|

Getting your Trinity Audio player ready...

|

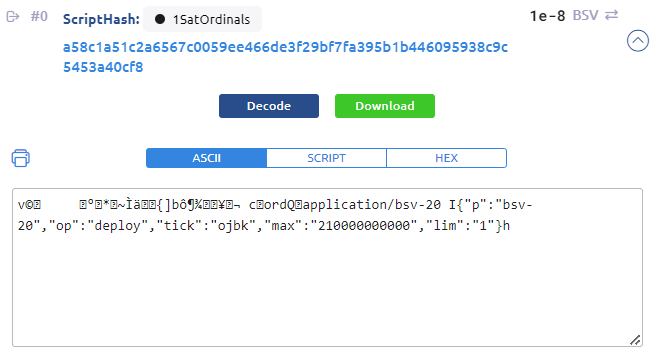

On December 10, 2023, a user deployed a BSV-20 token named “ojbk” with a max supply of 210 billion but with its “lim” field set to one, meaning minters can only mint one token per operation. Per the 1Sat Ordinals and BSV-20 protocols, mints of a token to be considered valid must follow the rules in the deployment transaction. To be a valid 1Sat Ordinal, the output must be created with only one satoshi.

This implies that if demand was sufficient to mint this token, 210 billion UTXOs would be added to the BSV blockchain. To compare, the first BSV-20 token, aptly named “1sat,” had a max supply of 21,000,000 with a limit of 1,000, therefore only requiring 21,000 mint operations.

The origin or motivations for this deployment are unknown, and it is unclear if the deployer was aware of the implications of creating such a token. In the following weeks, BSV users started to mint ojbk in bulk, ballooning the UTXO set, and causing much stress to the network.

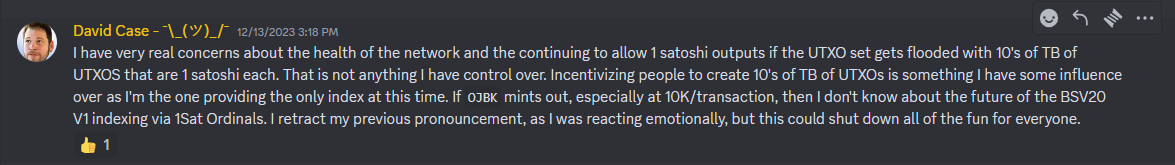

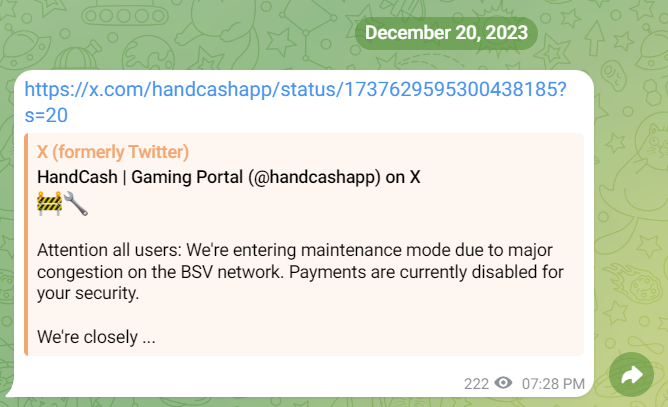

The 1Sat Ordinals GorillaPool indexer, which at the time was relied upon by various marketplaces and wallets, was completely overwhelmed to the point where BSV-20 support was questioned entirely, and its support was eventually migrated out separately so that non-fungible token (NFT)-like inscriptions could be serviced. Ordinal marketplaces on BSV were non-functional; for example, the leading market at the time, firesat.io, was under maintenance for weeks. BSV wallet HandCash even temporarily disabled payments altogether because of the network’s transaction volume impact on their infrastructure (see image below).

Even now that blockchain volume is more stable, BSV-20 support by GorillaPool is limited to only a handful of tokens that have significant usage and have paid them for indexing services, a new pricing model based on the number of those tokens’ operations. Despite these developments, some services looked at ojbk positively and helped users mint more easily, arguably being responsible for the network load.

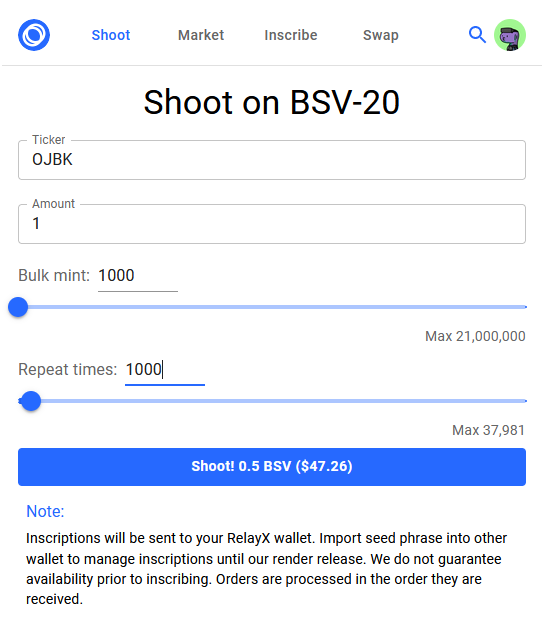

Wallet and marketplace RelayX allowed users to bulk mint ojbk in batches. RelayX even directed its home page to “Shoot” ojbk instead of their own market.

