Rostin Behnam

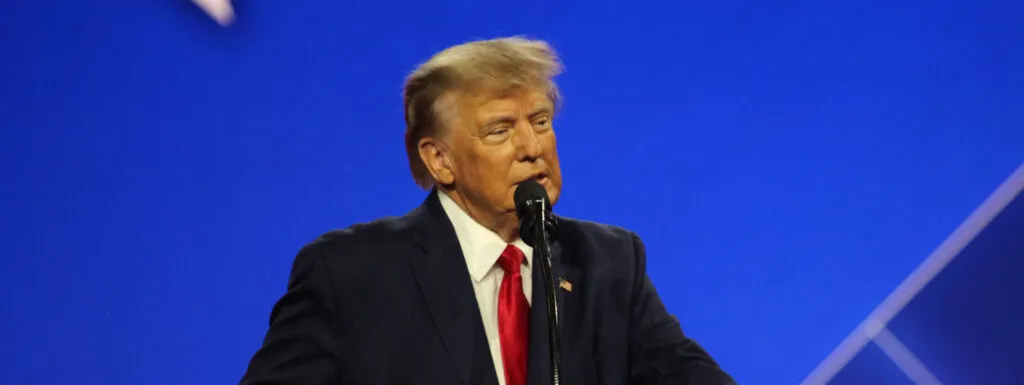

Trump having seismic impact on crypto even before he takes oath

Trump's second term as U.S. president is still a week away, but his impact on crypto is already huge. BTC's...

Coinbase crows over SEC court rulings, cringes at CFTC subpoena

Coinbase is celebrating some partial legal victories against America’s securities regulator while trying to dodge a new customer info request...

CFTC Chair Behnam quitting; Winklevii reach $5M settlement

The settlement will see Gemini pay a hefty penalty to the CFTC for a lawsuit the latter filed in 2022....

CFTC records $17B monetary relief in 2024, thanks to digital assets

In 2024, the U.S. agency brought 58 new enforcement actions, including precedent-setting digital asset commodities cases, but the crackdown of...

Lutnick now a Treasury longshot; SEC’s Gensler resigned to resigning

Gary Gensler gave a speech in which he hinted that his time at the SEC was coming to a close;...

US House hearing pumps CFTC, dumps SEC, achieves little

The new bill aims to carve out clearly defined roles for both the CFTC and the SEC and stop the...

Recent

Trending

Most Views

07-08-2025

07-08-2025