|

Getting your Trinity Audio player ready...

|

Dear Patrick Bet-David,

I recently listened to your PBD Podcast episode with Michael Saylor. I commend you on always keeping an open mind and being willing to address such a wide variety of people on your show, but after listening to the Saylor episode, I felt compelled to pen this article to correct some misconceptions and falsehoods he promoted during this episode.

I will handle Saylor’s arguments one by one, but not necessarily in the order that he made them on your show. This is because there are some points that tie together from different parts of the podcast.

Saylor has the basic nature of Bitcoin completely wrong

I’ve listened to several of Saylor’s interviews, and as he did on your show, he always begins by promoting a fundamental falsehood about what Bitcoin is. It is not a pristine form of property, a hedge against inflation, or an unconfiscatable version of digital gold.

Bitcoin is a peer-to-peer electronic cash system that facilitates small, casual transactions. How do I know this? Because I read the Bitcoin white paper (it’s literally written in the title) and I also studied the words of Bitcoin’s inventor Satoshi Nakamoto. He mentions micropayments in his very first public post and speaks of small, casual transactions in his white paper. No offense to Saylor, but I’m inclined to believe Satoshi Nakamoto when it comes to the subject of what Bitcoin is.

However, even if we allow that BTC is some form of digital property and has evolved and changed over a decade, there are several problems with Saylor’s arguments in favor of it as a superior asset.

1. Never more than 21 million BTC

Saylor promotes the notion that BTC is some sort of absolutely scarce asset that is hard-capped at 21 million coins. This is a myth promoted by BTC maximalists far and wide, but it’s not true.

First of all, the framing of BTC as rare because of the 21 million number is a deliberate choice. Why look at it from the perspective of whole coins and not Satoshi units, of which there are quadrillions? This choice to look at BTC from a whole coin perspective suits the agenda of those who wish to promote BTC as some rare asset, which is exactly why they choose to focus on the 21 million number.

However, even this ultimate hard cap is not necessarily true. Due to problems caused by BTC developers’ insistence on keeping blocks small and how this impacts the economics of the Bitcoin system, BTC protocol developers like Peter Todd have already begun floating the idea of increasing BTCs supply via inflation. I’ll cover mining economics in more detail below.

Ultimately it’s a myth that there can only ever be 21 million BTC units. All it takes is a code change to inflate BTC, and if history shows us anything, it’s that when BTC core developers want to change something, they’ll get their way by any means necessary.

2. BTC is not unconfiscatable

One of the key arguments that Saylor likes to make is that BTC is not confiscatable by governments. He told you the same story I have heard him tell multiple times; how investing in anything else leaves you vulnerable to arbitrary seizure and that BTC is immune to this.

While this is a nice idea, it’s also not true. There are multiple ways governments could seize BTC if they wished.

First, they could make owning BTC illegal and punishable by prison time. Most people, Saylor included, would have to hand their BTC over to the state or face the consequences. While one could hypothetically resist, it’s unlikely that most would do so. After all, BTC is no good if one doesn’t have the liberty to spend it. If most complied, which they would, the price of BTC would crash quickly, and there’d be no way to spend or cash out the coins the hold-outs cling to.

Second, they could ban exchanges and fiat on/off ramps and blacklist certain wallets. We saw this in action recently in Ottawa during the trucker protests. While the Canadian government was not able to physically seize the coins in those wallets, they were able to render them effectively useless with a few pen strokes. Since BTC is too slow and expensive to use as money, these fiat exchanges are essential for those who approach BTC as an investment asset.

Third, and going back to the point about Dr. Wright’s ongoing lawsuits, powerful enough governments can simply use the legal system to confiscate Bitcoin. Saylor told you there are tens of thousands of nodes on the Bitcoin network, but this is also false, and if governments compel miners to move coins from one wallet to their own by legal order, it can be done. The reasons for this will become apparent when I address the many nodes myth below.

Lastly, even if BTC was unconfiscatable, this would be a wholly undesirable state of affairs. Imagine a world where Pablo Escobar or the Taliban could build wealth in BTC, move it and use it for their purposes with no restrictions, and wouldn’t even have to bother hiding or launder it because there’s nothing any sovereign government could do about it anyway.

3. Bitcoin is not encrypted

Thankfully, people like Escobar or the Taliban will never be able to use Bitcoin for their purposes because it’s not “encrypted money,” as Saylor likes to call it.

Bitcoin is not encrypted at all. It literally presents in clear text and the entire history of every transaction since the Genesis block is visible on the Bitcoin ledger. That’s how it was designed to be, and at no time did Satoshi refer to Bitcoin as “encrypted money.”

That’s simply because Bitcoin is not encrypted. There’s little need to elaborate on this point as it’s self-evidently a false assertion.

The myth of thousands of Bitcoin nodes

Supporting Saylor’s fallacious argument about Bitcoin’s unconfiscatable nature is the premise that there are tens of thousands of nodes securing the network and keeping records of the ledger.

While it’s true that there are tens of thousands of ‘listening nodes’ that keep a record of the BTC ledger, it’s not true that these nodes do anything more than that. Truthfully, these are not nodes at all, and they might as well not even be there.

