|

Getting your Trinity Audio player ready...

|

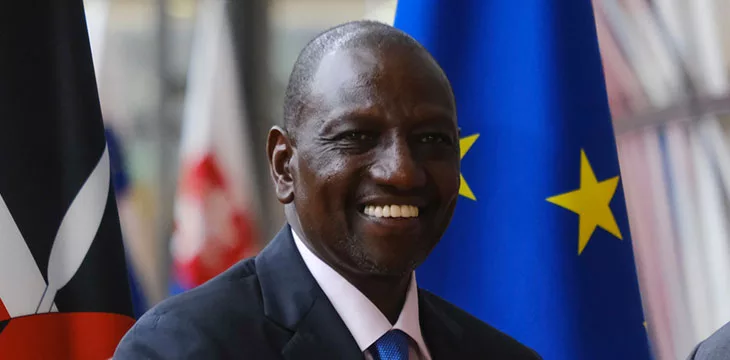

On June 26, Kenyan President William Ruto signed the controversial Finance Bill 2023 into law. According to the ruling party, the bill will add to the government coffers, reducing reliance on expensive foreign loans. However, for most Kenyans, the bill presents an unprecedented hike in existing taxes and an introduction of several new taxes, including a 3% digital asset tax.

Since its introduction in Parliament, the Finance Bill has stoked controversy and become the subject of intense debate across the East African country. The ruling Kenya Kwanza alliance has defended it, saying that a tax hike is the only way the country can break the shackles of expensive loans from China, IMF, the World Bank, and other development partners.

However, those opposed to it—90% of Kenyans by one poll—point out that it will add an extra burden to an ailing economy devastated by a high cost of living. As the opposition leader Raila Odinga summed it up recently, “The bill is a mistake and an experiment Kenyans can ill afford.”

And while the opposition threatens mass demonstrations to protest the bill, and most Kenyans decry the upcoming taxes, President Ruto’s 10-month-old government is marching on with its agenda. The new taxes take effect on July 1, and they include a 1.5% housing tax, doubling the fuel levy to 16%, and a 5% withholding tax for digital content creators.

For Kenya’s vibrant Bitcoin space, a looming 3% digital asset tax is of most concern.

Kenya’s 3% digital asset tax

Kenya is one of Africa’s most prominent digital asset hubs. In last year’s Chainalysis adoption index, it ranked 19th globally and third in Africa after Nigeria and Morocco. It ranked fifth for P2P exchange volume, a category it had led for the previous two years.

However, despite the rapid adoption, the Kenyan government has shunned digital assets. The central bank has continuously warned against them, reminding Kenyans that they could lose all their money. The government has also not formulated any regulations to protect investors, allowing some mega scams to defraud unsuspecting investors.

Despite the checkered relationship, the government has been intent on taxing the industry. Last November, lawmakers introduced a new bill to tax all digital asset holders, but it has yet to sail through Parliament.

The Finance Bill is the first law targeting Kenya’s estimated 6 million digital asset holders.

It demands a 3% tax on the value of the digital asset being transferred or exchanged. The platform owners will deduct this tax, and in the case of offshore platforms, the owners will have 24 hours to remit the tax to the Kenya Revenue Authority.

Many traders are up in arms over the tax. Some believe 3% is way too high for an industry where the profit is in the slimmest of margins. Hasty taxation could wipe out the nascent sector, they say.

Others believe the government should have worked on educating digital asset owners about the tax and how to remit it first before deducting it.

And yet others, like the Blockchain Association of Kenya (BAK), say the new law is too vague. “Taxing all digital assets under a single umbrella could stifle innovation and hinder the growth of specific sectors within the industry,” the organization said in a statement to the media.

BAK wants a more comprehensive approach differentiating between NFTs, security tokens, stablecoins, utility tokens, and more.

“By implementing appropriate taxes based on the use cases of each token, the government can support the industry without impeding innovation,” it noted.

Perhaps the biggest concern is the bill’s blanket taxation that applies to all digital assets being transferred or exchanged. This fails to account for loss-making transactions or even zero-profit transactions, such as users switching assets between their own wallets.

“The volatility and speculative nature of digital assets mean that not all transfers and exchanges result in profits. Ignoring this aspect could lead to unfair taxation and hinder the growth of the industry,” BAK observed.

Watch: Blockchain in Africa

07-14-2025

07-14-2025