|

Getting your Trinity Audio player ready...

|

This post originally appeared on ZeMing M. Gao’s website, and we republished with permission from the author. Read the full piece here.

While the whole world seems to be fixing its eyes on the bitcoin price charts, I closely watch a simple and mundane number:

The ‘transaction fee/subsidy’ ratios of BSV and BTC.

These ratios are the most significant Bitcoin chart to look at, because it is signaling the future.

Why is this important? Because this is where the dynamics of competitive mining economics is active.

In the past years, the total number of transactions on BSV blockchain has increased from nothing to first surpassing that of BTC and then reaching 10-100 times that of BTC as of March 2023.

If the trend continues, BSV miners will enjoy exponential growth of revenue from network fees, while BTC miners will face a growing avalanche of pressure to migrate to BSV for superior profitability, and this despite the fact that fee per transaction on BSV is many thousands of times lower than that on BTC and is likely to continue to drop further lower by many times in the future.

The only reason why the increase in BSV transaction volume has not already caused a shift of mining behavior according to the prediction of mining economics was a quite simple one: in the past, while the number of transactions of BSV increased, the fee per transaction of BSV decreased proportionally to cancel out the effect. Considered with a long-term view, this is healthy. Even though it is desirable for the fee/subsidy ratio to increase to show the superiority of BSV mining economics, it would not be good for the ratio to increase for a wrong reason, specifically as a result of fee per transaction increase. This is because the latter would diminish the utility of the system. A real production economy is always based on actual utility, in which a product/service is rewarded because it has made something more efficient. As BTC and the rest of the crypto sector find their life support in a fake economy driven by ponzymistic mental energy, it is a good thing that the real utility blockchain is not affected by that. So far, BSV has been doing marvelously well in this respect.

At the same time, the transaction fee cannot drop continuously without a limit. The lowest natural transaction fee is 1 sat/transaction, beyond which special measures would be necessary. Given the already very low transaction fee on BSV, the future decrease of the fee is expected to decelerate, to be outpaced by the increase of the transaction volume.1

Therefore, if the total number of transactions on BSV continues to increase unboundedly, it will be inevitable that the ‘transaction fee/subsidy’ ratios of BSV will pull away from that of BTC.

For example, the current peak of transaction volume on BSV is 50 million transactions per day. If it increases another 100 times to 5 billion transactions per day and sustains at around that volume, it will translate to about 10 BSV per block (versus the current 0.1 BSV per block). But if we assume the fee per transaction further drops from the current 25 sats/tx to 10 sats/tx, it would be about 4 BSV per block. In that scenario, the fee/subsidy ratio of BSV will be around 0.65 (65%).

In comparison, the fee/subsidy ratio of BTC is likely to be still in the range of 0.01-0.03 (1-3%) because there is inherently limited room for BTC transaction fees to move.

As will be explained in detail in this chapter, such a drastic gap between the fee/subsidy ratios will have irresistible impact on the miners’ profitability. The above is a very conservative estimate. Significant economic impact could be felt by the miners well before fee/subsidy ratio of BSV reaches 65%. It could happen at just 25% or even before that.

At the present time, the fee/subsidy ratio of BSV is just a bit over 1%, comparable to that of BTC. The transaction economics is therefore completely buried under noise.

But it will not remain like this forever, because the economics of profitability is an operative force like gravity is.

The basics of bitcoin mining economics

At the most basic level, the economics of bitcoin mining is not complicated, and is the same with BTC as with BSV.

Miner’s block reward = block subsidy + network transaction fees

The block reward is a miner’s revenue for successfully creating a valid block on the chain.

As will be shown in this article, in terms of comparative mining profitability, the block subsidy parts essentially cancel out on each other among BTC, BSV and BCH, and therefore the only competitive action is found in the network transaction fees.

And as will be shown in this article, the trend of the network transaction fees, along with the inherent designs of BTC and BSV, spells bad news for BTC.

Please do not quickly jump into the following superficial conclusions:

- Because presently there is a huge price difference between BTC and BSV coins, the block subsidies are not comparable and cannot possibly cancel out on each other.

- Because historically the BTC’s fee/subsidy ratio reached levels that were much higher than even the BSV’s recent highest fee/subsidy ratio, the current trend must be a temporary fluke.

Your intuition is wrong if you think the above. Read on. But first a hint:

The actual prices of BTC and BSV are irrelevant in this analysis, as the dynamics is determined by the relative ratios, and the fundamental profitability metrics is the profitability per-unit hash power (rather than that of the total hash power).

For example, the current price of BSV is 1/500th that of BTC. But as far as the mining subsidy is concerned, mining on BSV is equally profitable to that on BTC, because mining BSV requires 500 times less hash power. Therefore, the subsidy part of the economics evens out between BTC and BSV, and the only thing that is competitive comes from the network transaction fees, which is a focus of this article.

Because historically the price ratio and hash power ratio between BTC and BSV have largely matched each other in the market, this conclusion does not change whether this ratio further deteriorates to 1/1000 or improves to 1/10, or even 10/1, in the future.

This is not a theory. If you’re a miner, whether you understand this intellectually or not, you will actually feel it in your mining operations. Anyone who has done multi-chain BTC/BCH/BSV mining simultaneously would know this as a fact.

The background & status quo

The total block reward is a miner’s total revenue for successfully creating a valid block on the chain.

And creating a valid block involves two major types of work performed by the miner, namely:

(1) building a block, and

(2) proving the block.

Building a block including adding and processing transactions in the block. It can be very simple when the miner includes only those transactions that have simple straight scripts, but may become very complex when the miner includes transactions that have complex smart contracts.

For BTC, there are no complex smart contracts to speak of. All transactions on BTC have simple standard scripts and a miner needs no special software nor technological know-how to process these transactions. Before you say “wait a second, just because BTC doesn’t have complex smart contracts now does not mean it will not have them in the future!” please be reminded that it is a linchpin design of BTC not to have such smart contract. In order to support the “digital gold” moniker and an attractive but fake decentralization narrative, BTC Core removed all the Bitcoin smart contract capabilities and limited the block size to 1 megabyte. And this is all so deeply entrenched that they would have to fork into a new chain while openly acknowledging that they were totally wrong in order to change it.

