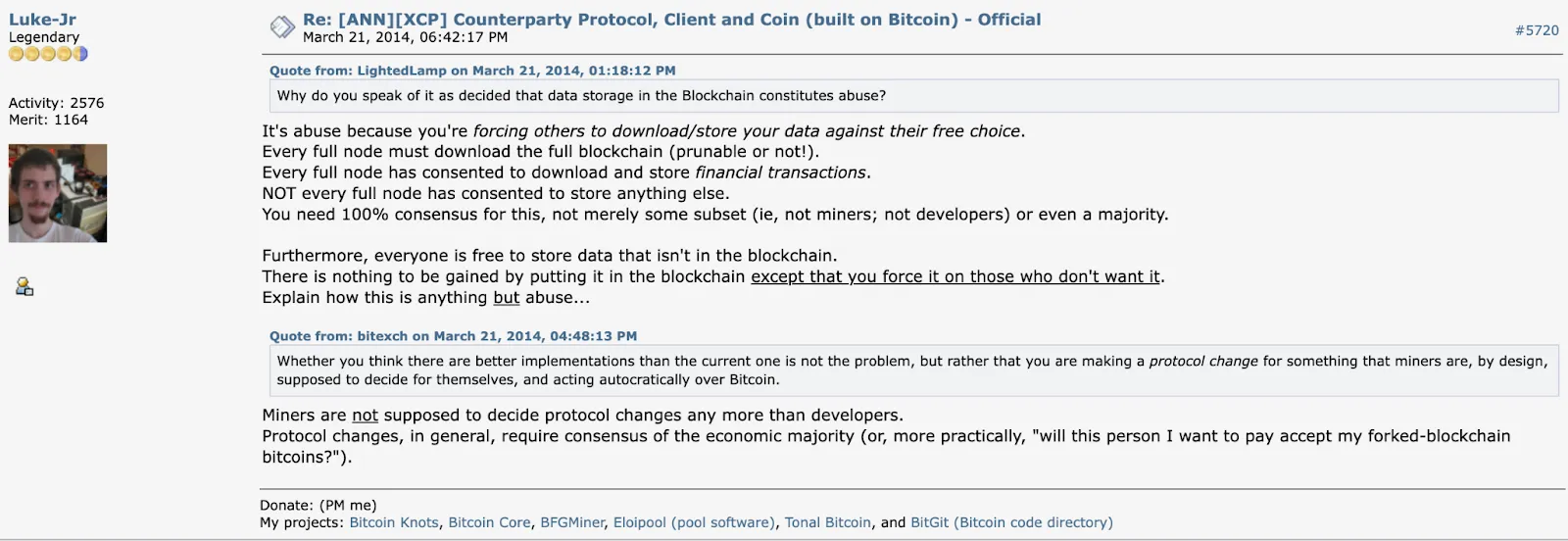

But the Core devs, led initially by Jeff Garzik but then later (and with considerably more fervor) by Luke Dash Jr. on this particular topic, killed off all of these projects by limiting the size of the OP_RETURN in the reference client and tailoring a few other things to eliminate all these use cases—leading to the rapid splintering of developers to create Ethereum and then the avalanche of altcoins that dominate the market today.

Here’s Luke nine years ago criticizing tokens as an attack on Bitcoin.

Fast Forward to 2023

The token dispute that started in 2014 ended up killing off most of the early Bitcoin businesses and token startups. In hindsight, these were the opening shots of the Bitcoin Civil War, and they led to the splits that created BCH and BSV and also ended the era of a Bitcoin-focused blockchain economy—leaving a massive crypto casino in its place.

Look at the falloff of BTC market dominance as people have increasingly desired tokens and apps over the narrative nonsense of people like Luke Dash Jr.

