|

Getting your Trinity Audio player ready...

|

The “BSV PacMan” is back!

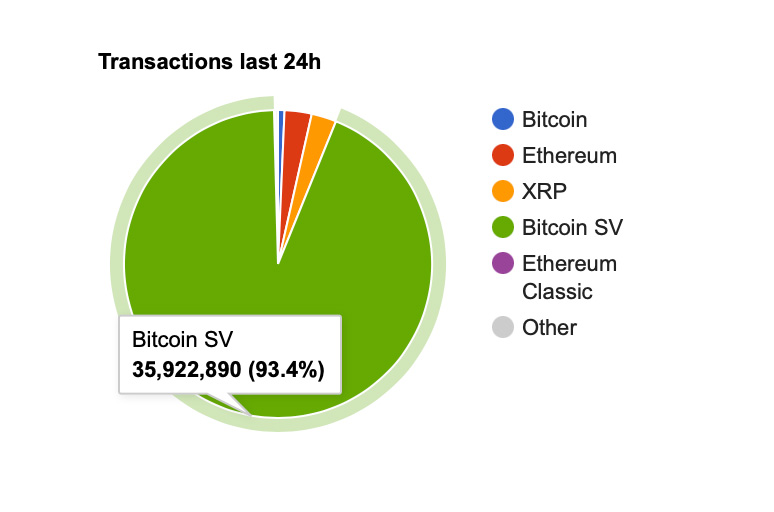

The original Bitcoin’s transaction volume peaked at over 35 million transactions in a 24-hour period this week. These record volumes prove once again that BSV is the world’s only scalable blockchain, capable of handling massive amounts of data without a corresponding increase in usage fees.

“BSV PacMan” refers to the pie chart showing BSV’s share of total transaction volume across major blockchain networks, including BTC, Ethereum, and Ripple. As BSV’s share of that pie increases (it’s currently over 88%), the chart resembles the 80s videogame icon swallowing all the other competition.

You can tell your prospects this is real. 35 MILLION per day!

Now, get out there and onboard them to become clients. Your ONLY goal should be to make as much short term profits without undermining your ability to make long term profits. #SellLikeHell pic.twitter.com/vIUJVkvwXm

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) September 6, 2022

It was only in April 2022 that we celebrated BSV’s new records of 10 and 20 million transactions in 24 hours. And BSV’s infrastructure can handle much more—potentially in the hundreds of billions every day of the year.

Today’s BSV transaction volume is closer to 19.1 million over 24 hours, but the chart resemblance (and percentage dominance) is still obvious:

Much of the record-breaking BSV volume came from Relysia, a coin/token wallet and blockchain infrastructure app that’s part of the Vaionex stable of applications.

Day 1 into our infrastructure testing and we pushed 31 million transactions to the #blockchain!

Relysia is doing 10x the volume of all blockchain apps combined across all chains. Made possible with #BitcoinSV, the only blockchain capable of scaling to meet global demand. pic.twitter.com/jkxbEgQODq

— Relysia (@Relysia_SV) September 6, 2022

Are they ‘real transactions’? Yes

But wait—if 31 million of BSV’s 35 million transactions in a day came from one application “testing” its infrastructure, does it actually count?

The answer is definitely “yes.” Whether part of a test or not, Relysia’s transactions occurred on BSV’s main blockchain, not a test network (testnet). The transactions were all processed by BSV’s regular Proof-of-Work (PoW) network and formed blocks alongside BSV’s ordinary traffic, which includes social media microtransactions, payments, gaming data, and other records. If the network can handle the additional burst of traffic (and sustain it) without grinding to a halt or devouring its users’ money with exorbitant transaction fees, then it’s very real.

BSV’s critics often point to large bursts in transaction volumes (either short-term or over longer periods of time) as somehow “not real.” First, they claimed BSV’s traffic was all from one weather app (WeatherSV) or from a single game (CryptoFights) since these use cases have dominated the network share at times. What they overlook is that BSV processed every one of those millions of transactions on the main network without a hitch. Making a value judgment over what kind of use-case is worthy/legitimate, and what isn’t, is irrelevant—blockchain data is blockchain data.

Processing massive amounts of data affordably is what BSV is all about, and these bursts in volumes prove that BSV is the only blockchain network fit for purpose.

At the time of writing, the average transaction fee on the BSV network is around 0.000003 BSV, or US$0.00015. That number is important if you’re running an application that puts millions of transactions on-chain daily. And it’s essential no matter what kind of data you’re processing, whether it’s game records, healthcare, and research data, IoT sensor data for supply chains and agriculture, contracts, tokens, or payments.

BSV isn’t just taking existing applications and putting them on a blockchain. It’s creating an entirely new digital economy. That economy is based on tiny payments at massive volumes, pay-per-use models rather than advertising and personal data-mining, and income being shared around all users, not just major platforms. This is also known as the “internet of value,” where data itself is the commodity, and users retain ownership and control over everything that’s theirs.

The original Bitcoin will continue to push boundaries with its scaling capacity and new use-cases, and introduces new opportunities to make money. Every new volume-burst and record-setting day inches closer to those goals.

Watch: The BSV Global Blockchain Convention presentation, BSV Blockchain: A World of Good

02-22-2026

02-22-2026