|

Getting your Trinity Audio player ready...

|

Those close to me know I have long advocated for Proof of Work (PoW). In fact, it was one of the prime reasons I got interested in Bitcoin initially. The notion that fairness in the system could be guaranteed through a publicly verifiable method, which puts an economic cost to the act of supporting the network infrastructure, was fascinating. Not only because it aligned economic incentives with network incentives but also because it anchored the value of the blockchain token to the cost required to earn them.

It is therefore significant for the industry that over the last week, Ethereum has finally made the long-awaited—perpetually “nine to 12 months away”—upgrade to proof-of-stake (PoS), one of the founding goals for ETH, and in fact, some will argue its original raison d’etre. I suppose congratulations are in order since Vitalik Buterin has been talking about the move to proof of stake even before ETH was officially launched (back when he was fundraising with pre-mined allocations of the yet-to-launch Ethereum blockchain). Don’t worry if you read through that blog and couldn’t make heads or tails of it. You aren’t alone. Even smart folks can’t decipher what VB is getting at there.

He seems to be trying to justify a half-baked idea that any economically-minded person would immediately see as bunk—the idea that PoW inherently “wastes” work. Therefore, staking is ultimately superior, even if it means sacrificing objectivity in the system, and makes staking very much similar to just equities and share voting.

But even though it took six years longer to deliver than Vitalik originally envisioned, at least they finally got there. I suppose there is some credit due for doggedly sticking to your guns, even though a decade has gone by working on PoW, which shows to be the most resilient, secure, transparent, and fair system that allows for competition among the participants, dictating who gets to earn the most fees. Even though, in recent years, it has been shown that PoW doesn’t need to consume as much energy some think, with some versions of it implemented on scalable versions of Bitcoin running more energy efficient than many PoS systems.

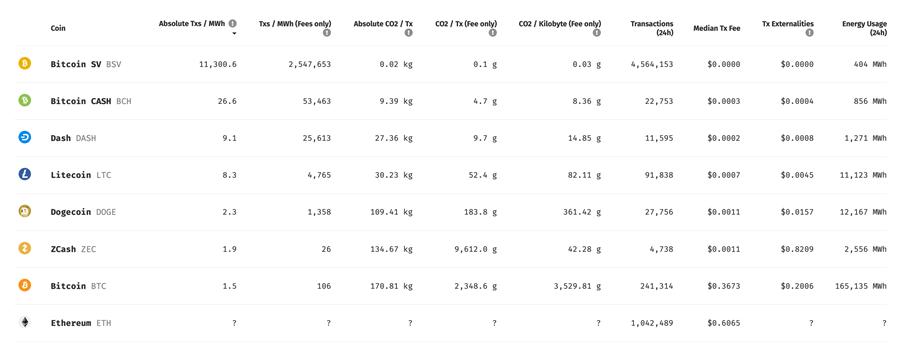

In fact, just before they switched to PoS, Ethereum was the second most energy wasteful blockchain in the top 10. Now they are marked as “?” as experts have yet to figure out how to measure its carbon cap with the new staking systems. But switching to PoS just because your mining nodes use too much energy is a bit of a bazooka vs. a fly type of solution.

As Bitcoin SV clearly illustrates, the carbon dioxide/transaction cost can be kept low simply by having miners not chase block rewards inflated by runaway speculation on the coin price. Once the block rewards in Bitcoin drop (it halves every four years and will likely be economically insignificant by 2040) to below the operating cost of producing the hashpower, the global hashpower will plummet and stabilize around the aggregate MEV (miner extractable value) supported by average transaction fees. If you look at BSV in the chart above, it is sufficient to maintain the network’s performance just as well as BTC from an end user’s perspective.

Put simply, how much hashpower (thus mWh) is expended going to be proportional to how much transaction fees are being paid by people posting transactions or the total transactional volume of the system.

If the transaction volumes are low, miners will shut down their hashpower to conserve costs. When they spike up, miners switch on to compete to try to earn the fees. In the long run, every PoW system is a self-regulating system, an auto-tuning circuit.

So there are no runaway costs and race to burn/waste more electricity in a working, scalable PoW system. People looking at BTC and leveling blame on PoW because it suffers a case of availability heuristic and belief bias.

BTC has a runaway hashpower problem because the price of BTC is manipulated, and people are taught to buy BTC because it will always go up in price because of a perceived scarcity belief. This is what distorts the whole ecosystem. This is not inherent to proof of work—just BTC.