With BSV, however, a new field is opened up because more and more transactions are created by customers to take advantage of the smart contract capability on BSV. A BSV miner has a choice to make when building a block, namely deciding what transactions it wants to include in the block it is building.

This is where the BSV mining business becomes sophisticated and competitive beyond the mere hash power competition. A BSV miner cannot just blindly include every transaction into its block. Transactions having smart contracts can be highly complex and diverse, and they can come from all kinds of customers in various businesses, from art, esports to enterprise software. To include such transactions in a block requires a good understanding of the customer’s business logic, building a good business relationship with the customer, and developing software capabilities to compile the smart contracts to straight OP_codes. Advanced miners may even go beyond and start to build tools for new businesses in BSV blockchain ecosystem. There is no limit.

Proving a block is a different matter. Broadly speaking, it involves two different kinds of block proving activities:

(i) solving a hashing puzzle, which is a hashing competition among miners for the next block (as every miner builds its own block and wants its block to be accepted in the chain), and

(ii) validating and accepting the block created by another miner who has won the hashing competition (miners are required to do this as matter of the consensus).

Note that the miner who has won the next block does not need to do extra work in validating and accepting the block, because all of that should have been done in building the block already, see the above (1), “building a block”. But to be accepted to the chain, the block has to be validated and accepted by other miners.

It is important to also note that, after a block has already been built, validating and accepting the block by another miner becomes easy and can be done by any miner, because all transactions have been compiled into straight scripts (OP_codes). In other words, although not every miner may be sophisticated enough to build a block to include transactions that have complex smart contracts, every miner that runs standard mining software is capable of validating and accepting such a block created by another miner.

This is part of the Proof-of-Work (PoW) consensus among the miners.

The concept of PoW itself has been a source of confusion, because by “work” in Proof-of-Work, most people refer to “hashing” only. But that’s a misunderstanding. There are at least two different types of “work” involved as indicated above.

The term “mining” is also confusing, because to many people, it suggests working for newly “minted” coins as a block subsidy only. But that is not accurate. The reality is:

(1) there is no ongoing “minting” (in a real sense of the term) of bitcoin, as all 21 million bitcoins were minted all at once when the Genesis block was created; and

(2) the only difference between block subsidy and network transaction fees is that the former receives new coins from the preprogrammed coinbase (an initial market) while the latter receives coins from customers (a secondary market).

Therefore, even after the block subsidy has stopped, miners’ work continues, and the work may still be considered “mining” in a sense that the process yields coins for a miner.

It is therefore misleading to focus on the block subsidy only. The block subsidy is supposed to be a temporary bootstrapping strategy for establishing the blockchain. The real dynamics of the mining economy is in the network fees.

The block subsidy is mostly static (except for halvings roughly every four years). And more importantly, as will be shown in this article, block subsidies are non-differential between different chains (that is, they are essentially the same for BTC, BSV or BCH, on a unit-hash power basis).

Currently, BTC and BSV prices track almost precisely in proportion to the network hashing powers (or in reality it is the other way around, but the key is that they are correlated). In other words, the ratio between BTC price and BSV price is almost exactly the same as the ratio between BTC hash power and BSV hash power. Both ratios fluctuate with time, but they are almost synchronized to match between the chains.

It means the market is completely writing off the network transaction economics. The market only sees the simple hashing part, and is completely blind to the transaction part that is the real story in the future.

This reflects a temporary fact that the fee/subsidy ratios of both networks are still very low and almost negligible (i.e., the network transaction fee is still a small portion on these networks and have a negligible impact on miners’ decisions on operations).

However, this ignores what is already happening behind the scenes and will likely happen at an even faster pace in the future.

This will be the textbook example of asymmetric information, or information failure, or knowledge failure of the market.

But watch the trend!

The network transaction volume is rapidly growing on the BSV blockchain, while that on BTC is flat and capped by design. As a result, transaction fees as a component of the BSV’s total block rewards is expected to grow as well, while the counterpart of BTC is perpetually limited by design. In the past, the total transaction fee per block on BSV did not increase despite the transaction volume increase, only because the fee per transaction on BSV has decreased proportionally to cancel out the overall effect. But because the fee per transaction cannot keep going down without a limit, it is expected to decelerate, and as a result the total transaction fees per block will eventually go up with the transaction volume.

Therefore, if the transaction volume on BSV keeps going up, an inescapable squeeze is being formed.

Imagine when BSV’s fee/subsidy ratio rises to 9, while that of BTC remains at 0.01 (1%). It would mean that, for roughly the same amount of hash power, a miner can generate 10 times (10x) as much revenue on BSV as that on BTC. It would also translate to much higher profits (see Section “What about profitability?”).

If the fee/subsidy of BSV is 99 while that of BTC remains at 0.01 (1%), the difference would be about 100 times (100x), so on. There really is no ceiling for this as BSV is unbounded in terms of the block size and the number of transactions included in one block. See further below for a more detailed mathematical explanation for this conclusion, but at this point, just trust the math.

But in reality, that’s not going to happen, as miners would have moved over to BSV long ago, because no business can ignore such a huge difference in revenue efficiency, and ultimately in profitability as well.

BTC miners therefore face a growing avalanche of pressure due to BSV’s exponential growth of network fees. If a 10% or 20% extra profit margin is not sufficient to overcome ignorance, ideological bias, personal sentiments, whatever the case it may be, how about 50%, 100%, 200%, 500%, or 1000%?

Wherever there is a higher profit to be made, the capital and resources will figure out a way to follow. The friction or resistance cannot be infinite, and therefore a breakout point will arrive sooner or later. It is simple economics and capitalism. A rapidly growing economic force cannot simply be ignored or pushed back by mere slandering. There will bound to be reactions, legally or not.

So overall, as long as the BSV adoption continues, it will all gravitate toward BSV.

For the same reason, the apps and transactions on BSV are absolutely the key. If they keep going up like they have been during the last month, something big is going to happen in the BSV landscape, including the coin price. It will not be a matter of personal opinions, but objective economics.

The present and the future

The present price difference between BTC and BSV is a known fact. The purpose of this article is to help readers focus on the trend.

Note again that BTC’s network fees are limited by design and have already reached the upper limit, while BSV’s are unlimited. The potential room of growth can therefore also be unlimited, perhaps reaching a difference of a million times and more in the future. Speaking of ‘potential’, this is based on objective boundaries defined by each system, not a mere subjective opinion. Please keep this in mind while reading this article, as otherwise some of the logic and reasoning may not come through naturally.

