|

Getting your Trinity Audio player ready...

|

Marc Andreessen recently made headlines by exposing the Biden administration’s alleged “privatized sanctions regime” on the Joe Rogan podcast. According to Andreessen, a number of politically exposed persons (PEPs) in the tech and crypto industries have been systematically debanked in what appears to be a modern-day resurrection of Operation Chokepoint, a controversial Obama-era program. Originally aimed at restricting financial access to industries deemed undesirable, this new iteration allegedly targets individuals and organizations whose politics conflict with prevailing government preferences.

This alarming claim shows the troubling nexus between financial gatekeepers and government power—a longtime theory touted by Crypto Bros worldwide, now brought into the mainstream discussion. And I’m glad to see it, as someone who has been calling out the risks of such censorship from “Big Tech, Big Banks, and Big Gov” and being roundly dismissed as a spooky conspiracy theorist.

By leveraging private banking institutions to carry out political censorship, governments circumvent due process and accountability, leaving the targeted individuals without recourse. As Andreessen aptly described, this is censorship by proxy, a chilling precedent in a democracy.

A necessary stand—but an unfortunate irony

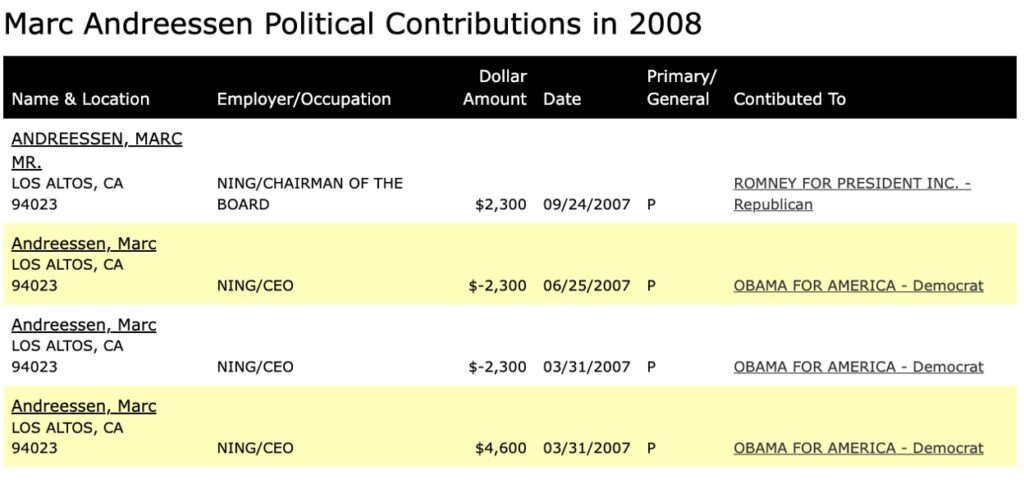

Andreessen deserves credit for calling out these abuses, but his advocacy comes with a bitter irony. As the driving force behind a16z Capital and its parent, Andreessen Horowitz, two of the most influential venture capital firms in Silicon Valley, Andreessen has heavily shaped the landscape of cryptocurrency and fintech investment for over a decade. This is on top of him generally being a Democratic Party supporter and donor for many years despite things like the original Operation Chokepoint occurring under the Obama administration.

Unfortunately, the portfolio of his firm also reveals the same imprudence and hypocrisy with a track record of prioritizing hype-driven projects over technologies that could have fortified financial sovereignty and reduced the friction of global commerce.

Instead of focusing on tools that could replace the need for centralized financial systems, a16z has funneled billions into ventures that have merely reinforced the existing banking paradigm. Projects like Coinbase (NASDAQ: COIN), OpenSea, and Solana have done little to challenge the centralized structures they claim to disrupt. Coinbase, for instance, operates more like a traditional bank, complete with stringent KYC (Know Your Customer) processes and compliance with government demands, than the decentralized vision Bitcoin was built to achieve.

