|

Getting your Trinity Audio player ready...

|

On March 11, RelayX launched Bitcoin’s “first fully decentralized open trustless peer-to-peer non-custodial DeFi order-book DEX.” While that is a mouthful of typical crypto-jargon, this product can be summed up as simply a peer-to-peer market.

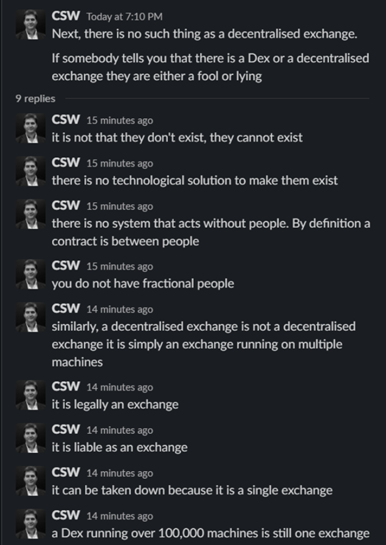

Predictably, Dr. Craig Wright who has been critical of the concept of a DEX responded in a way only he can:

Dr. Wright is correct about how an exchange that facilitates this behavior is liable as they are the front-end that process the trades. The point I want to make is that if RelayX were to be taken down, trades can still be placed and fulfilled in this manner peer-to-peer. In fact, because of the use of Bitcoin script to lock the tokens and satoshis if one knows how to broadcast a transaction to the network with the solution, they can unlock the tokens by paying the seller their requested amount of coins.

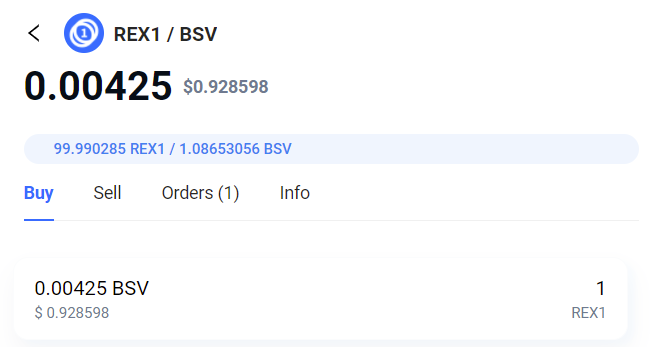

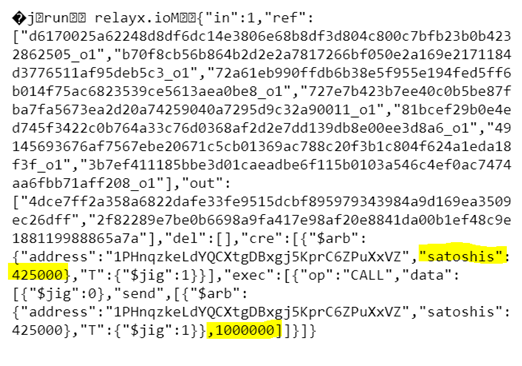

Above is an order placed on the RelayX Exchange, below is the metadata in the transaction specifying the order details.

One can inspect the ‘satoshis’ field which corresponds to the requested price, and the integer number of tokens 1.000000 (accounting for decimals).

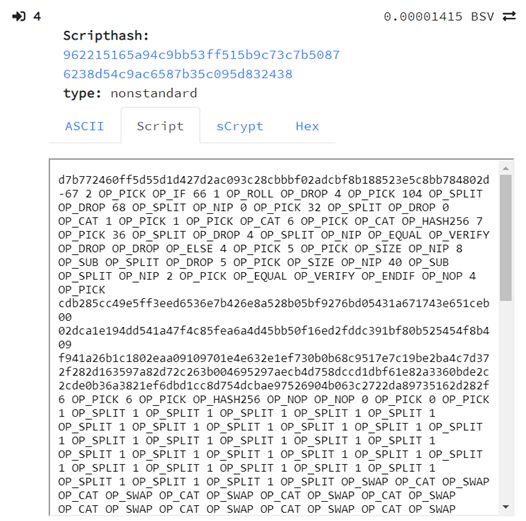

Another output contains a custom locking script built using sCrypt that validates the spending transaction and pays the seller the amount of satoshis above.

Custom locking script:

The question that arises is who becomes responsible if two parties fill orders between each other in this way without a so-called ‘Decentralized Exchange’? Is an arbiter required to be present when a homeowner sells junk out of their garage for cash? Given this innovation is possible with Bitcoin Script, such a feat has been possible since 2009. The title of the whitepaper is “A Peer-to-Peer Electronic Cash System” and this activity seems like just that.

At the end of the day, it is up to the two individuals transacting to be responsible for themselves with whatever laws, regulations, or taxation required in their respective jurisdictions. The enforcement of these rules is subject to economics in terms of resources like most things in life, so I do not see why one electing to pay another person $1 for something they find valuable necessarily makes them a criminal.

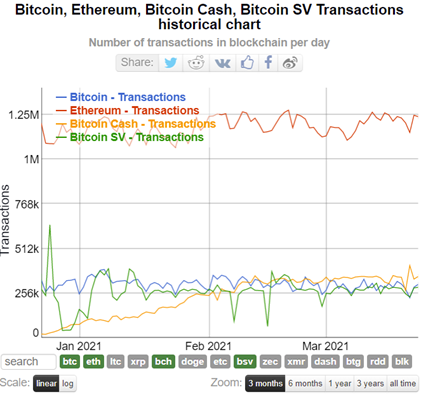

Additionally, given the New York Attorney General Office’s flippant response to counterfeiting the dollar with impunity, ordering a 0.006% fine on the largest ICO in history and $6.5 million slap on the wrist for fraud and wash-trading, I am not sure why leaders in the BSV space continue to fear-monger and discourage entrepreneurs from innovating under the threat of rotting in prison for doing so. As if BSV’ers have the luxury of criticizing how scale occurs given that it continues to lose ground in relative and total transaction count to other chains.

To be clear, this is not a suggestion to break the law, avoid taxes or ignore regulations. I am advocating for personal and corporate responsibility in these matters among the parties involved in a transaction. As far as anyone else who thinks they get to have a say in the validity or legality, that is none of their damn business.

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-12-2026

03-12-2026