|

Getting your Trinity Audio player ready...

|

There was a time the digital asset industry was such a niche that its only investors were dedicated technophiles: people who had either been drawn in by the early writings of Satoshi Nakamoto or by a general excitement at what could be achieved with digital cash.

In 2021, the reality is much different. The number of laypeople pouring their money into ‘crypto’ is growing exponentially, lured in by fantasies of overnight wealth and the false idea that BTC’s 300% gains over the past year can only continue. Companies in the industry—exchanges and well-funded propaganda machines—rely on this hype, so must cultivate it: they have to convince the uninitiated that not only are digital assets the path to fabulous riches, but that their platform is the vehicle to get you there.

Such promotion is obviously unethical. Though you wouldn’t know it by looking at your average digital asset advertisement, it’s also illegal: there are laws on the books which protect individuals from false advertising generally, and the SEC’s anti-touting laws limit the ways in which securities are promoted, for example.

The problem is that unlike banks, who are subject to a host of specific rules governing how they can communicate with the public about their products, exchanges are not subject to any central regulatory authority. Where shady promotional practices are caught by existing regulatory regimes and statutes, there is still the issue of inspiring the appropriate regulator to take notice and take action. Considering the role exchanges play in acting as custodians or brokers of billions of dollars’ worth of investor money and offering complex and highly leveraged derivatives products, this is inadequate; even more so when you consider the demonstrated risk that exchanges are in a position to manipulate digital asset markets at the expense of their own customers.

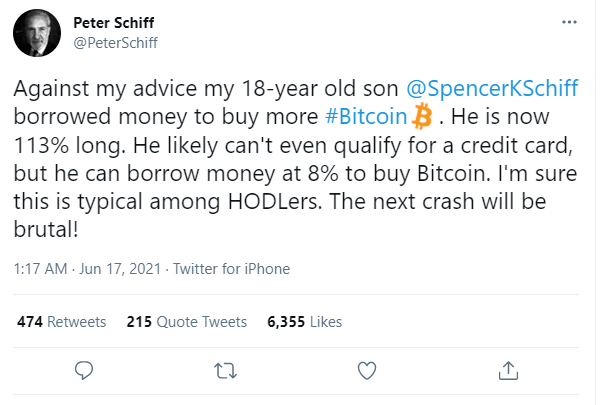

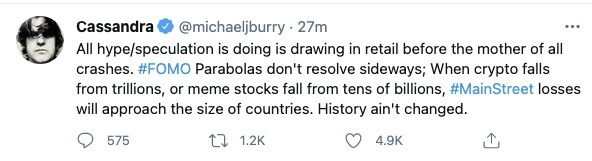

Though enforcement is happening with increasing regularity, these promotional practices have gone unchecked for so long—and companies in the industry have become so reliant on them—that there needs to be drastic change in order to mitigate the effects of the coming crash, which will be catastrophic for those taken in by the hype—people like Peter Schiff’s son:

It’s people like Schiff Jr. that will pay the price for this unethical promotion, and who Michael Burry was talking about in a now-deleted tweet from June 17:

Fraudulent solicitation

The more obvious instances of fraudulent promotion being used to dupe investors do get prosecuted. In February, the SEC brought charges against three individuals who were using fraudulent and deceptive practices to solicit customers to use two online platforms: ‘Start Options’ and ‘Bitcoiin2Gen’. The defendants used these platforms to launch an ICO, without registering with the SEC, for a token which never existed.

You will have heard all of the promises made by the defendants in this case before: they advertised their platforms as “the largest Bitcoin exchange in euro volume and liquidity” and “consistently rated the best and most secure Bitcoin exchange by independent news media.” None were true.

Though the ‘Start Options’ case is a straightforward and explicit example of individuals lying to sell a scam, the truth is that these tactics are used by companies to sell products throughout the industry, and the end result—scores of financially ruined investors—is going to be the same.

