|

Getting your Trinity Audio player ready...

|

Despite a public business-as-usual approach, BitMEX and its founders are facing a growing wave of legal action over what prosecutors and plaintiffs call a wholesale scheme to manipulate digital asset markets at the expense of its own customers. Its founders are awaiting criminal trial, and new civil plaintiffs are appearing on a regular basis.

In fact, the accusations levelled at BitMEX cryptocurrency exchange have reached such a cacophony that they become difficult to keep track of. Some cases have been consolidated, others have been settled, and more still are awaiting their day in court.

However, upon examining the cases against BitMEX separately, what stands out is the degree to which their accusations against the platform and its founders tell the same story—of brazen market manipulation, intentional non-compliance with anti-money laundering regulations and consumer fraud.

The BMA cases

The bulk of the civil cases against BitMEX can be traced back to a man named Pavel Pogodin, a practicing attorney based in Puerto Rico. Not only is he the attorney of record for the these cases, but he founded Bitcoin Manipulation Abatement LLC (BMA), a Puerto Rican company which is a plaintiff in the BitMEX cases as well as a number of other anti-manipulation lawsuits against digital asset providers, including against Ripple.

The first in this series of lawsuits was brought in May of 2020 on behalf of BMA and listed HDR Global Trading (owner and operator of BitMEX), ABS Global Trading (BitMEX’s alleged U.S. entity) and co-founders Arthur Hayes, Ben Delo and Samuel Reed. It makes a number of allegations against BitMEX: that it operates an illegal money transfer scheme, actively manipulates crypto markets, trades against its own customers and a host of associated Racketeer Influenced and Corrupt Organisations (RICO) Act violations.

The chosen defendants make sense. Arthur Hayes, Ben Delo and Samuel Reed co-founded and ran the BitMEX network, while HDR Global Trading is parent company behind the BitMEX brand.

The inclusion of ABS Global Trading is more controversial. It’s a name many won’t recognize, but is a Delaware-incorporated company with offices in San Francisco and which the lawsuits (including those not filed by Pogodin) say acts as a single enterprise inseparable from HDR, with shared resources. The defendants argue that ABS provides only operational support to HDR unrelated to the complaints being filed. According to them, plaintiffs only include ABS as a defendant in order to establish jurisdiction in California. It is worth noting that the Commodity Futures Trading Commission (CFTC), who are also suing BitMEX for violations of the Bank Secrecy Act, also included ABS as a defendant inseparable from BitMEX. It’s also worth noting that the name ABS appears to be a synonym derived from the first names of the co-founders—Arthur, Benjamin and Samuel.

As for the allegations themselves, it accuses BitMEX of being designed from the ground-up of being a haven for tax evaders, money launderers and other criminals by refusing to implement adequate KYC and anti-money laundering measures as required by U.S. law—requirements which BitMEX sought to avoid by incorporating in the Seychelles. The suit quotes a July 2019 video in which CEO Arthur Hayes brags the authorities in the Seychelles can be bribed more cheaply than their U.S. counterparts.