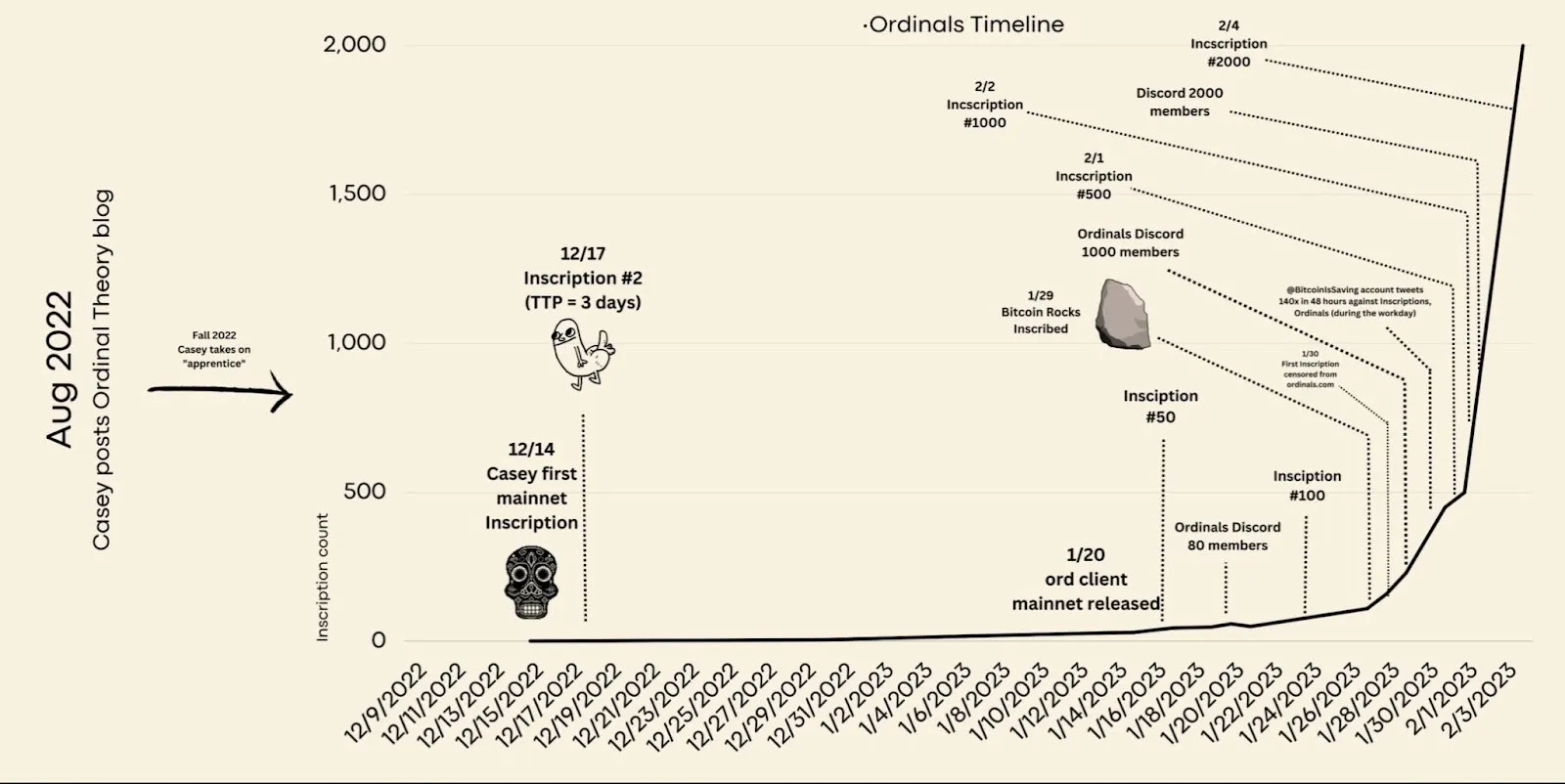

In 2023, after a resurgent Bitcoin token explosion on BSV, a new protocol appeared on BTC called “Ordinals.” BTC developer Casey Rodarmor announced in late 2022 that he had figured out a way to utilize various soft fork rules to create a variation of the original “colored coins” concept using ordinal numbers.

Inscriptions are finally ready for Bitcoin mainnet.

Inscriptions are like NFTs, but are true digital artifacts: decentralized, immutable, always on-chain, and native to Bitcoin. 🧵https://t.co/a4dK7zdITS

— Casey (@rodarmor) January 20, 2023

In short, it’s an NFT protocol on BTC, and it allows the use of the blockchain for the storage of token data, including data files like JPEG, GIF, and even audio or video files if they fall under the 4MB block weight limit of BTC.

