|

Getting your Trinity Audio player ready...

|

With all of the external drama happening in the BSV blockchain, I am happy to take it upon myself to remind everyone that if we are all going to make it, it will be because we focused like laser beams on our own businesses and our own success.

In Bitcoin mining, it’s crucial to stay ahead of the curve in terms of technology and efficiency. My previous explorations of Bitcoin mining economics highlighted the dynamics of surviving and thriving by mining, emphasizing the need for constant adaptation and forward-thinking strategies.

Against this backdrop, the Bitmain Antminer S21 and S19 K Pro models have emerged as leading solutions for hashing partners seeking to optimize their profitability in anticipation of the next bull market in 2024-2025. These “next-generation” hashing rigs offer unparalleled efficiency, making them a prudent decision for those looking to upgrade their mining hardware while also preparing to upcycle their tiring fleet.

Are you still operating rigs that run at or below 100TH/s? Then this article is for you!

Technical superiority of S21 and S19 K Pro Antminers

The S21 and S19 K Pro Antminers from Bitmain stand out as the leaders in the current generation of efficiency achievements in SHA256 hashing technology. These models epitomize the industry’s advancements in efficiency and performance. The S21 series is currently available to some key players in the industry, and they are indeed a testament to Bitmain’s ability to keep breaking the glass ceiling on chip efficiency, boasting a formidable 200Th/s hash rate and consuming about 3500 watts. In comparison, the K Pro series also made a significant leap with its use of 5nm chips and modified S19 architecture, which has been leading the charge since the last bull market, offering a hash rate of 120Th/s while notably reducing power consumption to 2760 watts—give or take 5% at the wall.

These improvements in the S21 and S19 K Pro models over their predecessors are not just incremental but transformative. The adoption of these models is a necessity for anyone who wants to stay seriously in the game for the next one to two year cycle as global hash power continues to hit all-time highs, but overall profitability stays in a middling low area—creating some extra opportunity for BSV hashers over the BTC contingent.

Why?

Because BSV profitability is often higher than BTC, but the open market price for rigs is based on BTC-only numbers. Big benefit for the big blockers!

Overclocking, up-cycling, selling

For anyone still running older S19 models in the 100 TH/s or lower range, there are two options:

1: Time to overclock, mine in an immersion setup, or otherwise “Frankenstein” your rigs to generate more power as profitability rises.

2: Prepare them for resale when the market is at a fever pitch over profitability. Used rigs will sell for a premium when fiat prices for BTC reach new all-time highs because Bitmain will have months-long back-orders, and used hashers can be flipped to newcomers very quickly. This is the time to offload older models to newcomers who want to wet their beaks in the mining game.

Market dynamics and the case for upgrading

Rapid technological advancements and increasing mining difficulty mark the current landscape. This scenario makes the case for upgrading to more efficient mining hardware like the S21 and S19 K Pro Antminers more compelling than ever.

The advantages of these newer models are not limited to their superior technical capabilities. The economics of mining, including factors like electricity costs and the fluctuating price of Bitcoin, play a significant role in determining profitability. The enhanced efficiency of the S21 and S19 K Pro models translates to lower operational costs, which can be a decisive factor in maintaining profitability, especially in a market where margins are continually squeezed.

For hashers currently operating with older, less efficient ASIC fleets, upgrading to these newer models represents a smart strategic decision. Not only do they stand to benefit from improved efficiency and reduced costs, but they also position themselves to take full advantage of the anticipated bull market in 2024-2025. By upgrading their hardware now, hashers can ensure they are well-equipped to capitalize on favorable market conditions when they arise.

Long-term investment strategy and future market projections

The latest S21 and S19 K Pro Antminers allow their owners to ride the current wave of mining efficiency; it’s a strategic move for long-term hashers. Miners aren’t just planning for a bull market in 2024-2025, but also the imminent release of Teranode, the Bitcoin halving and the potential shake-up due to outcomes in COPA. Hashers who upgrade their hardware now are placing themselves in a prime position to capitalize on future market opportunities regardless of outcomes.

I know nobody wants to consider the possibility of malinvestment, but when I speak to BTC-interested clients, I love to tell them why they should put 1-5% of their fleet on the BSV blockchain, and to my big blocker friends, I remind them that if BSV mining profitability ever falls off a cliff, any hardware can be pivoted to BTC within a day. When calculating risk, just having that information in the back of your head is essential.

Furthermore, upgrading to these newer models is another calculated risk that balances current costs with future gains. While the initial capital investment may be substantial, the long-term benefits—in terms of both enhanced mining capabilities and potential resale value—make it a prudent decision. As hashers with older, less efficient ASIC fleets consider their options, consider your upgrade cycle as existing in phases. Right now is likely a good time to invest, and in 6-12 months, it should be a good time to offload the older portion of the fleet.

