|

Getting your Trinity Audio player ready...

|

Blockchains aren’t fancy or new

In the glitz and glamour surrounding blockchain technology, it’s easy to forget that these so-called revolutionary advancements are, in many ways, neither fancy nor new. At the heart of this ostensibly cutting-edge field lies the hashed timestamp server, a technology that has been quietly and reliably publishing a hash in the Sunday New York Times for decades. This unassuming yet profound system, created by Stuart Haber and W. Scott Stornetta, was referenced in the Bitcoin White Paper and has been operating since 1991. It’s a stark reminder that the foundational elements of blockchain technology are rooted in history, not novelty.

How to Time-Stamp a Digital Document

Stuart Haber

W. Scott Stornettahttps://t.co/GNCH4TvWHw pic.twitter.com/d0nZKXAcxX— iang (@iang_fc) October 5, 2021

The pre-Bitcoin era of digital currencies

Before Bitcoin, there were numerous digital currencies that sought to revolutionize the financial system. Initiatives such as Karma, Digicash, eCash, eGold, and Liberty Dollar laid the groundwork for what the amateurs now call “cryptocurrency.”

Each of these attempts, however, succumbed to various weaknesses, the most notable being the centralization of the mint. Centralization proved to be a fatal flaw, as it introduced single points of failure and vulnerability. Second was the attempts at making them anonymous cash which invited regulatory and legal actions.

Bitcoin solved both problems.

Bitcoin’s contribution: Competitive consensus

Bitcoin, now about 15 years old, did not introduce the concept of digital currency. Instead, its true innovation lay in its game theory of competitive consensus, its public ledger and the difficulty adjustment mechanism. These elements ensured that Bitcoin’s network would remain competitive and sufficiently decentralized, providing security and persistence.

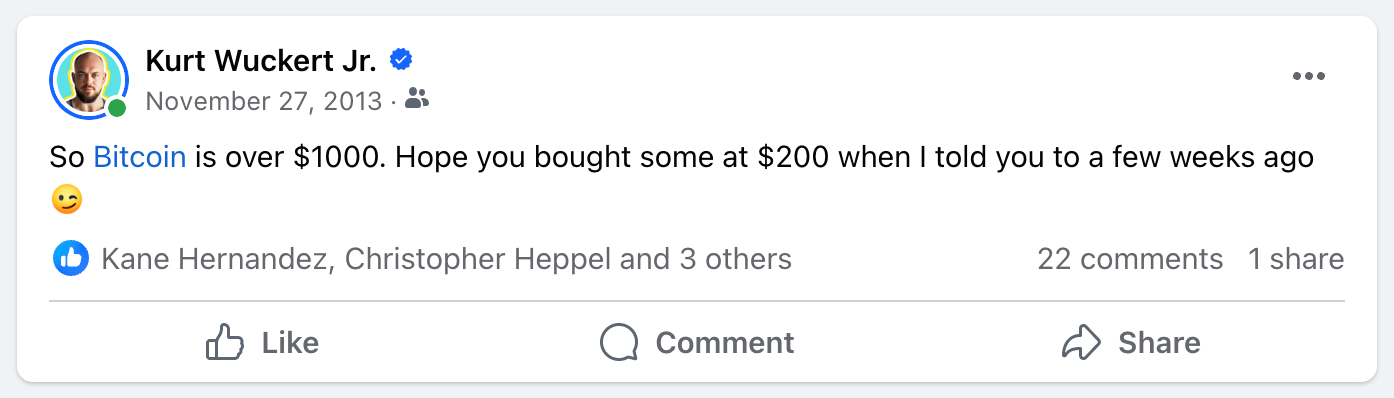

Recalling my own discovery of Bitcoin and falling in love with proof of work (PoW), I figured, at the time, that Bitcoin would have a rapid ascent to total domination through commercial use and competitive incentives.

Despite these advancements, the question remains: why has Bitcoin, and blockchain technology in general, been so slow to disrupt traditional systems?

