|

Getting your Trinity Audio player ready...

|

There’s a funny thing about being a big blocker. Small blocker culture is built on virtue signaling a sort of “proof of node” or “proof of hodl” mindset where if you look, sound and act the right way, you become an invaluable member of the tribe. But big blocker culture is different. We believe in governance, social status and real value by proof of work. It doesn’t matter to the big blocker of today that you had a really innovative product in 2019 if it’s been superseded by something cooler over the last couple of years. If you’re not providing incredible value RIGHT NOW, it is because you were replaced by someone who is providing new value. I distinctly recall Kevin Pham saying on one of my podcasts and probably more than once on social media that the kings and influencers in BSV today will probably just be replaced in the long term because of the attrition of constant proof of work. He wisely predicted that one of the major measures of success would be that 2018-19’s influencers would be fighting each other for clout five years later, while new faces make new money with ease.

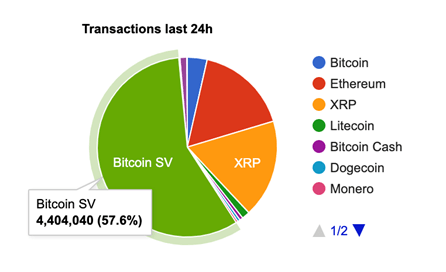

And we are seeing just that! Social media has become little more than a cesspool of yesterday’s heroes explaining all the ways things would be better if the BSV economy would “just do” this or “should have listened to” that. This means Bitcoin (BSV) is outgrowing its social media phase where it is rhetorically scalable and “soon” going to outperform competitors across the blockchain economy. It’s just happening! Millions of transactions per day. Tokens, smart contracts, P2P payments, gaming, tipping, etc. The fundamentals have never been better!

RelayX and RareCandy. Streamanity and Twetch.

I like the RUN protocol. So does most of BSV, as over 90% of BSV transactions are RUN tokens on a typical day. I think the RelayX REX is an extremely important tool too, as it’s the best place to mint and transact RUN tokens, but there was definitely some thunder lost to the pleasing aesthetics of the new RareCandy marketplace using a (another) proprietary token protocol. Just a year ago, people were wondering if tokens (something we all knew was theoretically possible on the Bitcoin protocol) would be a big part of the network soon. And today, BSV is a panacea of generative art NFTs, CryptoFights weapons, and there are millions of RUN transactions per day across the network. While RareCandy is a closed marketplace and a closed protocol with beautiful UI and UX for NFT purchase and resale, the Run protocol’s best example is almost certainly the Gopniks NFT collection and its use as entrance into the Gopniks DAO over at RelayX, and the competition between the two companies has done something incredible: it’s made us all better at competing in the tokenized art economy in less than a year.

RelayX is a platform based on open standards and free use (which is also why it’s riddled with right-clicked, NFT knockoffs), but RareCandy uses a curated model with hype marketing, lots of social media savvy, and a big push to participate socially in every minting of a new piece of art. And here’s where stuff goes a little sideways.

While the competition has generally been good for the consumer, there is an increasing amount of bickering from various protocol advocates and people fighting to take or keep the limelight.

A similar battle has played out on chain for the last couple of years between the same two parties. Streamanity was an exciting video platform from the 2018 era with a bunch of social tools, tipping and a free-for-all attitude. Twetch, on the other hand, is a little newer. It was a rough product at first, but focused hard on feature enhancement and UI/UX improvement for their users. Today, Streamanity has fallen into disrepair and caters mostly to cam girls from the developing world, and Twetch is on the 3rd iteration of its platform and slowly but steadily on-boarding users to socialize on chain. Where will it end? The market will decide.

So what?

We can’t plan the economy. We can only participate in it, and while the economy is still young in the BSV space, it’s more mature than the rest of the “crypto” ecosystem anyways. There are about 10,000 blockchains that all do roughly the same thing, and never provide real value to the economy. It’s about 99% investment schemes. And then, there’s BSV: a network that has focused on scalable infrastructure and slow, steady curation of value across a free economy.

BSV is NOT crypto. We ONLY care about our reputation in crypto if it does not conflict with our reputation with all that really matters, regulators, tech startups, Enterprise and main stream media. We do not advocate lawlessness to be cool in crypto…we just do not.

— Calvin Ayre (@CalvinAyre) January 10, 2022

Only on BSV, businesses are competing and growing, and the froth of social media from yesterday’s influencers is indicative of real competition bringing the cream to the top while those who failed to adapt and reinvest continue to fade into irrelevance. But again, that’s proof of work! In a Bitcoin system, the center of the network will be that which creates and provides the most value. That’s the promise of Bitcoin exemplified by the competitive big blocker! But if your legacy is to whine on social media about the way things could or should have gone while your businesses stagnate, then you are little more than a small big blocker.

02-20-2026

02-20-2026