I’ll go out and say it, I’m no fan of Proof of Stake. I’m its biggest critic, from as early as 2014 when it reared its ugly head from people who wanted to “fix Bitcoin” (and make themselves rich and famous in the process). It doesn’t solve any problems and creates a slew of new ones. It turns a system that deliberately encourages competition and imposes a toll on those who wish to compete to deliver services to one where fat-cats collect rent and the rich get richer while the poor fall further behind. This was the primary economic oversight that Vitalik never understood, and I even put the issue to him in person in 2015 when he visited Tokyo. He had no answer to this besides saying that the cost that stakers were “giving up” was opportunity costs. (Spoken like one who never worked in finance/business before, to equate constant cash outflows with lost opportunity cost!).

PoS breaks the economic “fairness” governor built into PoW, as it introduces all sorts of new problems and attack vectors, given that with PoS, one’s involvement with the system can be sold off as a right/derivative just like any interest-bearing instrument—or security. This meant that stakes could be easily traded, hidden, and shuffled around, without any on-chain transactions to track who the network’s ultimate beneficiaries (and controllers) were. This isn’t a system that should be used to run a public blockchain. This is just something more of what we already know all too well…the shell company game and what private blockchains are famous for.

But who wants more of these centralized shell games?

On the other hand, what about the supposed upsides to PoS? Lower user transaction fees right?

Vitalik has been all over the map on this topic, basically saying what was popular and what people wanted to hear at the time.

Back in 2020, he was saying how great higher fees meant for ecosystem sustainability.

Then two years later, as preparation and justification for PoS migration was coming up, he was saying how BAD the high fees were in stifling adoption. (And falsely claiming how great PoS will be to solve this)

Shortly before the merge, Ethereum Foundation admitted that actually, the switch to PoS won’t likely reduce the fees. Soon after, other bitcoin media press started breaking the bad news to the foaming anticipating public that the merge won’t do anything besides drastically change the way the ETH network is run. (Note the double meaning in that statement)

As for Vitalik himself? All he had to say after the merge was this obtuse, confusing comment that filled blocks percentages only fell from 20% to 10%. I suppose that is good? I guess? This doesn’t sound like it has anything to do with lowering fees right? Well, it is more complicated than that due to the “central bank planning” initiatives that Vitalik and his ETH-bank governors have set up for the economy back in the last EIP-1559 patch.

The EIP-15591 refers to the overhaul of the ETH fee model from being an auction-type system to one with a base fee and tip fee, which burns the base fees to destroy the tokens causing its price appreciation (which we have yet to see materialize). Having regular blocks and regular intervals lessens the chance of the edge condition where the new model may cause a massive increase in base fees (if enough full blocks are created in a row).

If all this is sounding very confusing to you, know only this—the point is that Vitalik himself has just pulled a magic trick on you, and with a wave of technical mumbo jumbo, have swapped the goal posts from that of “PoS will give us lower fees!” to “well at least it will make our new fee model work better, hopefully… oh and ETH price will go up.”

One important corollary of this is better EIP 1559 performance (because fewer blocks bump up against the 2x limit). So far, the percentage of full blocks has dropped from ~20% to ~10%.https://t.co/qmCkqzYn2z https://t.co/8ZzlPunGEZ

— vitalik.eth (@VitalikButerin) September 15, 2022

So the ETH PoS hype was another bait-and-switch, concocted to draw attention and pump some price appreciation for the token, all while prepping the public to accept a takeover of the network by large stakeholders, transforming it from one of a fair public blockchain to one where the rich and privileged will run the show.

But wait, there’s more!

Their upcoming patch to implement sharding, will mark the final stage of ETH’s transformation from a public blockchain to that of a permissioned ledger, except that the general public will be none the wiser. (Because people seem to have a hard time realizing that those with money earn perpetually from rent-collection systems, aka crony capitalism). The only thing that made Bitcoin innovative, namely the proof-of-work system which ensured that constant public scrutable competition kept the incentives of the infrastructure providers aligned with those who use the network, has been cast away. This marks the end of the ETH experiment, at least as a public project. Now it is just another tool for the system.

Isn’t it ironic that those who wanted to “get rid of the bankers” ended up creating a system where they were the exact thing they professed to despise?

Jerry Chan

Wall Street Technologist

Notes:

[1] Yes, the article has MULTIPLE errors and typos calling 1559, 1599. Just roll with it.

Watch: Proof of Work mining & energy innovation

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-04-2026

03-04-2026