|

Getting your Trinity Audio player ready...

|

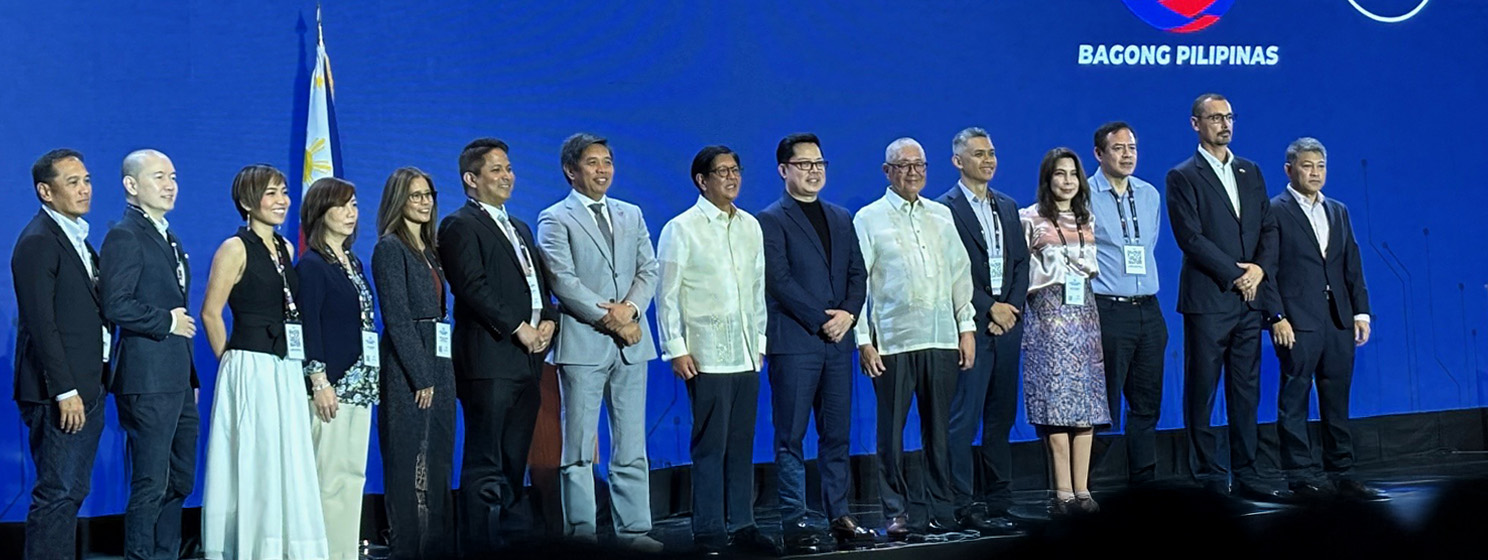

The Manila Tech Summit 2025 brought together the country’s most influential voices in fintech and governance for two action-packed days on August 26–27 at the Shangri-La Grand Ballroom in Bonifacio Global City. Organized by the Fintech Alliance of the Philippines and held under the theme “Forging a New Global Order: Risks and Opportunities Redefined,” the summit set the stage for what lies ahead in the country’s digital finance and Web3 landscape.

Lito Villanueva: ‘We are not passengers of the future; we are its pilots’

Opening the summit, Lito Villanueva, Founding Chairman of Fintech Alliance PH, highlighted the urgent need to embrace change in the face of global uncertainty.

“We gather at a time of seismic transformation, geopolitical divides are widening, climate risk and visual destruction are rewriting the rules of engagement,” Villanueva said. “What hangs in the balance is not just all of this. It is security, trade, peace, and even the survival of our planet.”

Villanueva framed the alliance’s vision through what he called the 4T Framework: Tech for Good, Tech for Growth, Tech for All, and Tech for Trust. With over 130 corporate members powering 95% of digital financial transactions in the country, he stressed the responsibility that comes with this reach.

“We uphold a zero-tolerance policy against the misuse of digital payment platforms for illegal businesses, especially online gambling. Consumer protection, and industry integrity are non-negotiable,” he said.

From the quarterly financial crime report to the Philippines‘ return to the global stage via the Singapore FinTech Festival, and the countdown to the 2026 Manila Tech Summit in Cebu, Villanueva made one thing clear: “We are not passengers of the future, we are its pilots.”

BSP Governor Eli Remolona Jr.: ‘Inclusion makes the network stronger’

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. followed with a call to “future-proof” finance by balancing inclusion, security, and innovation.

“The whole network works best when everyone is connected,” Remolona said. “First, inclusion makes the network stronger. Our QR PH allows tricycle drivers, sari-sari stores, and small businesses to take digital payments. Every new user adds value to the network.”

He emphasized security as the foundation for trust: “Our cyber resilience plan guards against fraud and cyber-attacks. Without trust, the system can’t grow.”

Remolona underscored BSP’s pragmatic approach to innovation: “We like smart innovations that solve real problems. We like simple solutions, that people can easily use. We like secure systems that can withstand shocks and attacks. This is how we connect inclusion, security, and innovation.”

For the Web3 community, his message resonates: without trust and simplicity, mass adoption remains out of reach.