Conclusion: Seizing the future of Bitcoin mining

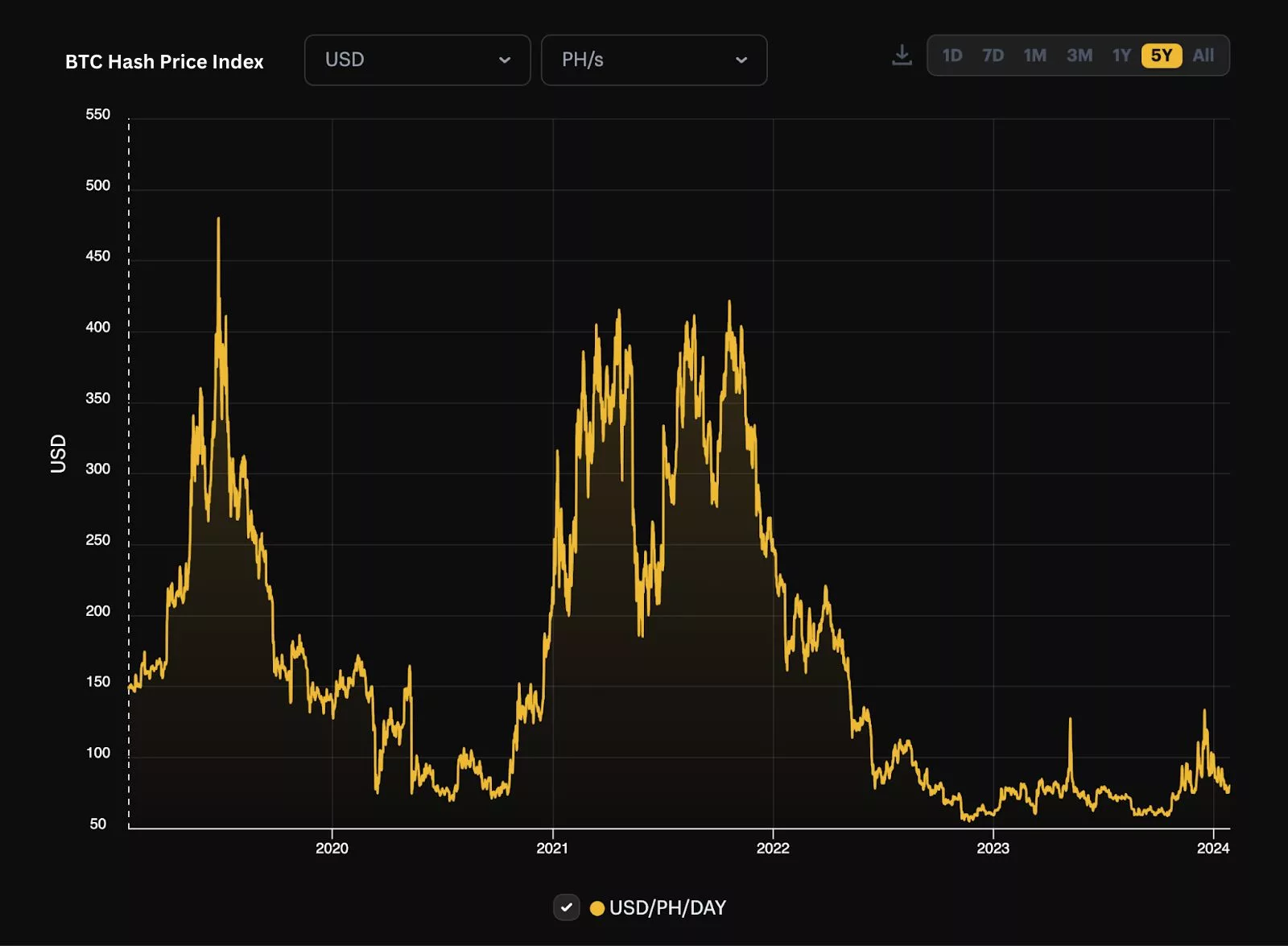

Prices for new hashing rigs are still near historical lows because difficulty is still ragingly high in BTC. This means profitability is still low despite the fact that the BTC price has been on an uptrend since the end of 2022. When prices hit new all-time highs, or if in a year from now, the average block size is in the terabytes, you will wish you had upgraded in Q1 2024!

In conclusion, the time to consider upgrading your mining hardware is now. The S21 and S19 K Pro Antminers offer an opportunity to stay ahead in the competitive world of Bitcoin mining, ensuring readiness for the next phase of growth in Bitcoin. As we’ve seen from past market trends and technological advancements, those who are best prepared are often the ones who succeed in the long term.

And if you’re running a business in the Bitcoin space and have no exposure to mining, well, now is the time to start!

Watch: History of Bitcoin with Kurt Wuckert Jr.

03-09-2026

03-09-2026