For example, part of the SEC’s case against ‘Start Options’ and ‘Bitcoiin2Gen’ was that the defendants had hidden their true identities from investors, so that their connections to past scams couldn’t be uncovered. The SEC considered this a serious misrepresentation worthy of enforcement action.

What, then, would the SEC have to say about Bitfinex and Tether, who are owned by the same company (iFinex) yet up until 2017 were insisting that they had no relation to one another? Around the time Tether was picking up steam in 2016, Bitfinex itself was being fined by the CFTC for offering illegal off-exchange commodity transactions, and yet Bitfinex CEO Phil Potter denied any relationship between the two companies—despite being a registered director for Tether at the time.

Of course, action against such practices aren’t restricted to regulators and lawmakers. A key pillar in the salvo of litigation against BitMEX concerns this very issue. The Commodities Exchange Act makes it unlawful to use manipulative or deceptive practices in connection with any trade. The plaintiffs in the BitMEX cases, all digital asset traders, are arguing that BitMEX’s lofty advertisements and representations were not based in fact, yet were used by the company to solicit customers to join their platform and begin trading. For example, BitMEX advertised itself as having 1500% more BTC/USD liquidity than any other platform—something which could be easily disproven (BitMEX removed this some time after the first wave of civil litigation).

Celebrity endorsements are another widely used, yet often illegal and usually unethical promotional tactic. For a new project with little to say in favor of itself, endorsements from famous people are a shortcut to generating buzz. You wouldn’t believe it to look at Twitter, but the U.S. securities legislation’s anti-touting provisions require that anyone promoting securities must disclose the nature, scope and amount of compensation received in exchange for the promotion. The SEC warned about this during the 2017 boom, and would go on to prosecute Floyd Mayweather Jr. and DJ Khaled for failing to disclose that social media posts they had made hyping up digital asset products were actually paid promotions by the product’s organizers. The celebrities settled the charges: Mayweather coughed over $600,000 in penalties, while DJ Khaled paid over $150,000.

Exchanges are always looking to offer new, exploitative products

Exchanges are continually looking for opportunities to offer new products to help draw customers to crypto. At best, this is simply because the hype machine needs to be fed: people need to be presented with new ways to get rich to ensure the flow of cash into the business grows over time. At worst, it’s a way to not only get customers in the door but use the asymmetries that exist between trader and exchange to exploit them.

Take Binance’s Savings service, launched in 2020, which makes an incredible promise to its customers: to allow you to earn “wherever the market goes.” The service offers a number of products:

“Earn more money from your crypto holdings with Binance Dual Investment, a new crypto investment product created by Binance Pool,” it says.

“With Binance Dual Investment, you can commit your crypto holdings and lock in a savings yield, but earn even more if the market price on your crypto holdings increases.”

How the product actually works is this: customers might put up 1 BTC at $30,000, with a 30-day expiry and a strike price of $35,000. If after 30 days, the price of BTC has risen above $35,000, they receive $35,000 worth of BUSD (Binance’s stablecoin) plus 2% interest, also in BUSD. If BTC is below $35,000 at the expiry date, they get their BTC back at market value plus interest. However, because you can’t sell your BTC before the expiry date, you run the risk of watching your BTC plummet without the ability to sell. If the price goes higher, you earn nothing over and above the strike point.

On the off chance BTC trades flat (and remember that Binance wants you to believe crypto only goes up), you earn your minor interest and get to keep your BTC.

What this does is it allows an easy way for Binance to take a bite out of your holdings whether the price of BTC goes up or down—the more drastic the movement, the better it is for Binance.

It’s interesting that while the advertisement tells you you’ll be “earning” off crypto, the actual explanation of how the product works refers to it as a “bet.” The terms and conditions also include this gem: “Binance.com will not be held responsible if the final outcome executed by Dual Currency Investments services differs from the customer’s expectations.”