That BTC’s daily fees has almost a hard cap is a well-known fact. It is because the total number of transactions the BTC blockchain can process is already at or near its maximum block capability. Although the actual number fluctuates from time to time, it has touched the top frequently in the past. And by the very design of BTC which predicates on small blocks, the top is a hard ceiling, with no possibility to pierce through.

With the total number of transactions per block fixed, the only way to increase the transaction fee is to increase the fee per transaction, which is unrealistic because ranging between $1-$20 it is already too high. It is in sharp contrast with the $0.00001 transaction fee on BSV, which has unlimited block size, and therefore unlimited number of transactions per block. For more detail, see BTC and Bitcoin, what is the real difference?

It really is an exciting time to be in the BSV space.

The dynamics between hash power and price

The dynamics between hash power and price is not a simple cause and effect relationship. Nevertheless, the correlation and even causality between hash power and price is real:

The total hash power of a blockchain (BTC or BSV) is largely determined by the block difficulty level. Block difficulty adjustment happens once in a while due to the 10 min block time restriction, which is affected by miner competition (because more competition leads to higher hash power and thus shortens block time), which in turn is driven by miners’ profitability, which in turn is determined by revenue sources and the coin price.

The coin price at any given time is determined by the market.

The market is influenced by demand and supply.

With an asset that has no utility, the demand and supply is purely speculative, depending on people’s perception of the future price, the network strength (which in turn correlates to hash power), the selling of newly mined coins by miners, and many other things. It is therefore not a simple one directional linear relationship.

But as BSV processes more and more transactions and bigger and bigger blocks, BSV becomes a real commodity, not for pure speculative trading, but actually needed by businesses, entrepreneurs, consumers to have transactions and to store data on the BSV chain. Thus, a market that has real economic basis emerges, and BSV price will be driven by economic demand and supply, not just speculations.

As the demand increases, the price will increase too, because BSV has a limited supply.

Therefore, if transactions and block sizes continue to grow and the number of sats per transaction stabilizes, it will eventually come to a point where BSV price will be pressured to rise. The faster the growth is, the higher the pressure is. This pressure may not be felt temporarily when the difference is still small, but eventually will be, if the growth does not stop.

But if the BSV price continues to rise, BSV hash power will rise as well, leading to higher energy cost for the miners. Will this diminish the attraction for miners to move to BSV?

The answer is no, because ultimately, a miner’s willingness to increase its hash power are driven by profitability. Due to the extra revenue of transaction fees, the mining economics continues to be in favor to BSV, because no matter how much BSV hash power rises, it cannot make BSV miners’ transaction fee revenue advantage disappear.

Definitions and examples

In order to look at this more quantitatively, let us look at several definitions.

Block reward = block subsidy + network transaction fees

BSV/BTC hash ratio: BSV hash power / BTC hash power

BSV/BTC price ratio: BSV price / BTC price

Fee/subsidy ratio: network fee / block subsidy (either BSV or BTC, respectively)

BSV’s fee percentage: BSV network fee / BSV block reward (%)

BTC’s fee percentage: BTC network fee / BTC block reward (%)

BSV-BTC difference in fee: BSV’s fee/subsidy ratio minus BTC’s fee/subsidy ratio (%)

The issue before the miners is quite simple:

Anytime when BSV’s fee/subsidy ratio is greater than BTC’s, there is attraction/pressure for a miner to move its hash power from BTC to BSV, because the difference is extra revenue, almost free surplus profit, provided that the BSV/BTC hash ratio and BSV/BTC price ratio are roughly tracking each other (which have been historically).

This is because, when BSV/BTC hash ratio and BSV/BTC price ratio are the same, the block subsidy alone results in the same profitability on BSV and BTC.

For example, currently, BTC price is 500 times that of BSV, but if the mining subsidy only is concerned, mining on BSV is equally profitable to that on BTC because mining BSV requires 500 times less hash power (and correspondingly 500 times less equipment and energy). So the subsidy part of the economics evens out between BTC and BSV. The conclusion would remain the same whether BTC/BSV price ratio is 1000 or 10, or even reversed at 1/10 or 1/1000 for that matter.

At the present time, because the fee/subsidy ratios of BTC, BCH and BSV are all very small, the mining profitability of these three chains are essentially the same when measured over a longer period of time by unit power conception, e.g. per THash/s, despite some short period fluctuations. See for example, profitability charts on bitinfocharts.com.

But all this will change when BSV’s fee/subsidy ratio quickly rises above BTC’s, and the difference becomes bigger and bigger. See further discussions below.

In other words, the bitcoin subsidy portion of the block rewards always cancel out with each other when compared between BTC and BSV, and as a result, any competitive difference in profitability comes only from the difference in transaction fees.

This may be very counterintuitive to many, because people’s mind tends to gravitate toward this skepticism: how can that be when BTC price is hundreds of times that of BSV?

The key: the actual prices of BTC and BSV are irrelevant in this analysis, as the dynamics is determined by the relative ratios, and the fundamental profitability is the per-unit hash power profitability (rather than the total hash power).

Now, if BSV’s fee/subsidy ratio and BTC’s fee/subsidy ratio were also the same (in other words, BSV-BTC fee/subsidy ratio difference is zero), the transaction fee part of the economics would also be the same on BSV as it is on BTC, making the per-unit hash power profitability on both blockchains entirely equal to each other.

But as the transaction volume on BSV keeps increasing but that of BTC doesn’t, BSV’s fee/subsidy ratio and BTC’s fee/subsidy ratio are not going to be the same.

Due to the design difference of BSV and BTC, the difference is destined to be large, and may grow larger and larger with no bounds.

And that, is where the real dynamics is operative.

When the fee/subsidy ratios of both blockchain are small, miners can ignore them. For example, when BSV’s fee/subsidy ratio is at 2%, it is still almost negligible, despite its being twice the BTC’s 1%, the difference (2% -1% =1%) between the two is almost negligible.

But if the difference between fee/subsidy ratios of BSV and BTC becomes larger, say over 10%, or 15%, it would become harder to ignore. And a difference of 25% or greater may be impossible to ignore.