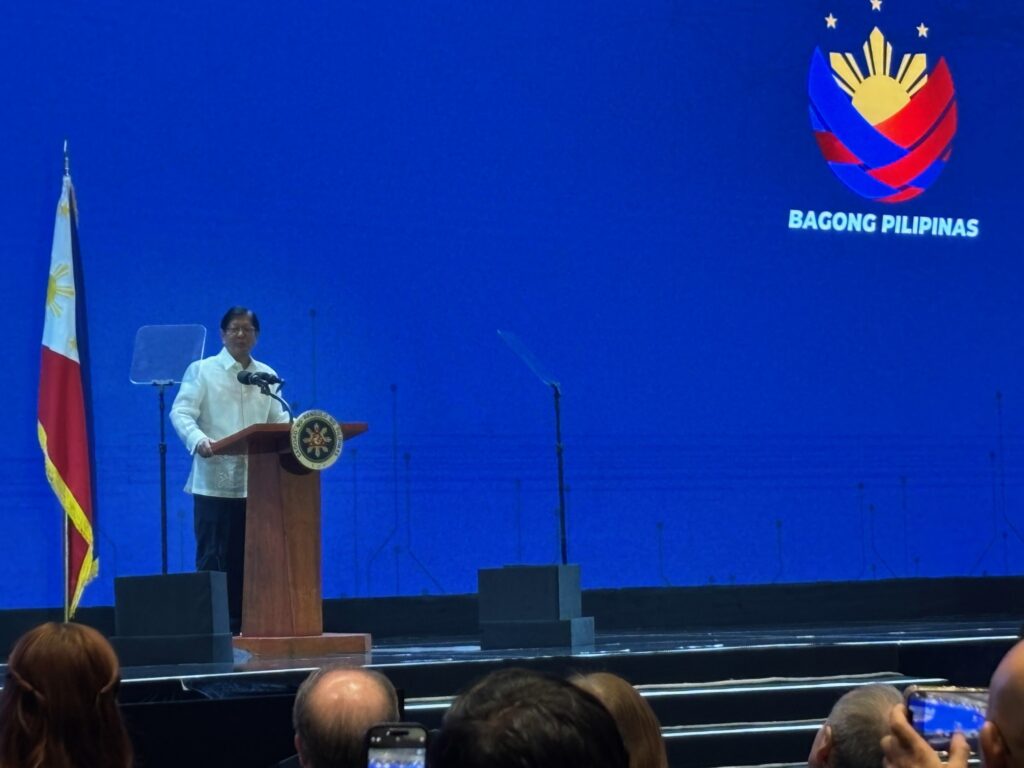

President Ferdinand Marcos Jr.: ‘Technology allows more opportunities to reach every Filipino’

The much-anticipated speech came from President Ferdinand R. Marcos Jr., who highlighted the transformative power of technology in shaping an inclusive digital Philippines.

“It’s no secret our lives are being transformed every single moment by technology. Technology presents both opportunities and challenges. So, the question is, how can we harness technology’s power and close the gaps between those who have more in life and those who have less?” Marcos asked.

He pointed to the rapid acceleration of fintech adoption in recent years. “More than half of our payment transactions in 2024 were made digital. The advancement in financial technologies made paying bills and sending remittances safer and less burdensome. Last year alone, our digital economy was valued at 2.25 trillion pesos… equivalent to 8.5% of our GDP. It also created 11.3 million jobs.”

For Web3 builders, these figures reflect not just growth but momentum, a clear signal that the Philippines is moving toward becoming a digital-first economy.

Marcos outlined several cornerstone projects that will define this trajectory. The National Fiber Backbone (NFB), expected to be completed by 2028, will provide faster and more reliable internet access across the archipelago, bringing an estimated 17 million Filipinos online. The rollout of the Philippine Identification System aims to equip every citizen with a trusted digital ID, streamlining KYC (Know Your Customer) processes for financial services. Meanwhile, the “Free WiFi for All” program and the “Bayanihan SIM” project will expand digital access to students, teachers, and remote communities.

“For Filipinos, digital technology means shorter queues, faster transactions, making it easier to pay bills, renew licenses, and access government services. It also means farmers can register their products online, teachers can access digital tools, and entrepreneurs can sell to larger markets. In other words, technology allows more opportunities to reach every Filipino,” the President said.

But Marcos also reminded attendees that progress comes with risks. “Fraudulent schemes and scams have become increasingly sophisticated, every day, with the aid of artificial intelligence,” he warned. To counter this, his administration is implementing the Anti-Financial Account Scamming Act, supporting the Internet Transactions Act, and tightening controls on online gambling.

“There is also a growing problem of online gambling, which preys on our people’s vulnerabilities. We are adjusting this to initial measures such as suspending the in-app gambling access in mobile payment apps and websites,” he said. “This way, we can help protect our citizens and preserve the integrity of our financial system.”

Looking ahead, Marcos highlighted the importance of preparing Filipinos for the jobs of the future. “We are undertaking measures to reskill and upskill more Filipinos in emerging technologies. They will be trained for jobs in AI, security, E-commerce, and creative design,” he said.

The President’s speech struck a balance between optimism and caution, celebrating the gains of digital transformation while also recognizing the real risks of fraud, privacy loss, and AI-driven disruption. His message for the fintech and Web3 audience was clear: the Philippines is betting on technology, but safeguards will be just as important as innovation.

“We envision a Philippines where every Filipino can reach their full potential and where new technologies open wider possibilities for all,” Marcos concluded.

A shared call to action

From Villanueva’s rallying cry to “turn risk into resilience” to Remolona’s vision of a secure, inclusive, and innovative financial system, and the President’s national strategy for digital equality, the Manila Tech Summit 2025 reflected a united front: technology must be a force for good, trust, and inclusion.

The call was resounding: build a digital-first Philippines, driven by ambition, guided by accountability, and leaving no one behind.

Watch | Philippine Blockchain Week 2025: Web3 innovation goes from hype to use case

03-07-2026

03-07-2026