|

Getting your Trinity Audio player ready...

|

I’ve spoken often about Mastercard’s hegemony over the BTC and general blockchain ecosystem. The information is public, and verifiable, but critics rally to call the information “conspiracy theories,” which is offensive since Mastercard’s blockchain patents and news of their acquisitions can be found with simple Google searches.

So, it got me thinking about other so-called conspiracies. Corporate, state and military conspiracy theories are often silly. Things like the enigmatic Q, flat earth and reptilian elite, while tantalizing, started in paranoid corners of the culture and made their way into the mainstream much to the chagrin of actual researchers everywhere. Folks like David Icke, the modern face of reptilian humanoid storytelling, have made millions of dollars on such ideas without anything other than half-truths and (admittedly fun/interesting) hearsay.

Meanwhile, very real conspiracy theories get bundled together and tossed out the window along with the crazier ones. Some great examples would be the Gulf of Tonkin incident. In 1964, it was claimed by the National Security Agency that the North Vietnamese Navy fired torpedoes at the USS Maddox, demanding a military response and creating the predicate for the U.S. entrance into the Vietnam War. The problem was that it NEVER HAPPENED, but the U.S. entered a decade of war anyways!

On the home front, from 1932 until 1972, the U.S. government allowed the syphilis infection of African Americans in rural Alabama in order to document and study its natural progression without penicillin—telling the recipients that they were receiving treatment for “bad blood” and giving them free food and subsidized healthcare from the state.

Add those to your reading list along with MK Ultra, Operation Paperclip, or the year-long unofficial presidency of Edith Wilson! The fact of the matter is that crazy things do happen especially when money and power hang in the balance, and the Bitcoin economy is no exception.

A moderate corporate conspiracy

Did you know that McDonald’s ice cream machines have over 15% downtime? That’s dismal by any business standard, but it’s true! The biggest restaurant in the world has a terrible user experience with their ice cream machines where cleaning cycles are extremely finicky, and error codes are indecipherable to company employees leading to an incredible amount of downtime.

So much downtime, in fact, that internet conspiracy theories even exist to explain why.