This has created an explosion of interest, transaction fees, excitement, and memes among users, and it has also deeply upset the high priests of BTC—gouging deeply into the pillars of their convoluted narratives about governance and decentralization.

Good morning ☀️ the post above you is now on the blockchainhttps://t.co/BEs9fbO3AU

— snipe.fun (@snipefun) January 29, 2023

In a matter of days Ordinals has evoked more passion, anger, controversy and, most importantly, a community with a desire to build than Liquid NFTs 🥱 ever did in more than 2 years.

The people want their JPEGs on #Bitcoin.

Deal with it. 😎

— Mike In Space (@mikeinspace) January 30, 2023

As BTC enters its latest era of existential crisis between soft protocols and allegedly hard money, Luke Dash Jr is (once again) calling this an “attack on Bitcoin,” but life goes on.

Bitcoin doesn't actually support storing images.

This is all a front for a DoS spam attack against Bitcoin._Every_ Bitcoin user _forever_ will be forced to download all of their spam. And there is no _real_ benefit to it.

— Luke Dashjr (@LukeDashjr) February 3, 2023

What the Twetch?

Seeing the opportunity to capitalize on the malaise, Twetch came out with a bunch of tooling within 48 hours of the public explosion of Ordinals NFTs and launched a mint of 69 “Planetary Ordinals” to kick off the party.

Planetary Ordinals have officially SOLD OUT!

69 NFTs minted directly to the #BTC blockchain using Ordinals

This project is not possible without Taproot – the recent update to the BTC node software

Thread 🧵

— Twetch (@twetchapp) February 1, 2023

When asked for comment, Twetch’s Josh Petty said, “We have always been blockchain agnostic, so if people want NFTs on BTC, we just want to give the best experience. As soon as we heard the news, I let the team know we were pulling an all-nighter to get a product out.”

Well, that product is the Ordinals Wallet, which is a file browser, and their Ordinals Wallet Discord community which serves as an excellent place for OTC trading of these new NFTs. They said there’s more to come, so we should probably assume a proper wallet is on the way too.

Twetch has been in a unique position to push out Ordinals content because of their experience with light wallets, node operations, and NFT work on BSV with their main brand and Rare Candy drops with automated secondary market trading.

“It’s funny, some miner is taking these transactions and doing them for free, so we have [lead developer] Harry up at 5AM sending transactions when the mempool is quiet,” Twetch’s Billy Rose said, speaking on the experience.

He went on to discuss some more differences between doing NFTs on BTC vs. BSV and Ethereum—where the founders got their start many years ago.

“Man, BTC nodes are super disconnected and hard to deal with. And the network makes the experience inconsistent, but if people are willing to pay $200-$300 per item, then it’s worth it to take the time to push through it.”

https://twitter.com/LUTRONIA/status/1621133351493959680?s=20&t=R4u6KLcCvEU9PCWQU4dA2A

Rose closed by saying, “we’re not here to tell anyone what to do, but it’s been fun getting to meet new people in BTC who like this stuff. Maybe high value JPEGs will live on BTC where they won’t move much. But, for the stuff that changes hands more often, they can be on BSV where the network is happy to have big blocks.”

Petty chimed in to say, “either way, we’re here to have fun, and this stuff is pretty cool.”

The Future

Depending on who you ask, Ordinals may be the future of BTC, or they may be gone in a few weeks. Or maybe there will be another token-fueled civil war. Either way, the protocol shows the world that average users just want to have fun and make money while the ruling class intelligentsia copes with reality.

Huge limitation of Bitcoin is that there can only ever be 2.1 quadrillion ordinals

— NickH 🟧 ⛏️ (@hash_bender) January 29, 2023

seems like it's mostly flamed out. a 4MB test transaction has some stress testing utility. i don't think anything crashed this time? layer2 handling, bitcoin libraries, alternative nodes, block explorers things are getting more robust!

— Adam Back (@adam3us) February 2, 2023

Sure, Adam.

Meanwhile, Ordinals are the most bullish thing to happen in BTC in many, many years.

Watch: Build on Blockchain – Common Challenges & Tools to Make it Easier

07-02-2025

07-02-2025