Minting batches of 1,000,000 ojbk (across 1,000 transactions of 1,000 ojbk each) would cost 0.5 BSV via RelayX, but note that a premium is being charged. To craft these types of transactions requires development and proper UTXO management, but the actual

blockchain transaction fee for doing so is much less.

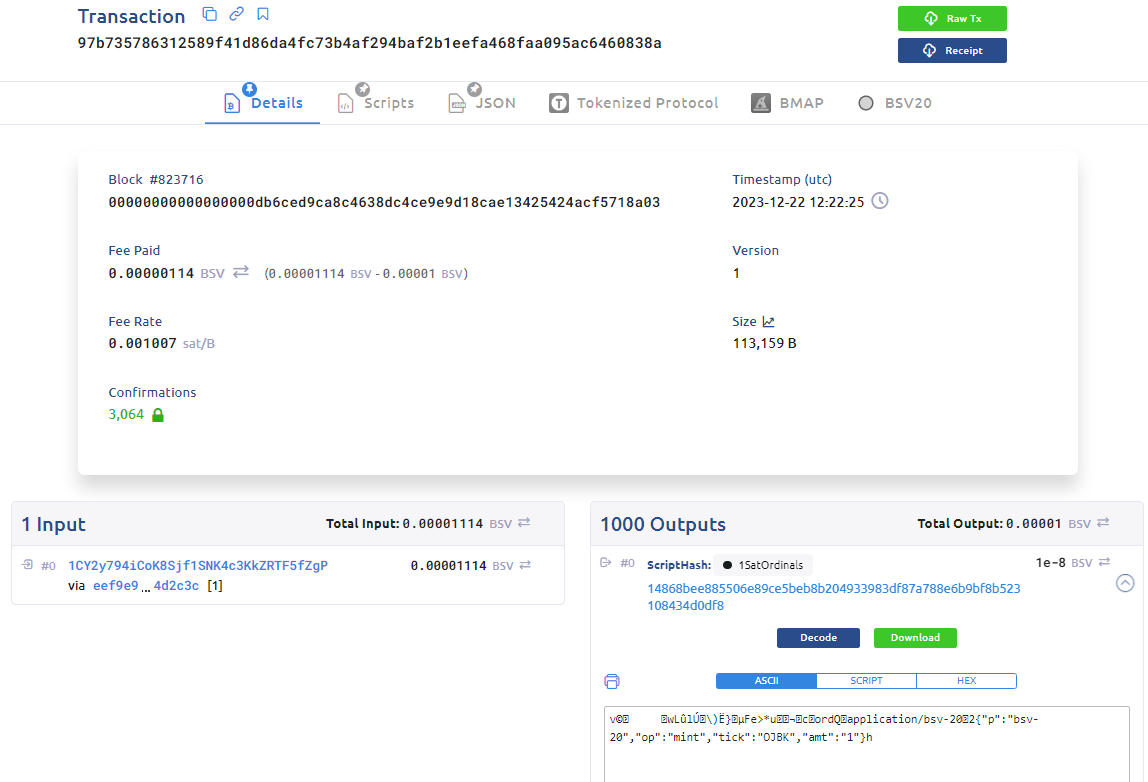

For example, by paying the minimum network fee possible (1 satoshi per kilobyte) with the most precise handling of UTXOs, minting 1,000 ojbk in a single transaction would cost 1,114 satoshis (1,000 satoshis to inscribe in 1,000 outputs of 1 satoshi each, plus 114 satoshis as the mining fee (transaction size is ~114 KB).

Repeating this 1,000 times gives a total cost of 1,114,000 satoshis; at the time, BSV was priced at $50, so around $0.50.

just inscribed 1 million $ojbk for $0.50 wbu

— shua (@cryptoAcorns) December 19, 2023

Of course, computation and bandwidth costs need to be accounted for, so those, along with the development cost and maintenance of the service, justify why RelayX’s premium and, clearly, users are willing to pay. Despite the demand for minting, which caused so much chaos, only the current estimate of circulating supply of ojbk is around 2 billion so barely one percent has been minted. No indexer currently supports ojbk, so balances can only be estimated at this time.

The ojbk mint reveals BSV’s desire to prove it has the scalability to onboard the entire world. The ability to manage 210 billion UTXOs, which is how many must be created to mint out ojbk is a necessary steppingstone. Ordinals Wallet and Twetch developer UTXO intern on an X.com space questioned that every person on Earth can’t have 30 UTXOs? If Bitcoin is to be adopted worldwide, then managing that many UTXOs is a clear requirement.

With only 1% of ojbk minted out thus far, no one knows if it will ever conclude. However, arguably ojbk minting out is a self-fulfilling prophecy by its proponents as it would be objective proof that BSV does indeed scale.

Welcome to the

Orange Juice Breakfast Club. pic.twitter.com/ZqIiYukKx2— Zack Wins (@DevelopingZack) December 14, 2023

Watch CoinGeek Roundtable: Open Social Protocols

03-01-2026

03-01-2026