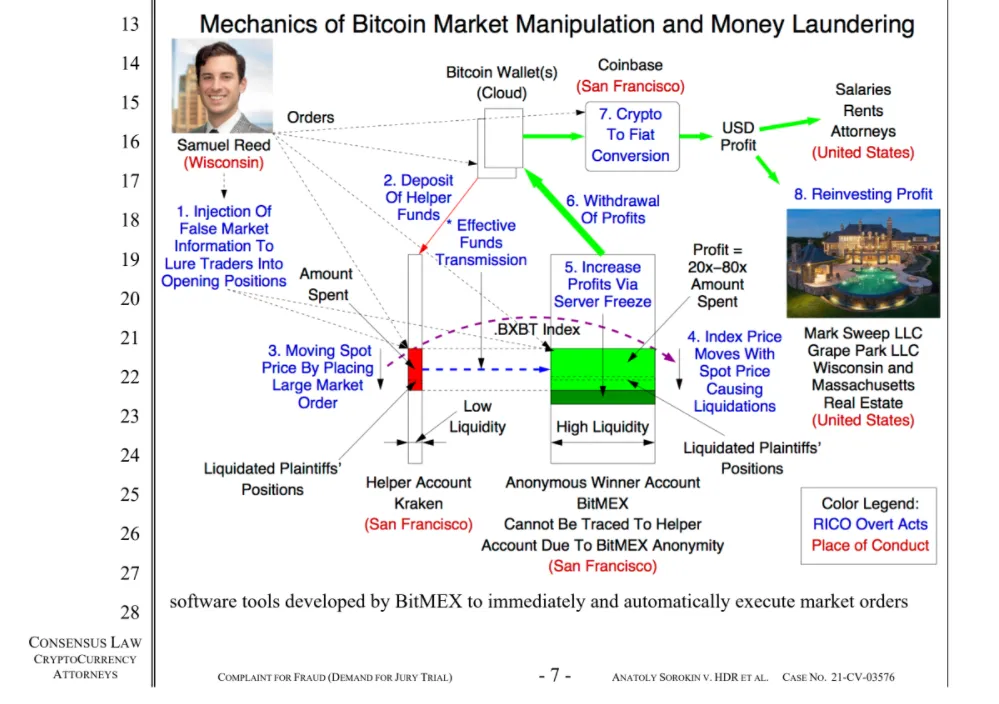

Additionally, BitMEX is said to have deliberately based the index price of its futures on low-liquidity exchanges where they could easily be manipulated. BitMEX would then engage in manipulation on those platforms in an effort to affect the price of the products—specifically those relating to BTC and ETH—so as to allow BitMEX to margin call and liquidate its own highly leveraged traders.

BitMEX also allegedly traded against its own customers, going as far as to use “anonymous ‘burner’ email addresses, as opposed to ‘official’ BitMEX email addresses, to open trading accounts for its Insider Trading Desk with BitMEX exchange, to cover up the tracks of wrongdoing so the trading histories and illegal manuplation profits cannot be traced back to BitMEX.”

While the initial lawsuit had only BMA as the plaintiff, it would go on to add two traders in July: Russian citizens Vitaly Dubinin and Yaroslav Kolchin. Like BMA, both traders were allegedly damaged by the defendant’s activities—though Dubinin was a user of Kraken, one of the exchanges the lawsuit says BitMEX used to manipulate the market.

Co-founders indicted by DoJ, sued by CFTC

The timing of the lawsuit turned out to be prescient: less than three months after the updated complaint in July, the BitMEX founders were indicted by the U.S. Department of Justice (DoJ) and hit with a separate civil suit by the Commodity Futures Trading Commission (CFTC), over accusations very similar to those in the BMA suit.

The DoJ indictments were for violations of the Bank Secrecy Act, which requires that financial institutions actively implement anti-money laundering measure. Once again, BitMEX’s founders are accused of failing to meet these obligations intentionally, including by incorporating in the Seychelles in the hope that they could escape the reach of the U.S. legal system.

The accusations in the CFTC suit are more of the same: failing to register with the CFTC despite offering futures products, failing to implement adequate KYC/AML procedures and offering illegal off-exchange commodity options.

Just two weeks after the indictments and CFTC suit were revealed, two more traders filed lawsuits against BitMEX—again being represented by Pogodin. The traders were Dmitry Dolgov and Paun Gabriel-Razvan and though filed separately, the suits contained largely the same allegations as in the BMA case.

As a result of the growing number of cases concerned with the same set of facts, the defendants applied—and the plaintiffs agreed—to have them consolidated into one action. To that end, on November 25, an amended complaint was filed which included all five of Pogodin’s plaintiffs—BMA, Kolchin, Dubinin, Dolgov, and Gabriel-Razvan.

The new, consolidated complaint was an amalgamation of the separate suits, which were already substantially similar. Notably, it adds a claim for fraudulent solicitation, a violation of the U.S.’ commodities legislation which makes it unlawful to use manipulative or deceptive practices in connection with any trade. BitMEX is accused of making a ‘laundry list of material misrepresentations, half-truths and omissions’ to induce the plaintiffs into trading and continuing to trade on their platform. These include, among other things, false claims that trading on BitMEX was fair and that HDR did not trade against its own customers.

The defendants filed a motion to dismiss the consolidated lawsuit in December, saying that the “plaintiffs seek to blame someone for bitcoin losses that they purportedly suffered from trading leveraged bitcoin derivatives. If plaintiff’s complaint establishes anything, it is only that plaintiffs lack a factual basis for the charges they levy at defendants.” Principally, their argument was that the lawsuit fails to allege facts sufficient to establish that the plaintiffs suffered losses resulting from trading on BitMEX.

This motion to dismiss was granted in March, with the Judge inviting the plaintiffs to amend their complaint and refile once its deficiencies had been addressed. The Judge agreed with the defendants: “They fail to plausibly explain how the defendants have harmed them. The limited allegations plaintiffs offer about their price manipulation theory are all alleged on information and belief, with no explanation of the basis for such beliefs or facts that would make their allegations plausible.”

The suit was re-filed by the plaintiffs in on May 5, 2021.

Other lawsuits against BitMEX

Two more civil suits have been filed against BitMEX in 2021: one by each of Domagoj Zdilar and Anatoly Sorokin—both traders. While the Sorokin complaint is very close to the consolidated BMA case, the Zdilar lawsuit differs somewhat. Chiefly, in addition to the four usual defendants, Zdilar lists 10 additional DOE defendants—defendants whose identities cannot be ascertained before the commencement of the lawsuit but who the plaintiffs expect to be revealed as the case progresses. The suit indicates that these “the agents and employees of their codefendants, and in doing the things alleged in this complaint were acting within the course and scope of that agency and employment.”