Consider a situation where BSV’s fee/subsidy ratio is at 100% while that of BTC’s is at 1%. This would mean that on BSV, the transaction fees are half the block subsidy (a 1/2 and 1/2 split), but on BTC it is negligible. Together this would translate to a 2x in total revenue per-unit hash power on BSV as compared to BTC, and in much higher profit as well (see below Section “What about profitability?).

The revenues in the above scenario are as follows:

total BTC block reward = 6.25 BTC

total BSV block reward = 6.25 BSV + 6.25 BSV = 12.5 BSV.

That is, the mining revenue with a given amount of hash power would double (2x) if it is on BSV blockchain from the BTC blockchain.

If BSV’s fee/subsidy ratio further becomes 10, while BTC’s fee/subsidy ratio remains 1%, the total block rewards would be as follows:

total BTC block reward = 6.25 BTC

total BSV block reward = 6.25 BSV + 62.5 BSV = 68.75 BSV.

That is, mining revenue on the BSV blockchain would be 11 times (11x) the mining revenue on the BTC blockchain for the same amount of hashing power.

If BSV’s fee/subsidy ratio becomes 100, mining revenue on BSV would be 101 times (101x). And so on.

The above calculations are based on ratios, and the actual prices of BTC and BSV are only relevant to the extent they a part of the ratio calculations.

But as said above, in reality the above scenarios are not going to happen, as miners would have moved over to BSV long ago.

For profitability and coin price scenarios that are more likely to happen, see the below sections “But what about the profitability?”, and “Hypothetical scenarios” of this article.

Coin price difference and revenue comparability

But how can you be comparing BSV coins with BTC coins! A reward in BSV coins is not the same as a reward in BTC coins, as BTC is presently hundreds of times more valuable than BSV per coin. This is the typical protest.

The answer is, for miners, the fundamental metrics is revenue and profitability per-unit hash power.

Provided that BSV/BTC hash ratio and BSV/BTC price ratio keep tracking each other, which has been the case historically, the subsidy revenue on the BSV chain and the subsidy revenue on the BTC chain are comparable on a per unit hash power basis. It is straightforward math.

Only the difference in revenues from transaction fees contribute to profitability in competitive terms.

But what about the profitability?

The above discussion is based on revenues. But what about the profitability? If the cost also increases by the same proportion, there would be no change in profitability even if the revenue increases.

This is the part that is widely misunderstood or not understood at all:

In terms of energy consumption, Bitcoin’s transaction processing will be computationally far more efficient than hashing, probably by orders of magnitude. The reason is twofold.

First, hashing is standardized on both BSV and BTC, as both use the same mining machines and same hashing algorithm. The hashing competition is never about utility, and never cares about energy efficiency in terms of utility, but only cares about sheer power in hashing. Although the makers of hashing hardware compete on energy efficiency, at the miner level roughly everyone is on the same footing because everyone uses comparable equipment at any given time. Of course, miners all seek the cheapest energy sources, but this does not have intrinsic technological innovation for the miners themselves, nor does it differentiate between different Bitcoin blockchains, BTC or BSV. Therefore, the hashing part of the business stands alone on its own basis, but does not become a basis for competition in efficiency. The fact is that competitive hashing alone has never been a noticeable reason for miners to switch between BTC and BSV. However, this lack of an obvious differentiator in the past has given people a misimpression that competition does not exist and there is none to come, while in fact the real competition in transaction processing is temporarily hidden and is bound to rise.

Second, the transaction processing on BSV is becoming a highly competitive business and is driving a tremendous amount of technological and business innovations that improve efficiency continuously. This is how progress is made, and also how new values are created.

At the current stage when the block sizes are still not too large, the transaction processing happens almost as a byproduct, requiring almost negligible energy consumption besides the hashing itself.

This may have a dramatic effect on profitability, making the profitability boost even greater than the revenue boost in the scenarios discussed above.

Judging from the energy efficiency of the current BSV nodes, the costs due to energy consumption in transaction processing are almost negligible. The cost for BSV transaction processing is mostly business overhead, not for energy consumption. This also shows how energy efficient BSV would become when compared to BTC.

Wherever there are more profits to be made, the capital and resources will figure out a way to follow. It is simple economics and capitalism. Therefore, as long as the BSV adoption continues, the mining business will all gravitate toward BSV.

Hashing difficulty level and network security

When the competition described above arises, BTC might be forced to lower the hashing difficulty level to artificially maintain a higher price/hash ratio and make mining on BTC more profitable to prevent miners from leaving for BSV.

In response to that, BSV would have options. It may match BTC’s price/hash ratio (as it has done in the past). Or it may ignore BTC’s move and thus breaking the current coupling between BTC/BSV price ratio and BTC/BSV hash ratio. Or it may position anywhere in between with a more balanced and sophisticated strategy.

Once the coupling between BTC/BSV price ratio and BTC/BSV hash ratio is broken, BTC and BSV mining would be essentially two different kinds of economies. To the extent that more hashing power is required on BSV to generate a coin subsidy having the same dollar value, BSV would have developed a different dimension of network security which BTC cannot reach, because hashing on BSV would then be objectively “harder” than that on BTC on a per subsidy dollar basis, and it can afford to be ‘harder’ due to its better economics.

But to the extent that BSV miners are still more profitable than BTC miners thanks to the much higher network fee, it would demonstrate itself as simply a better technology as well as a better economy.

At the same time, as the block subsidy continues to diminish through future halvings anyway, it would be beyond any doubt which technology and economy is sunsetting, and which is rising.

To the extent that mining on BSV is “harder,” however, the level of pressure for BTC miners to move to BSV may be somewhat alleviated. So there may be a curved dynamics.

The dynamics of mining

When the above-described dynamics kicks in, the only thing that could counter an avalanche effect is a divergence of the hash power ratio and the price ratio between BSV and BTC.

Following the above analysis, it is rather clear that the only thing that would mitigate the pressure for miners to move to BSV is that somehow the price ratio between BTC and BSV is greater than the hash power ratio between BTC and BSV.

That is, to reduce the pressure of miner migration from BTC to BSV, the market would have to deem BTC’s hashing to be qualitatively (not just quantitatively) more valuable than BSV’s.