The a16z portfolio: Opportunity squandered

In fact, a quick glance at a16z’s largest investments tells a tale of missed potential:

- Coinbase: As a custodial exchange, Coinbase centralizes blockchain asset storage, making users vulnerable to account freezes, regulatory overreach, and even things like technical incompetence, which should not be underestimated as a risk of censorship.

- OpenSea and Yuga Labs: Investments in non-fungible token (NFT) platforms and projects like Bored Ape Yacht Club fuel speculative markets but contribute nothing to solving real-world financial inequities or censorship issues.

- Solana: Touted for its scalability, Solana operates with significant centralization, leaving it prone to outages and governance concerns—not that it matters, since most of what happens there is memecoin trading among degenerate gamblers.

- Uniswap and MakerDAO: While decentralized in theory, these platforms are tied to Ethereum, a blockchain plagued by high fees and scalability bottlenecks and only really used for staking in decentralized finance (DeFi) contracts and “rugging” confused newcomers of their money.

These ventures have generated substantial profits for a16z and its partners, but they have done little to advance the original ethos of Bitcoin: creating a censorship-resistant, borderless, and inclusive financial system!

What Bitcoin could have been—and still can be

Bitcoin, as originally envisioned in Satoshi Nakamoto’s white paper, was meant to be a peer-to-peer electronic cash system, capable of solving the exact problems Andreessen now laments. Properly implemented, Bitcoin offers:

- Banking and remittance without middlemen: A global payment network that doesn’t require permission from financial gatekeepers.

- Micropayments and reduced transaction costs: Solving inefficiencies in everything from global trade to online commerce.

- Censorship resistance: A decentralized system where no single entity has control, ensuring that transactions cannot be arbitrarily blocked.

Instead of supporting the scalability and evolution of Bitcoin to realize these goals, the narrative of “digital gold” was prioritized, turning BTC into a speculative asset rather than a tool for economic transformation. This shift, fueled by Silicon Valley’s investment dollars, has stifled the adoption of Bitcoin as money and delayed its revolutionary potential by years.

The real risk of censorship

The resurgence of Operation Chokepoint tactics underscores the urgency of returning to Bitcoin’s original mission while snuffing out the influence of the guys who are happy to be heroes on Sunday morning while being villains every Saturday night!

Hero:

Villain:

Without robust, censorship-resistant financial systems, we are left vulnerable to the whims of powerful entities—both government and corporate. Andreessen has highlighted a real and present danger, but his own role in advancing a centralized, hype-driven “crypto economy” cannot stand without scrutiny.

Imagine what could have been if a fraction of a16z’s investment capital had gone toward scaling Bitcoin for global commerce. The tools to prevent financial censorship, ensure privacy, and streamline economic activity already exist. The blockchain wars have made this clear: blockchains like BSV, with unbounded scalability and cost-effective transaction capabilities, have the potential to achieve the kind of financial revolution that Andreessen himself advocates for—if only they received the support they deserve.

Why not support the R&D necessary to test Teranode with Amazon Web Services (AWS)?

Why not participate in solving the token back-to-genesis problem?

Why not invest in deploying true Simplified Payment Verification (SPV) and LiteClient solutions for a scalable future?

Because he doesn’t actually care about the problem. He wants to talk about the problem to pad his reputation and get back into the conversation so he can get first dibs on the next round of juicy pitch decks during the incoming bull market.

In closing

Andreessen’s revelations about the Biden administration’s financial overreach are both alarming and important. But frankly, pointing at a problem is the easy part. He is also asking you to assume his newfound good will and ignore the complicity of Big Tech and venture capital in general [and his own firms in specific!] in muddying the waters of Bitcoin adoption. While billions have been poured into speculative ventures, the opportunity to create truly transformative tools has been squandered.

In no unclear terms, Bitcoin, properly implemented, is the solution, and Andreessen knows it.

It is time for industry leaders to align their investments with the original vision of a borderless, censorship-resistant financial system. Anything less is a betrayal—not just of Bitcoin’s promise but of the global community’s need for a fair, open, and accessible economic future.

Watch: Teranode is the digital backbone of Bitcoin

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-09-2026

03-09-2026