|

Getting your Trinity Audio player ready...

|

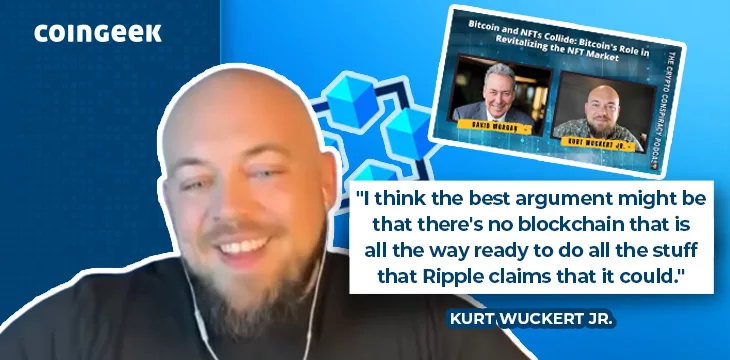

Kurt Wuckert Jr. appeared on the Morgan Report to discuss Ordinals and Bitcoin’s role in revitalizing the non-fungible token (NFT) market. Of course, he covered more ground than that in this latest interview.

NFTs on BTC—thanks, Casey Rodarmor!

Morgan begins by noting that Wuckert was the most requested guest to return to the podcast by viewers. He says he intentionally held off on having him back as he wanted to make the podcast as valuable as possible and was waiting for the right moment.

Wuckert dives right in, saying that the NFT craze is the big thing that made Ethereum blow up—some of them were selling for millions of dollars. He points out that, on Ethereum, users can’t store their NFTs which have to sit on separate servers due to the technical limitations of that blockchain.

After the frenzy, people presumed the NFT market had gone away, and in many ways, it did, Wuckert says. However, there’s a lot of potential utility to NFTs that this immature market hasn’t yet explored.

More recently, BTC developer Casey Rodarmor came up with Ordinals inspections on the BTC blockchain. He realized he could inscribe artwork directly on satoshis, storing it on the blockchain and making it immutable.

“Now your artwork is as immutable as the blockchain itself,” he says, noting that this has caused a huge stir, and many are asking fundamental questions about tokens, NFTs, and what’s possible on Bitcoin again. This is causing tension between those who see BTC as digital gold and those who are interested in what else it can do.

A brief look at the wider digital currency industry

Morgan then asks Wuckert for his thoughts on the recent BTC price move upwards and the value of XRP. He is interested in both and wants to hear Wuckert’s opinion.

Handling the BTC price move first, Wuckert believes it’s a sucker’s rally. He can’t see where the money is coming from to kick off a bull market when interest rates are so high, BRICS nations are attacking the dollar, and we’re on the precipice of a major global conflict. In short, the macro conditions aren’t favorable to a new bull market right now, and the maximalists calling for it have a track record of being wrong.

What about XRP? Wuckert notes that Ripple (the company) preceded Bitcoin and was even mentioned by Satoshi Nakamoto in the early days. However, while he thinks Ripple has some interesting technology, he doesn’t see the need for XRP, which has done little other than enrich Ripple executives, hence the lawsuit with the SEC. He says that Bitcoin should try to compete with Ripple in the areas they are interested in, such as remittances, settlements, and small payments.

Having said this, Wuckert notes that BTC is incapable of competing with Ripple in the aforementioned areas. He’s a miner on Bitcoin SV, which has much faster payments with lower fees. If any blockchain can compete, it’s BSV, and Wuckert is betting with his reputation and his money that it will.

Are the regulators taking crypto-friendly banks down?

Morgan notes the recent failure of banks like Signature, Silvergate and Silicon Valley Bank and wonders if there’s a conspiracy to get ‘crypto’ out of the way.

Wuckert asks a return question, “who are the banks?” He notes that there are factions, and banks like JP Morgan (NASDAQ: JPM) can hardly be classified as the same as the others. He notes that the same factions exist within the regulator camps, with different agencies stating different opinions. For example, the Commodity Futures Trading Commission (CFTC) has said Ethereum is a commodity, whereas the SEC is leaning towards classifying it as a security.

Wuckert also points out that, as the “traveling circus” of crypto goes from town to town, robbing people blind, it makes it more difficult for libertarians such as himself to make a case for a light-touch or relatively hands-off approach to the industry. Likewise, as the years roll by, the chance for Bitcoin to disrupt payments and create change is slipping away; whereas it was compelling in 2008, it’s now facing competition from a multitude of apps like Venmo.

Speaking briefly on central bank digital currencies (CBDCs), Wuckert says they have only entered the conversation because Bitcoin has failed to disrupt payments meaningfully. For him, CBDCs are the worst of both worlds.

On the pointlessness and absurdity of maximalism

Morgan states his opinion that maximalism of any kind is pointless. He wants to know Wuckert’s thoughts on it.

Wuckert says he’s a Bitcoin maximalist, but not in the typical way. In fact, many typical BTC maximalists would consider him a Judas and a traitor. He views Bitcoin as a valuable attestation tool and source of truth.

However, he agrees that BTC maximalism is absurd. The vision some of them promote is dystopian and can’t exist unless the world collapses, and that’s not to anyone’s benefit.

In summary, Wuckert says we’ve wasted a lot of time, but there’s still time to pull off the Bitcoin revolution. He’s deeply invested and hopes it works out, but he says it’s important to hedge and remember you might be wrong. In closing, he encourages everyone to invest in themselves and their skills because that way, you’re never really out of the game.

Watch: On the very start of Bitcoin

06-01-2025

06-01-2025