But how can that be? Even under the current market condition that is completely biased against BSV, the market considers BTC’s hashing to be qualitatively the same as that of BSV’s, with the only difference recognized by the market being quantitative, why would it change when BSV is clearly winning the business?

It is therefore conservatively reasonable to expect the hash ratio and the price ratio to be the same for quite long time in the future. But as illustrated above, that would be an extremely favorable condition for BSV, because the extra revenue from transaction fees would be a source of increasingly greater extra profit for BSV miners, a condition that would trigger an avalanche of miner migration to BSV.

Therefore, as long as the mass adoption of BSV occurs, the tectonic shift is unavoidable. It will not be a matter of personal opinions, but objective economics.

The dynamics of mining has a simple and clear signal here. The only way for BTC to avoid an onslaught/avalanche type of collapse is that BSV perpetually fails to see app/user adoption. Without adoption of utility, BSV would be competing against BTC as a store of value, an inferior one at that according to what the market has spoken.

The effect of rising BSV price on BSV’s low fee advantage — hypothetical scenarios

Some may ask: While the BSV’s fee/subsidy ratio continues to go up, how does BSV’s coin price come into play? If one expects the coin price to also increase, would it not also make BSV transaction fees continue to rise and gradually lose the low fee competitive advantage?

An alternative way to put this question is: If the BSV blockchain’s competitive edge is premised on its low fees, does it even have room to allow the BSV coin price to increase?

This is a valid question, especially considering that BTC’s transaction fees, although extremely high at the present time, does not depend on the coin price and does not have to go up with the coin price, whereas BSV charges a certain number of satoshis per byte of data, and therefore the continuous rising of BSV coin price would eventually make the fee per transaction increasingly too high.

It is reasonable to assume that customers would measure fees in dollar amounts (or any other fiat preferred by the customers) even though miners price them in satoshis.

However, the above concern causes no difficulty to BSV. As the BSV coin price increases, BSV miners always have the option to lower the number of satoshis charged per byte, to maintain the fee competitiveness.

But this raises another question: if the transaction fee in satoshis continues to drop, how can BSV maintain its higher fee/subsidy ratio relative to BTC (which is the cause of pressure or attraction to BTC miners in the first place)?

As will be shown in the following scenarios, as the transaction volume increases, BSV has a lot of room to maneuver and would be able to increase the overall transaction fee/subsidy ratio while decreasing the fee per transaction in satoshis.

The following is a series of hypothetical scenarios in which BSV’s fee per transaction decreases about 3x every time when BSV’s transaction volume increases 10x, still resulting in a total transaction fee increase of 3.3x.

Note the fees and subsidies are measured in satoshis, the coin price is irrelevant, as far as the fee/subsidy ratios are concerned.

the present state:

transaction fee = 1; block subsidy = 99 (unit does not matter); fee/subsidy ratio = 1/99 = 0.01 (1%)

future state 1:

transaction volume goes up 10x, fee per transaction drops by 2x, and the total transaction fee goes up 5x (10/2), while block subsidy remains the same (in satoshis regardless of the coin price).

transaction fee = 1×5 = 5; block subsidy = 99; fee/subsidy ratio = 5/99 = 0.05 (5%)

future state 2:

transaction volume goes up 100x, fee per transaction drops by 5x, and the total transaction fee goes up 20x, while block subsidy drops 2x (due to the next halving).

transaction fee = 1×20=20; block subsidy = 96×0.5 = 48; fee/subsidy ratio = 20/48 = 0.42 (42%)

future state 3:

transaction volume goes up 1,000x, fee per transaction drops by 10x, and the total transaction fee goes up 100x, while block subsidy drops 2x (due to the next halving).

transaction fee = 1×100=100; block subsidy = 96×0.5 = 48; fee/subsidy ratio = 100/48 = 2.08 (208%)

future state 4:

transaction volume goes up 10,000x, fee per transaction drops by 20x, and the total transaction fee goes up 500x, while block subsidy drops 4x (due totwo halvings).

transaction fee = 1×500=500; block subsidy = 96×0.5×0.5 = 24; fee/subsidy ratio = 500/24 20.8 (2008%)

In the above scenarios, BSV’s fee/subsidy ratio sequentially rises from 0.01, to 0.05, 0.42, 2.08, and 20.8 times, despite that the fee per transaction measured in satoshis continues to decrease by 2x, 5x, 10x, and 20x. According to the economics discussed here, the continuous rise of the fee/subsidy ratio represents a squeeze against BTC, while the continuous decrease of transaction fees represents an elevation of BSV in its competitive power in the market. Either of these two is bad news for BTC, but a simultaneous combination of both is worse.

Once BSV’s fee/subsidy ratio rises above 0.25 (25%), the difference will be substantial and the pressure will be clearly felt by BTC miners. When the BSV’s fee/subsidy ratio multiplies, the pressure would also multiply. It is hard to imagine that BTC miners would not consider to move when the ratio rises to 50%, 200% and 2000%.

I would predict that, once BSV’s fee/subsidy ratio approaches as high as 50%, there is no way that BTC could catch up. BTC will either collapse or have to concede that its mining economics is inferior to that of BSV and find a “political” solution to make up its market inferiority.

At the same time, the fact that in the above scenarios the per transaction fee measured in satoshis continues to drop will have profound impact on the market and price.

For one thing, a decreasing number of sats per transaction gives room for the BSV coin price to rise without affecting the per transaction fees in actual dollar amounts. That is, even with the BSV price increasing by large multiples, the fee/subsidy ratio on BSV can continue to increase without affecting the BSV’s low fee competitiveness.

The effect of the objective economics is that, being able to create an unbounded economy enables BSV to maintain competitiveness in all the following three areas simultaneously:

(1) competitive in the mining business by maintaining a high fee/subsidy ratio;

(2) competitive in user adoption by maintaining low fees per transaction;

(3) competitive in the coin price market by providing efficiency to compensate price appreciation.

BTC restricted in this competition

The higher BSV’s fee/subsidy ratio is comparative to BTC’s, the higher the pressure is for BTC miners to move over to BSV. This is the conclusion from the previous analysis, which assumes that the hash ratio and the price ratio continue to be the same or comparable between BTC and BSV (regardless of the actual price difference of the two coins), as they have been historically.