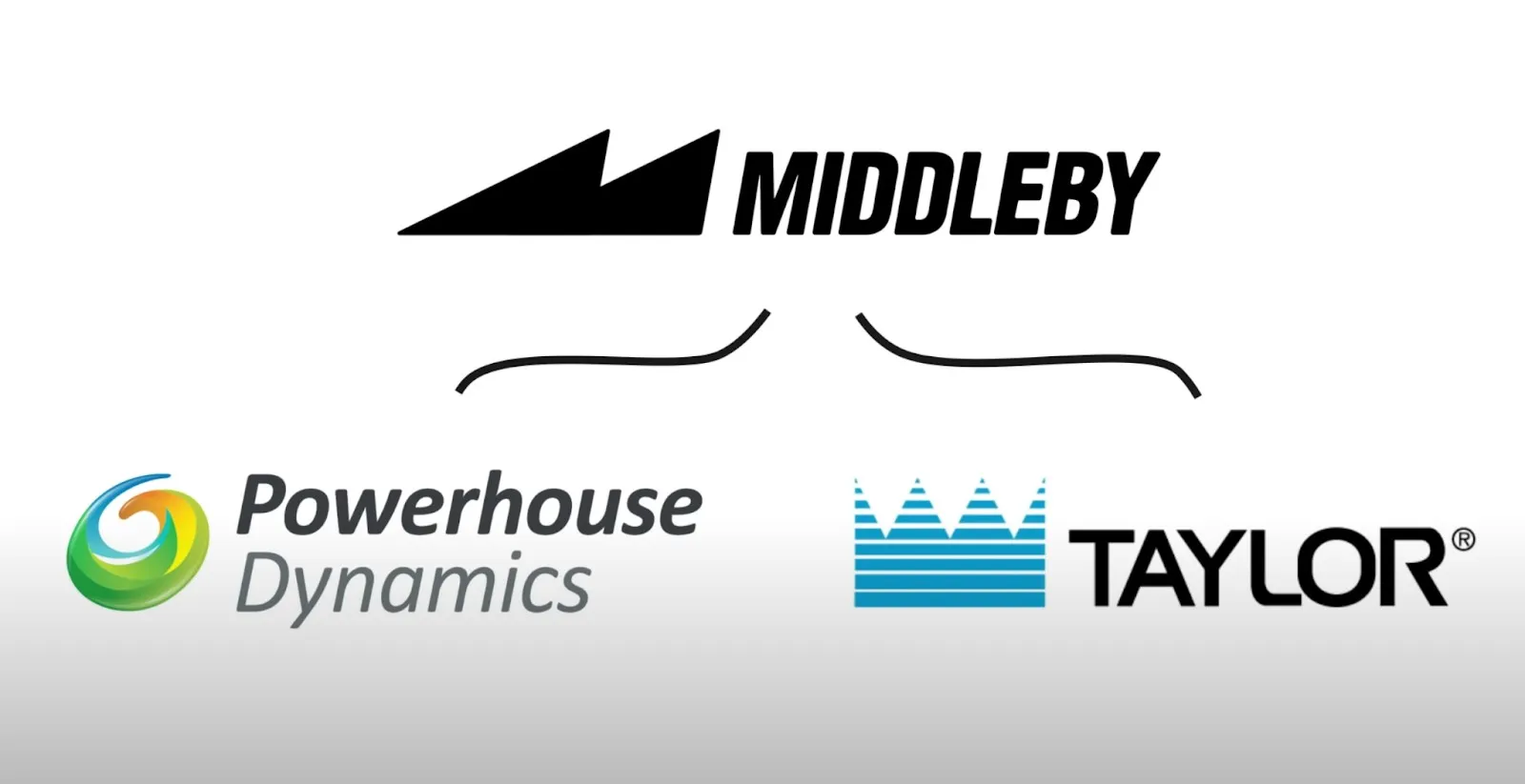

The ice cream machines are manufactured by a company called “Taylor” since the early days of McDonald’s, and they have had a prosperous partnership. So prosperous, in fact, that Taylor manufactures the ice cream machines of Wendy’s, Chick-Fil-a and other major chains in such a way where they have exponentially less downtime.

Wait. What?

It’s true, Taylor makes an incredible amount of money selling service solutions to McDonald’s franchisees because the machines don’t work very well—by design. Their business model is to insert Taylor ice cream machines into McDonald’s restaurants under exclusive contract for the purpose of forcing them to have to rely on their centralized (and profitable) solutions for their constant breakage, guaranteeing control and profit forever due to complicated corporate structures. The spill-over benefits go to McDonald’s competitors in the form of more reliable machines.

If franchisees want to switch solutions, the only option that the parent corporation allows is to switch to a software “upgrade” called “Powerhouse Dynamics,” which is owned by the parent company of Taylor (a firm called “Middleby”) so you can’t really escape the system. All roads lead to profit by the central planners of the system, and all to the detriment of the franchisees and the customers of McDonald’s.

So what does this have to do with Bitcoin?

Contrary to popular belief, “Bitcoin” Core (the repo, the team of devs, and everything else associated with BTC) is not decentralized. Decentralization doesn’t even actually exist in any practical sense, even though BTC has been working on maximizing it for years. In reality, most attempts create de facto business entities with major liabilities which fall onto individual contributors to systems while creating “decentralization theater” for the public. But to venture investors, it’s all just business, and the developers are collateral damage. They aren’t all innocent though. For example, the name “Bitcoin Core” has been used to establish an online presence to imply leadership or centrality or even ownership of the system to use as a bargaining chip for investment capital from big firms.

Today, the BTC Core team is largely paid by Mastercard Ventures through various venture branches, and they are the rulers of the network through their developer proxies.

How did it get this way?

