Tax

IRS bares new digital asset reporting form for US taxpayers

Under the IRS' latest tax rule, anyone considered a digital asset broker must prepare Form 1099-DA for customers who sell...

IRS warns ‘crypto’ fans to include digital asset income on tax return … or else

Partnering with Chainalysis, the IRS insisted on the need for digital asset sales to be reported on businesses' tax returns,...

Thailand issues tax exemption for investment tokens

Thailand’s Cabinet will allow investors who have had their 15% capital gains tax deducted to exclude their investment token profits...

Israel proposes for digital shekel to bear interest

The Bank of Israel published a CBDC paper, which outlines a system in which CBDC wallets aren’t linked to banks...

Indonesia’s watchdog considers double taxation changes for digital currencies: report

Indonesia's Bappebti has requested that the country's Ministry of Finance evaluate the current tax regime for digital currencies to reflect...

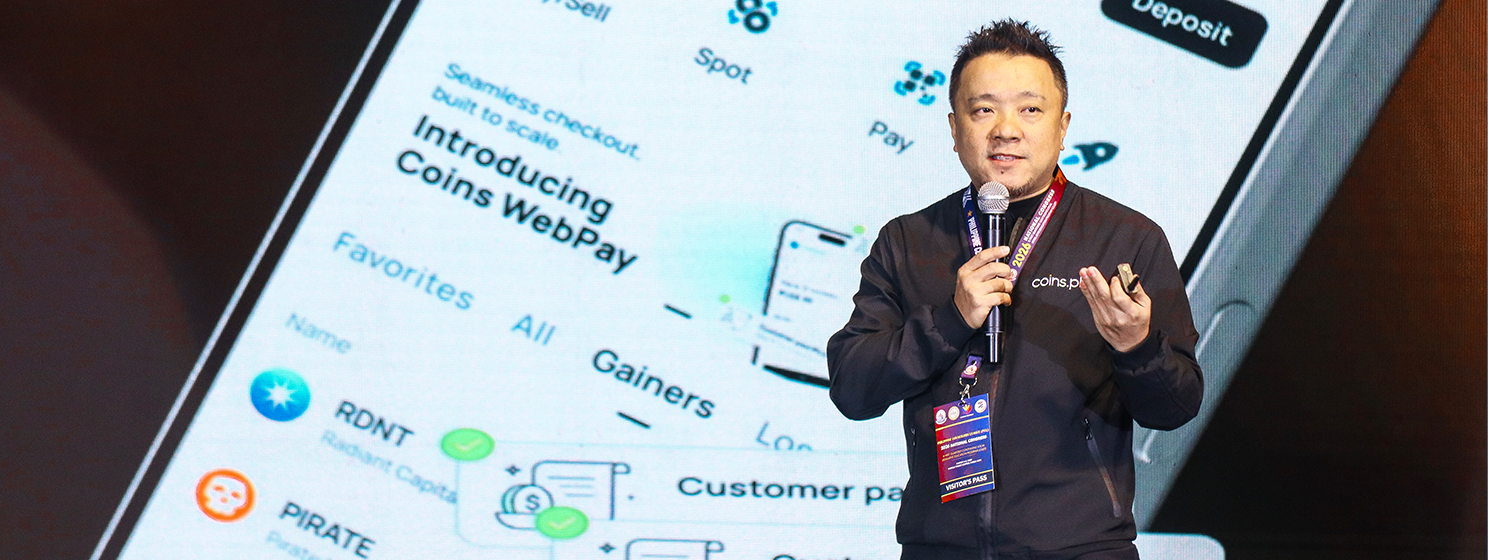

IRS taps 2 former digital asset execs to ramp up ‘crypto’ tax expertise

The IRS has hired Sulolit “Raj” Mukherjee, formerly with Coinbase and Binance.US, where he led tax compliance efforts, and ex-TaxBit...

03-09-2026

03-09-2026