Turns out, the allure of gains wins again! Or maybe there’s something else going on…

The true barriers to disruption

One could argue that the slow pace of disruption indicates that blockchain technology is not as transformative as its proponents claim.

It’s just a bad idea that doesn’t actually work like people have believed it worked for so long. The conclusion of big blockers was that “Bitcoin was attacked but this time we will stop it.” Maybe the correct one is “Bitcoin was attacked. It can’t work.”

Time will tell.

— Deryk Magill (@dmkgll) June 24, 2024

Alternatively, one might blame gatekeepers and scammers for stifling its potential. The longer people perceive blockchains as complex and novel, the more developers and consultants can extract exorbitant fees for maintenance and consultation. This is where BSV presents a compelling narrative.

Conceptually, BSV aims to shift consensus rules into policy, transferring power from developers and central planners to economic actors and the free market. This decentralization of risk points challenges the very structure that allows rent-seeking behavior to thrive.

It should also discourage take-over by an influencer class who seeks to keep things complicated in order to push for bigger and bigger speaker fees! [gulps in terror]

The threat of true decentralization

BSV’s approach has earned it severe criticism. Its existence threatens a vast economy of overpaid rent seekers and individuals exploiting gray markets. Furthermore, there is likely a significant amount of illicit activity, potentially involving three-letter agencies, that benefits from the opaque nature of multiple blockchain networks, anon tools and bucket shops.

By advocating for a single, scalable blockchain, BSV poses an existential threat to these entrenched (wealthy and powerful) interests.

But that is also why the argument for a singular blockchain is compelling. Blockchains are, at their core, distributed databases. If a blockchain is indeed a good idea, then the most scalable one should prevail because a global, public ledger on which all data can be monetized and transacted globally is an extremely undervalued idea, even in 2024!

A unified blockchain network would create immense efficiency and transparency by consolidating all economic activity and reducing business friction. If BSV, the most scalable and efficient blockchain, fails for technical reasons, it would suggest that the concept of blockchains itself is flawed and perhaps was never a good idea.

As an excuse, influencers claim that having multiple blockchains and/or a single unscalable “store of value” blockchain is a necessity because blockchains are inefficient, so we either need to just admit it or have lots of them.

The misconception of blockchains as inefficient

In reality, well-designed blockchains are fast, efficient, and scalable. BSV exemplifies this potential, being the most cost-effective and high-performing blockchain available, and I’m not even talking about Teranode. SV Node, for all of its problems, is a highly efficient variation of the monolithic Bitcoin node concept. It allows for at least 10,000 transactions per second (TPS), powerful programmable transaction tools, and a stable platform to conduct business that is currently orders of magnitude faster than BTC and even the allegedly scalable “Bitcoin Cash” trading under the BCH ticker.

It’s also faster, in real world practice, than other scalable blockchains like Solana, Algorand, Polygon, etc…

When Teranode arrives, we will see this TPS number get into the millions which is another several orders of magnitude more than the other blockchains can handle. So, If BSV fails, it would indicate that all blockchains are destined to fail, highlighting a fundamental flaw in the technology or perhaps the people in the economy.

Conclusion: The future of blockchain

As we ponder the future of blockchain technology, it is crucial to cut through the noise and recognize the fundamental truths. Blockchains are not fancy or new. Their potential lies in their ability to provide a decentralized, efficient, and scalable solution to digital transactions. The success or failure of BSV will be a critical indicator of the viability of blockchain technology as a whole. If BSV succeeds, it will validate the concept of a single, scalable blockchain. If it fails, it will serve as a warning that perhaps blockchain was never the transformative solution it was heralded to be.

In the end, the blockchain industry’s survival depends not on hype or novelty but on its ability to deliver tangible benefits in a transparent and efficient manner. The sooner we dispel the myths surrounding blockchain technology, the sooner we can focus on realizing its true potential—or acknowledging its limitations and moving on with our lives.

Watch: Determining blockchain’s economic value

02-25-2026

02-25-2026