Before 2015, most developers were unpaid volunteers in the Bitcoin economy, but the value of the project was growing despite the fact that they were not getting rich unless they were spending their hard-earned money from their day jobs and buying bitcoin like any other person.

This led to the pursuit of investment, and by 2015, Mastercard led a seed round with Mitt Romney’s Bain Capital, Transamerica Ventures, FirstMark Capital, and New York Life to establish a company called “Digital Currency Group” led by Silicon Valley darling Barry Silbert. Silbert stated, “being structured as a company, versus a fund, allows us to evolve with the industry given our permanent capital base and flexible mandate,” which means that they can be less held down by financial regulations, and therefore have more influence over their portfolio companies.

This led to the creation of paid BTC development firm Blockstream, and the rest is history! Their portfolio also includes Lightning Labs, Kraken, Coinbase, BitGo, BitPay, Blockstacks, CoinDesk, Circle, Chainalysis, Curv, eToro, Fireblocks, Genesis Trading, Grayscale, ItBit/Paxos, Ledger, Parity, Ripple, Hedera (Hashgraph), RSK Labs, Ripio Network, ShapeShift, Xapo and many, many more. Basically, they own over 90% of the public infrastructure for BTC and all of its competitors.

With hegemonic control in 2015, Mastercard was able to shift the narrative of Bitcoin from being a “Peer-to-Peer Electronic Cash System,” and force its user experience into being unpleasant and occasionally unusable in order to create business opportunities for their other portfolio brands to profit from specialized services to BTC like Lightning Network.

Much like Taylor/Powerhouse/Middleby/McDonalds, Mastercard has inserted themselves into every aspect of the management of all the profitable offshoots of BTC’s failure to scale, and they make money whether it wins or loses based on providing services like custody and debit cards where just a year or two earlier, intrepid entrepreneurs would have just built native bitcoin point-of-sale systems.

To what end?

Like the McDonald’s/Taylor situation, there is no seedy conspiracy theory. It’s just business, if you’re willing to follow the money. Bitcoin was disruptive, so Mastercard muzzled it, using “number go up” as lubrication to shut down the narrative of Bitcoin being a true fintech revelation. According to Silbert, “We are still far away from Bitcoin being a functional currency, and I don’t think we’ve gotten closer lately. First it’s going to function as a speculative investment that will drive up the price and create a larger monetary base that will draw in Wall Street to trade it.”

Once one company comes in to pump the bags of early investors, it makes things “safer” for other players to enter the space, like American Express investing in Abra, or big acquisitions by Visa, Citi, NASDAQ, Capital One, etc.

And amid the years of malaise, Mastercard has been bidding with central banks on being the provider of central bank digital currencies instead of such things being replaced years ago by [checks notes] Bitcoin. Then, as far as the suits are concerned, BTC and everything else gets thrown on the scrap pile of history while they retain their power. And it was easy because everyone was silenced by becoming the petty bourgeoisie just for “hodling.”

Now, BTC’s largest infrastructural partner, rather than going out of business, is looking to eliminate the need for BTC payments altogether saying, “Mastercard is driving innovation with the public sector, banks, fintechs, and advisory firms in the exploration of CBDCs, working with partners that are aligned to our core values and principles. This new platform supports central banks as they make decisions now and in the future about the path forward for local and regional economies.”

Ultimately, the goal is control. It always has been. The unbounded Bitcoin protocol eliminates the need for Silicon Valley tech startups, old world banks, inefficient money transmitters, credit card giants and a whole bunch of other financial service providers. And that is exactly why Mastercard led the charge to tangle up the influencers, media and service providers in the Bitcoin economy, creating the altcoin trading, ICO, DEX, DeFi nightmare in the process.

So on the altar of fiat profits, small blockers allowed the corporate subversion of BTC, which triggered the beginning of the still ongoing Bitcoin Civil War all for the benefit of the banks and the big payment and fintech titans. But the BSV blockchain remains as a testament to Satoshi’s Vision for a truly unbounded bitcoin.

It really is that simple.

06-21-2025

06-21-2025