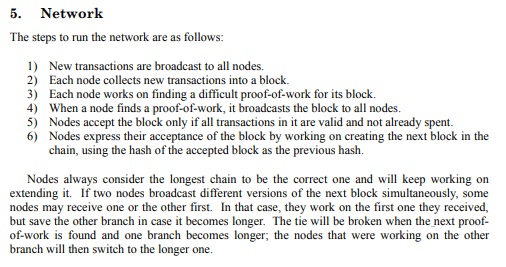

How do we know what a node is and is not? All we have to do is refer to the Bitcoin white paper again. In section five, Satoshi makes it clear that nodes are involved in collecting new transactions into blocks, finding a difficult proof-of-work for blocks, broadcasting blocks to other nodes, and working on creating the next block in the chain.

Source: Bitcoin: A Peer-to-Peer Electronic Cash System

Listening nodes do not solve proof-of-work, and they do not work on creating blocks at all. Therefore, by the very definition of the Bitcoin white paper published by its inventor, these “tens of thousands of nodes” are not nodes at all.

Once again, who are we going to believe about Bitcoin, Michael Saylor or Satoshi Nakamoto? The fact that most of these nodes are not nodes is precisely why Bitcoin will prove to be confiscatable by legal order. Nobody needs to know who runs these listening nodes or concern themselves with them in any way. All a government needs to do is send a legal order to miners, the real nodes on the Bitcoin network. Since miners are legal entities with a profit motive and often tens of millions invested in their operations, they will almost all comply.

Saylor’s 100-year timeframe and Bitcoin mining economics

One of Saylor’s key BTC selling points is that even gold hasn’t stood the test of time in most cases and that virtually every fiat currency has collapsed on a 100-year timeframe. He believes that BTC has been a safe investment for at least a century. Yet, it is clear that he hasn’t thought out the ramifications of how simply holding BTC and stashing it away would impact Bitcoin miners and the economics of the system.

How so? Satoshi designed the Bitcoin block subsidy to halve every 210,000 blocks precisely because he designed it as a peer-to-peer electronic cash system, and he expected transaction fees to replace the block subsidy over time. Of course, for this to work, it requires big blocks full of millions of transactions (the kind you find in BSV) and not piddly 1MB blocks capable of seven or so transactions per second.

The Bitcoin transaction fees inside blocks are the incentive for miners to keep mining as the block reward diminishes over time. If you have the opportunity to speak with Saylor again, ask him why miners will bother lending their massive hash power, at a considerable cost, to the BTC network for an ever-diminishing block reward. If everybody views BTC as digital property and simply holds it, locking it away in digital vaults, what will pay the miners to keep pushing hash power to the network? In a couple of decades, the block subsidy won’t be worth much at all. The problem becomes blatantly obvious with few transaction fees because of the HODL mentality.

Saylor incorrectly says that “that’s why Bitcoin Satoshi Vision collapses” in reference to his winner take all thesis. In fact, mining economics explains perfectly why BTC will collapse. For a more in-depth look at Bitcoin mining economics and BSV’s inevitable victory, I suggest reading Zemes G’s essay on the subject.

The Bitcoin protocol has not changed—a jaw—dropping moment in your Michael Saylor interview

Perhaps the most startling falsehood Saylor came out with during your interview is that the BTC protocol has never changed. This is either deliberate deception or astounding ignorance about the history of Bitcoin.

Is Saylor not aware of SegWit and how it fundamentally altered the nature of Bitcoin by stripping the digital signatures out of transactions? If this is not a fundamental protocol change, I don’t know what would qualify as one. And it’s by no means the only one, either.

The truth is that BSV is the only version of Bitcoin that remains true to the original. Again, all one has to do is read the Bitcoin white paper, compare the various Bitcoin forks, and draw the necessary conclusions about which ones changed. Bitcoin is not a trading ticker (BTC). It is a protocol. It doesn’t matter that when BTC forked off, it kept the original ticker. It does matter that Bitcoin SV retains all the original capabilities of Satoshi’s Bitcoin and remains the same protocol he released in 2009.

This assertion alone should call Saylor’s credibility into question. Someone so unaware of Bitcoin’s history can not possibly make accurate predictions about its future.

Saylor is reckless and in way over his head

The only conclusion that can be reasonably drawn from your extensive and excellent interview with Michael Saylor is that he is either being deliberately deceptive or that he has failed to grasp even the basics of Bitcoin.

It’s quite frankly frightening that this man has transferred the entire treasury of a multi-billion dollar public company into BTC while holding such badly mistaken beliefs about it. Not only this, but he has repeatedly encouraged others to mortgage their homes, borrow money, and acquire BTC by any means necessary.

Patrick Bet-David, I hope this article has given you food for thought if you should ever have the opportunity to interview Michael Saylor again. While he turned down your offer to debate Peter Schiff on your show, perhaps he might accept a debate against Dr. Craig Wright or Kurt Wuckert Jr. about what Bitcoin is and how it works.

Thank you for always being willing to hear all sides of every story and continue your excellent work on the PBD Podcast!

Watch: CoinGeek New York presentation, BSV Blockchain: It’s About Time

01-05-2026

01-05-2026