|

Getting your Trinity Audio player ready...

|

Recently OKEx founder Star Xu was reportedly questioned by police and soon after the exchange suspended all withdrawals. Given that BSV based exchange FloatSV is partnered with OKEx, they were affected by this announcement as well.

As a partner exchange, FloatSV assets are custody’d by OK and thus face same withdraw suspension.

We will await further news from @OKEx on resumption of full services.

On a personal note, I have had privilege of working with Star Xu since 2014. Wish my partner and friend well! https://t.co/1M2VgOQhKk

— Jack 🇪🇸 🇭🇰 🇸🇬 🇨🇦 (@liujackc) October 16, 2020

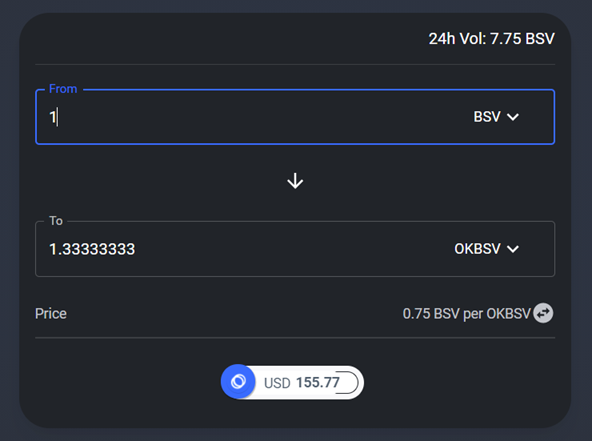

In response, RelayX quickly launched their second token on the RUN protocol, OKBSV. OKBSV is a derivative of actual BSV held on OKEx and FloatSV. Those who have an account on either exchange can immediately claim OKBSV at a rate of 1-1 to their Bitcoin SV balance.

Ignoring the predictable screeches of LAWR, the innovation and timing here are impressive. Usually when exchanges suspend withdrawals for an extended amount of time, customer’s funds end up being everything but SAFU. For example, if one held 500 BSV on either exchange then withdrawals become suspended, their funds are un-spendable.

With OKBSV, regardless of the fate of OKEx, customers have a temporary exit. In the crypto-world, users do not have many means of spending their funds (let alone BSV) on actual goods and services. Imagine if one was HODL’ing their live savings on an exchange expecting their coins to ‘moon’ in 18 months. By claiming their OKBSV they now have spendable tokens that have actual value instead of being dead in the water.

The natural question may be who wants to buy derivative tokens that may end up being worthless if OKEx never resumes withdrawals? Given that Degens love to gamble on sh*tcoins, why would they not want to gamble on this one? The key piece here is that RelayX allows the purchase of OKBSV by anyone—even if the buyer does not have an OKEx or Float account. This is enabled by the permission-less nature of the RUN protocol and executing the trade of assets on-chain.

If those affected by the OKEx situation need to exchange their locked assets for actual value during this time they can. Depending on their situation, accepting a 30% haircut on their holdings is preferable to losing 100% of their funds to yet another cryptocurrency exchange debacle. In this case, the affected customer does not have to care about the status of the exchange.

As RelayX founder Jack Liu states in the interview below, this product enables Float to ‘give some assurance that there are options for Float users’ (timestamped below):

Moreover, the buyer looking to speculate on OKBSV can take a risk to potentially obtain more BSV. If OKEx does enable withdrawals again one can claim 1 BSV for each OKBSV they own, netting 33% more BSV at current rates. The reverse is true where if OKEx never enables withdrawals, then the OKBSV token price goes to zero.

Liu also states in the interview that this method could lead the way in porting assets on Ethereum over to BSV. Liu goes on to give a simple example that if one held $9 of an ETH token on an exchange, the high fees could erase that value such that it is not even worth it or possible to withdraw. However, having an exit onto the Bitcoin SV ledger with a much smaller fee preserves the value held, thus ability to spend in other applications.

In the micropayment economy BSV strives to enable, this innovation has huge implications in the space.

See also: CoinGeek Live panel on Better Payments: Improving the Consumer Experience with Bitcoin

03-09-2026

03-09-2026