|

Getting your Trinity Audio player ready...

|

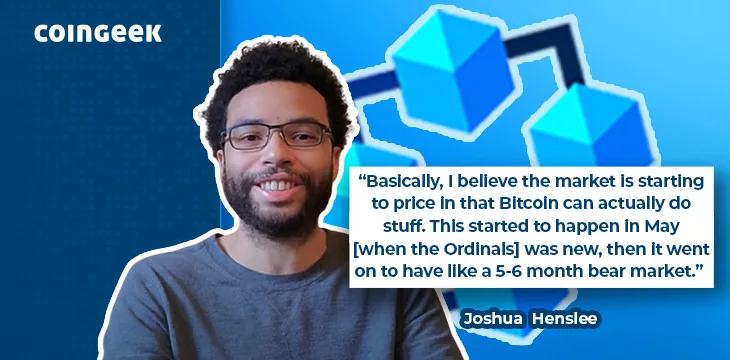

Bitcoin developer and thought leader Joshua Henslee recently released a video sharing his thoughts on the Ordinals bull market and the new lock-to-mint protocol. It was an insightful and exciting video speculating on what’s going on and what’s likely to come next.

Ordinals are pumping

Henslee begins by noting that Ordinals, Doginals, and some tokens on the BSV blockchain are pumping hard. BTC tokens are leading the charge, with Ordi at an all-time high at the time of the video.

In Henslee’s view, the market is starting to price in what Bitcoin can do. Things took off in May before descending into a multi-month bear market, but as prices show, we’re back in an Ordinals bull market.

While the increase in token prices is exciting for speculators, it has driven BTC fees sky-high. BTC Core devs such as Luke Dashjr have threatened to update Bitcoin Core to fix what they characterize as a bug and an attack on Bitcoin. While OCEAN (Dashjr’s mining pool backed by Jack Dorsey) and some others won’t process Ordinals transactions, other pools have said they will mine Ordinals exclusively. It’s highly profitable, so why not?

Henslee notes that token prices could draw back, but he thinks this is the new normal. The booming on-chain economy is very different from the regular one, and people are having a hard time wrapping their heads around the monumental change and what it means.

Lock to Mint on BSV blockchain

Henslee has been a vocal supporter of locking coins in recent months. He’s been deeply involved with Hodlocker and has made multiple videos explaining the value of locking and its potential applications.

He shares that lock to mint, a new innovation on the BSV blockchain, has already taken off significantly. Rather than exchanging coins for tokens as on BTC, Doge, and other blockchains, this involves locking coins for a fixed period of time to mint tokens. Technically, this is a new token protocol, LRC-20. He notes that a secondary market doesn’t exist yet, but one may develop soon.

Henslee points to a new, technically clean lock to mint smart contracts linked to Bamboo token. Using the Panda wallet, minters had to lock BSV to get their share of 10 million tokens. This had taken off in a big way at the time Henslee made this video, but it is not fully minted, showing the enthusiasm for it. People from outside the BSV blockchain ecosystem are getting involved, pouring into the relevant Telegram channels, and using Hodlocker.

We’re close to surpassing 10,000 coins locked on-chain, Henslee says, predicting that this will soon be a blip on the radar due to how this concept is resonating. He notes there’s something psychologically different about knowing you’ll get your coins back when the lock period is over rather than having to spend them.

More about Ordi, Dogi, and the future

Henslee says he isn’t surprised at how Ordi is pumping. He made a video called Ordi is the Black Swan seven months ago, outlining how this was a fundamental change. He notes that this wasn’t an ICO—it was a literal inscription, and people got 1,000 ORDI for inscribing a JSON file for $1 in fees. This was a fair mint and is nothing at all like what FTX did with SOL or any of the countless other ICOs from the 2017 era.

What about Dogi and the inscriptions on Dogecoin? Henslee thinks they’re pumping partly because of the high fees on BTC. However, he says the Dogecoin blockchain isn’t up to the task if and when there’s a wave of demand. It’s not equipped to scale and can’t touch the BSV blockchain technically.

Will all of this be put into big block Bitcoin? Not necessarily. Henslee says we need something fundamentally different and better. He believes lock-to-mint is both. In the worst-case scenario, lockers have saved their money into the future and didn’t get anything in return.

Where is all of this headed? Henslee predicts it will build on itself and bring new people into the BSV blockchain. In any case, it’s an innovative new thing that can’t easily be replicated on other blockchains in the same way.

Roundup of this Joshua Henslee video

- Henslee notes that Ordi, Dogi, and other on-chain inscriptions are pumping on various blockchains. He believes they are a big deal, and the market is beginning to realize their significance.

- BTC Core is threatening to spoil the party. However, there’s a lot of support for Ordinals, and several mining pools have vowed to keep mining these transactions.

- Lock to mint is a new thing on the BSV blockchain. Instead of spending coins to mint tokens and inscriptions, users lock their coins into the future. Henslee notes that this is fundamentally new and different, and it’s exclusive to the BSV blockchain right now. There’s been huge enthusiasm so far, and new people are pouring into BSV as a result.

- Henslee thinks this is just the beginning as the market realizes what the on-chain economy is really all about. He’s not sure it will pour into big-block Bitcoin, but lock to mint is certainly drawing attention to the BSV blockchain.

Watch: Locking coins and HODLocker with Joshua Henslee

Recommended for you

British lawmakers of the parliamentary national security committee have called for a temporary ban on political parties receiving donations in

Circle (NASDAQ: CRCL) soared in 2025 thanks to U.S. ‘regulatory clarity,’ but can this momentum survive a ban on crypto

02-26-2026

02-26-2026