The BMA series of lawsuits are far from the only legal actions brought against BitMEX over their alleged scheme of market manipulation and consumer fraud. In addition to the aforementioned DoJ and CFTC cases, a class action suit was filed in New York in April of 2020 (Messieh v HDR Global Trading). There, the plaintiffs’ accusations are more or less the same as those in BMA: that BitMEX purposefully manipulated digital asset prices by freezing its service in periods of significant price movement and traded against its own customers.

There’s another class action suit, also in New York: Williams et al v HDR Global Trading. Again, it contains some of the same accusations as in the BMA and Messiah cases, and recounts the same theory as in BMA: that BitMEX would rely on illiquid third-party exchanges to determine the price of its futures products so that those prices would be easily manipulated. The case was voluntarily withdrawn in April of this year.

There’s also a $540 million suit which was filed in California on behalf of two early investors in BitMEX on May 13, 2020 (Amato v HDR Global Trading). According to that suit, BitMEX cheated the investors out of tens of millions of dollars’ worth of shares which should have been assigned to them upon the issue of preferential shares to subsequent investors. This case was dismissed following a settlement paid by the defendants of an unspecified amount.

BitMEX’s response

BitMEX has deployed a number of arguments in response to the lawsuits. One of these has been to argue that the lawsuits—most of which have been filed in California—should be thrown out for lack of jurisdiction. For example, in the Zdilar case, BitMEX filed a motion in May to dismiss the case on the basis that California is not the appropriate venue, instead suggesting England. In support of this, they say that HDR is based in the Seychelles, the platform is hosted on servers in Ireland, and that BitMEX is largely operated from Hong Kong. ABS is the only defendant incorporated in the U.S. and that its functions—systems support, maintenance, digital security—have “at best, a tenuous relationship to Plaintiff’s claims.”

Lawyers for the plaintiffs have called these attempts “frivolous.” They argue that they are intended to overwhelm the plaintiffs into submission and delay the case long enough for the co-founders to “loot their company dry and prevent the Plaintiffs from collecting any money on the inevitable judgment.”

BMA’s lawyers aren’t the only ones to accuse BitMEX of these tactics. In the Amato early investor suit, lawyers complained that the defendant’s response to the suit was to come “with the kitchen sink: an onslaught of motions, denials, pseudo meet-and-confers, and other legerdemain calculated to delay, frustrate and overwhelm Plaintiffs with frivolous motion practice to run out the clock.” This also included the claim that the U.K., not California, was the appropriate venue for the case, despite BitMEX operating out of San Francisco and having no operations in the U.K. In Amato, BitMEX ultimately abandoned the argument before eventually settling with the plaintiffs.

Outstanding cases

Though BitMEX has paid settlements to some of its accusers, there are still substantial open cases pending against the company and its founders. It remains to be seen whether the amended BMA complaint, filed this month, will be acceptable to the Judge. It also remains to be seen whether the Zdilar and Sorokin cases are consolidated into the main BMA complaint, or otherwise joined with the open class action suit in New York.

Regardless, there seems to be no shortage of plaintiffs with an axe to grind against BitMEX, with two new plaintiffs appearing this year in California alone. Pavel Pogodin, the attorney responsible for the BMA cases, appears to be fielding litigants with each new BitMEX outage or questionable trader liquidation that occurs.

The chief obstacle in the way of these private litigants is the difficulty of proving the specifics of the scheme allegedly perpetrated by BitMEX. The lawsuits are packed to the brim with detail, but for a lawsuit to be accepted by the courts, there must be specific allegations which rise beyond mere speculation. Considering the scheme involved multiple corporate entities and third-party exchanges, specifics can be hard to allege in the early stages of litigation. This is made even more difficult, because according to the criminal indictments against the founders, BitMEX was designed specifically with non-compliance in mind.

It is for this reason that the CFTC and DoJ actions are so important. While there are undoubtedly a great many traders who will have suffered loss as a result of BitMEX’s alleged activities, a scheme as damaging and impactful as BitMEX’s is accused of running is only likely to be resolved via direct law enforcement action—presumably why the DoJ stepped in and why each of the BitMEX’s founders are currently awaiting trial, currently set for March 2022.

Of course, you wouldn’t know it to look at BitMEX today. Despite its founders awaiting criminal prosecution and the company facing a mountain of civil suits, BitMEX is still welcoming new customers without a hint of the accusations it faces. For that reason alone, a prompt and decisive resolution is in everyone’s best interests (unless, perhaps, you happen to work for BitMEX).

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—

from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple and

Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

07-02-2025

07-02-2025