In light of the various market manipulation suits to have been launched against digital asset exchanges over the years, such a product should be untouchable to any informed investor; at the very least, the way it is offered and promoted should be highly regulated.

Yet, here is Binance, promising investors a way to profit whether BTC goes up or down.

Media outlets are complicit

It isn’t just the exchanges. An influx of entrants to the ecosystem brings with an appetite for digital asset-related coverage and confirmation bias, and a host of outlets are happy to oblige. These outlets are instrumental in disseminating hype. When an exchange is charged by the authorities, or when a start-up embarks on an ICO, it is these outlets that many unsophisticated investors will turn to.

Take Cointelegraph for example, publishers of such sober, unbiased journalism as ‘Jamie Dimon Calls Bitcoin “Fraud” Despite Clear Conflict of Interest’ and ‘$56.3K Bitcoin price and $1T market cap signal BTC is here to stay’. In additional to general editorial coverage, Cointelegraph provides regular price analysis on the most popular digital asset tickers, which typically only skew in one direction: for example, analysis published following a sharp downturn in BTC price in September 2020: “While Bitcoin price is correcting today, this exposure of potentially illegal behavior by banks will only strengthen the narrative for why investors should buy Bitcoin (BTC).”

Most illustrative is Cointelegraph’s coverage of the Tether fiasco. When the New York Attorney General’s Office fined Tether and announced that its investigation into the company had discovered that USDT had not in fact been fully backed, as Tether continues to insist, Cointelegraph’s reporting omitted any reference to USDT’s now-proven lack of backing, instead choosing to point out that the $18.5 million fine is “a very small portion of all existing USDT”—which makes perfect sense considering we now know they are printed out of thin air. Subsequent coverage, which consists almost entirely of press statements from Tether, also ignores the story.

Of course, neither the writers at these outlets nor their readership are interested in the news that Tether’s management had been lying about its backing. After all, there is a credible case to be made that Tether is the tentpole keeping the industry afloat, and will collapse on a moment’s notice. Why would the people who have been sold on a fantasy of free money be interested in that?

CoinDesk is no different. Though purporting to be a general-purpose digital asset website, their 2018 CoinDesk Conference was the subject of a boycott inspired by allegations of biased reporting, with various blockchain developers complaining that they had received unfair coverage from the outlet.

Ethereum developer Vitalik Buterin posted a list of grievances, but either way, the idea that CoinDesk’s reporting is biased doesn’t seem that unlikely considering the company is owned by none other than the Digital Currency Group (DCG). DCG was founded by current CEO Barry Silbert, who was the subject of SEC action in 2016 over the use of his name to pump a scam coin. Silbert is also a co-investor in ShapeShift, which has a checkered past of its own. However, perhaps most troublingly, DCG is also the parent company for Grayscale Investments, which runs the Grayscale Bitcoin Trust BTC ETF. How do you think Silbert feels about BTC and more importantly, their competitors?

Naturally, sites such as CoinDesk and Cointelegraph do a great deal of communication with its users via social media, and it’s here where biases can be most easily spotted. For example, a look through CoinDesk’s Twitter feed—even over the past 24 hours—betrays a desire to communicate a clear message about BTC’s trajectory:

It’s the same with Cointelegraph. Take, for example, their treatment of February’s news that Tesla would be acquiring a large amount of BTC:

We all know how that’s been going.

Regulation

Unfortunately, it won’t be the Binances and Cointelegraphs of the world who will be most devastated by an industry crash. It will be the people they have led into the woods. For some, it’s already too late: the perpetual stream of market manipulation lawsuits from aggrieved traders show that. The people responsible should be held to account before the damage spreads further. Whether this is to be done primarily through private litigation or law enforcement action is yet to be seen. With legislators finally kicking into gear in addressing the industry’s many regulatory holes and as more wronged traders realize the extent to which they’ve been deceived, such accountability feels inevitable: the real question is whether it takes a colossal crash for it to happen.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—

from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple and

Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

12-29-2025

12-29-2025