|

Getting your Trinity Audio player ready...

|

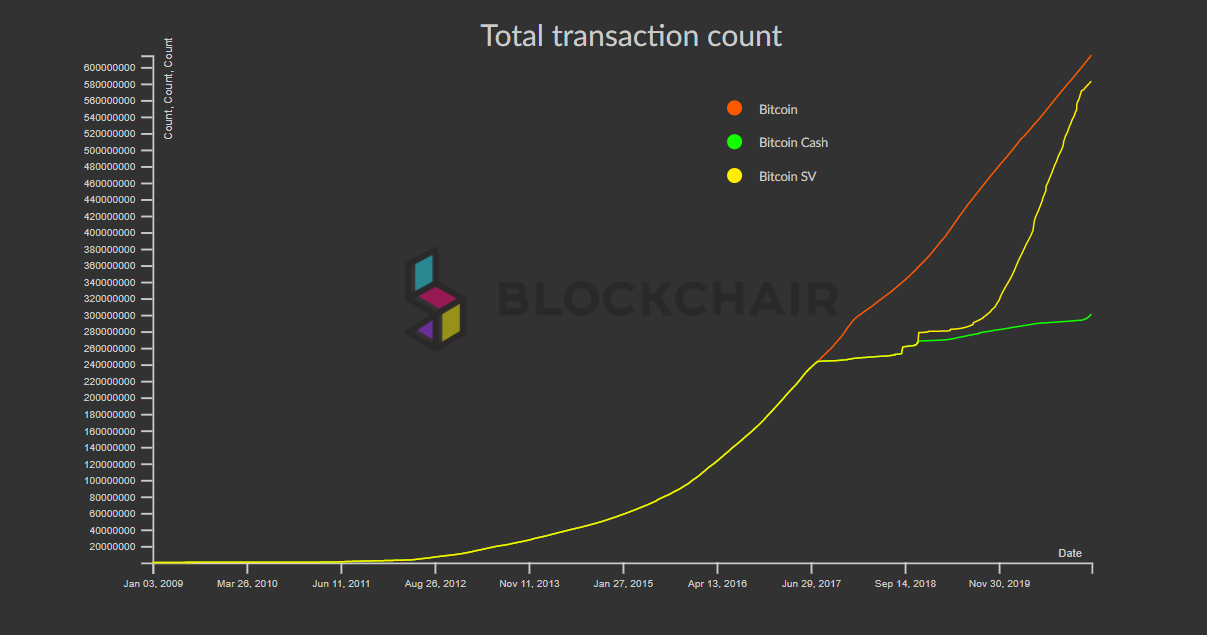

Here’s a couple of charts that put Bitcoin‘s future into better perspective. The total number of transactions for Bitcoin SV (BSV) is now above 580 million—just shy of the ~614 million on the BTC network. There’s every chance BSV’s total will surpass BTC’s very soon, given BSV’s unbounded capacity for scaling, ever-cheaper transaction fees, and use-case scenarios still being discovered.

That’s not just transactions per day, that’s transactions in the entire history of Bitcoin. These statistics put to rest so many years of pointless debate over whether Bitcoin could scale on-chain simply by making its transaction blocks larger, and making individual transactions cheaper.

The restoration of the original Bitcoin protocol at the start of 2020, with the launch of BSV’s “Genesis” software, saw a rapid rise in the number of transactions. Genesis removed all block size limits (leaving them to the discretion of processors) and set the protocol’s basic rules “in stone.” This also led to a plunge in transaction fees. These three factors saw several data-heavy projects grow over the course of that year, such as WeatherSV, Twetch, TDXP, and Preev. These applications produce thousands of micro- and nano-transactions every day; something that isn’t even possible on BTC with its 1-4MB blocks, 3-7 transactions maximum per second, and per-send fees that regularly top US$10.

Common rebuttals to BSV’s argument from people with a poor understanding of how blockchains are used include “these transactions are fake” and “it’s not people spending money.” Both these are provably false. There is no such thing as “fake transactions” on a blockchain—either they occur and are processed, or they’re not on the blockchain. All those transactions can be traced back to their users, all of whom are providing usable services and paying real money to run their operations. No one who makes these arguments can explain why WeatherSV recording data on the blockchain (thousands of times at a fraction of a cent each) is somehow less legitimate than one person paying $5 for a coffee.

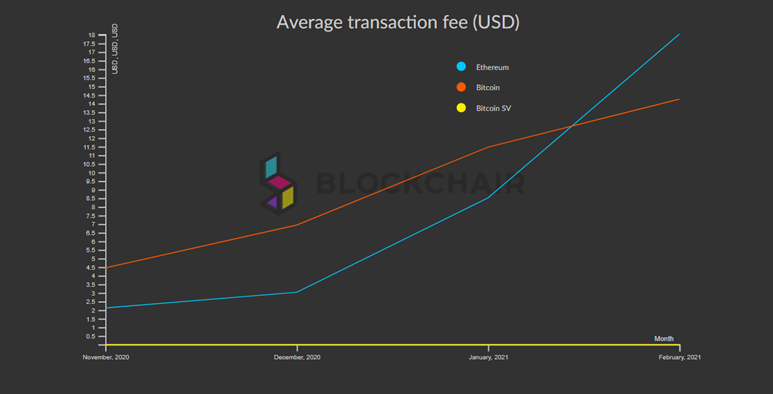

On that note, let’s take a look at another blockchain aimed at large-scale data processing: Ethereum. Ethereum has been making even BTC look like a bargain since January 2021, and making its own value proposition look like a complete disaster:

If you look closely, you’ll see BSV is on this chart too—but its average fee barely even registers on the scale. Note also that high data volume users on the BSV network generally make deals with processing operations, meaning they pay only a fraction of a cent per transaction.

As more projects come online and BSV usage increases, these fees will actually go even lower—the opposite effect to that on BTC and ETH.

This week, someone posted this angry tweet when confronted with a US$646 “gas fee” to run a contract worth $1,684 on Ethereum. It’s profane, but the frustration is understandable.

$646 gas fee.

Oh just absolutely FUCK. OFF.

Who are you psychos that think #ETH is a good plan?

Seriously is this some kind of mass hysteria thing where everyone’s just buying into the madness because clever people talk it up?

When do we all take a sanity check on this? pic.twitter.com/Q7ZGQ6o2rH

— Moon Face (@PianoXr) February 6, 2021

Add to this Ethereum’s tendency to become bogged down with its own data volumes and protocol rules so shaky they couldn’t even set in a Jell-o mold, let alone stone. It’s little wonder more and more ETH developers have been approaching representatives from the BSV industry recently, enquiring about porting their projects.

Unbounded scaling and miniscule fees: it’s a no-brainer for any blockchain project looking for mass usage. Bitcoin was always built to be a large-scale data processing network; these functions existed in its protocol right from the start and were part of Satoshi Nakamoto‘s original vision. That’s why only Bitcoin BSV represents this vision… and is the only blockchain that actually works as promised.

03-09-2026

03-09-2026