BTC is restricted in these competing dynamics because it has no effective tools to counter. Can it increase its own fees/subsidy ratio to match that of BSV? Theoretically, it could, but in practice that would be committing suicide, because the only way for BTC to do that are (1) reducing the hash power (but accordingly undermining the BTC price market); or (2) increasing the fee per transaction, which is already too high.

But why can’t BTC increase its profitability simply by the virtue of perpetually increasing BTC price?

Well, the fact that it cannot be done is the point of this article.

First off, even if the competitive dynamics brought in by BSV did not exist, it would still be mathematically infeasible to expect the BTC price to go up perpetually. For an asset that has no inherent productivity but only designed to extract value from the existing economy, it has an upper limit even if the Ponzi scheme works to its maximum power.

But that is not even what matters the most here. It is the competitive dynamics brought in by BSV’s network fees that matters. A higher BTC price means higher hash power, but the higher hash power is not going to come, because the hash power would be attracted to BSV to make more money by chasing the surplus profit from the higher network fees on BSV.

So BTC is inherently restricted, and things cannot happen freely on BTC’s terms. Everything is going to be framed and driven by the increasing BSV network fees.

Another perspective from block size

Because BSV nodes charge fees per byte, the clearest indication of the pressure created by BSV is the average block sizes.

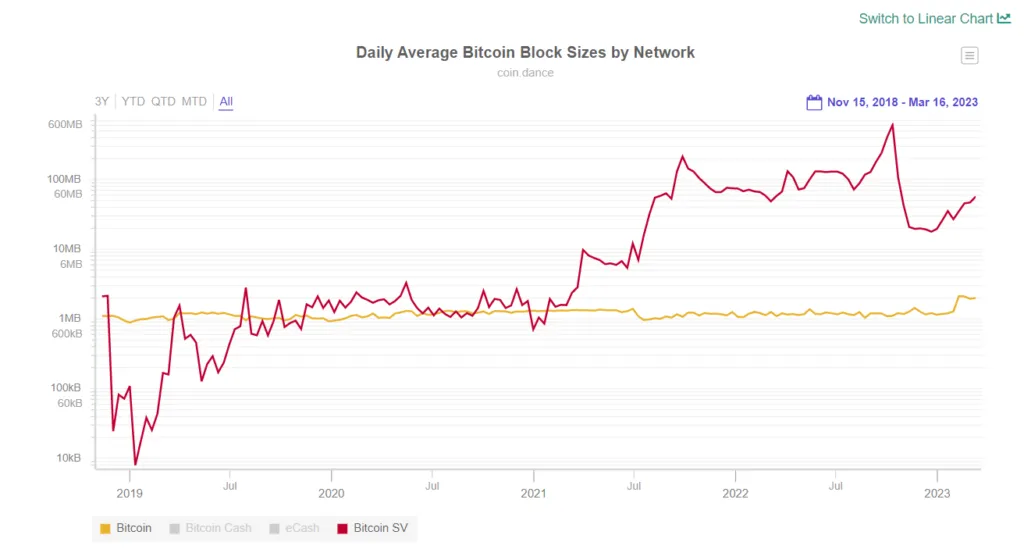

As the chart below shows, BSV’s average block size started very small in 2019, rose to a level comparable to that of BTC during 2020, but took off in early March 2021, rising rapidly, then plateaued in 2022, currently standing at about 50 times that of BTC (50MB).

Note the chart is logarithmic.

The larger the BSV block size is, the higher the pressure is for BTC to keep up. As long as the BSV block size keeps increasing, the pressure continues to increase.

And the pressure on BTC miners would create a vicious cycle. First, hash power is being attracted to BSV due to apparently higher profitability per-unit hash power, diminishing the actual and perceived quality of the BTC network, thus creating downward pressure on BTC price. But this is a death spiral, because once the BTC price goes down, mining on BTC becomes further less profitable compared to that on BSV, so the vicious cycle continues.

The BSV’s average block size is currently about 50MB, 50 times that of BTC and growing. Yet few people are paying attention to it, it must be because BSV’s total transaction fee per block in dollar amount is still many times smaller than that of BTC.

For miners, however, it is not the total transaction fees in an absolute dollar amount that matters, but the ratio between the total transaction fees and the subsidy. People will notice it when miners finally do. If they don’t notice it when BSV’s average block size is 50 times that of BTC, they will more likely notice when it reaches 500 times or 1000 times. But people should notice it much earlier, as the growth trajectory is a critical indicator of the future destination of the two different systems.

Regardless of the attention received, BSV’s average block size will continue to go up on a projected track like this: 1(MB) > 5 > 50 > 500 > 5,000 (5GB) > 50,000 > 500,000 > 5,000,000 (5TB)…

A critical point on the way to reach a BSV/BTC paradigm shift:

In particular, let us estimate the above scenarios when BSV’s average block size reaches 5GB (a further 100 times increase from the present 50MB level).

To do this estimation, let’s first make an assumption that is in favor of BTC in terms of the coin price: assume that BTC/BSV price ratio further enlarges to 1000 (i.e., BTC price being 1000 times that of BSV), despite the fact that the BSV’s block size has grown to 5000 times that of BTC, a further 100 times increase from the present 50MB.

Below, you will soon see the absurdity of this price assumption, but let’s use this assumption for the sake of reasoning, because as the saying goes, “Never underestimate people’s stupidity.”

At block size 5GB, and a fee of 50 sats per kbyte (assuming a future further price reduction of 50% from the current BSV data fee of 100 sats per kbyte), the total fees for one block would be 250 million satoshis, or 2.5 BSV.

For simplicity, we assume in the discussion below it is after the next halving. Note that the network fees are not affected by halving; only the subsidy is.

In this case, BSV’s total reward per block would be 5.625 BSV (= 3.125 + 2.5, block subsidy plus transaction fees) versus BTC’s 3.125 BTC (the block subsidy after the next halving), with BTC’s fee at a negligible percentage.

Assuming BTC/BSV price ratio is 1000, BTC’s total block reward would be equivalent to 3,125 BSV, about 555 times of BSV’s 5.625 BSV.

