|

Getting your Trinity Audio player ready...

|

BRC-20 is an experimental token standard launched on BTC amidst the ongoing Ordinals craze.

An experiment into "brc-20's" and fungibility on bitcoin with ordinals 1/x pic.twitter.com/9khKLbEPk6

— domo (@domodata) March 9, 2023

Inspired by Sats Names, a naming protocol leveraging Ordinals, BRC-20 lets any user mint against a defined contract. The initial contract has only five fields defining its protocol, action, ticker, maximum supply, and how much users can mint in a single transaction.

BRC-20 adopts the “first is first” mantra, such that the first mints under the supply are valid, and everything minted after the supply is reached is invalid. The order is determined by its position within a block mined. A flaw in the protocol is that if you happen to inscribe a minting request where the supply is almost reached and your transaction ends up ordered after the last valid minting transaction, you may pay high BTC fees for nothing in return.

The protocol specification goes on to describe transfers. As such, the first few BRC-20 tokens deployed on BTC already have market value and OTC trading desks formed as a result.

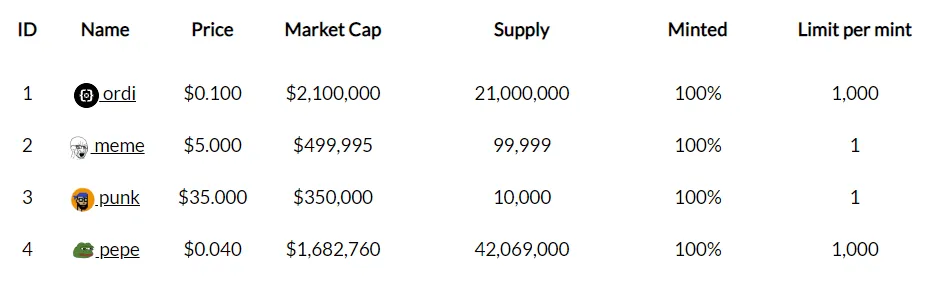

ORDI was the first BRC-20 token inscribed on BTC, and thus the most valuable so far in terms of market cap, trading around $0.10 with 21 million issued. Swiftly taking advantage of this unique situation and opportunity, RelayX tokenized 100,000 ORDI on top of BSV, so users could trade derivatives of the BRC-20 without high fees, and on a decentralized exchange.

NEW LISTING – ORDI {o}

Now live on RelayX – trade and bridge ordi-BRC20https://t.co/JK7UriUzzt https://t.co/STFRNaFLFv pic.twitter.com/3BAMu2AA0t

— RelayX (@relayxio) April 3, 2023

In four days, ORDI on BSV has traded over 120 BSV in volume and currently trades at a premium of $0.11 cents compared to the native BRC-20 token. Naturally, this move sparked criticism as BTC users simply asked:

https://twitter.com/yan26562013/status/1643207556633083908?s=20

To answer this question, one must ask how and why is it possible to trade BTC tokens on BSV more efficiently than BTC itself? With ability to use Bitcoin Script and large block size, on-chain trading is somehow most efficient on the network that is repeatedly maligned as a pariah. The interesting thing is, as the Ordinals experiment continues, suddenly data on-chain is a good idea and gives BTC additional value and utility.

I get the feeling I'm missing something. There was LOTS of discussions a few years ago about the dangers of on-chain NFT data storage, but now, suddenly it's a good idea? & On #bitcoin?

Really? #Ordinals

— Dan Thomas (@Archit3ctDan) February 8, 2023

Just as many projects before, many will fall victim or fail to even start because of the high upfront cost and transaction fees. Just as former Blockstream CSO famously stated, “Bitcoin (BTC) isn’t for people that live on less than $2 a day” and apparently, neither are Ordinals. Those eager to create collections or start building with Ordinals may look for so-called Layer 2 solutions just as they have done with Ethereum projects in the past.

Now that we have a proven, and objectively useful Layer 2 solution for BTC’s first BRC-20 token on BSV, why wouldn’t people use that too? Well, the same reason BTC is worth thousands of dollars and BSV is worth nearly 1/1000th of BTC: perception, ignorance and poor reputation. That stated, BSV has never competed with BTC in terms of tokenizing assets and data on-chain because this ability was thought to have been impossible due to the BTC Core developers’ protocol changes.

How long will users, especially newcomers tolerate high fees that consistently erode their wealth and choose to die on the transaction fee hill because “Aussie Man Bad”? Only time will tell.

Ordinals on BSV! Luke Rohenaz explains utility and value on the CoinGeek Weekly Livestream

09-18-2025

09-18-2025