But before you celebrate on behalf of BTC miners, you should realize how that is not making BTC mining a better business at all, because at that point, a BTC miner generates this 555 times fees using 1000 times as much hash power, nearly 2 times less efficient. On a per energy unit basis, the BTC revenue is a 0.555 fraction of BSV. For every dollar revenue, a BTC miner would need to consume nearly 2 times the energy consumed by a BSV miner. Please first do not even consider who is greener[2] because that’s a very different matter. Just think like a businessman, you should notice in this hypothetical scenario the mining business on the BSV side is far more efficient.

In other words, at that point, a BTC miner could almost double its revenue if it moves the same amount of hash power from BTC to BSV.

What if the BTC/BSV hash power ratio and thus BTC/BSV price ratio are reduced instead, say from the current 500 to just 50? Will the economics become reasonable then?

Still no. At this price ratio, BSV’s total block reward would still be 5.625 BSV, but BTC’s would be equivalent to 156.25 BSV (3.125 x 50), about 28 times that of BSV. Now, using 50 times as much energy to generate 28 times as much revenue means BTC mining is still near 2 times less efficient than BSV.

The result is independent of the coin prices as long as BTC/BSV hash power ratio and BTC/BSV price ratio roughly matched. As long as the market recognizes a correlation between the hash power ratio and price ratio as it has done in the past, the transaction fee generated by BSV constitutes hard economics, and there is simply no escape for BTC mining.

Therefore, if the transaction volume on BSV continues to increase, there is no escape for BTC miners except for moving over to BSV. Regardless of where the BTC price goes, higher or lower, BTC mining as a business is doomed.

The reality will always find a way to escape the absurdity though. Absurdity might last for a while, but it cannot last forever.

Even a stupid market will gradually find its way to reality when miners are under continuously increasing pressure to move from BTC to BSV.

Overall, the economics will be always in favor of BSV, by virtue of it constantly creating a larger economic space, while BTC will be more and more restricted, and squeezed.

The market will seek equilibrium, and there is a lot of room for BSV by virtue of the unbounded economy it has created, but no room for BTC other than the “brain vacuum” it has created in people’s mind.

5GB block size is therefore a critical point on the way to reach the BSV BTC paradigm shift. This is a very conservative estimate, because the shift may happen earlier than that (before the energy efficiency disparity between BSV and BTC reaches 2 times), but it is inconceivable for it not to have happened by then.

And even after BSV’s average block size has reached the above-mentioned critical point (5,000 times that of BTC, or roughly at 5GB per block), there is still no stopping it to go even higher. As a reference, BSV’s Teranode architecture aims at block sizes above 1TB.

Noticing the above estimates, we assumed that BSV continues to reduce transaction fees while still maintaining superior miner profitability. Lower and lower fees are catalytic to explosive further mass adoption.

How far is BSV away from reaching the above critical point, where the present average block size will have been increased by 100 times?

It depends on the adoption. But once adoption starts, it can be exponential. For example, if it doubles every three months, it will take about 20 months to reach 100x. But if it doubles every half year, it would take a little bit over 3.5 years to reach 100x.

It is probably unrealistic to expect the average block size of BSV to sustain explosive growth as it did in 2021, but it may be reasonable to project it to double every six months, which will compound a 100x to reach 5GB average block size in about three years.

Such estimates of the future growth of average block size may be way off, either too aggressive or too conservative, but it is not the main point of this article. The main point is the fundamental economics of Bitcoin mining, and that does not change whether the BSV average block size is doubling every month or only every year.

If you do not understand the above statements, please re-read this article.

Question and answers

1. But miners also consider other factors such as speculating and cashing out, how will that play into the economics?

These factors are real. But it’ll all change dynamically and would easily shift in favor of another chain when the price and profitability shift. It may be impossible to predict an exact time point when certain change may occur, but the overall trend is pretty clear. People who have done mining will not only understand this but can actually feel it when the time comes.

That’s why the ultimate “argument” for BSV is the real numbers that reflect an economic reality. The numbers have just started to emerge since last month. Prior to that, there was a lot of great theories and solid reasoning, but it was too much foresight for most people.

That’s also why I try not to blame the market, not even the crypto market, for its stupidity, although it’s full of that. Even the stock market, as speculative as it may be, has real numbers, such as P/E ratios, to at least give people a psychological guide. Crypto markets have none now. It’s pure speculations. In fact, it is the worst kind of speculations, because some speculations (e.g., stock market) can be based on some reasoning and knowledge, while crypto market speculations at the current stage are almost completely a publicity vote by a blind mass’ enthusiasm driven by a lack of information or misinformation.

But BSV will produce real economic numbers, entrepreneurs will feel that first, smart investors will then follow, and then finally the mass. This is the right order.

Presently, the order is reversed in the crypto market. The cart is placed before the horse, but the cart is flying due to people’s imaginations and the blind following the blind.

2. What is the evidence to support that big block size correlates to economic success?

This is the central point I tried to make in this article. I did not assume this, but rather provided evidence to prove it is the case. I know where this question comes from, because prior to this I had always thought the same way, like:

“It is nice and well, even looking promising, to have big blocks, but you can’t simply assume that big blocks mean better node (mining) economics, especially when compared to BTC which has led to a large successful mining industry.”

But then I came to this realization: the way BSV nodes are designed to operate, big blocks translate straight to not only higher fees but also an increasingly greater extra profits relative to BTC. Therefore, once the difference between BSV’s fees and BTC’s fees becomes obvious and hard to avoid economically, miners will be pressured to switch to BSV.

And the above in turn is because the bitcoin subsidy portions of the block rewards always cancel out with each other when compared between BTC and BSV.

The above last point is something that is very counterintuitive, because one’s mind tends to gravitate toward this question: how can that be when BTC price is 500 times that of BSV? But the key is: the actual prices of BTC and BSV are irrelevant in this analysis, as the dynamics is determined by the relative ratios, and profitability is most fundamentally that per-unit hash power (rather than the total hash power).

I must admit that I never thought about this clearly until just a few days ago. I did a lot of explaining in the article why this is the case. I hope at least some people would give it a serious read and think about it.

3. Why would BTC miners moved to BSV, instead of much larger cryptocurrency such as Ethereum?

Miners are less ideology-driven and more profit driven in general. However, to the extent that the forces behind BTC control some of the miners, it is not going to be a smooth transition. Therefore, whether BTC miners will move to BSV or Ethereum is not going to be a clean picture.

But because of the following reasons, BSV will receive a disproportionately large portion of the BTC mining exit.

(1) If BTC mining starts to show signs of weakness due to the rising profitability of BSV mining, miners that decide to move would have a clear understanding what is causing it, and that would be BSV specifically. So the natural choice is firstly moving to BSV. Some may go to other blockchain such as Ethereum due to various reasons, but BSV is a natural destination.

(2) BSV’s rising mining profitability cannot happen in abstract, but has to be based on certain concrete reasons, which are almost certainly to be BSV’s success in real applications such as e-sports, tokenization, and smart contracts. This means that BSV in that case would not only be beating BTC, but clearly threatening Ethereum and other competing blockchains as well. This would give a further reason for miners to move to BSV instead of Ethereum. If BSV finds success in more esoteric applications such as fractal database, decentralized data, decentralized computation, and decentralized AI, more power to BSV, because it would put BSV in an unrivaled position.

4. Are there any hard rules in place that are preventing BTC from also increasing the block size limit?

No, there is no hard natural rule that BTC cannot adopt big blocks as well. But they won’t, at least not until they see the writing on the wall. For reasons why, you need to understand the history of BTC and what has formed a foundation of their narrative. I recommend a reading: BTC and Bitcoin, what is the real difference?

On the other hand, I would not be surprised if BTC declares a limited increase of their block size, to say 2MB or even 8MB, in the future. After all, they will have to cope with the reality.

However, once they make that move, they essentially validate what big blockers have been saying, and will also have a hard time to reconcile with their narrative. This is because 1MB was not a random number to begin with. It was carefully chosen to make sure that small personal computers can always hold the entire BTC blockchain. You might argue, because PC storage capacity is always increasing, so BTC should be able to increase its block size without destroying its narrative. But no, the total BTC blockchain size increases with time as well. So 1MB will remain its magical number.

The small block size is a meaningless goal to strive for if you see how completely useless those PC “nodes” really are, but it is nonetheless a pillar in the BTC narrative. Like many other public narratives, leveraging people’s ignorance is a powerful tool, powerful not only against the audience, but also against the owner of the narrative because it becomes an addictive condition.

But at the same time, even if BTC does make a limited compromise as indicated above, it will not stop the avalanche caused by BSV (assuming that BSV sees mass adoption).

5. Do you see an increase in miners mining BSV instead of BTC?

There have been no significant moves of BTC miners to BSV so far. As analyzed in the article, at the present time, the difference in the fee/subsidy ratios is just too small (around 1%), and no one notices it. But they will eventually, perhaps when the difference is greater than 15%, 25%, or even 50%.

However, some BTC miners have always done mining on both BTC and BSV. For example, Binance’s mining division had done that for a long time until they were ordered not to. These miners do not do this because they support BSV. They engage with this “duality” simply because the profitability of mining on BTC and BSV are essentially comparable on per-unit hash power basis even when the subsidy constitutes almost all of the block reward. So even before the pressure/attraction of the BSV transaction fee economics kicks in, for smaller miners that are not bound to a certain ideology or controlled by an interest group, the question would be “Why not?”

But before miners are actually pressured to move due to the shift of economics, such duality has no significance, all because of the historical and ideological bias against BSV.

6. Given the fact that the bitcoin subsidy will eventually run out, the conclusion seems obvious, so why such a long analysis?

Many people already understand and acknowledge the following without any further help: if BTC price does not constantly at least double every four years, BTC mining is doomed, because the subsidy cannot last forever. However, it is not clear to most people that BTC is doomed even if the BTC price could keep going up long enough not to be the direct cause of the BTC’s doom, as something else in the economics will take care of that first.

The economics has a multifactor competitive dynamic and requires a careful analysis to count for all forces and scenarios.

If BTC collapses eventually due to natural halving, its bubble could easily have another decade of life or longer, as long as the public’s blind faith is sufficient to support its circular logic.

However, according to the economics of the bitcoin mining, the bubble may pop well before its natural death, depending on the adoption of the genuine bitcoin BSV.

Summary

The economics of bitcoin mining predicts an eventual gloom of BTC mining.

This is not to say that the particular outcome is unconditionally guaranteed. All that can be said is that if the BSV’s transactions per block and block sizes keep going up, the outcome is guaranteed.

Killing BTC is not the goal of BSV. It is still possible for both to be successful in serving their different purposes. However, based on the trend analysis above, the kind of expansion that BSV may experience is intrinsically restrictive to BTC due to the natural competitive economic forces. BTC therefore faces growing pressure as BSV grows, even if there is no intentional competition.

In addition, the economic analysis is premised on the rationality of actors, but there are many irrational actors in the world. Based on the hostile attitude toward BSV, many who are with BTC probably realize this by intuition. For some parties, there may be simply too much at stake due to the strange history of Bitcoin, and therefore may act not according to the normal incentives of the next block mining but rather some other nefarious motives.

However, if the dynamics is strong enough, ultimately the economic reality takes place against the backdrop of illegal attacks and irrational acts.

Finally, it is a perilous thing to make a theoretical prediction. Most people are probably even not interested in hearing such things, but rather they want to hear about things that have already happened, such as a present price point. Many cannot tell the difference between a speculation and a theoretical prediction. But blessed are those who do, as that is the difference between astrology and physics.

So there it is, my theory, stands to be tested.

Note [1] : Because the transaction fee of BSV has already dropped to about 25 sats/transaction ($0.00001 add to the current BSV price around $40), it does not seem to have great room left for the transaction fee of BSV to further drop, say another 10 times or more in the near future, unless the price of BSV increases dramatically. Ultimately, the lower limit of transaction fee is 1 sat/transaction, but that is unlikely to happen before the total scale of BSV has reached millions of transactions per second (TPS), and the price of BSV goes beyond $10,000. Even if the transaction fee remains at 25 sats/transaction, and the price of BSV increases 100 times, the transaction fee would still be as low as $0.001, not ideal for real high-volume microtransactions but still much lower than any competitors on the market.

Note [2]: Greenness is a different matter, because real “greenness” is not measured by revenue, but by actual utility produced by the energy consumed. If this is measured by energy consumption per transaction, BSV would be over 10,000 times greener than BTC in this particular scenario, not just three times, because it processes 5000 times more transactions using halve the energy.

07-08-2025

07-08-2025